Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

What to Ask Your Financial Planner Before Buying a Home

US home prices continue to rise in 2022. Just last March, prices spiked at a rate of 20.6%, making it the highest year-over-year price change in over 35 years. With rapid home price surges across 20 different US cities, it’s crucial for aspiring homeowners to consult with financial planners to better navigate the pressures of enlarged home values. That being said, demand for personal financial advisors has likewise increased; their employment rate is even set to grow by 15% in the following years. As formal finance education now focuses on investment strategies and securities analysis, planners can make informed recommendations according to your income, debt, and credit history. This advice will help you manage the potential risks and returns when purchasing a house. For instance, finding the right mortgage can help homebuyers retain a decent part of their gross income, and meet future maintenance and repair costs better.

The questions you ask your financial planner before purchasing a house can lead to a more well-rounded decision. We’ve listed below the four questions you need to start with.

1. How much can I actually afford?

Mortgages are quite costly and can affect your plans of buying your dream home. As it stands, a $300,000 loan, for example, can require you to pay $1,734 a month. Now although financial calculators prove beneficial in planning your budget, they aren’t enough. It’s important to seek advice from a financial planner on how much you should save for house costs. Consulting a professional is especially relevant if your budget oversees non-negotiable costs like student loan debt. Financial planners can identify your debt to income ratio, which is used when you apply for a mortgage, and suggest how much you should borrow — this way you don’t have to stretch your budget thin.

2. What type of mortgages can I pick from?

Your financial planner can present a selection of mortgages that are proportional to your financial situation. Below are some of the mortgages you can apply for:

Conventional loans

These loans require a strong credit score and come in two types: conforming and non-conforming. Conforming loans, specifically, follow a set of standards for loan size, debt and credit created by the Federal Housing Finance Agency. Most areas have a loan limit of $647,200, while expensive locations go up to $970,800, so it’s best to talk to your planner to know how much you can take out for your home — especially if you want to purchase a house in expensive areas.

Government-backed loans

FHA, USDA, and VA are among a few examples of this loan. There are varying conditions for each, like how much money should be put down, and your planner can see if you qualify for these loans. Typically, VA or USDA loans need high credit scores, whereas FHA loans require much steeper down payments. Also, if you aren’t within a low-to-moderate income level or don’t prefer a home in rural areas, your advisor might warn against taking out a USDA mortgage.

3. How much do home insurance policies go for?

Alongside your mortgage plan, financial planners make sure you get the right insurance coverage for your needs. Insurance plans should correspond to the type of coverage your house requires, and planners can base them on the home’s past claim history and physical condition, as well as its location. On average, the cost of homeowners insurance policies in the US amount to $1,312 annually for a $250,000 dwelling coverage amount. If you live in disaster-prone areas, however, insurance premiums can rise up to 12.1%. Ultimately, home insurance policies differ across different houses, so speak to your planner about which coverage best suits you.

4. Should I place my home in a trust?

Houses are large purchases that double as assets. Consult your financial planner about having your home protected through an estate plan (which transfers any legal responsibility of your assets to trusted loved ones). In particular, trusts enable you to pass down your home to another. Depending on your home’s value, planners can recommend whether a trust is beneficial for you. A house worth $160,000, for instance, can be included in a trust. Trusts are ideal if you’re buying an expensive home, as they prevent your family from undergoing probate court to contest homeownership rights. If you’re worried that placing your home under a trust means losing control over the property, don’t be. As your financial planner will affirm, a trustee can choose how and when their beneficiary will inherit the house.

Finding your Financial Advisor with Kari Haas

The Kari Haas Real Estate Team works closely with a trusted Financial Advisor and has connections and referrals for you in all steps of the home buying/selling process. Give Kari a call to be connected with one of our highly recommended service providers.

Article exclusively submitted to karihaas.com

Written by Rita Janine

Image via Pexels

Fix It Up and Sell It: A Senior’s Guide to House Flipping

Believe it or not, retirement doesn’t suit everyone. In fact, some people simply enjoy working while others want to earn a little extra cash. That’s where house-flipping comes in. It can be an extremely profitable side gig for seniors willing to invest time and money. If you’re curious about learning more, you’re in luck. Kari Haas has some tips and resources to help you get started in the house-flipping business. Continue reading for a Senior’s Guide to House Flipping.

Finding Your Ideal Property

To find your ideal property, start by:

- Employing an agent: They know the best areas for flipping homes. If you’re looking for rehab properties, HomeLight suggests hiring an REO agent.

- Look for auctions: If you’re looking for a good discount, estate and foreclosure auctions provide good opportunities.

- Short sales: Some homeowners need to sell their property quickly, sometimes for less than the amount owed on their mortgage. These are known as short sales.

Finding a Mortgage

There are several options when it comes to finding a mortgage. FHA 203 (K) is a type of government-insured mortgage that allows a borrower to take out a loan for the property’s purchase and renovation costs. Other options include a VA renovation loan, HomeStyle loans, and a CHOICE Renovation loan. The Kari Haas Real Estate Team has trusted mortgage brokers to assist you in finding the right fit for you.

Caution Is the Name of the Game

The primary purpose of buying a fixer-upper home is to save money on the purchase price. Still, it doesn’t always work out as expected due to unforeseen repairs and necessary renovations. When searching for a property to renovate, look out for certain red flags, such as structural damage or dry rot. Add 20% to your estimate, particularly for major repairs, such as electrical work, HVAC upgrades, foundation problems, or issues with mold or asbestos.

Formalize Your Business as an LLC

When starting a house-flipping business, consider forming a limited liability company (LLC). This business entity offers benefits when it comes to filing taxes and helps shield you from personal liability. Each state has its own rules and procedures for setting up an LLC. In most cases, it’s easy and affordable and can often be done online.

Now that you’re legitimately structured and ready to operate as a going concern, you’ll need to take initial necessary steps to get up and running. This includes drafting a business plan, setting a budget, and developing a marketing strategy. This strategy should involve digital marketing on social media, which in today’s day and age is essential. Fortunately, you don’t have to be a technological wiz; in fact, these days, you can easily design banners online then let them do the work for you. With free online templates, you’re able to customize and share posts in no time.

Renovations to Boost Value

Homes & Gardens notes that there are several options to add value to your property through renovations. For instance, you can upgrade the kitchen lighting or hood range over the cooking surface, or add insulation to the attic to make the house more energy-efficient.

Some renovations, such as kitchen remodels, add more value to a property than others. Remodeling a kitchen requires a competent plumber, especially if you plan to have pipes repaired or replaced. Plumbing services typically cost between $45 and $150 per hour. Before hiring, always take a close look at reviews and insist on only working with licensed and insured professionals.

If you plan to hire contractors for repairs or renovation projects or a property manager, it’s important to set up a payroll system before contacting them. Keep in mind that there are many payroll software options; just be sure the platform you choose offers automatic payroll scheduling, as well as automatic calculating and tax filing, in addition to same-day direct deposit and the ability to manage employee benefits.

Selling Your Fixer-Upper

When the time comes to sell your fixer-upper, find a real estate agent who’s as invested in selling your home as you are. When searching for one, ask for referrals from people you trust. Set a realistic sale price using a home estimate tool.

House Flipping in Your Senior Years

House flipping is an exciting side gig, and if done correctly, it can be considerably rewarding financially. If you can avoid the pitfalls, employ the right professionals, and deal with the finances, you can enjoy all the benefits of house flipping in your senior years.

Whatever your real estate needs, Kari Haas can help you reach your goals with confidence. Call 206-719-2224.

This post was written by guest blogger, Lisa Walker.

Image courtesy of Unsplash

September 2022 Real Estate Market Update

After its breakneck pace over the last two years, it appears the housing market has finally reached a soft bottom to the price corrections that began in April of this year. Reports that we’re entering a bear market are generally exaggerated, however, as the market seems simply to be resetting to a more balanced state where buyers and sellers are at last on more equal footing. Perhaps as much as anything, the market’s performance in August reflects a typical pattern for a month that has traditionally been a slower time for housing sales.

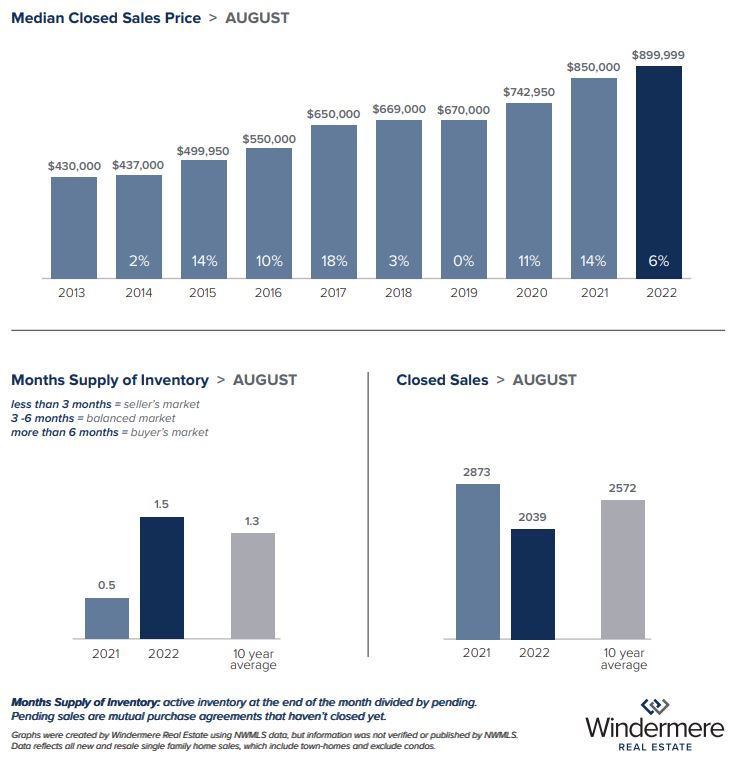

In King County last month, available inventory declined slightly to 1.5 months’ supply, with the median home price of $899,999 up slightly over July’s median of $890,000. That’s also an increase of 5.8% from $850,000 in August 2021. With 57% of homes selling in under two weeks and 22% selling over list price, many King County home buyers still have to move quickly and competitively, although with more leverage than they had earlier this year thanks to recent supply increases.

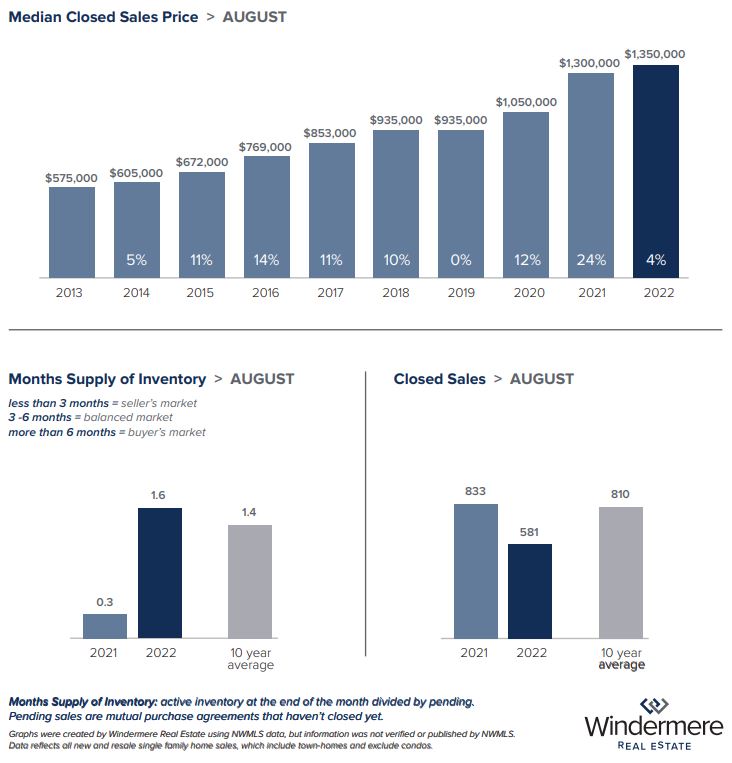

The Eastside had slightly higher levels of housing inventory available, at about 1.6 months. The median sold price for single-family homes rose 4% year-over-year, to $1,350,000. The higher asking prices in this area mean fewer homes are selling over asking than in Seattle, with about one in four homes selling at or over list price. Condos remain a more affordable option in this highly desired area, with the median price for an Eastside condo sitting at $569,500 last month.

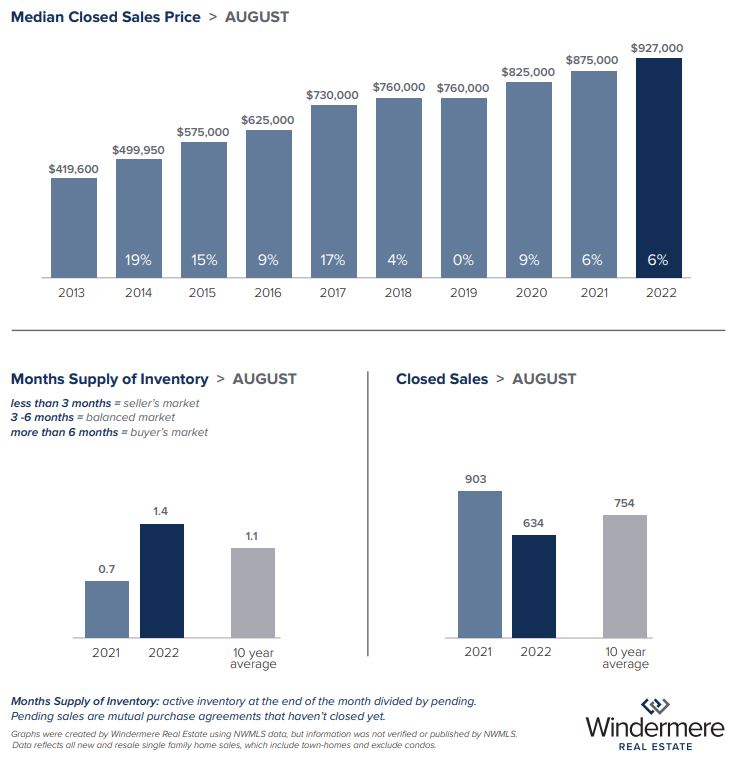

Seattle has slightly less supply than King County as a whole, sitting around 1.4 months of inventory. The median sold price for single-family homes was up 6% year-over-year, at $927,000. About 65% of single-family homes in the city sold within two weeks, while 26% of homes sold above list price. With 2.4 months of inventory, condos may offer buyers an easier way to break into the market. The median sold price for condos last month was also a more affordable $520,000, though that’s still up 8.3% year-over-year. Increasing rents in the city and across the Puget Sound region are driving some buyers into the market, as homeownership is a hedge against inflation and rising rent costs. Even with that in mind, sellers still need to price accurately to avoid their homes sitting on the market for too long.

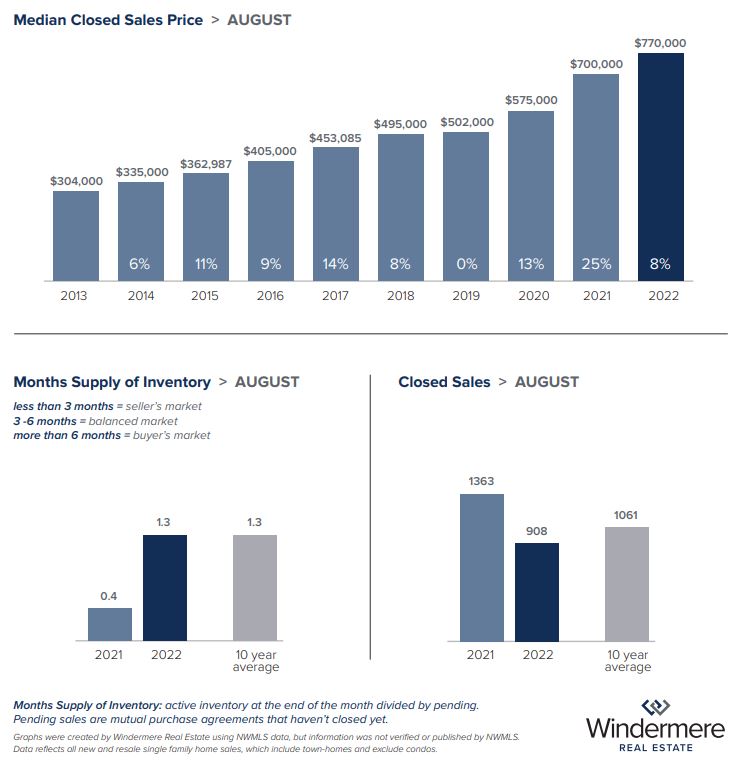

Snohomish County had the lowest inventory level at 1.3 months of supply (which is still more than the county’s average the past few years). The median sold price for single-family homes was $749,999, which is up 8% from August 2021. Just over half of the available homes sold within two weeks, and 19% sold over list price. The median price for condos in Snohomish County fell almost 5% year-over-year, landing at $474,999. This area continues to be a draw for buyers who may be priced out of the Seattle and Eastside markets.

Windermere’s Chief Economist Matthew Gardner believes the decrease in prices is a sign we’re entering a more typical housing market than we’ve seen in the last few years. “Home sales increased month-over-month, but the rise in listings is causing prices to soften,” he said. “I predict prices will drop further as we move into the fall. The market is simply reverting to its long-term average as it moves away from the artificial conditions caused by the pandemic.”

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

6 Tips for Moving and Starting Over in New State

Moving is both exciting and overwhelming at the same time. Without proper planning, it can become chaos, slowing down your chance to adjust quickly to your new home. If you’re moving to a new state, you may come across even more obstacles. Consider these tips to help you simplify the process.

-

Start Planning Far in Advance

Planning a move properly means starting the process far in advance. For example, research shows that you should have enough to cover at least three months of expenses before you move. Start the packing process at least two months before the moving date, and consider putting items in storage if you’re not sure you want to take them or think you may not have room. You can find storage companies that offer discounts, such as a month free, for new customers.

-

Consider Location When Looking for a Home

Talk to a local real estate agent before you start looking for a home in your new state. Kari Haas can help you find your dream home. Your goal should always be to find a place that best suits your needs in a location you love. Remember, location is often the most important aspect when searching for a home. You want an agent who can tell you about the school districts and shopping available in the area. A more desired location will cost more, but it will also have a higher resale value.

-

Starting Your Own Business

If you’re thinking about starting your own business in your new location, make sure you have all the plans in order before you make the big move. Create a thorough business plan to help you stay on track and show potential investors what your company has to offer. Your plan should include an executive summary about the business and products or services you’ll provide, how you plan to structure your business, any funding you will need, and any financial projections you’ve made about the company.

-

Join Your Community

If you’re looking for ways to get involved in your new community, join local social media groups or look for a community app where you can access local news and necessary information. Introduce yourself to neighbors virtually and in person to get to know people quickly. Being more involved helps you adjust more quickly.

-

Consider Investing in a Home Warranty

A home warranty is a service contract that covers the repair or replacement of major home appliances and systems, such as air conditioning, electrical, plumbing, and more. Many homeowners choose to get a home warranty to protect themselves from the high cost of repairs and replacements. Home warranties typically cover items for one year and can be renewed annually. When you’re weighing home warranty cost vs benefit, be sure to look over the home inspection report to see if there are any red flags.

-

Figure Out Your New Cost of Living

One of the first things you should do is research the cost of living in your new state. Start by looking for averages of things such as rent or mortgage, food, education, and entertainment. In Washington, housing costs are above the national average, but you can expect to pay less for health care and utilities. Washington is home to some of the best public schools in the country, so you can find affordable education for your children.

Before moving to a new state, choose a location, learn about the cost of living, consider investing in a home warranty, and think about starting a new business. Once you’ve completed your move, you’ll be ready to settle into your new life. Take the time to get to know your area, and you’ll speed up the process of feeling comfortable. Focusing on the positives of the move will help you overcome any possible homesickness.

Image via Pexels

This post was originally written by a guest blogger, Lisa Walker.

August 2022 Real Estate Market Update

The summer continues to heat up, and patient buyers are being rewarded as market shifts create a new dynamic between buyers and sellers. After years of intense competition between buyers for the most desirable listings, increasing inventory and slower price appreciation across the region have caused a pivot, with sellers competing more strongly against each other than they have in previous years.

The Return to a Balanced Housing Market

While this may cause uncertainty in some sellers, the rise in active inventory is an indication that we are returning to a more balanced housing market as a whole. Sellers can still be very successful with their home sales, as long as they price their homes accurately and understand that they may not see the exorbitant offers that were typical a few months ago. This is a pragmatic approach, and we should see some relief in the “buyer gridlock” that had kept homeowners in place who wanted to sell and move but simply had no place to go.

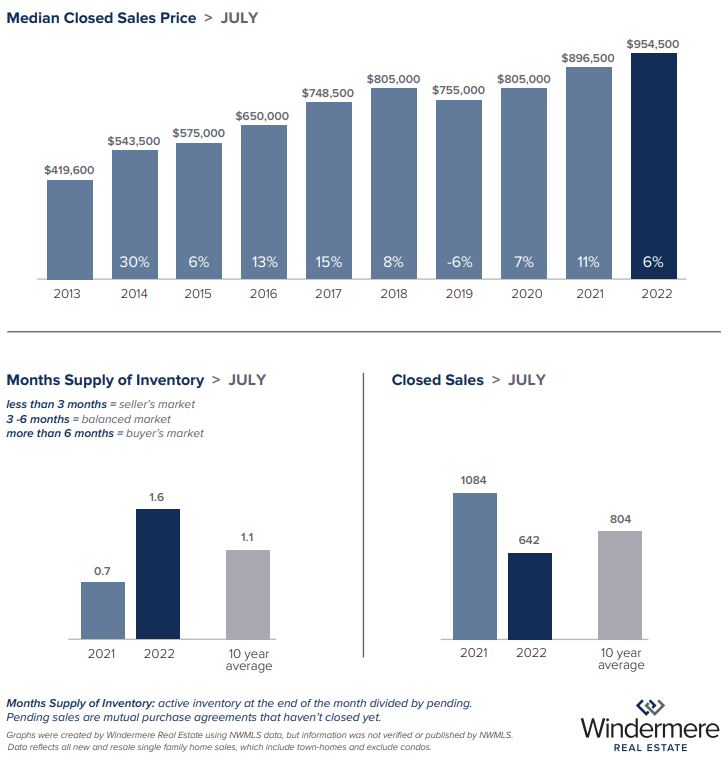

Inventory, Affordability, & Median Sale Prices

Even with the increased inventory across the Puget Sound region, we may start 2023 with low supply, high demand, and multiple offer situations. Prices are coming down largely as a result of the previous rapid price appreciation and rising interest rates. However, Puget Sound’s underlying lack of supply and huge demand has not changed, although rates have improved. Seattle’s median price for single-family homes rose 6.4% year-over-year, from $896,500 to $954,500. That’s down slightly from the million-dollar median the city hit in April, and should help create a more inviting market for prospective buyers. The median price for condos is currently a more affordable $537,000, with 2.5 months of inventory.

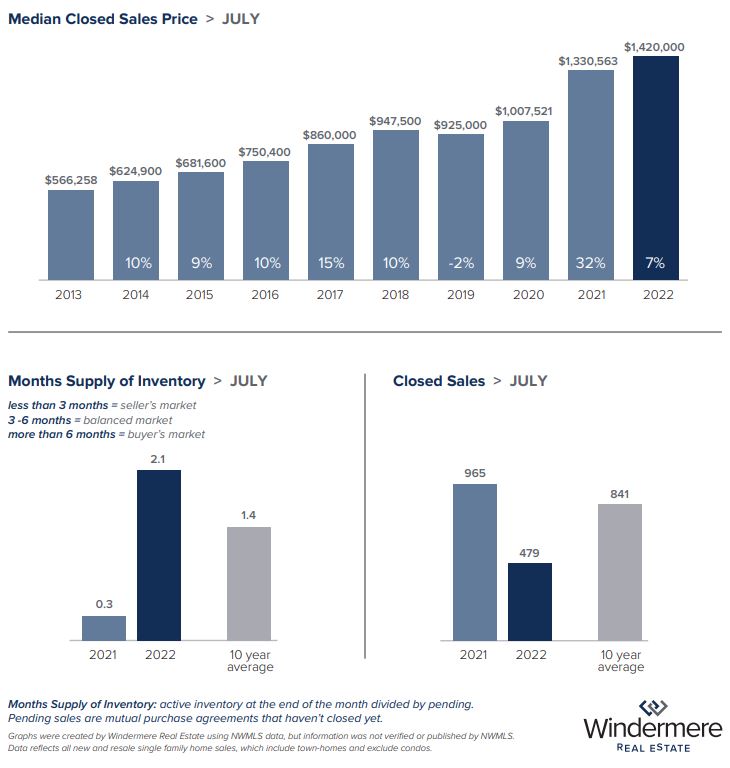

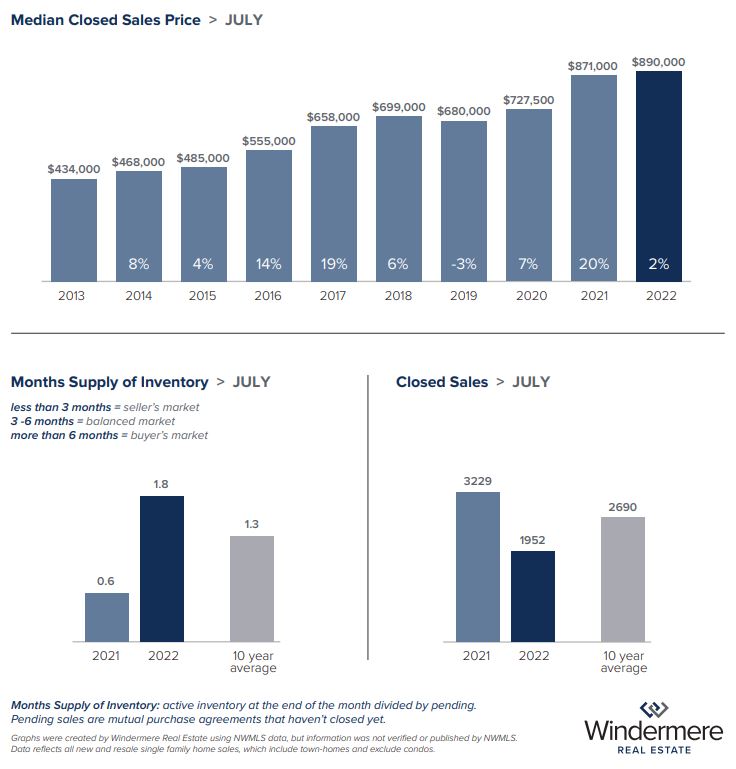

King County as a whole is experiencing much the same phenomenon, with the median sale price for single-family homes decreasing from $938,225 in June to $890,000 last month. However, that’s still up 2.1% from $871,000 in July 2021. Single-family homes on the Eastside currently have the most inventory in the tri-county area, with 2.5 months’ supply. The median price for single-family homes has dropped to $1,420,000, down from $1,500,000 in June, but up 6.7% year-over-year. It’s important to note that this decrease in the median price is likely not due entirely to price depreciation, but from the fact that lower-priced homes made up a larger percentage of the overall sales in the area, thus lowering the median sold price. Real estate experts believe that the area continues to model a price correction based on the 2018 market, suggesting the median closed sales price will bottom out in about two months’ time around $1,300,000 or higher.

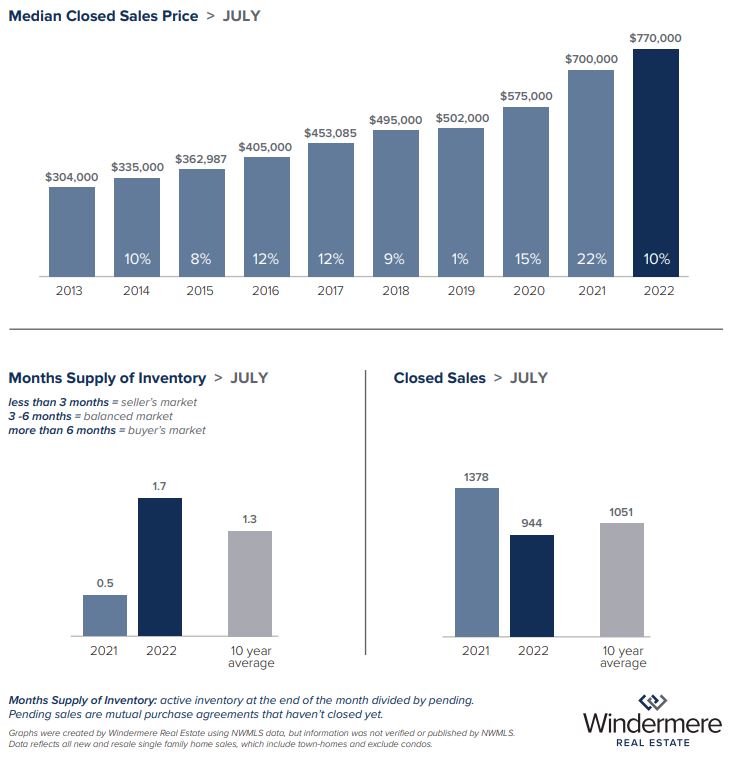

Snohomish continues to remain a more affordable area for buyers, with a median sold price for single-family homes of $770,000. Although that’s down from June, it is up a full 10% year-over-year, from $700,000 in July 2021. The area also has more active inventory—nearly two months’ supply. This, combined with the lower median price for condos of $500,000, makes it an appealing option for buyers with more constrained budgets.

Conclusion

The increase in active inventory across the region is not an indication of slowing demand. The majority of homes are selling in under two weeks, and prices continue to appreciate year-over-year. Builders are working diligently to meet demand, but until more projects come online, buyers and sellers will have to navigate these new market dynamics together.

If you have questions about these changes in the market or about real estate in general, please reach out to the Kari Haas Real Estate Team, we are happy to help!

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

Q2 Western Washington – The Gardner Report

The following analysis of the Q2 2022 Western Washington real estate market report is provided by Windermere Real Estate Chief Economist, Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact Kari Haas.

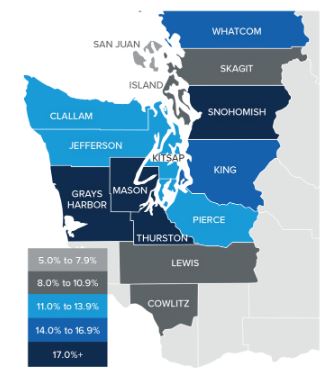

Regional Economic Overview

The most recent employment data (from May) showed that all but 2,800 of the jobs lost during the pandemic have been recovered. More than eight of the counties contained in this report show employment levels higher than they were before COVID-19 hit. The regional unemployment rate fell to 4.5% from 5.2% in March, with total unemployment back to pre-pandemic levels. For the time being, the local economy appears to be in pretty good shape. Though some are suggesting we are about to enter a recession, I am not seeing it in the numbers given rising employment and solid income growth.

Western Washington Home Sales

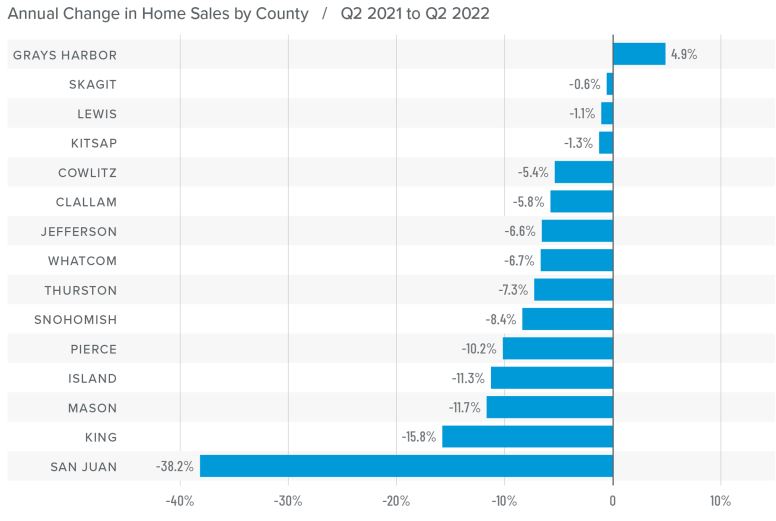

- In the second quarter of 2022, 23,005 homes sold, representing a drop of 11% from the same period a year ago, but up by a significant 52% from the first quarter of this year.

- Sales rose in Grays Harbor County compared to a year ago but fell across the balance of the region. The spring market, however, was very robust, likely due to growing inventory levels and buyers trying to get ahead of rising mortgage rates.

- Second quarter growth in listing activity was palpable: 175% more homes were listed than during the first quarter and 61.98% more than a year ago.

- Pending sales outpaced listings by a factor of 3:1. This is down from the prior year but only because of the additional supply that came to market.

Home Prices

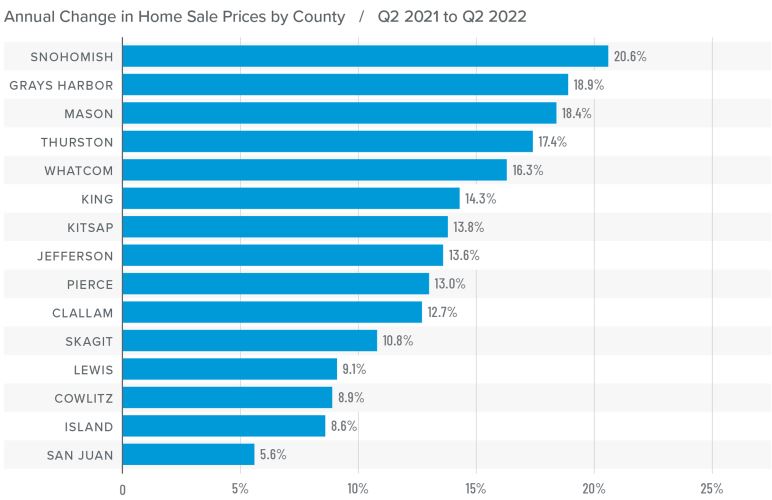

- Even in the face of rising mortgage rates, home prices continue to rise at a well-above-average pace, with average prices up 13.3% year over year to $830,941.

- I have been watching list prices as they are a leading indicator of the health of the housing market. Thus far, despite rising mortgage rates and inventory levels, sellers remain confident. This is reflected in rising median list prices in all but three counties compared to the previous quarter. They were lower in San Juan, Island, and Jefferson counties.

- Prices rose by double digits in all but four counties. Snohomish, Grays Harbor, Mason, and Thurston counties saw significant growth.

- List prices and supply are both trending higher, but this has yet to slow price growth significantly. I believe we will see the pace of appreciation start to slow, but not yet.

Mortgage Rates

Although mortgage rates did drop in June, the quarterly trend was still moving higher. Inflation—the bane of bonds and, therefore, mortgage rates—has yet to slow, which is putting upward pressure on financing costs.

That said, there are some signs that inflation is starting to soften and if this starts to show in upcoming Consumer Price Index numbers then rates will likely find a ceiling. I am hopeful this will be the case at some point in the third quarter, which is reflected in my forecast.

Days on Market

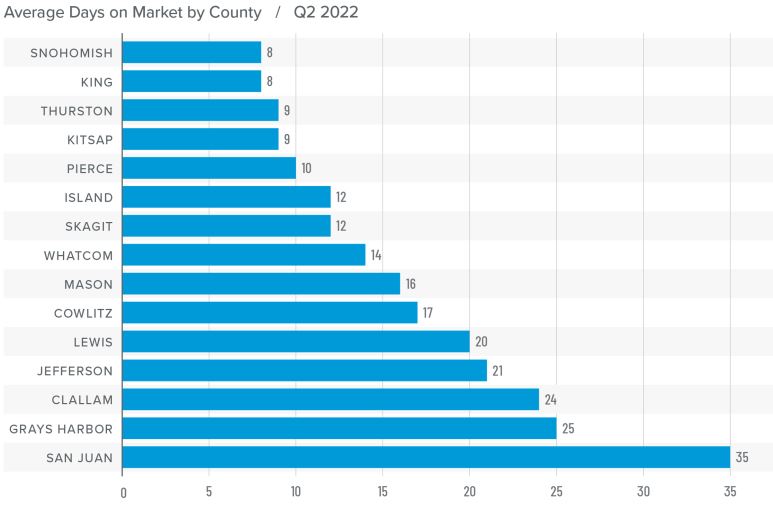

- It took an average of 16 days for a home to go pending in the second quarter of the year. This was 2 fewer days than in the same quarter of 2021, and 9 fewer days than in the first quarter.

- Snohomish, King, and Pierce counties were, again, the tightest markets in Western Washington, with homes taking an average of between 8 and 10 days to sell. Compared to a year ago, average market time dropped the most in San Juan County, where it took 26 fewer days for a seller to find a buyer.

- All but six counties saw average time on market drop from the same period a year ago. The markets where it took longer to sell a home saw the length of time increase only marginally.

- Compared to the first quarter of this year, average market time fell across the board. Demand remains very strong.

Conclusions

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog.

July 2022 Real Estate Market Update

Cooler temperatures and a cooler regional real estate market have been this summer’s hallmark thus far. After months of blazing hot sales and a breakneck pace, buyers are finally seeing inventory levels accelerate and price gains slow. With inspection and financing contingencies once again becoming the norm, the region may, at last, be shifting toward a more balanced market.

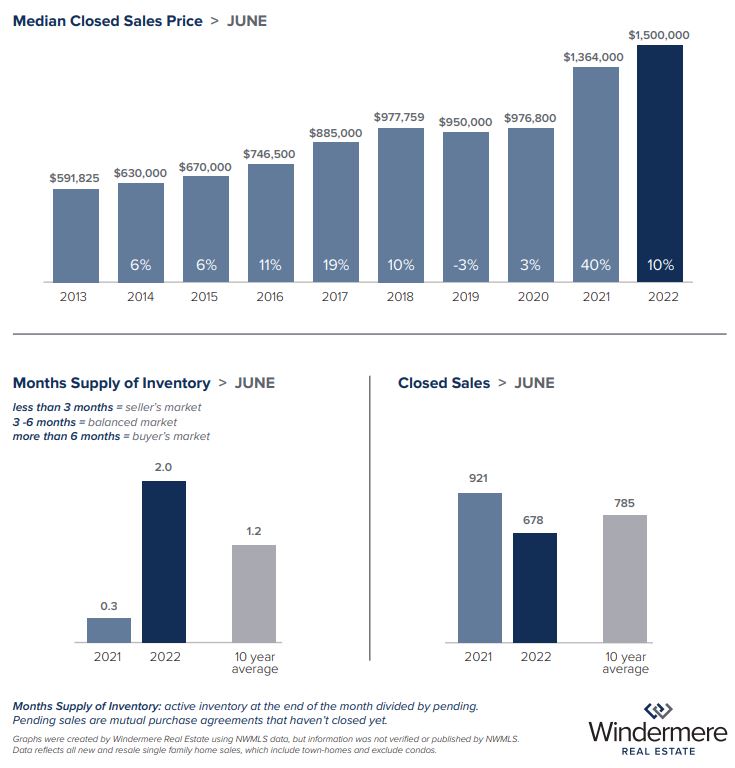

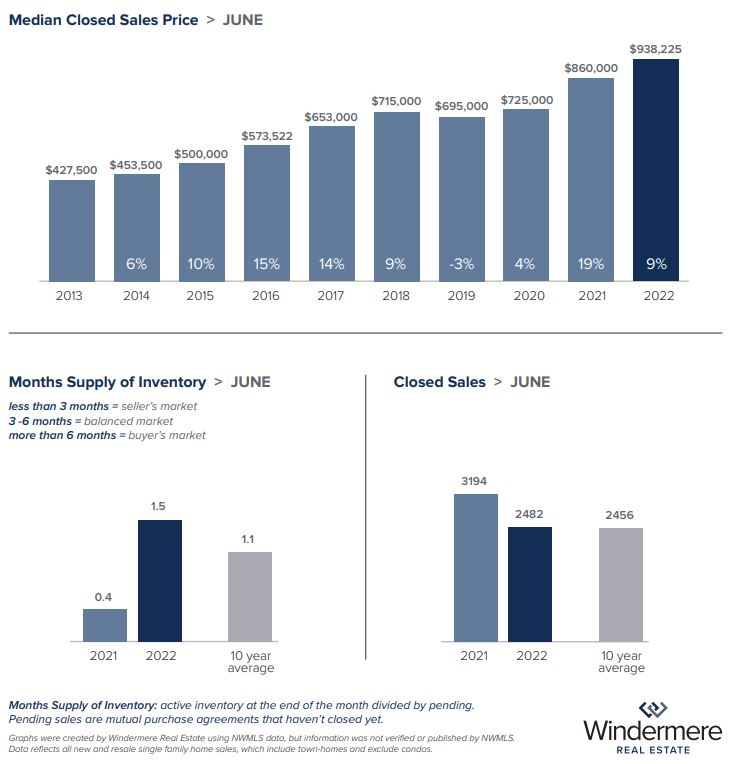

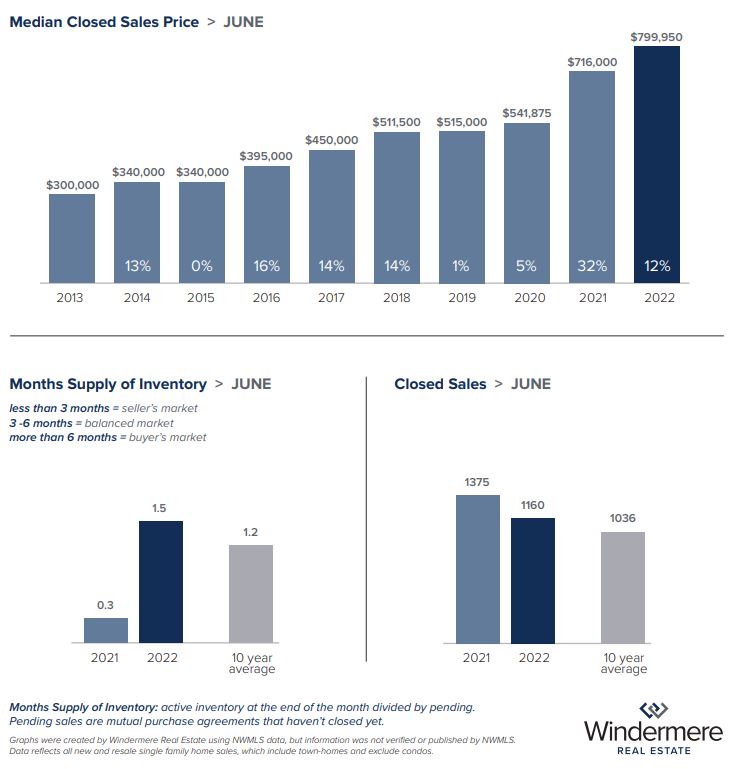

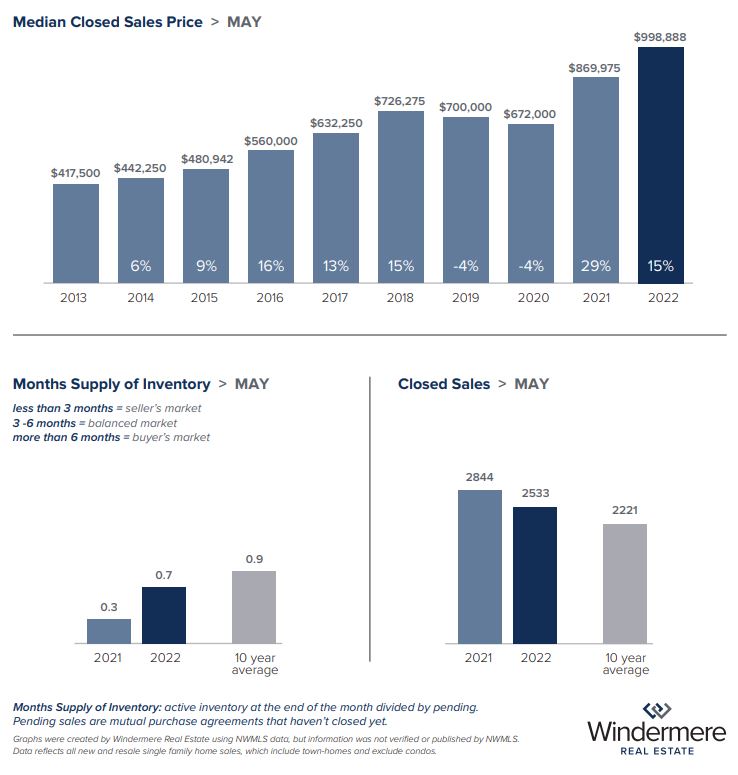

Area home prices were down across the board last month. The median sold price for King County single-family homes dropped to $938,225, slightly lower than May’s near million-dollar price ($998,888). Year-over-year, however, King County prices were still up by 9%, despite the higher 1.5 months of available inventory.

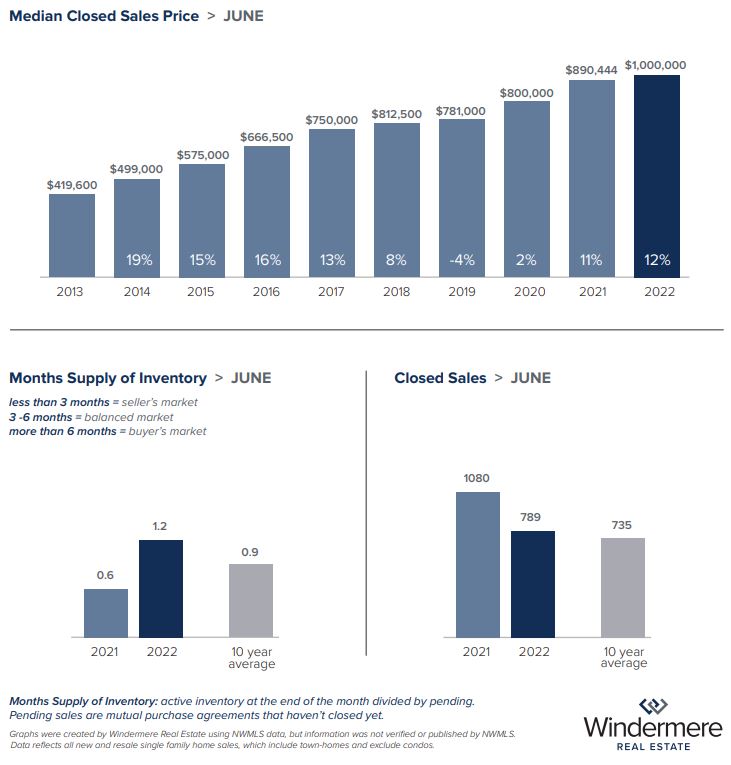

Seattle mirrored the county’s trend, with the median price dropping from $1,025,500 in May to an even $1,000,000 in June. This price was still up 12% year-over-year, indicating continued demand for housing in the city.

Real estate experts have pointed out that areas that saw the greatest appreciation earlier this year will likely see a more significant dip in prices as the market rebalances. The Eastside market bore out this theory in June as the median sold price for single-family homes was $1,500,000 — down almost $100k from May’s median price of $1,590,000. That said, last month’s Eastside median sold prices were still up over June 2021, increasing 10% year-over-year in the residential market and 12% in the condo market. And with two months’ supply of homes currently listed, Eastside buyers have significantly more options to choose from than they would have had earlier in the year.

Snohomish County — long a refuge for buyers seeking more bang for their buck — followed a similar trend. The median sold price for single-family homes dropped to a more attainable $799,950, down from May but still up 11% year-over-year. Snohomish County condo prices dipped in June as well, with the median sold price of $500,000 down 9% from May and up a meager 1.6% from June of last year.

While these recent price dips may cause concern for some sellers, local real estate experts reiterate that this is a necessary step toward a more balanced market. “The increase in listings has started to slow the rapid pace of price gains that we’ve experienced,” said Matthew Gardner, Windermere’s Chief Economist. “This is a good thing, not a cause for concern.”

Other factors influencing the summer real estate market are higher mortgage rates, higher post-pandemic rates of travel, and typical seasonal buyer patterns. With graduations occurring and school years finishing up, many potential buyers are scratching their itch for travel and family time, putting off their home search until a little later in the year.

For sellers looking to make the most of the current market, flexibility is key. Pricing their home correctly from the get-go and being willing to negotiate with buyers on terms can still result in a top-of-market sale, albeit one in which multiple offers are less expected.

If you have questions about real estate opportunities in the current market, please reach out for additional insights and analysis. The Kari Haas Real Estate Team is here for you! “Let’s Sell Your House & Find Your Home!”

Eastside

King County

Seattle

Snohomish County

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

June 2022 Real Estate Market Update

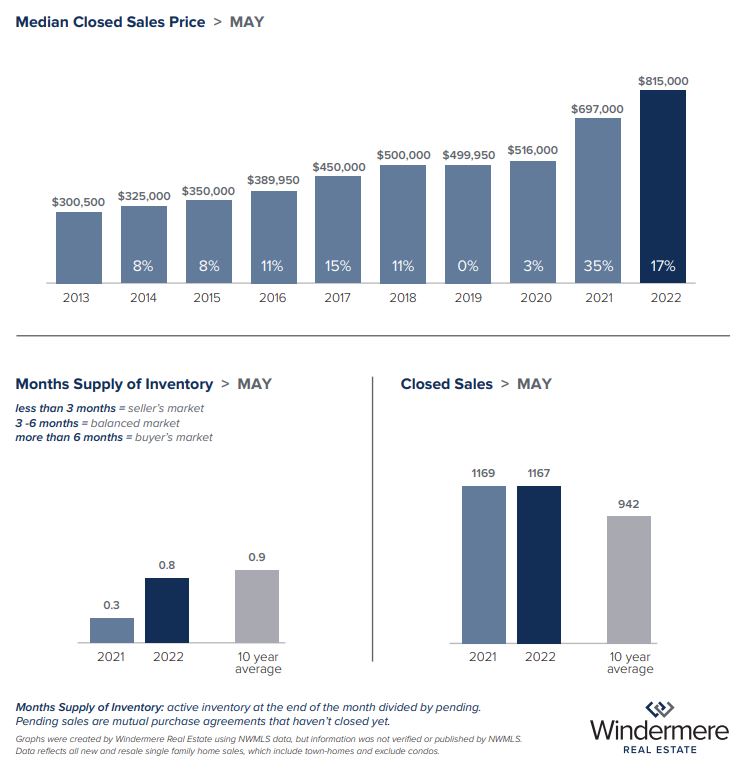

Windermere just released the market statistics from May, so let’s review what’s happening in the real estate market.

The tides of our local real estate market may, at last, be shifting, as buyers find relief in increasing inventory and the frenetic pace of sales slows noticeably. At the end of May, inventory across the 26 counties served by the Northwest MLS had increased by 59%, with 8,798 active listings in the database, compared to 5,533 active listings just a year ago. While this shift may cause concern from some who anticipate a drop in the market, Windermere’s Chief Economist Matthew Gardner had this to say: “What’s more likely to occur is that the additional supply will lead us toward a more balanced market, which after years of such lopsided conditions, is much needed.”

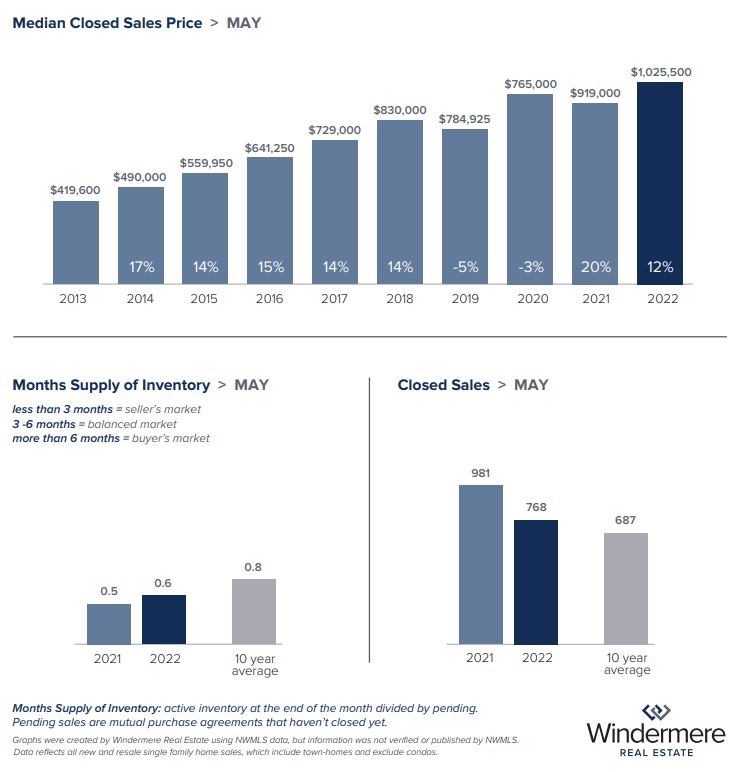

Are Price Hikes Slowing?

While inventory has increased, the meteoric price hikes seen in this first part of 2022 – including again in May’s closed sales – are expected to slow dramatically in the next half of the year. Seattle saw a historic first in April, with the median sold price for a single-family home topping $1 million for the first time. May home sales continued that trend, with the median sold price inching up to $1,025,500, which is a 12% increase from $919,000 in May 2021. King County as a whole mirrored this trend, with the median price of single-family homes reaching $998,888 in May, up from $995,000 in April, and up 14.8% from last May’s median price of $869,975.

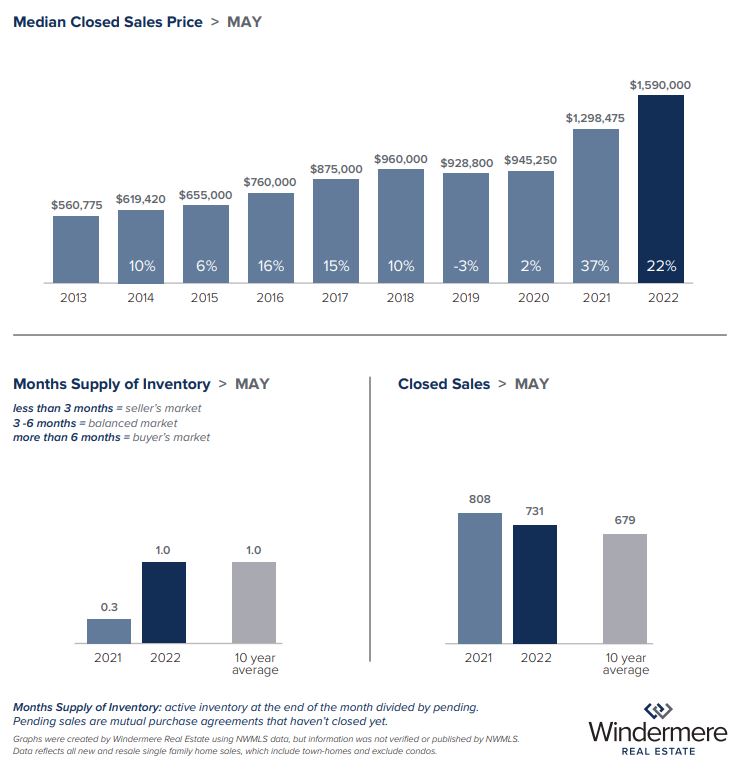

Eastside & Snohomish Markets Cool

May closings reveal that the Eastside and Snohomish County didn’t follow this same pattern, instead experiencing a much-needed cooling of prices. On the Eastside, the median sold price for single-family homes fell from $1,722,500 in April to $1,590,000 in May. While last month’s median price is the lowest since January of this year, it was still up 22% year-over-year. The Eastside saw an increase in the percentage of homes that had a price change before selling, hitting 10% in May — double that of April. This is likely due to Eastside sellers needing to adjust their price expectations. While a majority of listings in the area — about 66% — still sold over list price last month, a full month of inventory and a 403% increase in active inventory on the Eastside from February to May means that buyers have more choice and agency than they’ve had in some time. Homes are still selling, but multiple offers are far fewer, and sellers are more likely than before to accept an offer written with contingencies.

Snohomish County also saw a shift in May, likely due to the combination of increasing inventory running headfirst into decreasing buyer budgets thanks to rising mortgage rates. With .85 months of inventory, prices reflected this, with the median sold price for single-family homes falling slightly to $815,000 last month, down from $839,298 in April. However, most homes sold for over list price and quite quickly, averaging less than two weeks on the market. It’s worth noting that these statistics largely reflect home sales that went under contract in prior months when the competition was at its fiercest. The median sold price for Snohomish County condos dropped just slightly to $545,000 last month, down from $550,000 in April. With only two weeks of inventory on hand, the county’s condo market is likely to remain competitive for a while.

A Chance for Buyers

Falling prices in the Puget Sound region may have caused concern for some, but most analysts see this as a necessary and long-overdue price correction. Prices for single-family homes (excluding condos) in King County rose from $775,000 in January to a whopping $995,000 in April, a change of $220,000 in only four months, or 28.4%. Last month, the Eastside saw prices decrease by only 8%, and this was likely only because prices had previously risen so astronomically in the area. Neighborhoods that saw the highest appreciation will likely experience a sharper correction, but this may serve to help some previously unlucky buyers re-enter the market and finally find success.

If you have questions about pricing trends in your neighborhood, or how to make the most of your purchase or sale, please reach out!

Seattle

Eastside

VIEW FULL EASTSIDE REPORT HERE

King County

VIEW FULL KING COUNTY REPORT HERE

Snohomish County

VIEW FULL SNOHOMISH COUNTY REPORT HERE

This post originally appeared on GetTheWReport.com

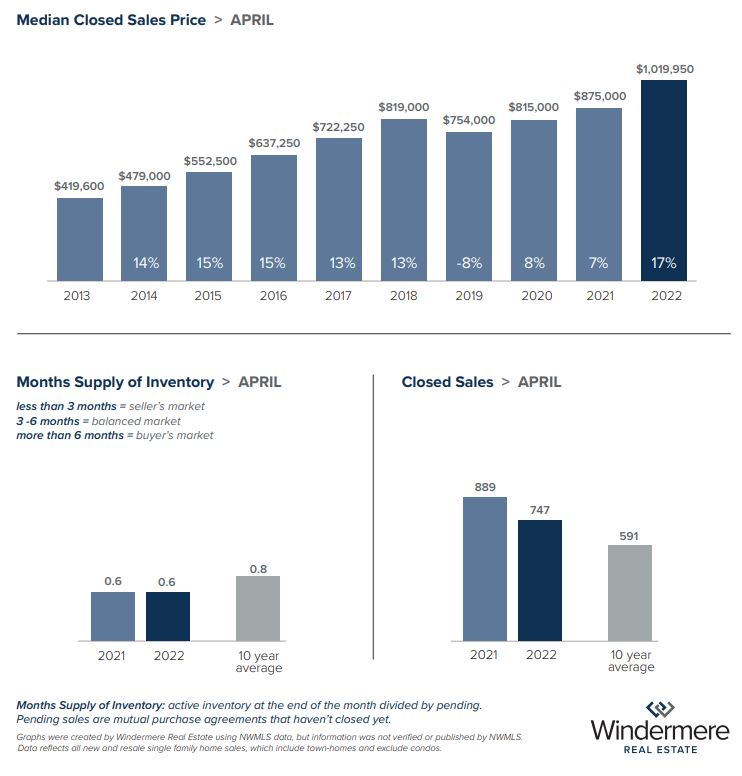

May 2022 Real Estate Market Update

After a long stint of suppressed housing inventory across our region, buyers may, at last, have more options as the supply of available homes ticks up ahead of the summer market. The month-over-month increase in inventory has been as much as 50% in some areas, offering renewed opportunities for those buyers who are not dissuaded by high home prices and rising mortgage rates.

The Eastside appears to have experienced the most dramatic inventory growth, with .79 months of available single-family homes last month compared to .46 in March. Seattle increased slightly to .59 months of inventory, while Snohomish also had a notable increase up to .67 months of inventory compared to .46 in March.

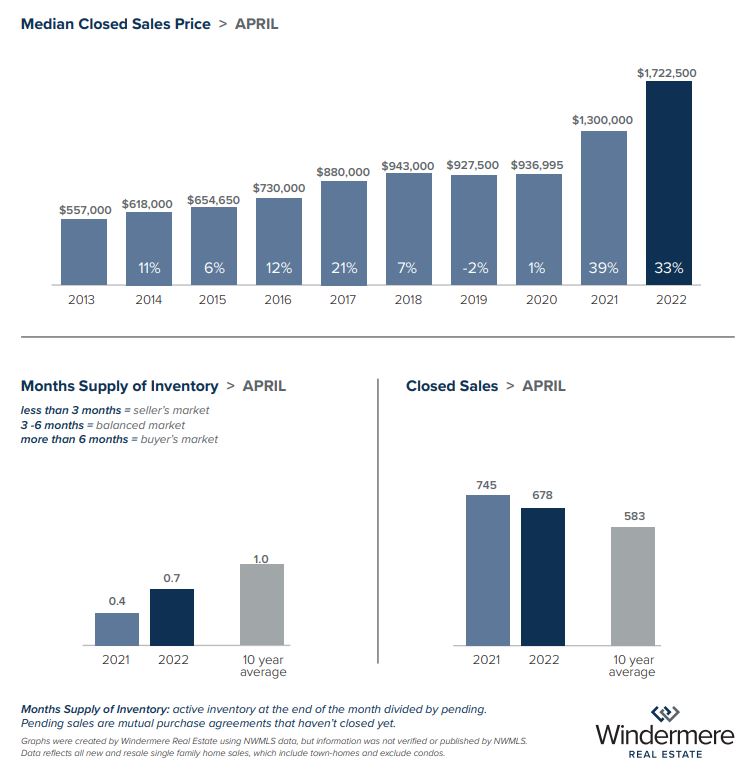

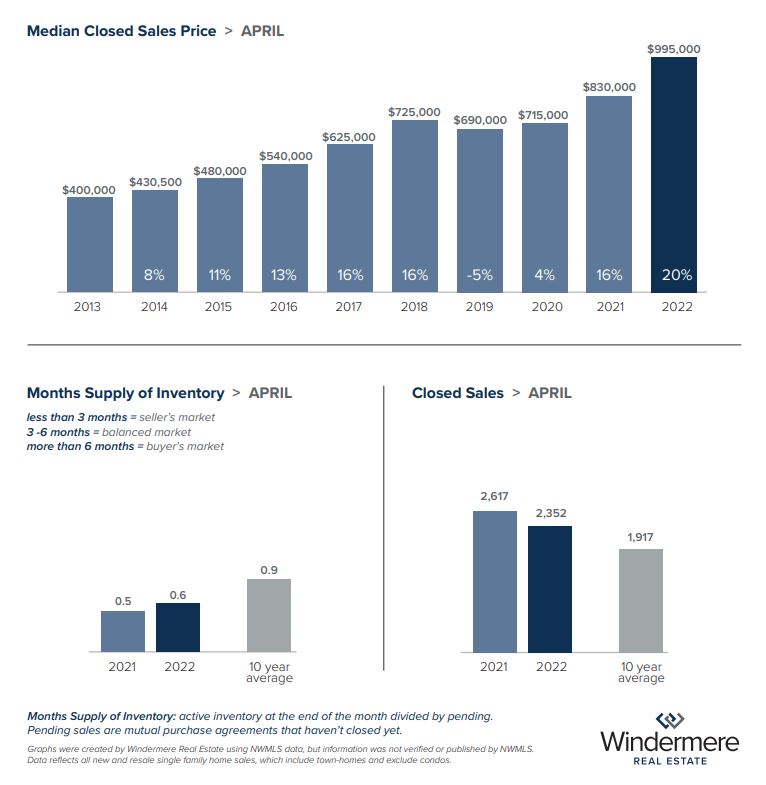

The increase in supply is likely occurring because rising home prices and mortgage rates have put a slight damper on sales in the area. Last month, the median sold price for a single-family home in Seattle surpassed $1 million for the first time—landing at a historic $1,019,950. This is up 16.6% year-over-year from $875,000 in April 2021. The median price for single-family homes on the Eastside last month was an eye-watering $1,722,500, with 80% of homes selling over list price. Although inventory has increased in the area, Eastside homes are still selling quickly, with 96% of listings selling in under two weeks. King County as a whole also saw prices increase, with the median sold price for single-family homes reaching $995,000, up from $830,000 a year ago.

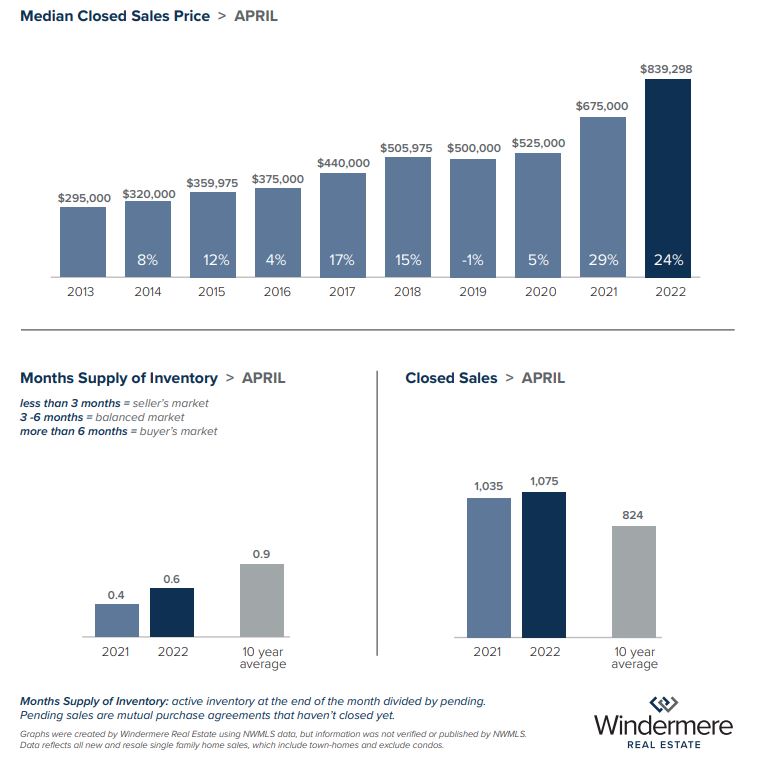

Snohomish County home prices have kept pace with the market, with the median sold price for a single-family home reaching $839,298. That’s an increase of 24.3% year-over-year from $675,000 in April 2021. This is likely due to increased demand from buyers who can’t compete in the intense Seattle and Eastside market, seeking more bang for their buck in the relatively more affordable Snohomish County market.

Affordability issues have also trickled into the condominium market, as some prospective homebuyers divert from the single-family market to condos. Eastside condo prices have increased 29.7% year-over-year to $674,444 last month from $520,000 in April 2021. In Snohomish County, the median sold price for condos rose to $550,000 year-over-year from $432,250 last year. That’s an increase of 27.2%.

Despite rising home prices and heftier mortgage rates, many buyers are still eager to take advantage of the financial benefits of homeownership. According to Windermere’s Chief Economist, Matthew Gardner, “Owning real estate is a hedge against rising inflation. Homeowners with a fixed-rate mortgage will always have the same monthly payment, even as other costs rise.”

If you have questions about how to find the opportunities presented by today’s market, please don’t hesitate to contact me.

Seattle

Eastside

King County

Snohomish County

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

April 2022 Real Estate Market Update

The spring market continues its frenzied pace, with soaring prices and stiff competition testing the resolve of buyers. Despite these obstacles and rising mortgage rates, inventory remains low across King County, as pending sales keep pace with new listings, demonstrating a strong demand from buyers. Continue reading for the April 2022 real estate market update.

Buyer Demand

This demand has factored into the way sellers are approaching the market. Windermere’s Chief Economist Matthew Gardner notes that median listing prices continue to rise, saying “this suggests that sellers remain quite bullish when it comes to pricing their homes.”

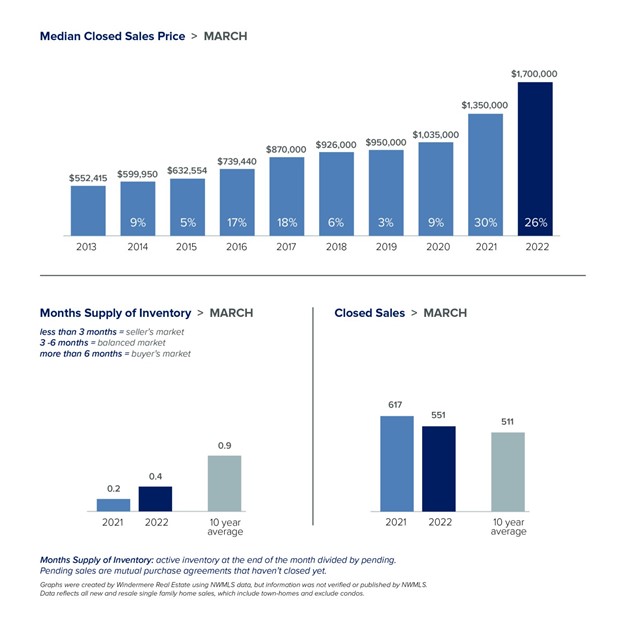

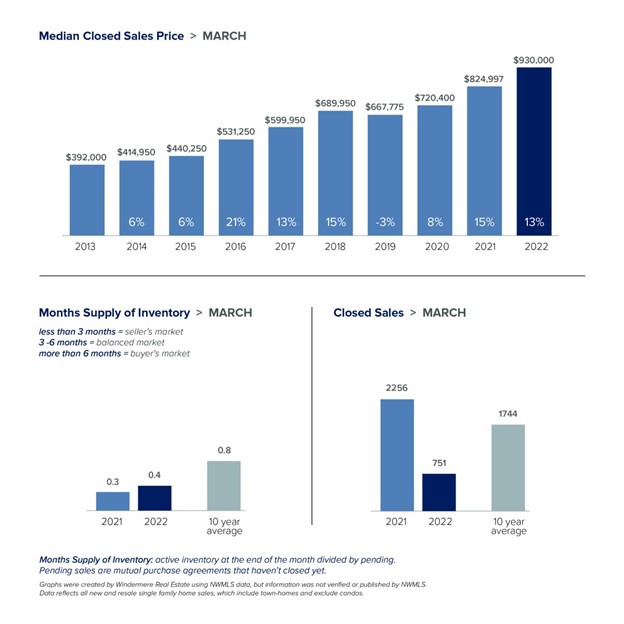

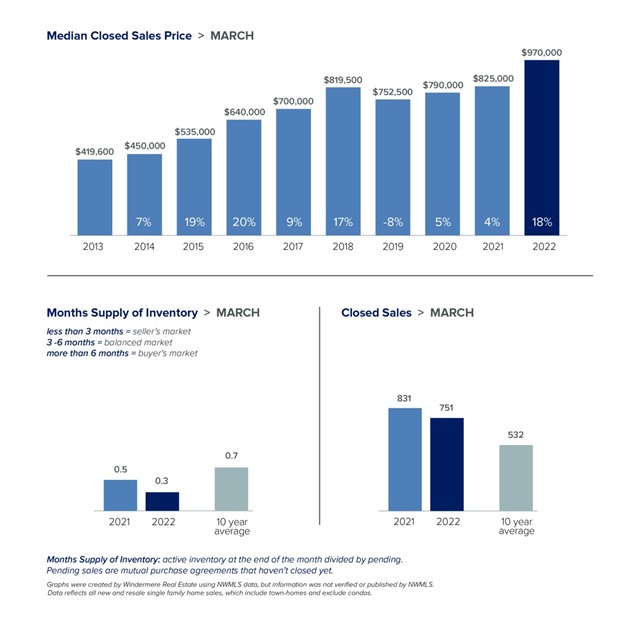

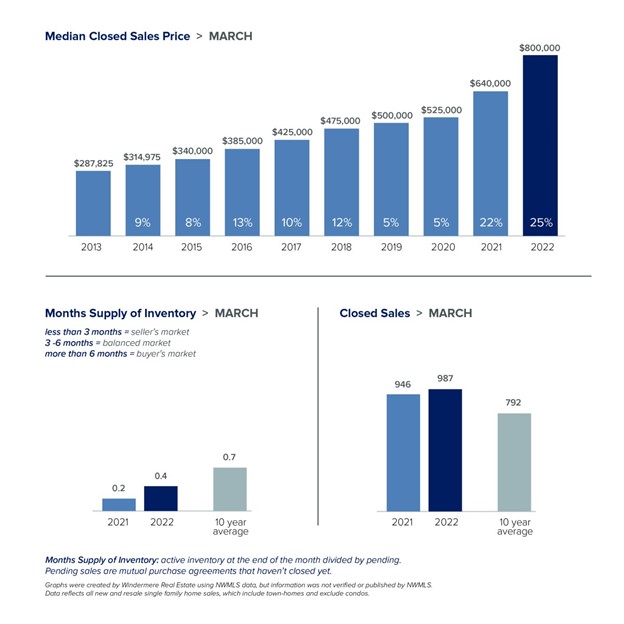

This was certainly true in March on the Eastside, where the median closed sale price for single-family homes was $1,700,000, an all-time high. This was up 26% year-over-year, and slightly up from February, when the median was $1,697,500. In Seattle, the median price for single-family homes achieved an all-time high of $970,000, up 18% year-over-year. Snohomish County continues to feel the impact of this voracious demand, with a median closed sale price of $1,298,000 for single-family homes — that’s an increase of 38.1% year-over-year.

Selling Over List Price

Not only are asking prices increasing across the region, but many homes are selling for well over the list price. On the Eastside, a staggering 85% of closed sales in March 2022 sold for more than the list price. Overall, that’s down from an all-time record last month of 87% but tied for the second-highest month ever with April 2021. Of the Eastside homes that sold over asking last month, the median difference was 21% over asking, and they spent an average of just 4 days on the market.

Seattle is experiencing a similar pattern, with 71% of the closed sales in March going over the list price. This is high for Seattle; in March and April of 2018, 63% and 68% of listings closed over asking, respectively. Last month, the Seattle listings that sold over the list price sold for a median of 15% over the list price, and were on the market for 5 days.

In Snohomish County, homes that sold over list price went for a median of 21% over the asking price.

With these conditions, many buyers are looking to condos as a more affordable way to break into the market. Consequently, condo prices have also seen a year-over-year increase. In King County, condos remain relatively more affordable, with a median price of $540,000 in March 2022. That’s up from $470,000 in March 2021, a 14.9% increase. Snohomish County has seen a more dramatic increase, as the median condo price in March 2022 was $555,000 — up 33.1% year-over-year, from $417,000 in March 2021.

Expectations

Matthew Gardner expects mortgage rates to continue trending higher in the coming months, but so far he says there’s nothing to be too concerned about, as the interest rates have not yet caused sales to taper off. Savvy sellers can still easily benefit from the opportunities presented by this market, and although rates are higher, buyers can finance their home purchase with rates still far lower than the historical norm.

If you’re looking for knowledgeable advice as you consider when might be your best time to enter the market, whether as a buyer or a seller, please give me a call or text. We are here to give you professional insight to help you make the best decisions possible.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link