January 2021 Real Estate Market Update

What’s Happening in the Market

In this January 2021 real estate update we see record-low temperatures combined with record-low inventory put a chill on housing activity in December. With very few homes available to buy, sales were down. Lack of supply and high demand continued to push prices up. Since the winter months historically bring the smallest number of new listings, buyers should not expect relief anytime soon.

December Results

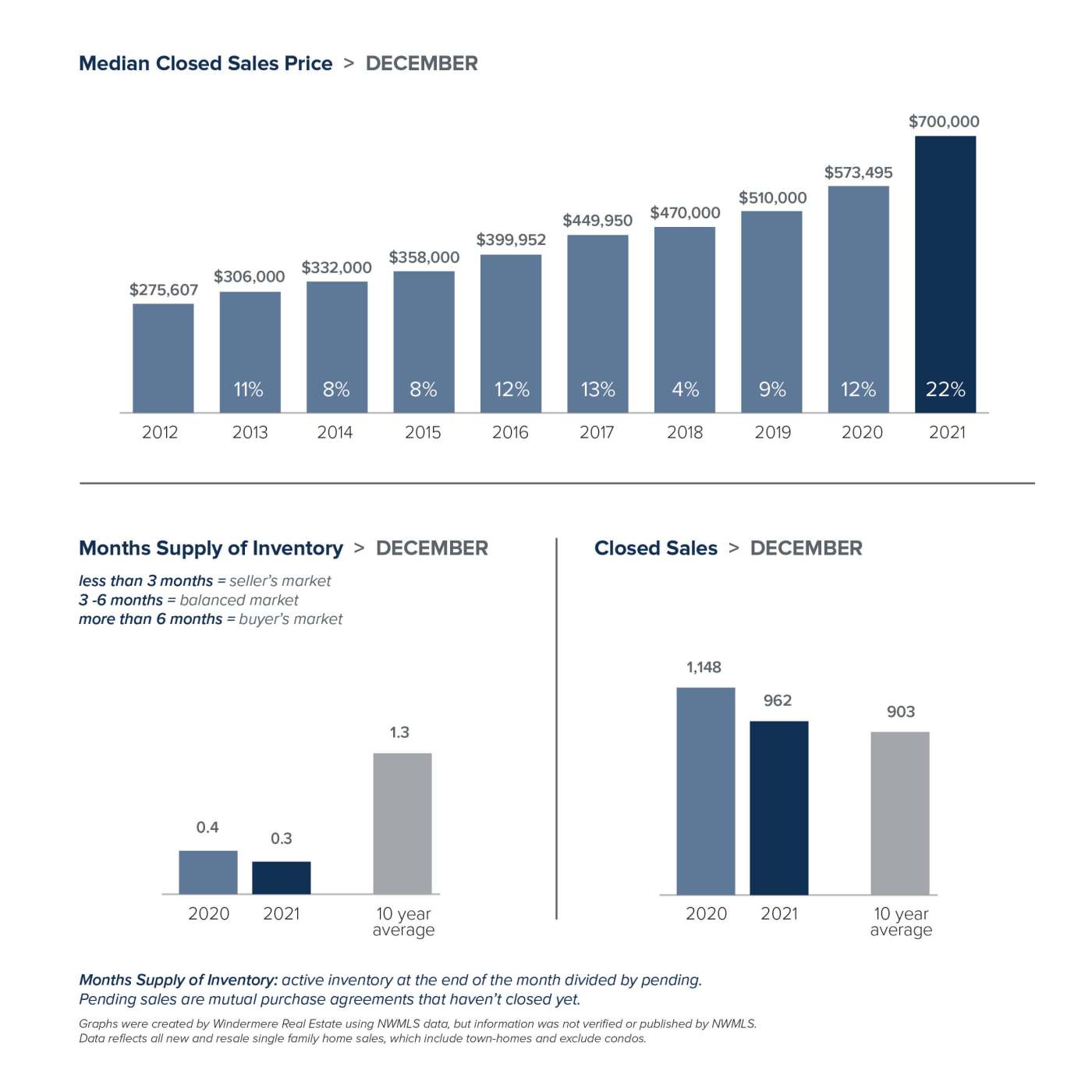

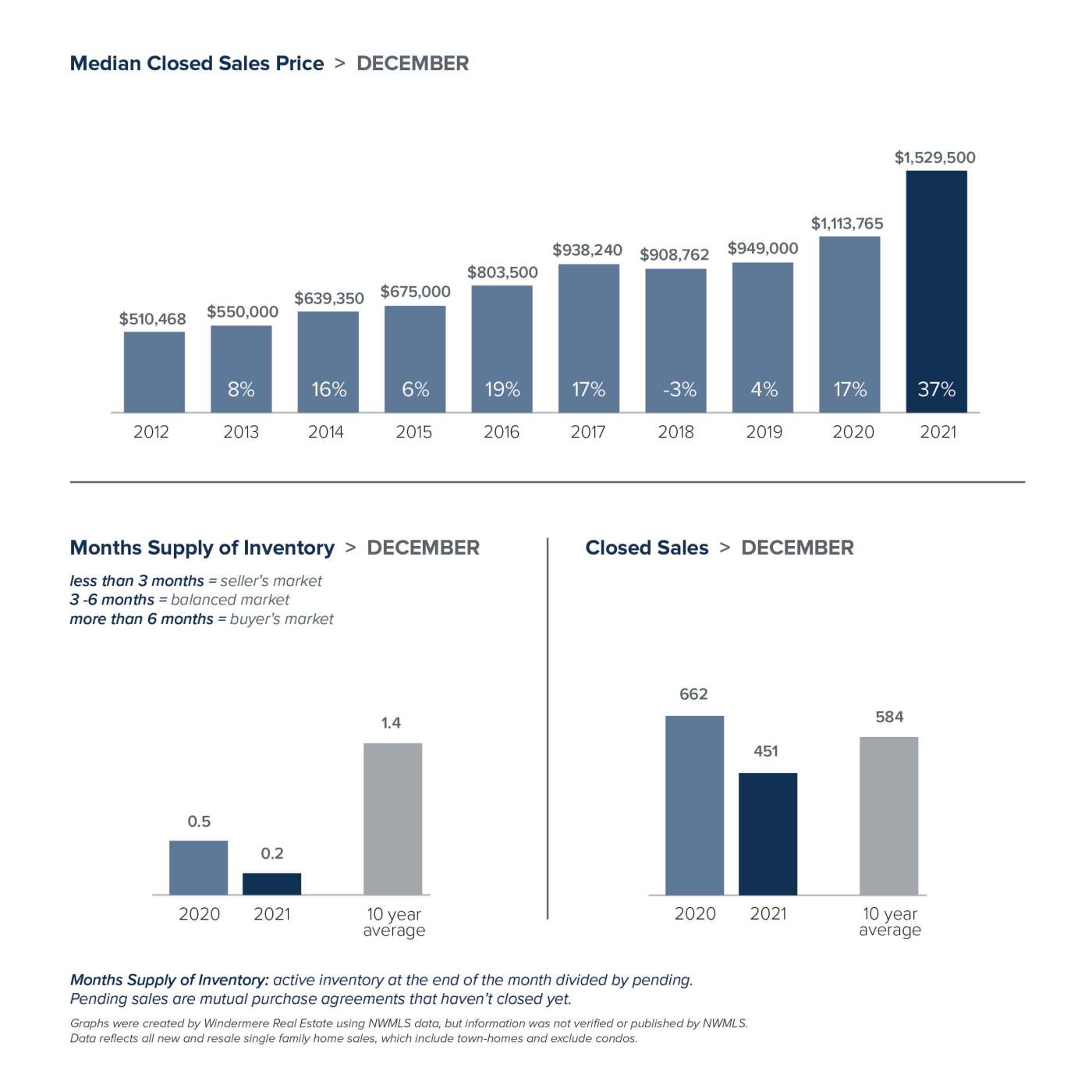

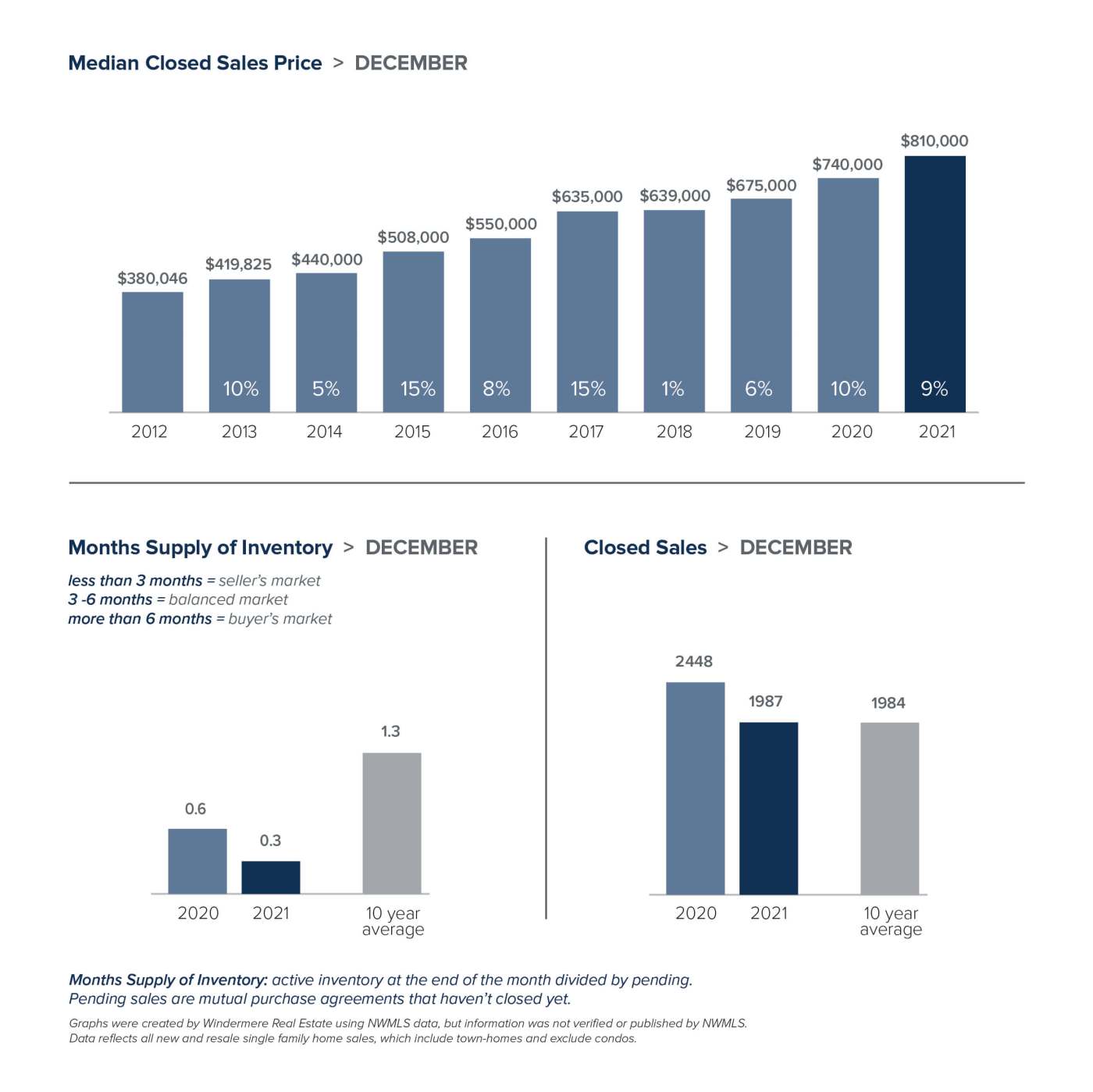

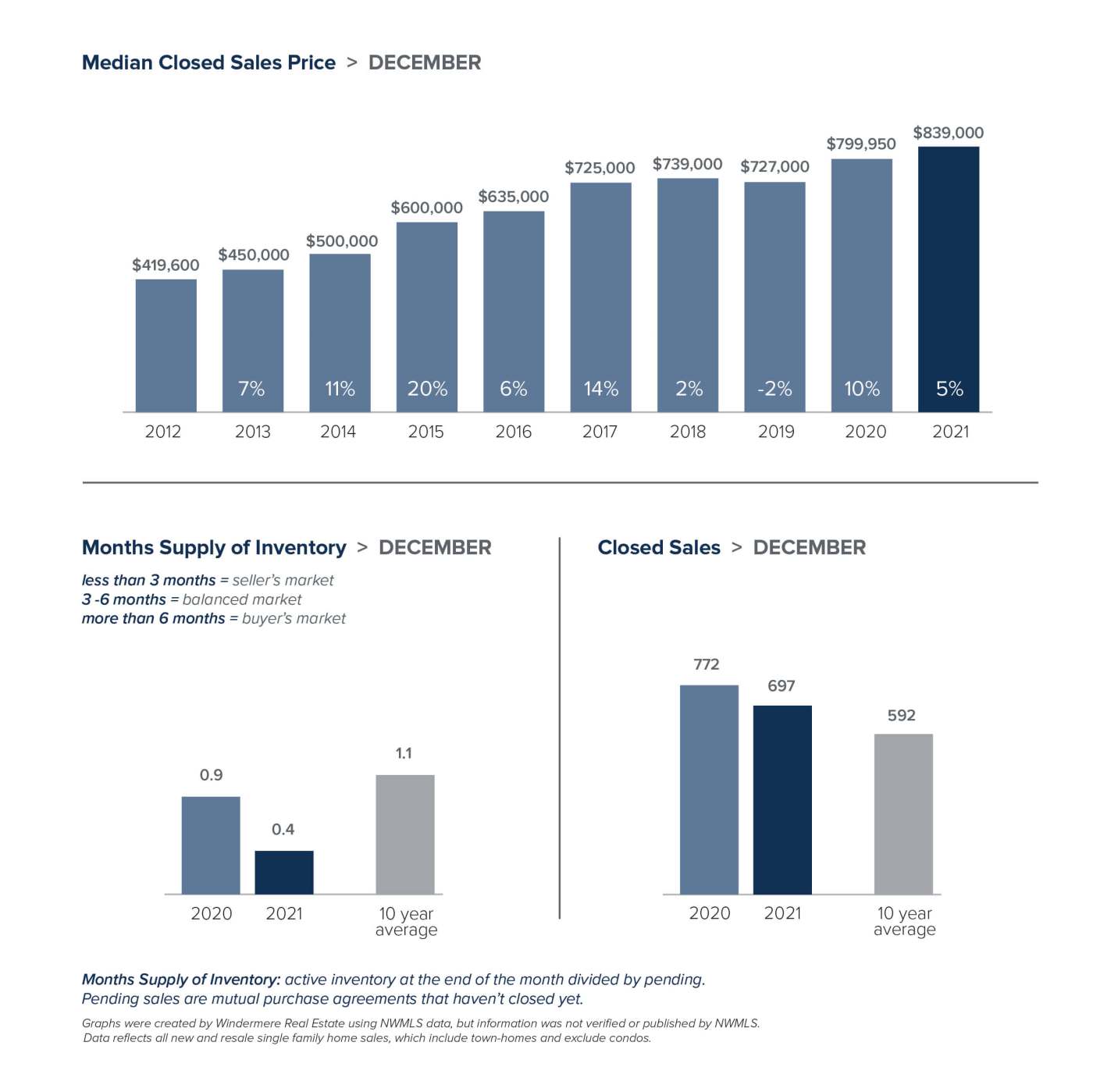

While up from a year ago, home prices in general were relatively flat from November to December. In King County, the median single-family home price rose 9% from last December to $810,000. Despite high demand and low inventory, prices in Seattle continue to level off. While down slightly from November, the median price increased a modest 5% over a year ago to $839,000. The Eastside was again the outlier. After breaking price records in October and November, home prices soared 37% year-over-year to set yet another all-time high of $1,529,500 in December. That represents a 7% increase from November. In further evidence of just how hot the Eastside market is, 75% of the properties there sold for over list price. Prices in Snohomish County continued to inch closer to King County. The median home price there jumped 22% to $700,000.

The driving force affecting affordability is lack of inventory. In both Snohomish and King counties it would take less than a week to sell the homes that are currently on the market. At the end of December, Snohomish County has just 210 single-family homes for sale in the entire county. Seattle had only 167 homes for sale; the Eastside just 55. That represented 70% less inventory for both Seattle and the Eastside as compared to a year ago. To give some historical perspective, the ten-year average inventory for the end of December is 545 homes in Seattle and 743 homes on the Eastside.

Matthew Gardner, Chief Economist at Windermere, registered his concern. “The Puget Sound region is in dire need of more housing units which would function to slow price growth of the area’s existing housing,” he said. “However, costs continue to limit building activity, and that is unlikely to change significantly this year.”

The demand side of the equation isn’t expected to wane any time soon either. With millions of square feet of new office space and new light rail developments in the works, the area continues to be a draw for employers – and more potential homebuyers.

2022 Predictions

What’s ahead for 2022? Matthew Gardner expects the market to continue to be strong, but believes the pace of appreciation will slow significantly from this year. “I predict single family prices will increase by around 8% in King and Snohomish counties. Affordability issues and modestly rising interest rates will take some of the steam out of the market in 2022.”

From working remotely to finally retiring, life events often trigger housing decisions. If you find yourself looking to buy or sell a property, we’re here to help.

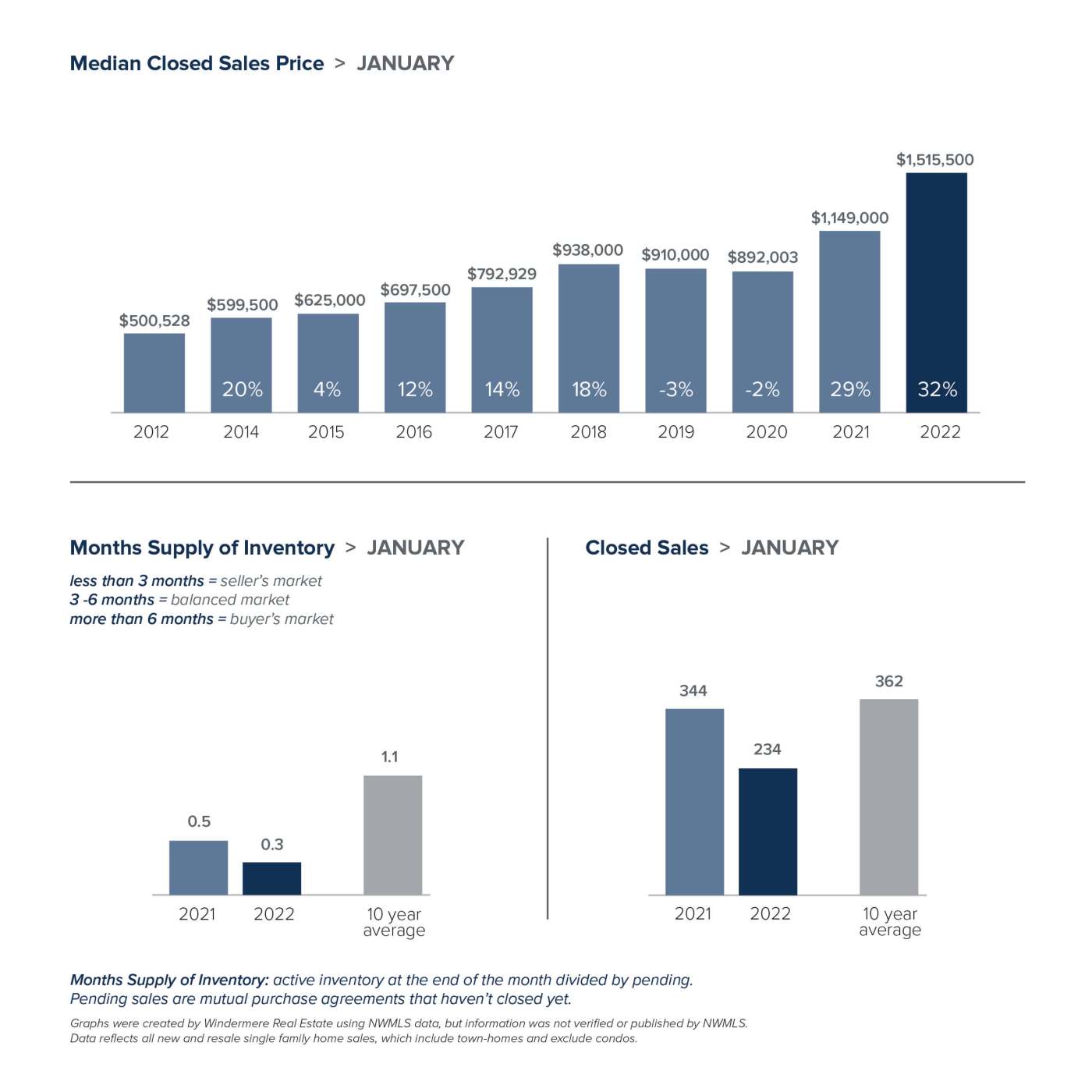

EASTSIDE

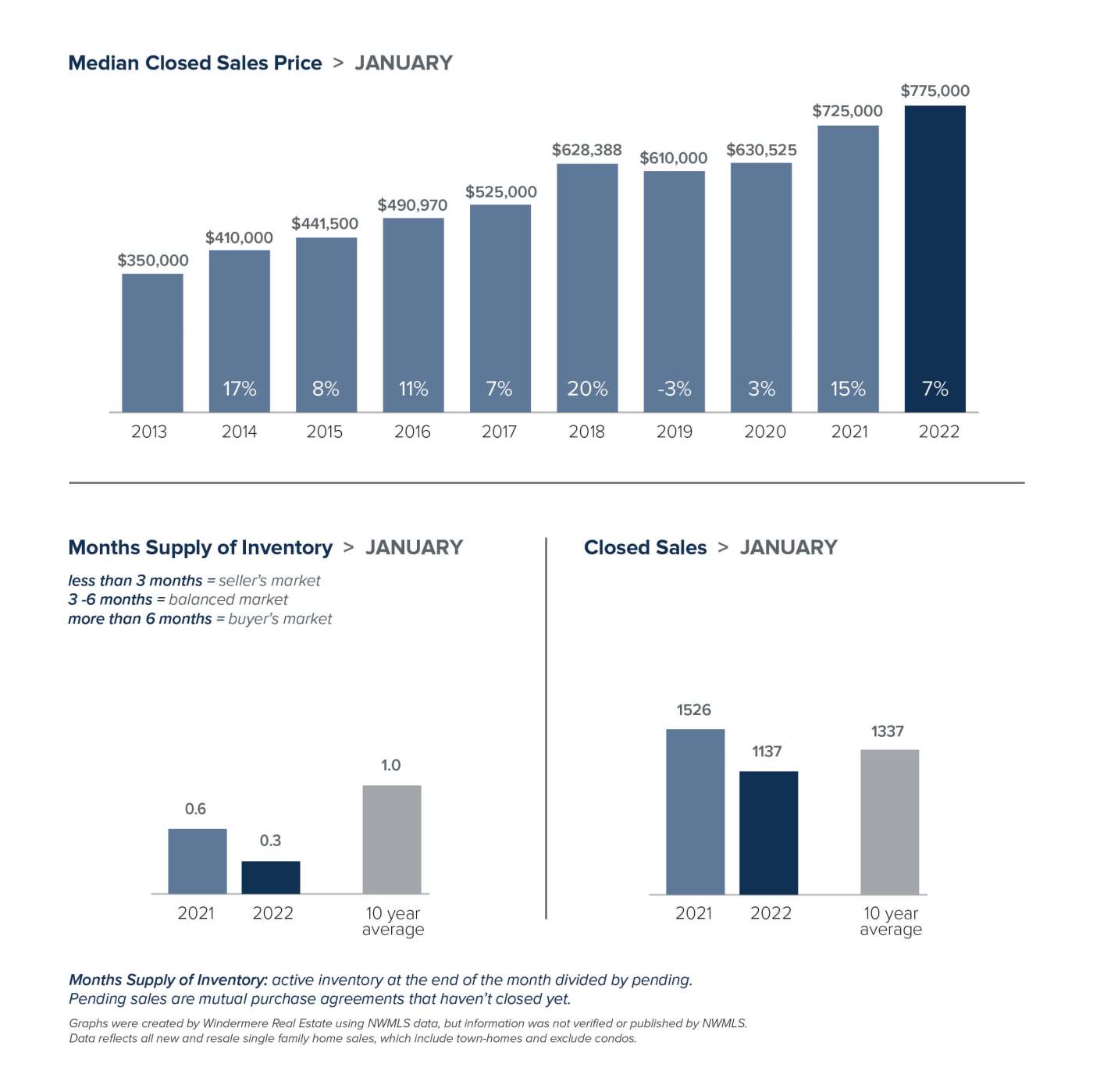

KING COUNTY

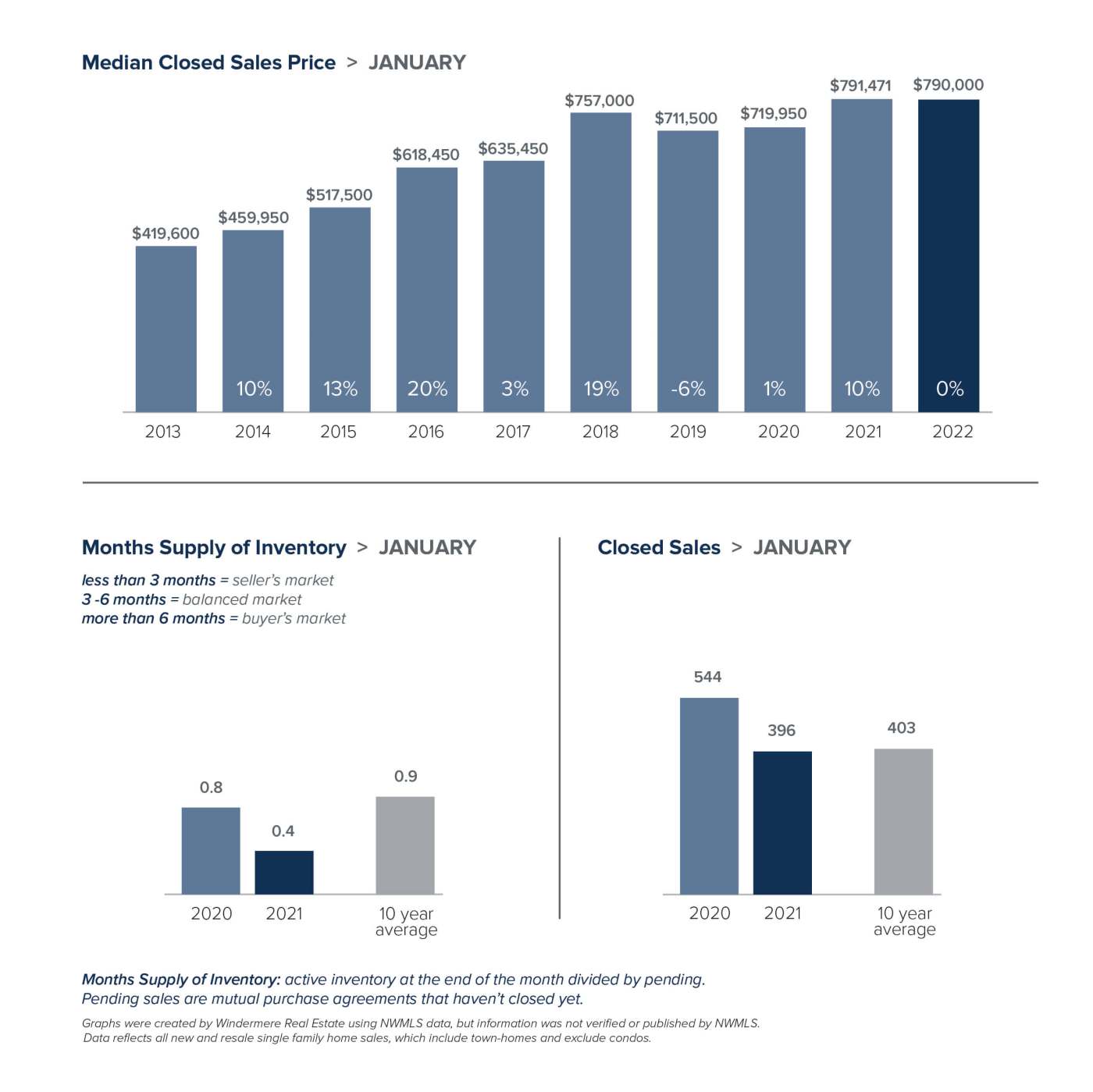

SEATTLE

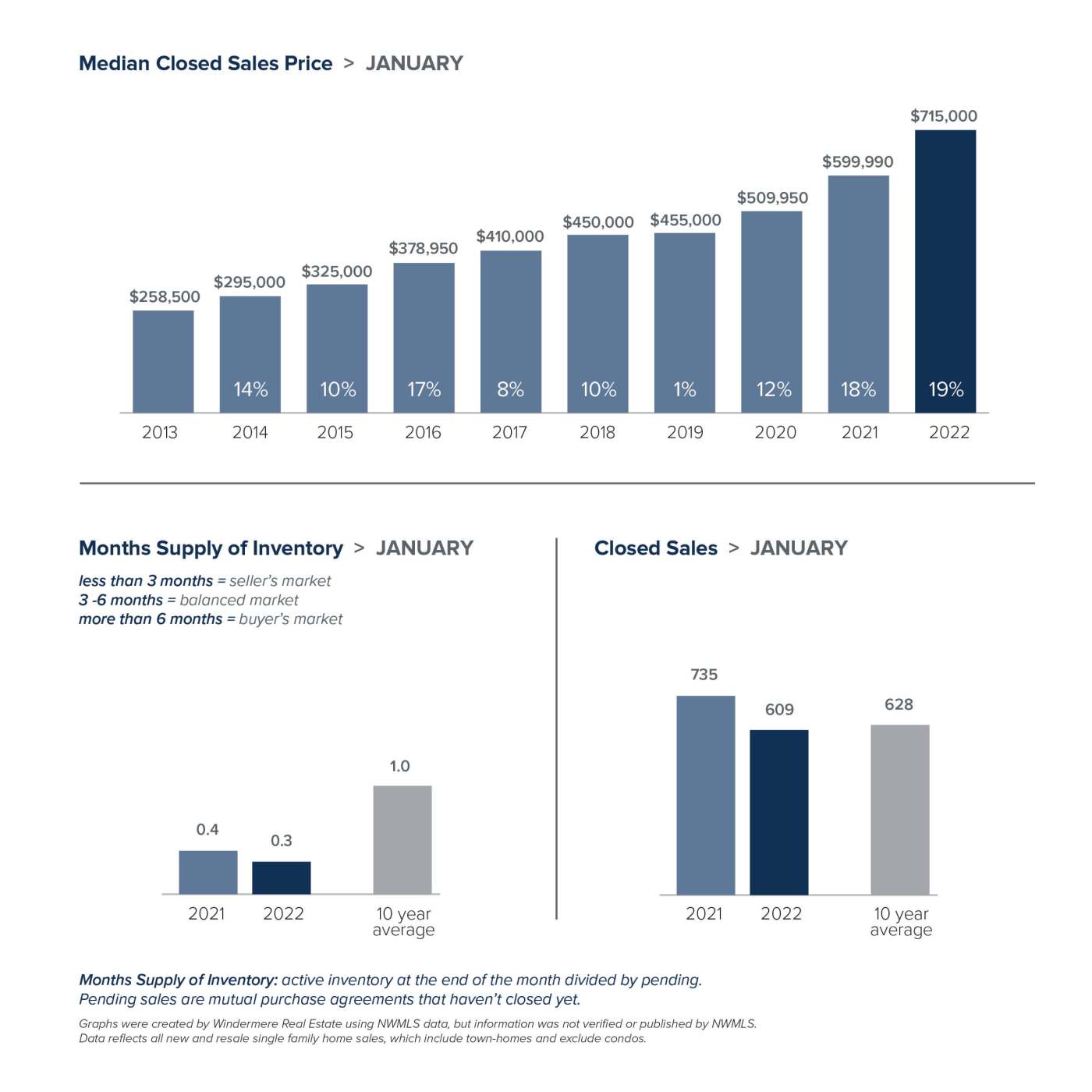

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

Check back next month for a new local market update.

Connect With Us On:

Instagram!

Facebook!

YouTube

This post originally appeared on GetTheWReport.com.

December 2021 Real Estate Market Update

What’s Happening in the Market

While the housing market typically slows down in the winter, fewer buyers are taking a break this year. High demand and scant inventory still favor sellers, who continue to see multiple offers. In one bright spot for buyers, home prices – while up from over a year ago – appear to be evening out in most of the region. Potential home sellers who’ve been sitting on the fence may want to consider taking a leap into the market now.

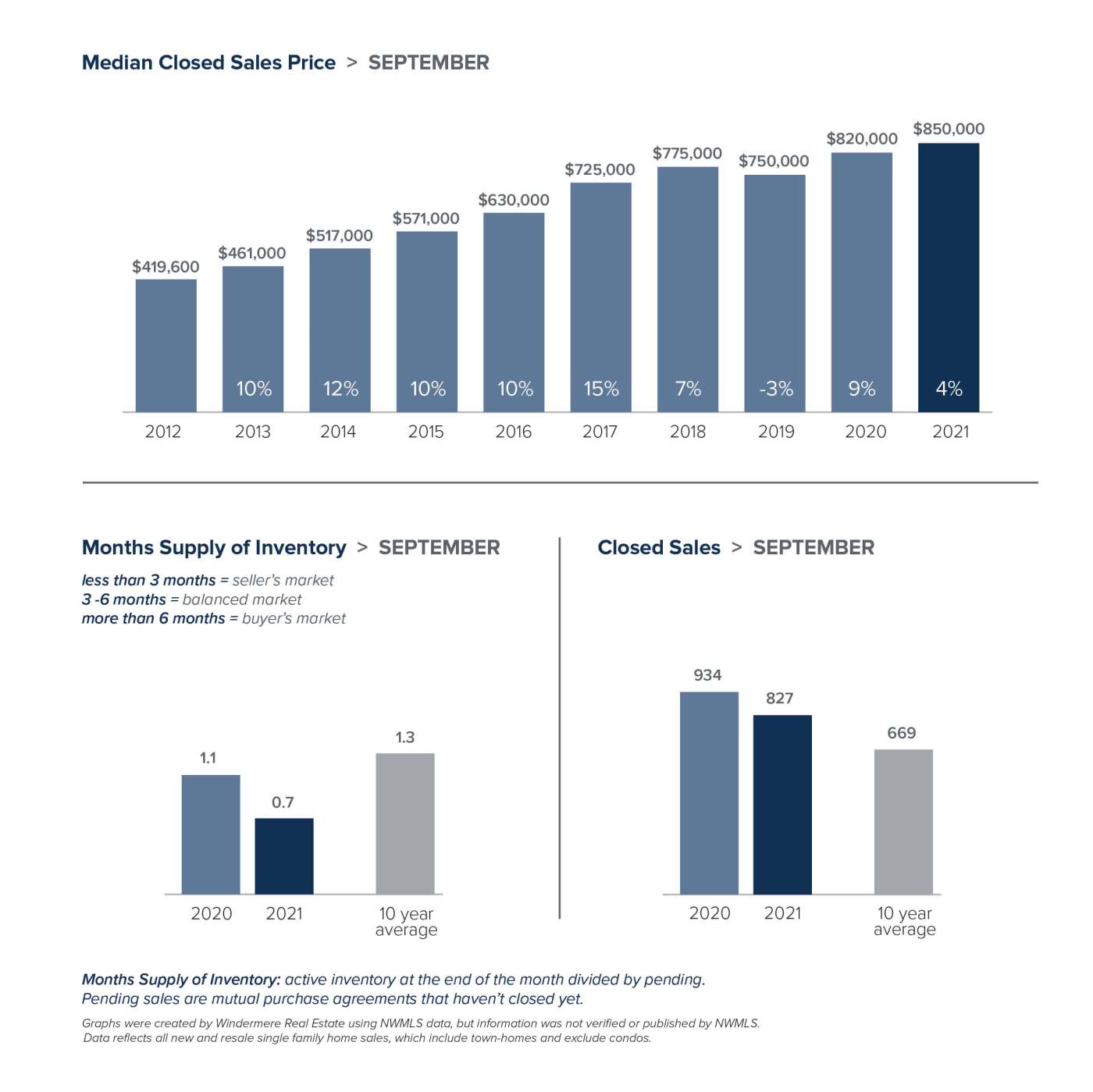

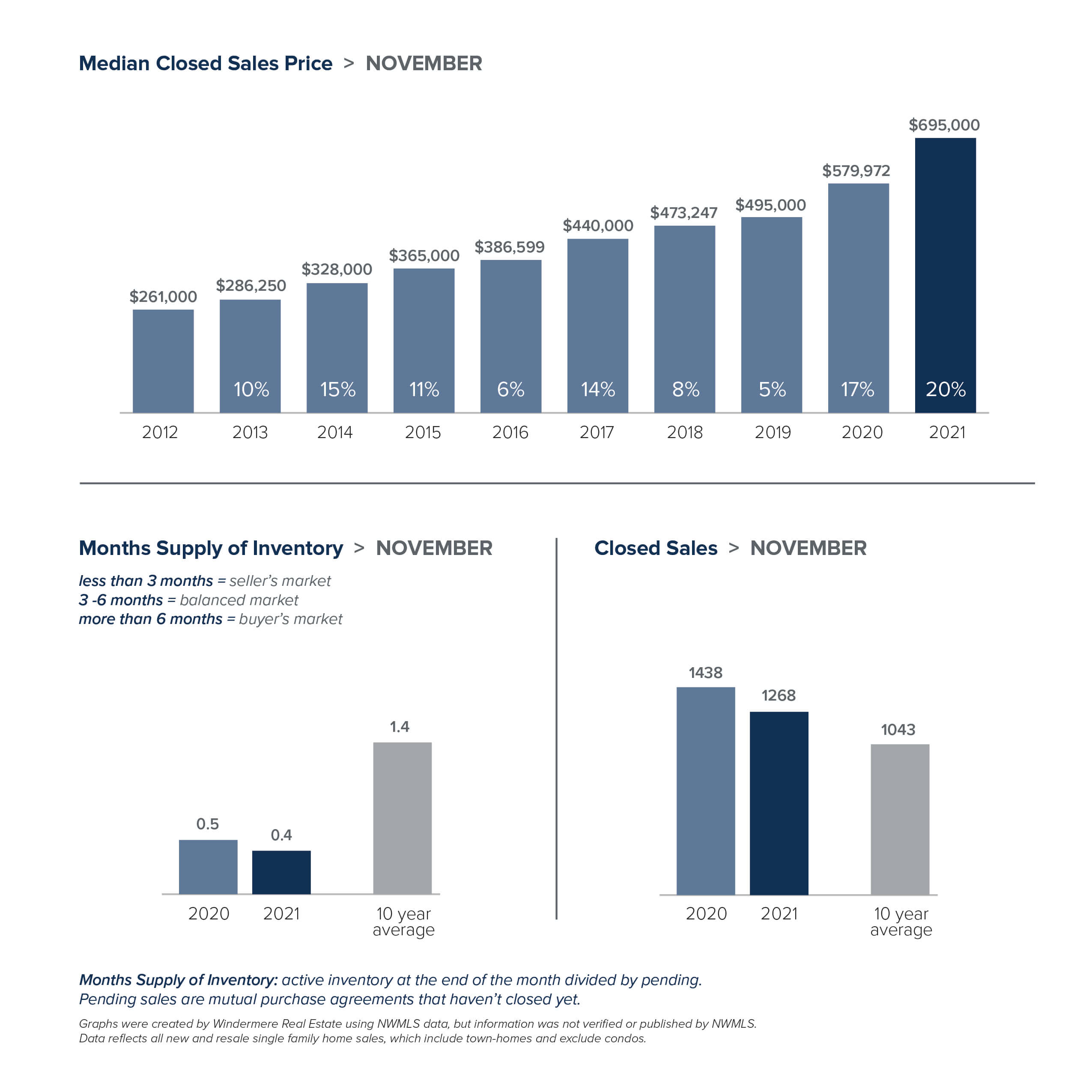

November Results

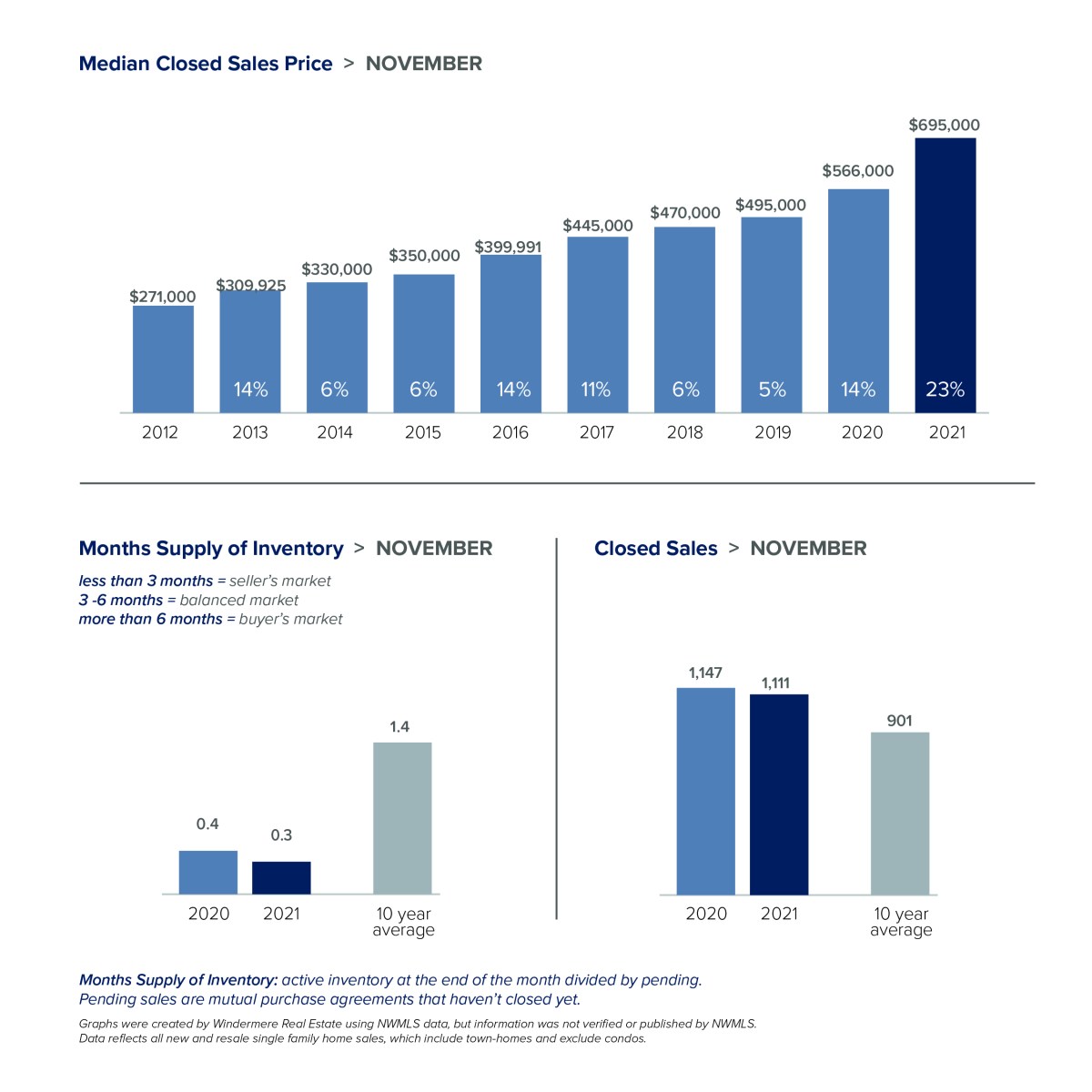

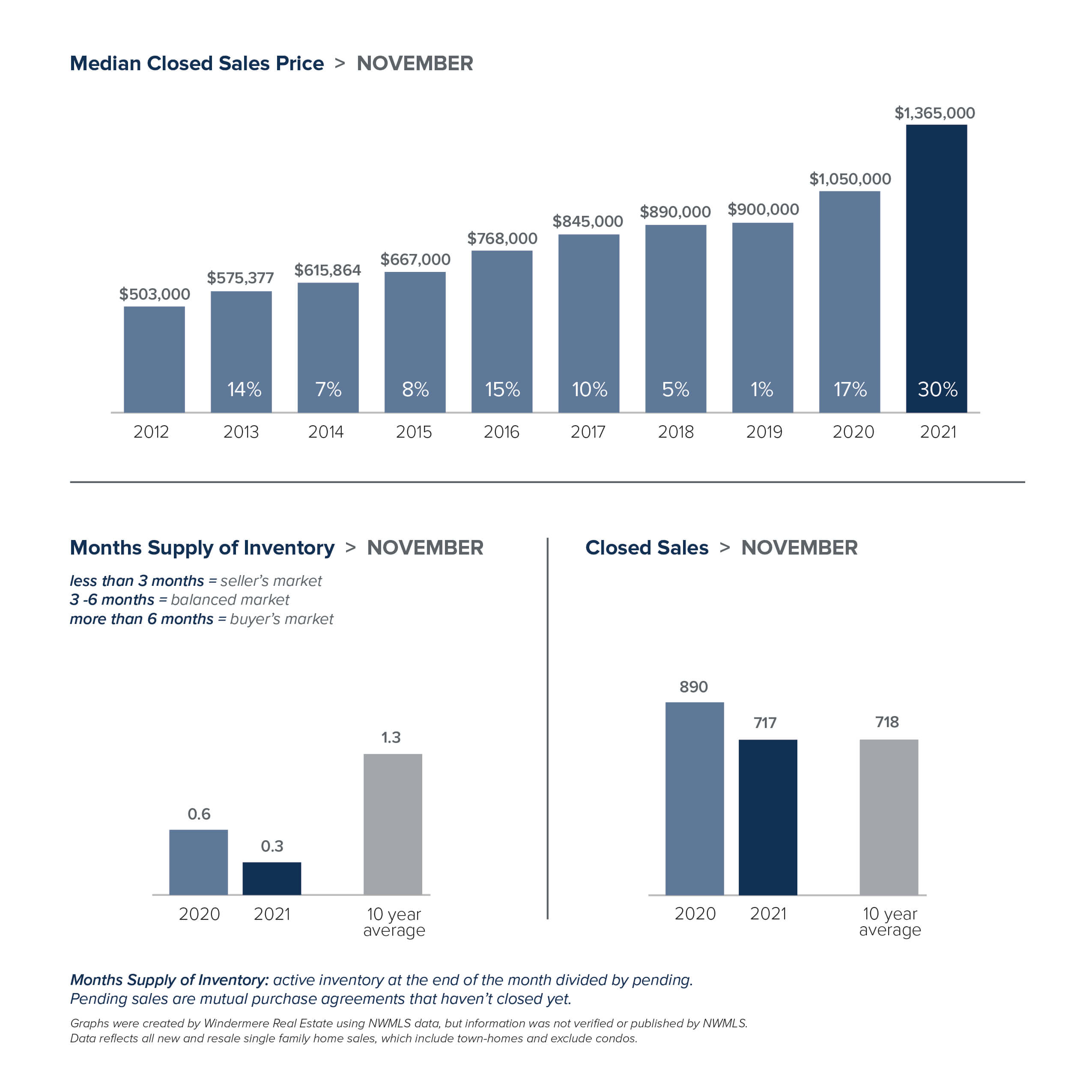

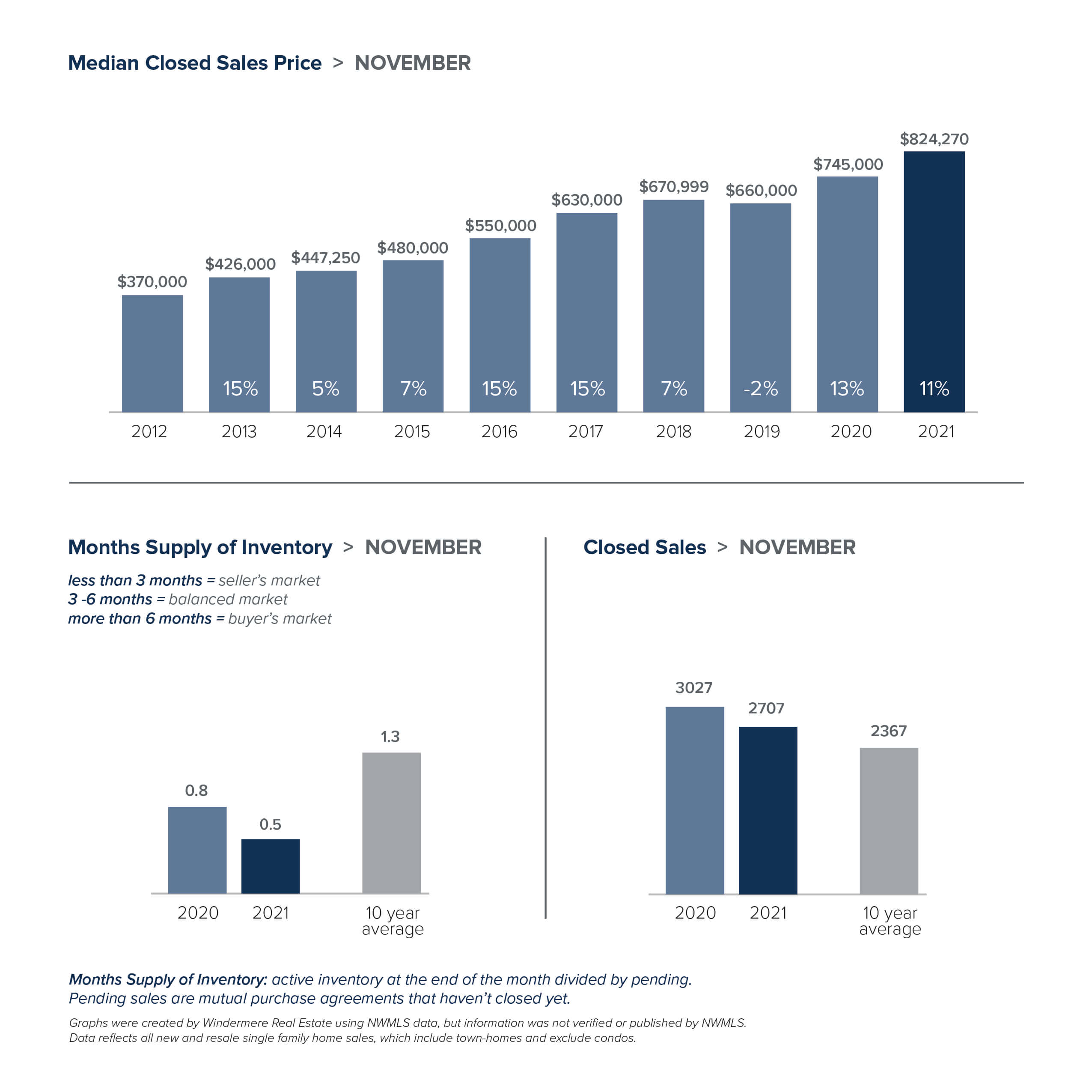

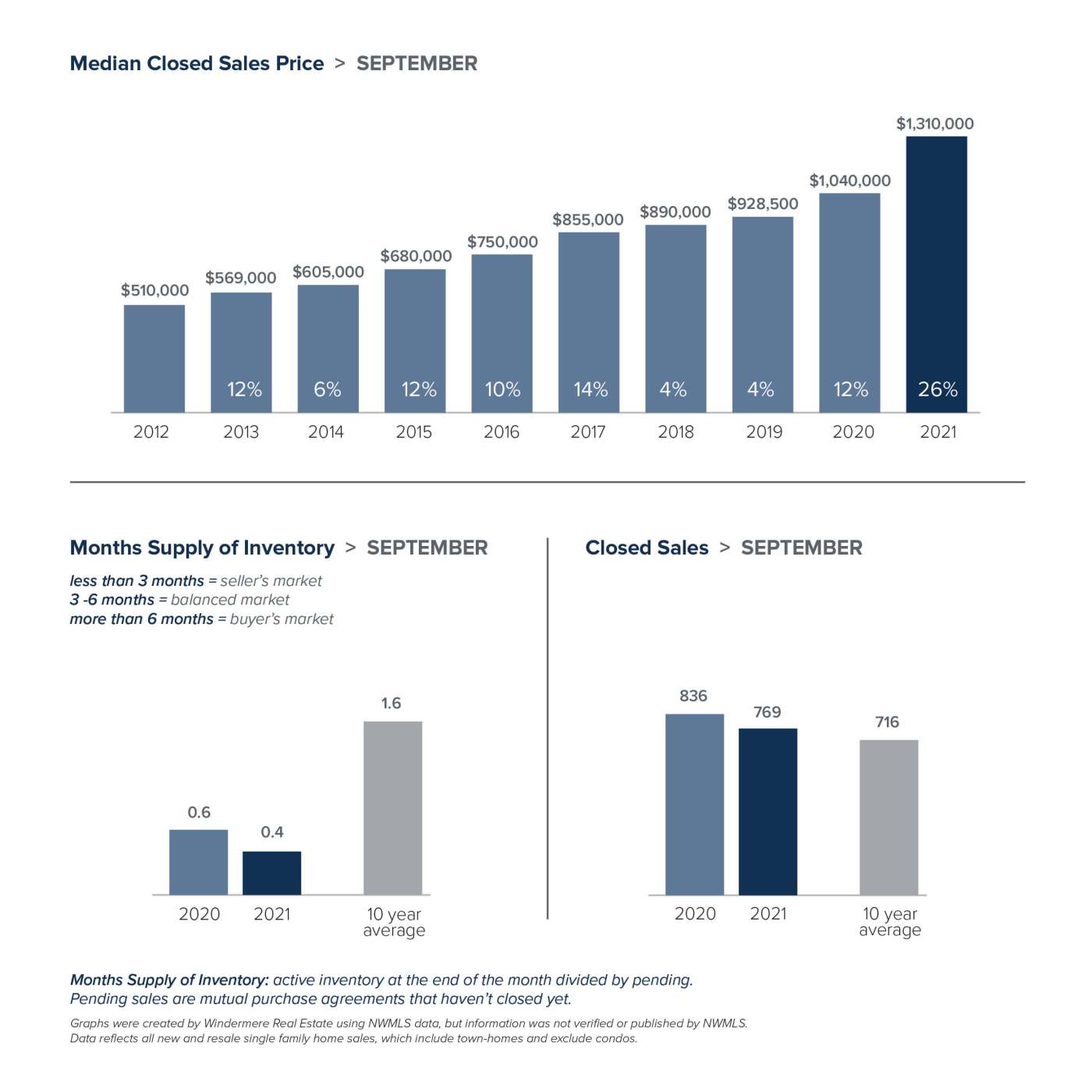

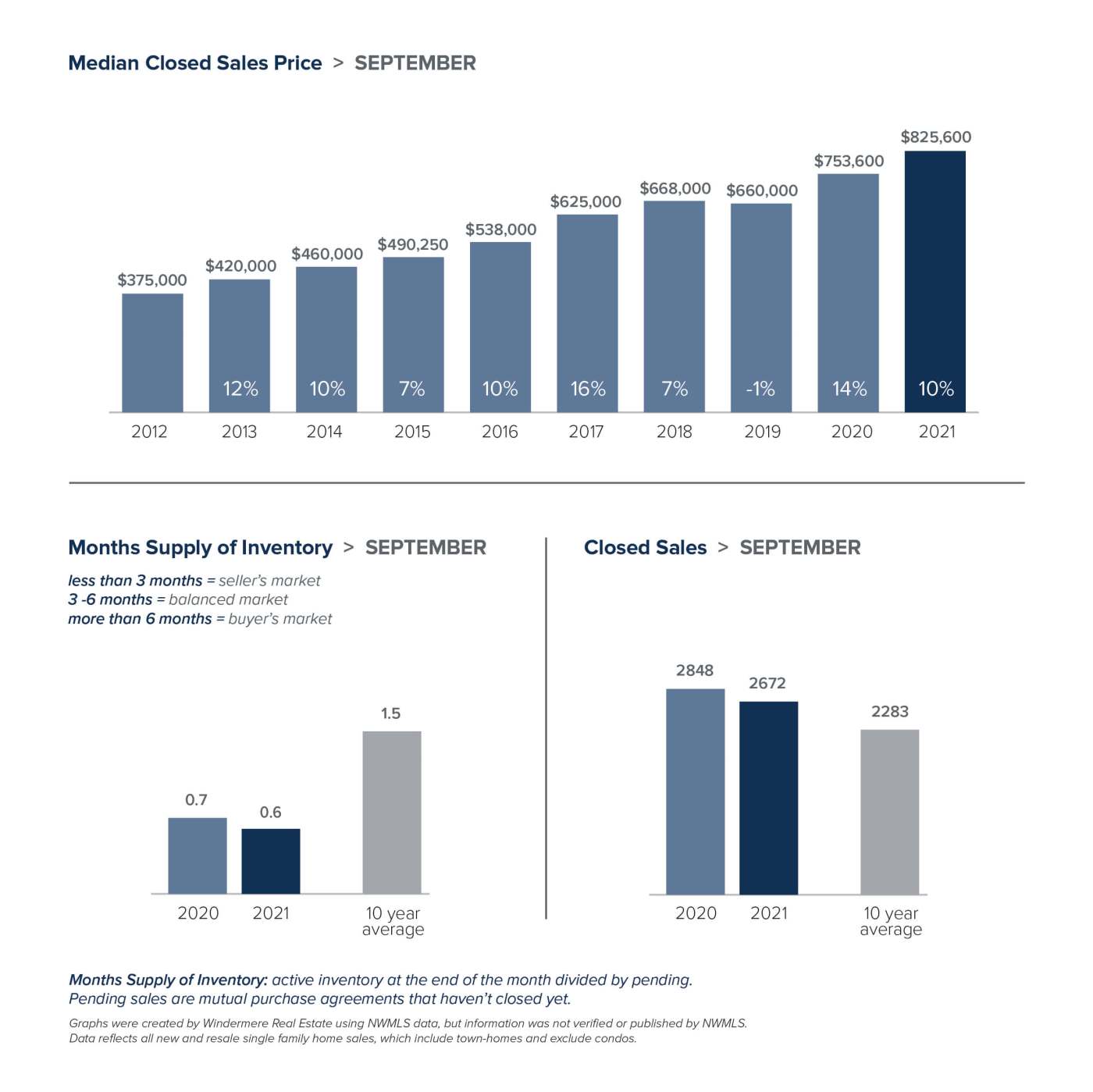

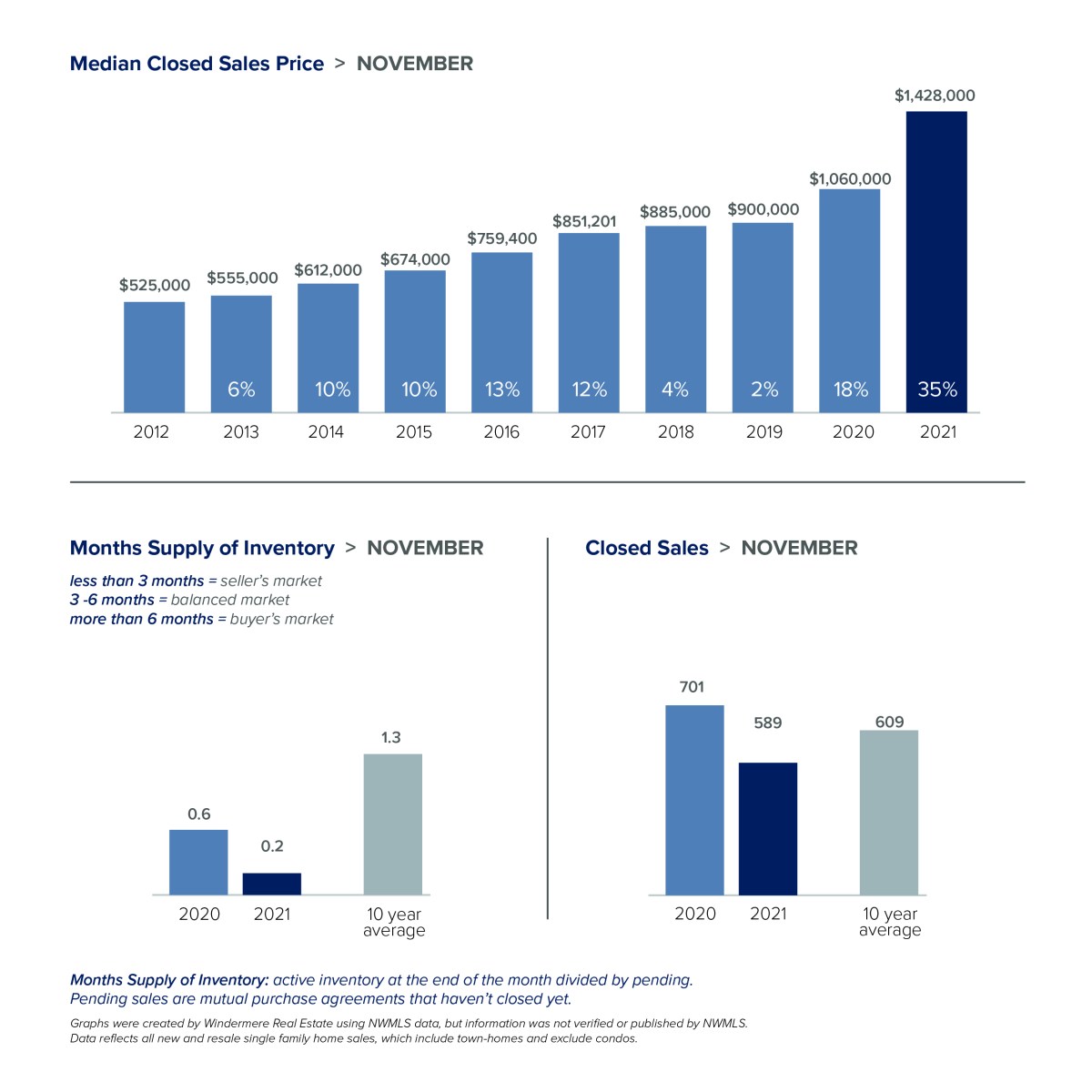

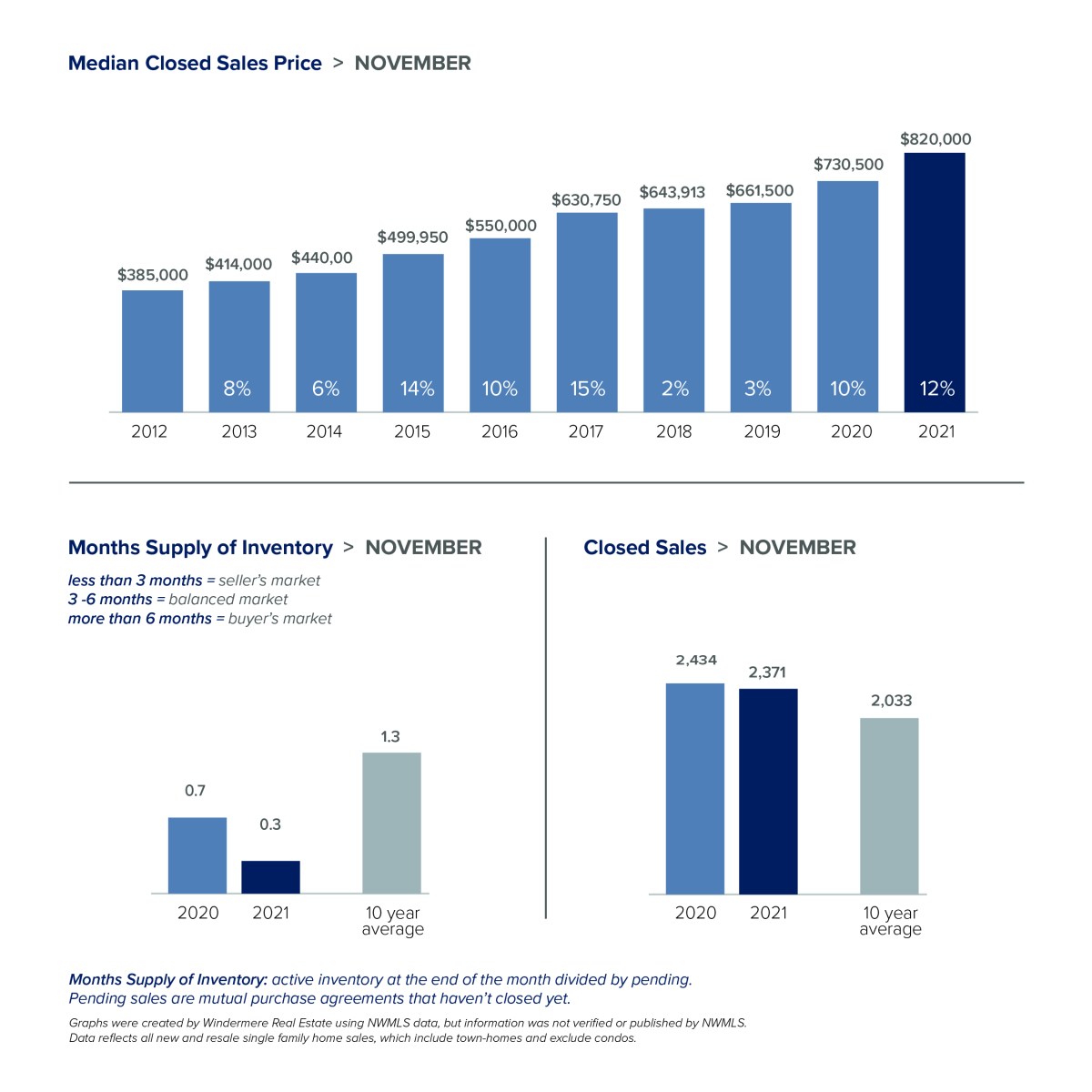

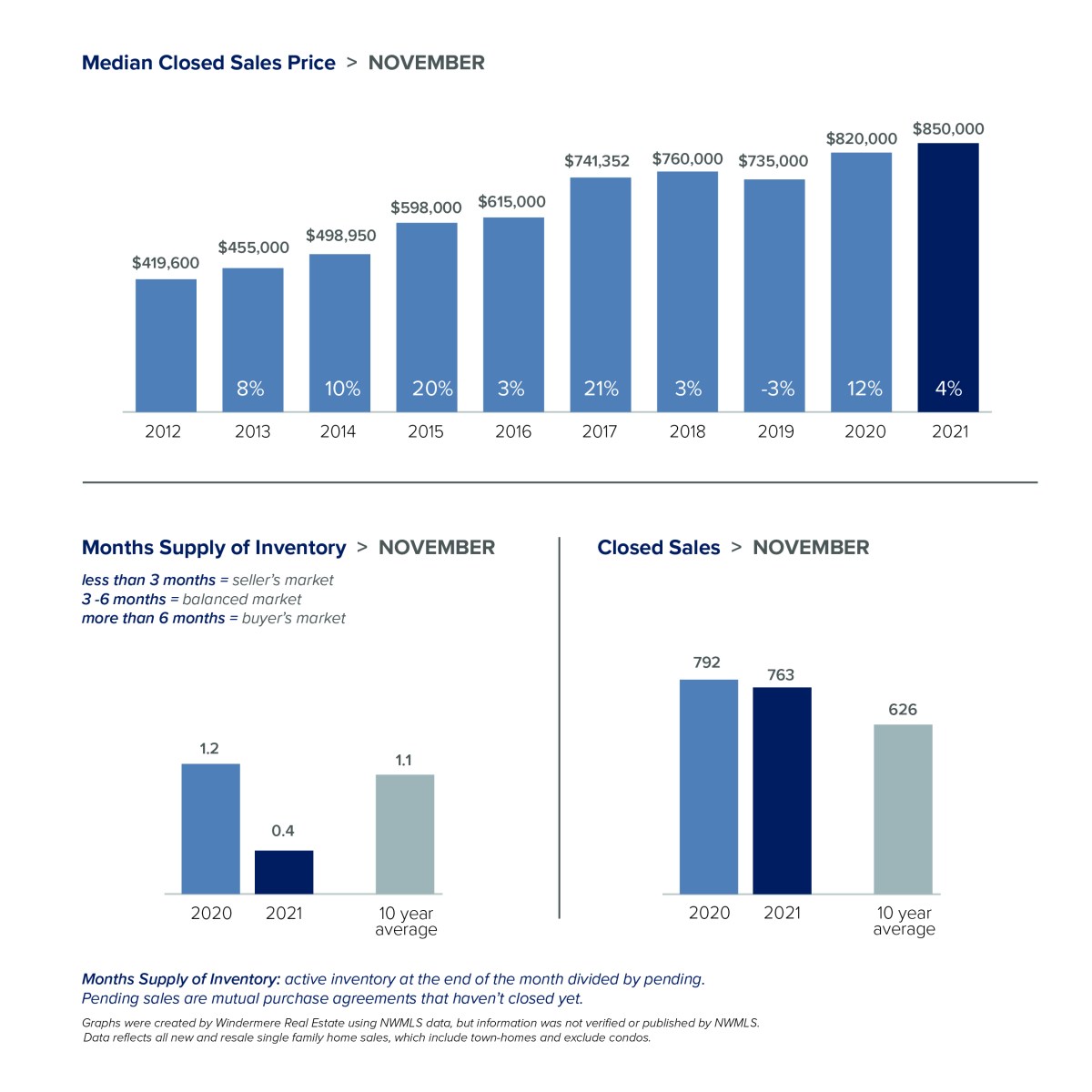

With the exception of the Eastside, Puget Sound median home prices were essentially flat in November compared to the previous month. However, prices increased by double-digits in most areas from last year. In King County, the median single-family home price rose 12% from last November to $820,000. Home prices in Seattle continue to level off, with the median price of $850,000 up just 4% from a year earlier. The Eastside maintained its strong appreciation, with prices soaring 35% from a year ago to a new record. The median home price there of $1,428,000 topped the previous all-time high price of $1,365,000 set in October. Prices in Snohomish County jumped as well, rising 23% to $695,000.

Despite the traditional winter slowdown, the supply of homes for sale just isn’t budging. Snohomish County has just three weeks of inventory. In King County it would take just over a week to sell through all the homes for sale. Inventory is at an all-time low on the Eastside, where there are only 100 single-family homes for sale in the entire area, which stretches from Issaquah to Woodinville. Homes there are snapped up quickly, with 85% of properties selling within two weeks. With demand at a peak, the inventory crunch is expected to continue. Developers are particularly bullish on the Eastside, where plans are in the works for numerous projects, including a new condo tower in Bellevue, a $500 million transit-oriented development, and over 7,500 new apartment units that are being built in Redmond.

2022 Predictions

What’s ahead for 2022? Matthew Gardner, Chief Economist at Windermere, expects the market to continue to be strong, but believes the pace of appreciation will slow significantly from this year. “I predict single family prices will increase by around 8% in King and Snohomish counties. Affordability issues and modestly rising interest rates will take some of the steam out of the market in 2022.”

Do your New Year’s plans include buying or selling a home? Your broker can keep you up to date on the latest trends and help you create a plan to meet your goals. Let us know how we can help.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

Check back next month for a new local market update.

Connect With Us On:

Instagram!

Facebook!

YouTube

This post originally appeared on GetTheWReport.com.

The Gardner Report – Quarter 3

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

REGIONAL ECONOMIC OVERVIEW

The emergence of the of COVID-19 Delta variant had a palpable impact on the region’s economy, which, naturally, impacted job recovery. Employment levels in Western Washington had been picking up steam in the spring but started to slow quite dramatically over the summer. To date, the region has recovered more than 201,000 of the jobs that were lost due to the pandemic, but we appear to be in a bit of a holding pattern. That said, the ending of enhanced unemployment benefits has led many business owners to see more applicants for open positions, so I am hopeful the numbers will pick back up as we move into the winter months. The most recent data (August) shows the region’s unemployment rate at a respectable 5%, but we still have a way to go before we reach the pre-pandemic low of 3.7%. On a county level, the lowest unemployment rate was in Kitsap County (4.4%) and the highest was in Grays Harbor County (6.6%). There are still many hurdles in front of us, but I believe we will continue to add jobs and reach full employment recovery by mid-2022.

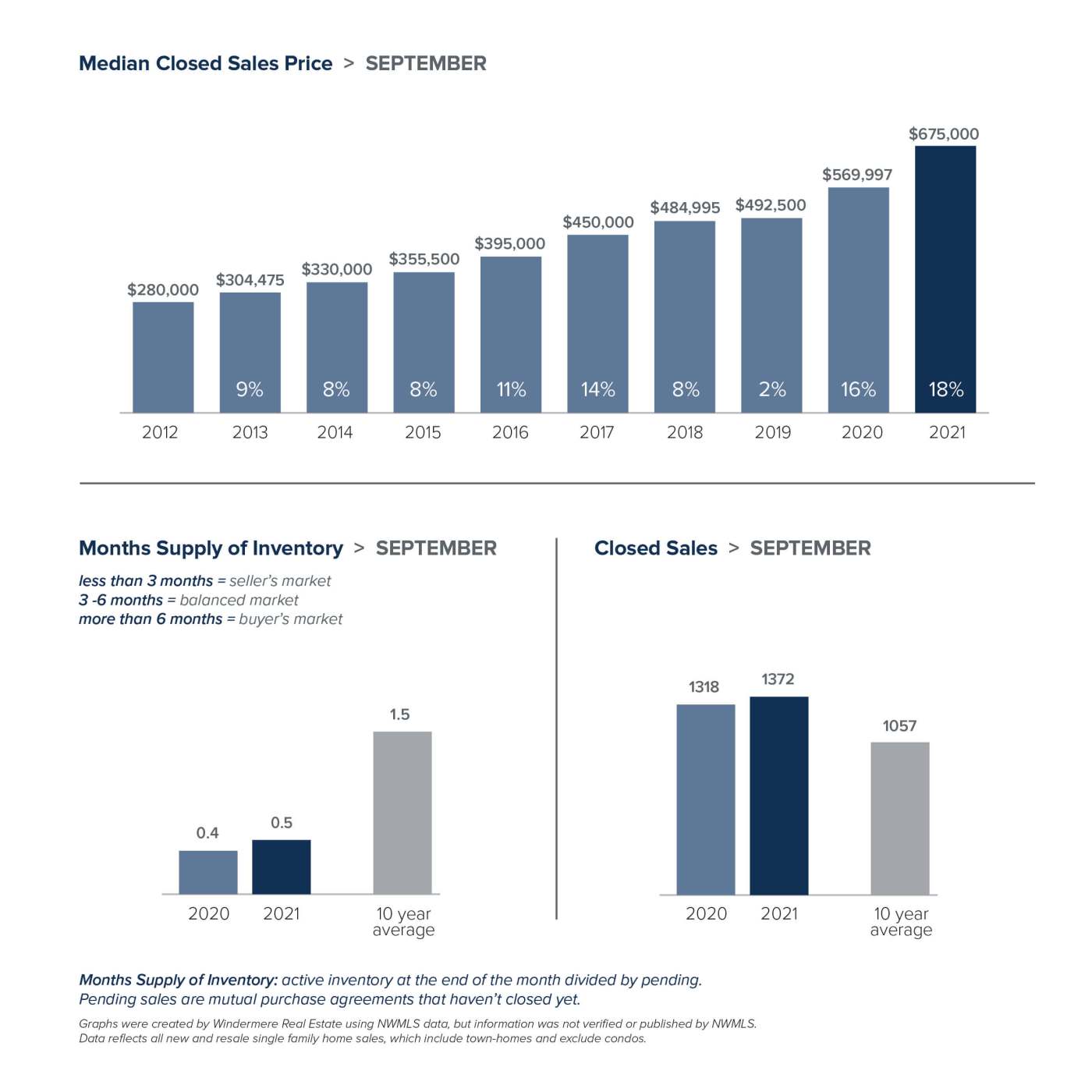

WESTERN WASHINGTON HOME SALES

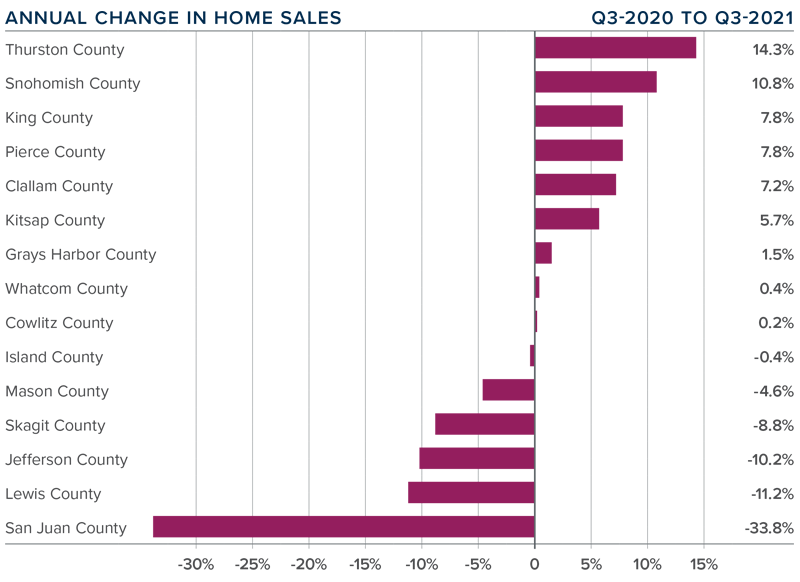

❱ Sales in the third quarter rose 6.4% year over year, with a total of 27,280 homes sold. The increase matched what we saw in the second quarter of this year.

❱ I was pleased to see sales growth continue. This rise was supported by a 28.4% increase in the number of homes for sale. Listings rose the most in Grays Harbor (+62.6%), Lewis (+53.6%), and Skagit (+52.0%) counties.

❱ Sales activity was mixed. Nine counties saw year-over-year growth, but sales slowed in six counties. That said, sales were up in every county other than King and San Juan compared to the second quarter of 2021.

❱ The ratio of pending sales (demand) to active listings (supply) showed pending sales outpacing listings by a factor of 4.6. Even with the increase in the number of new listings, the market is far from balanced.

WESTERN WASHINGTON HOME PRICES

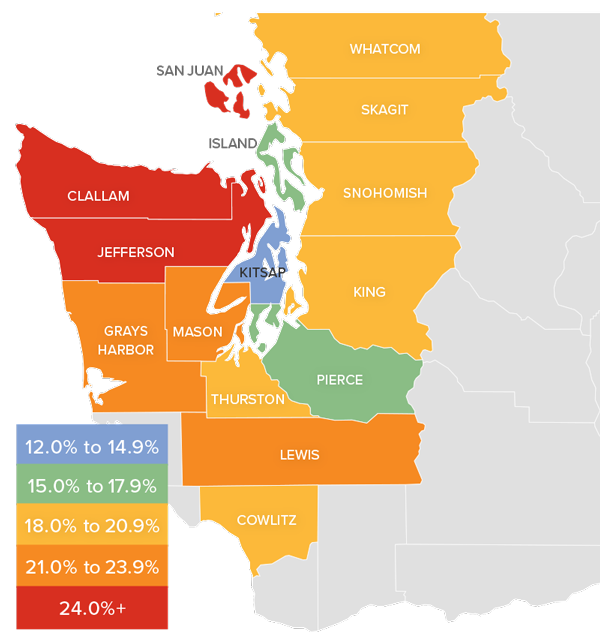

❱ Home prices rose 18.9% compared to a year ago, with an average sale price of $726,168—another all-time record.

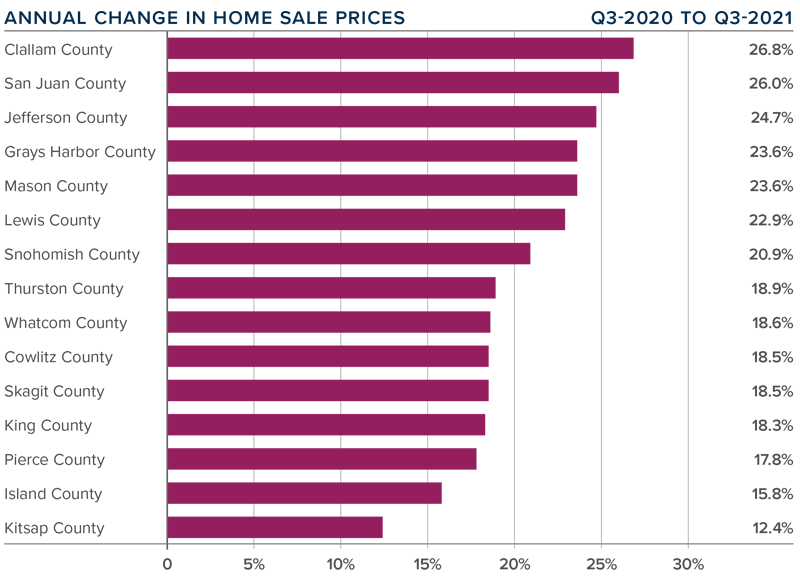

❱ When compared to the same period a year ago, price growth was strongest in Clallam, San Juan, and Jefferson counties, but all markets saw prices rise more than 12% from a year ago.

❱ Average sale prices pulled back 1.1% compared to the second quarter of this year. Given the massive increase in value over the past few years, it is not at all surprising. The key indicator has been a softening in list prices and that naturally translates to slower price growth. This is nothing to be worried about. It simply suggests that the market may finally be heading back to some sort of balance.

❱ Relative to the second quarter of this year, all counties except San Juan (-0.1%), Island (-0.5%), and Whatcom (-0.5%) saw higher sale prices.

DAYS ON MARKET

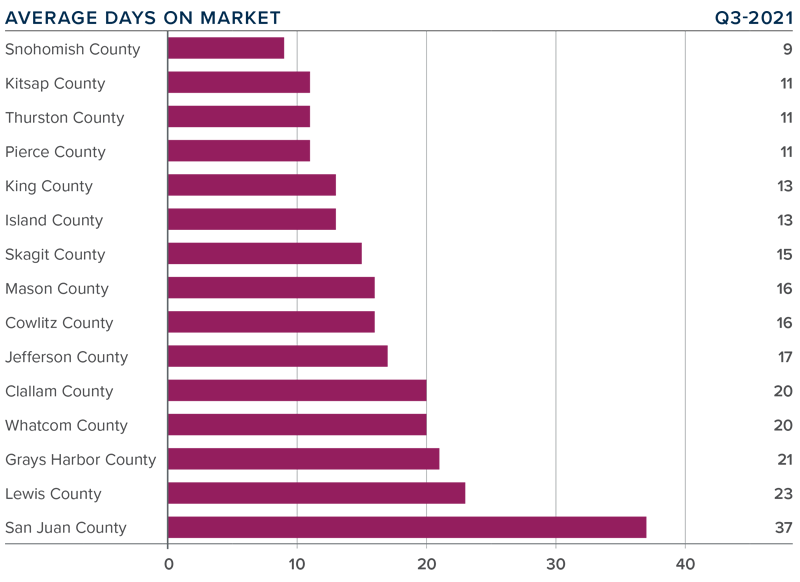

❱ It took an average of 17 days for a home to sell in the third quarter. This was 19 fewer days than in the same quarter of 2020, and 1 fewer day than in the second quarter of this year.

❱ Mirroring the second quarter, Snohomish, Kitsap, Thurston, and Pierce counties were the tightest markets in Western Washington, with homes taking an average of 9 days to sell in Snohomish County and 11 days in the other three counties. The greatest reduction in market time compared to a year ago was in San Juan County where it took 102 fewer days for homes to sell.

❱ All counties contained in this report saw the average time on market drop from the same period a year ago, but eight counties saw market time rise from the second quarter; however, the increases were minimal.

❱ Even with inventory levels increasing in most markets, the region’s housing market remains remarkably tight. That said, I do see some of the heat dissipating and I am hopeful that if inventory levels continue rising, we will start a slow move back toward a balanced market.

CONCLUSIONS

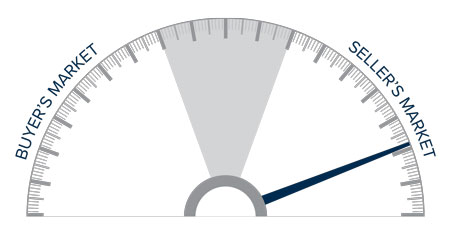

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Even given the speedbump that hit the region’s economy with the emergence of the Delta variant, the housing market remains remarkably resilient. Demand from buyers continues to be very strong, and modestly increasing inventory levels appear to have—at least for the time being—reduced some of the fever from the market. Mortgage rates remain very favorable, and my current forecast is for them to stay in the low- to mid-3% range until next summer. Rising inventory levels have led price growth to slow and days on market to start increasing, which may be a sign that the market is retreating from a prolonged period of exuberance.

As we move through the balance of the year, I believe demand will remain solid, but we will continue to see price growth soften as more listings compete for the buyers that are out there. That is not to say price growth will turn negative; rather it suggests that we are slowly moving back toward a more balanced market. That said, the market certainly still favors home sellers. As such, I am leaving the needle in the same position as the second quarter. I may move it a little in the direction of buyers next quarter if the current trend continues through the winter months.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog.

How to Plan Your Own DIY House Rehab

Are You Planning to DIY a House Rehab?

For many people, home renovations are a part of life. Whether it’s painting the living room or installing a new dishwasher, most homeowners will take on at least one project over the course of their time in their home, but what circumstances make it worth it to get an expert contractor involved in your remodel? Is it ever actually worth doing DIY projects around the house? Continue reading to learn more!

Common Myths about Home Renovation

If you are planning on doing renovations of any sort around the house, it is an important decision to make about whether it is worth it to do it yourself or hire a professional. Home renovations can be a fun, rewarding experience, but there are a lot of myths about home renovation that might make it seem more difficult than it is. Here are some of the most common myths regarding home renovations:

- If you don’t know what you’re doing, then it’s probably better to hire a professional. Not true! For most homeowners, knowing how and when to get help is the difference between a successful project and a disaster. Knowing when it’s time to ask for help can save you money and heartbreak down the line. With that said, for smaller jobs, there are plenty of online resources available to learn how to do something like changing light fixtures, faucets, electrical outlets, etc.

- All contractors are the same. Well, not really! It’s important to do some research into which contractor is the best fit for your project. For example, if you’re getting your fence repaired or installing a new one, it may be good to receive and repair quotes from different contractors before making a decision. A quick search on a platform like Angi for ‘fencing near me’ will put you in touch with several local contractors that you can then vet based on their rates, client reviews, licenses, insurance, and more.

- You need to spend a lot of money to make your house look beautiful. Not true! Most homeowners don’t need to spend a lot of money, nor do they want to. There are many small improvements that can have a big impact on the way your home looks and feels without breaking the bank. There are many different options when it comes to materials and supplies that can drastically affect the cost of your renovation.

Our Simple Guide to DIY or Hire Out

Deciding to DIY or hire a professional can be a difficult choice for homeowners. Here are some tips for specific jobs about when to do it yourself and when you should hire a professional:

Do These Yourself:

● Painting: For many people, painting is an easy thing to tackle on their own. You can learn the basics with a few YouTube videos and some practice. If you paint often, it is easy to perfect the skill and achieve a close to professional-looking finish. Painting can make a huge difference in the selling process!

● Cabinet knobs and handles: A few new cabinet knobs and handles can really go a long way towards making your kitchen feel modern and fresh, and it’s an easy job for most homeowners. Most hardware stores have tons of different and affordable options. Sometimes the small details such as these can make all the difference saving you from a much larger project, such as replacing the entire cabinet.

Hire These Out:

● Countertops: Countertops are one of the most important, stand-out pieces in your kitchen. It’s worth it to hire a professional for this job if you don’t want to risk messing up the finished product.

● Flooring: If you’re planning on using hardwood floors, tile, or other types of flooring that require precise measurements and cuts, hire it out. You want these jobs to look perfect.

Time to Start Your Rehab!

While these decisions can be difficult to make, they are more often than not worth it in the long run. Hopefully, the tips and advice in this article will make it easier for you to figure out what is best for your situation.

This post was originally submitted by Lisa Walker and has been edited by the Kari Haas Real Estate Team.

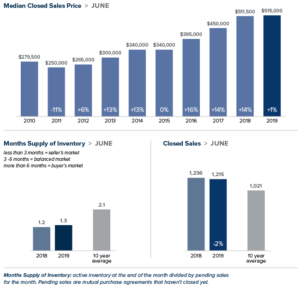

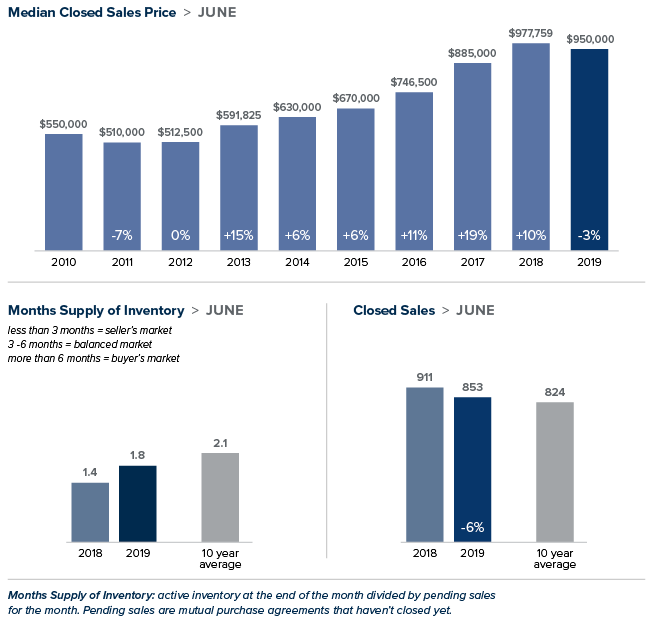

July 2019 Real Estate Market Update

The market in our region appears to be moderating. Inventory is up, prices are relatively stable and homes are taking a bit longer to sell. However, with less than two months of available inventory, supply is still far short of demand. Steady buyer activity, low interest rates and a thriving economy are making for a strong summer in the housing market.

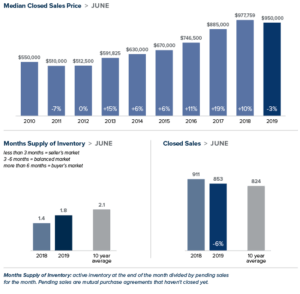

Eastside

The median price of a single-family home on the Eastside was $950,000 in June, down 3% from the same time last year and up $21,000 from May. Many buyers are looking to take advantage of the Eastside jobs boom with Amazon announcing plans to build a 43-story tower in Bellevue and Google expecting to reach 1 million square feet of office space in Kirkland.

Kari Haas Stat:

Since April 2019, Kari’s buyers have bought at an average of 97% of list price. That means that Kari’s clients are buying for less than the industry average and therefore closing with more money in their pockets! Call Kari Haas today at 206-719-2224 to discuss your real estate goals.

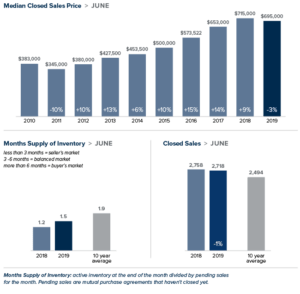

King County

There was good news for buyers in June as a growing supply of homes helped boost inventory close to 2012 listing levels. The median price of a single-family home in King County was $695,000. That figure is a 3% drop from a year ago and virtually unchanged from May. 33% of homes sold above list price; another sign prices are moderating when compared to 52% of homes sold over list price this time last year.

Click here to see Kari’s current listings!

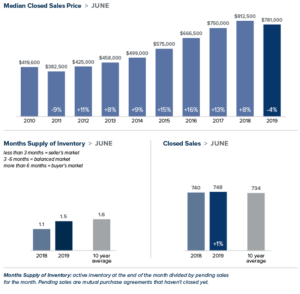

Seattle

Home inventory in Seattle inched slightly higher in June. However, with less than two months of supply, the city is still a solid seller’s market. Apple’s plan to turn Seattle into a key engineering hub can only add to demand. The median price of a single-family home in Seattle was $781,000, down 4% from a year ago and nearly unchanged from May.

Connect with Kari on Twitter

Snohomish County

After hovering around $500,000 since March, home prices in Snohomish County crept up in June. The median price of a single-family home was $515,500, as compared to $511,500 last June. Snohomish County continues to attract buyers priced out of the King County market, putting an additional strain on supply which stands a just 1.5 months of inventory.

This post originally appeared on the GetTheWreport.com.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link