Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

November 2022 Real Estate Market Update

As the final quarter of 2022 rolls on, it’s clear that these last months will be anything but typical for home buyers and sellers in King and Snohomish counties. In a real estate market that’s been defined by high competition and low supply for the last number of years, buyers and sellers are changing tactics as market dynamics shift due to rising mortgage rates and growing inventory.

While some buyers are waiting to see if rates and home prices drop, others are getting creative with their financing by utilizing buydowns, adjustable rate loans, carrying back second deeds of trust, and closing cost allowances to make their purchases. Sellers have been slower to adjust, with many resisting the idea of lowering their asking price to meet the constraints of buyers dealing with high-interest rates. However, for sellers willing to correctly market and position their listing, successful sales – and even occasionally multiple offers – can still be attained.

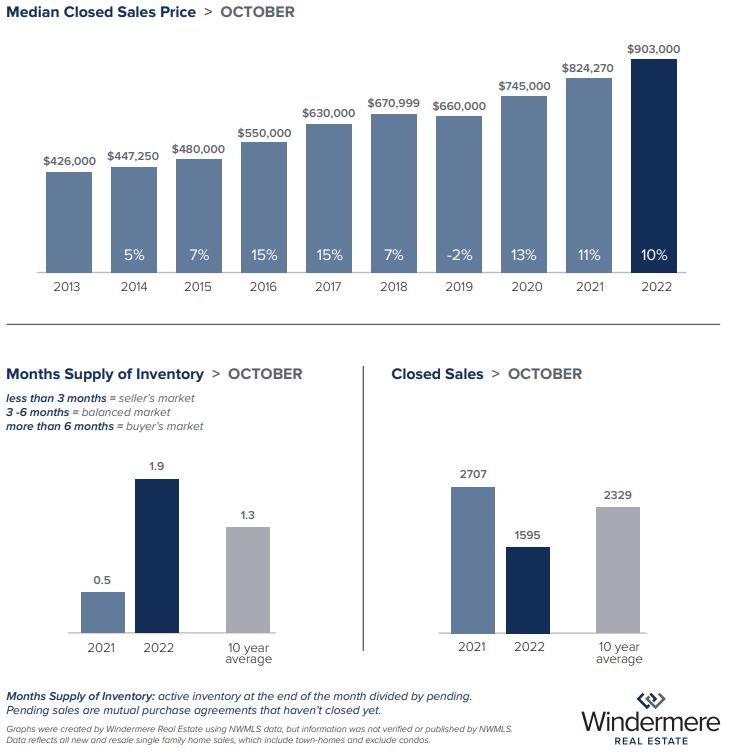

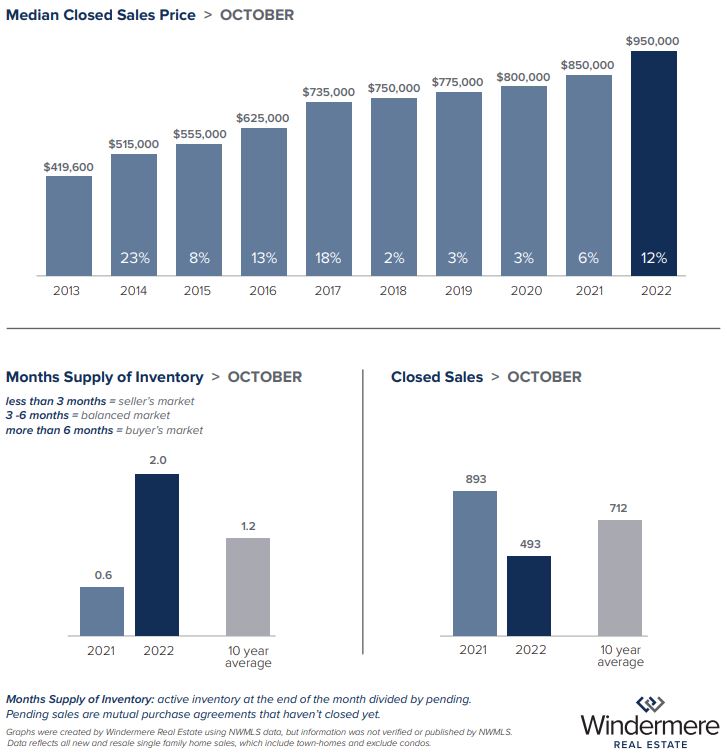

Seattle & King County

King County as a whole saw the median price of a single-family home increase from $875,000 in September to $903,000 last month. This was primarily a function of price gains in Seattle, where single-family homes sold for a median of $950,000 in October — up from $900,000 in September. Seattle and King County both have about two months of available supply, which is the most balanced inventory level the market has seen in years. The Seattle condo market has slowed a bit more than residential sales, with over 3 months of inventory and a median price of $522,500 — down from $525,000 year-over-year.

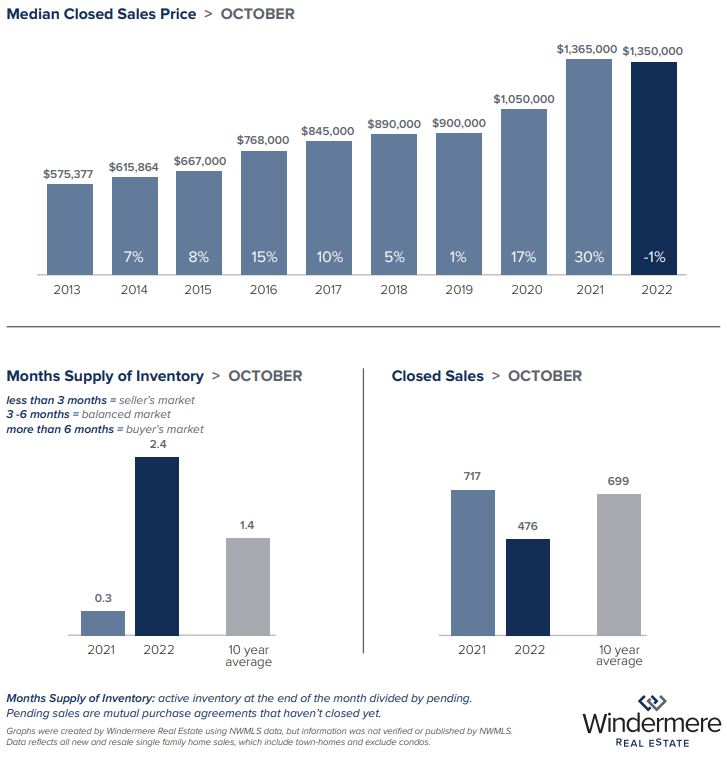

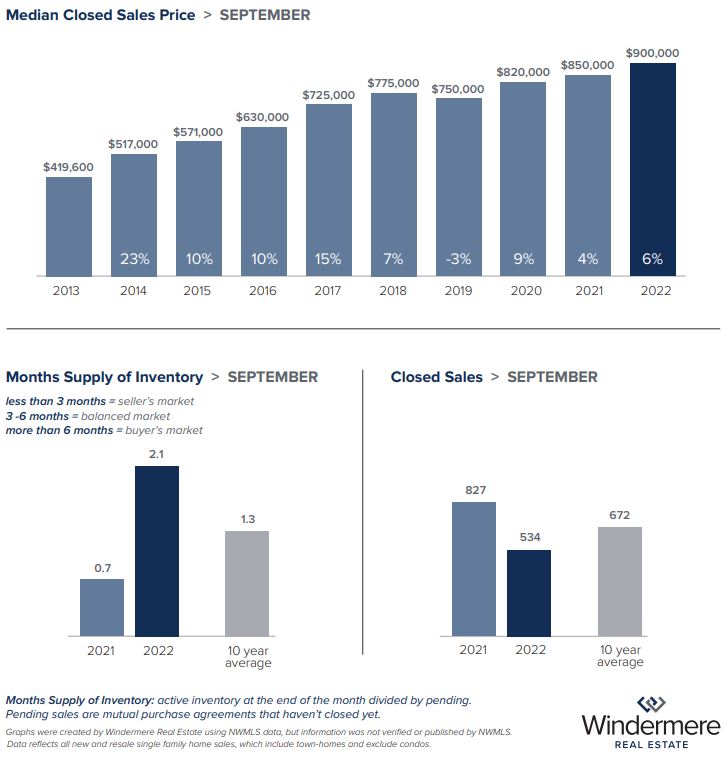

Eastside

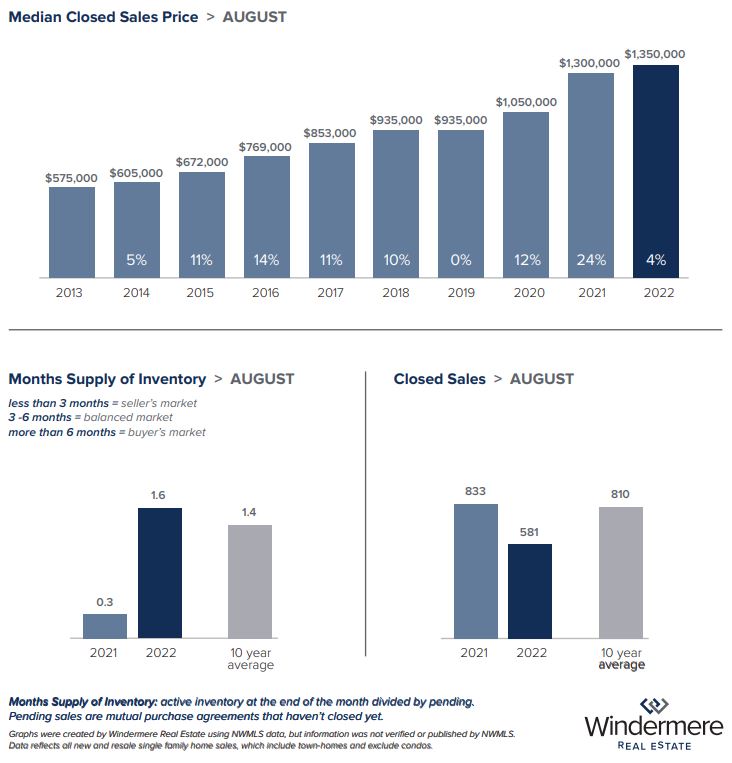

On the Eastside, the median price for single-family homes has remained constant, sitting at $1,350,000 for the third month in a row. The average monthly mortgage payment on the Eastside dropped 19% from $9,226 in April 2022 (when the median price was $1,722,500 with a 4.98% interest rate) to $7,430 in August 2022 (with a median price of $1,350,000 at a 5.22% interest rate). However, while the median price has remained the same since August, the 30-year interest rate rose to 6.9% in October. At that rate, the average monthly payment is $8,891 — only 4% off the peak payment of $9,226 in April; this is despite a 22% drop in prices since then.

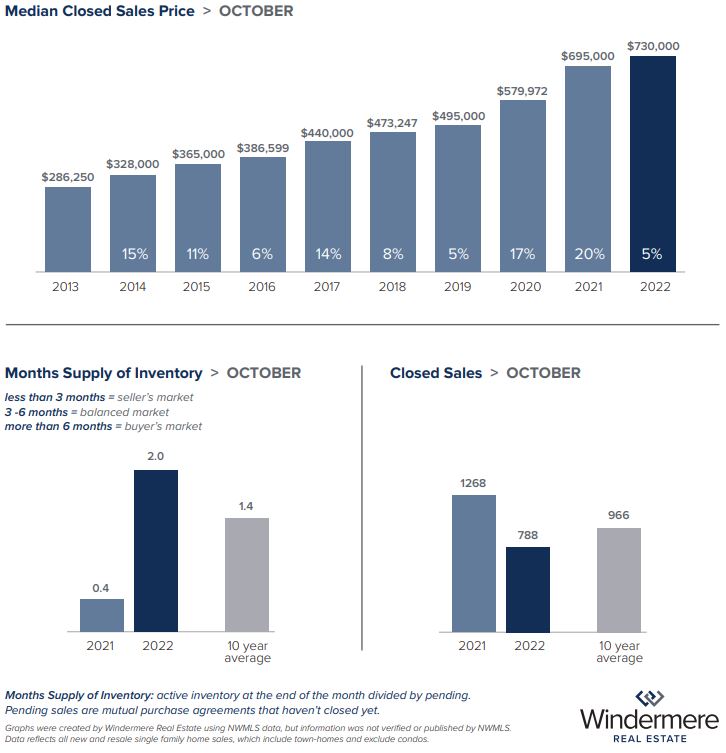

Snohomish County

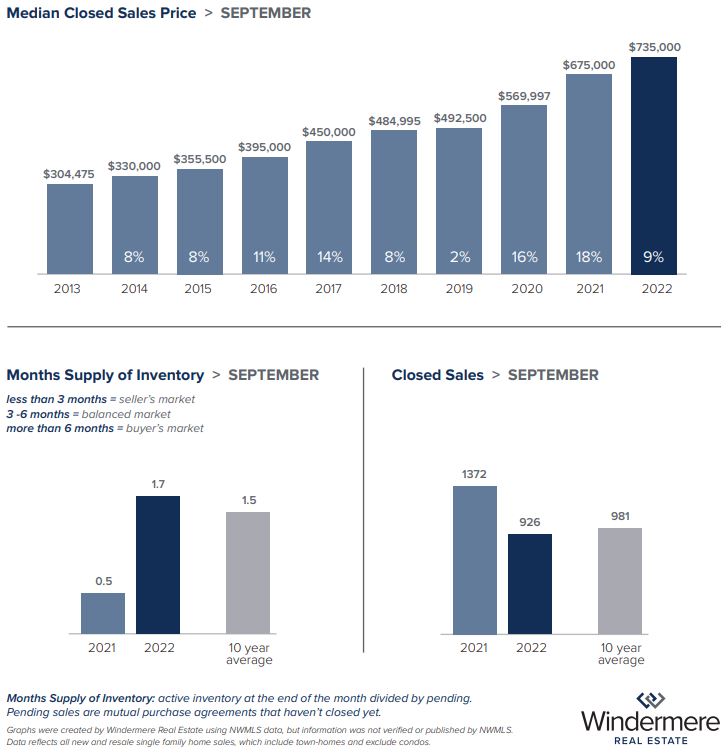

Snohomish County saw prices fall slightly from a median of $735,000 for single-family homes in September to $730,000 last month. With less than two months of inventory, that market remains slightly more competitive than the Eastside or Seattle, possibly due to lower prices making it more accessible for buyers as they combat the higher interest rates.

Matthew Gardner’s Take

Windermere’s Chief Economist Matthew Gardner weighed in on the effect of mortgage rates on buyer behavior. While he believes many buyers may be forced to wait (either voluntarily or not) for interest rates to stabilize, he advises would-be buyers not to wait for prices to bottom out. “Those who hope to pick up a home ‘on the cheap’ are likely in for a long wait,” he said.

For many buyers, the answer to this conundrum is a pivot to adjustable rate mortgages, which are currently set at around 5.9%. With the 30-year fixed mortgage rate currently at 6.9% or higher, adjustable rate mortgages offer a more affordable inroad to homeownership, with the possibility of refinancing to a lower rate in a few years.

As we navigate these changing market conditions, Kari can help you assess the best path forward for your home sale or purchase.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Q3 Western WA 2022 Gardner Report

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact Kari.

REGIONAL ECONOMIC OVERVIEW

The Western Washington labor market continues to expand. The addition of 110,000 jobs over the past 12 months represents an impressive increase of 4.9%. All but seven counties have recovered completely from their pandemic job losses. In total, the region has recovered all the jobs lost and has added an additional 30,000 new positions. The regional unemployment rate in August was 3.8%. This is .2% higher than at the end of the second quarter. That said, county data is not seasonally adjusted, which is likely the reason for the modest increase. The labor force has not expanded at its normal pace, which is starting to impact job growth. Although the likelihood of a recession starting this winter has risen, Matthew Gardner is not overly concerned; however, he anticipates businesses may start to taper hiring if they feel the demand for their goods and services is softening.

WESTERN WASHINGTON HOME SALES

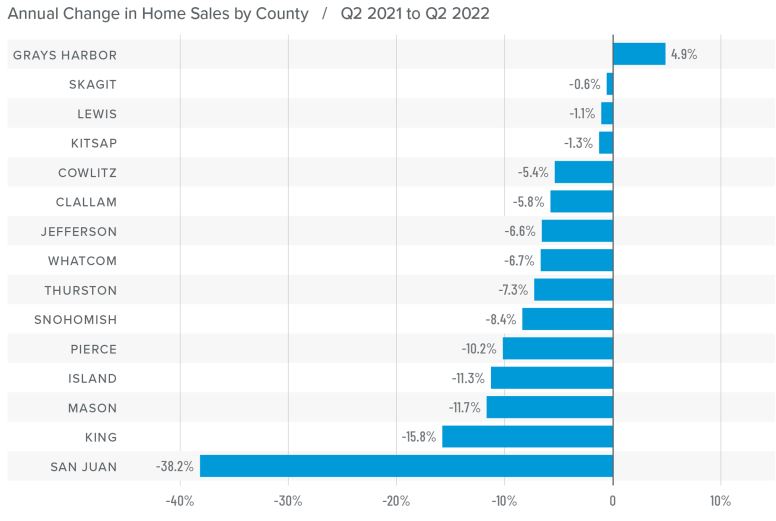

❱ In the third quarter, 19,455 homes traded hands, representing a drop of 29.2% from the same period a year ago. Sales were 15.4% lower than in the second quarter of this year.

❱ Listing activity continues to increase, with the average number of homes for sale up 103% from a year ago and 61% higher than in the second quarter of 2022.

❱ Year over year, sales fell across the board, but when compared to the second quarter they were higher in Mason, Cowlitz, Jefferson, and Clallam counties.

❱ Pending sales (demand) outpaced listings (supply) by a factor of 1:6. This ratio has been dropping for the past three quarters and indicates a market moving back toward balance. The only question is whether it will overshoot and turn into a buyer’s market.

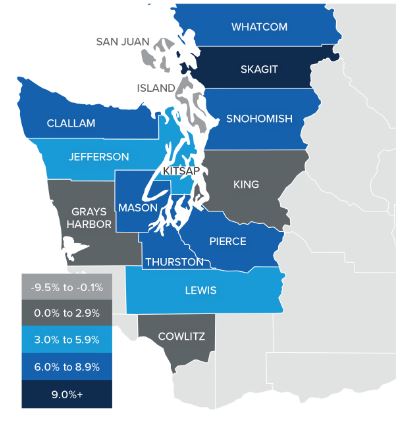

WESTERN WASHINGTON HOME PRICES

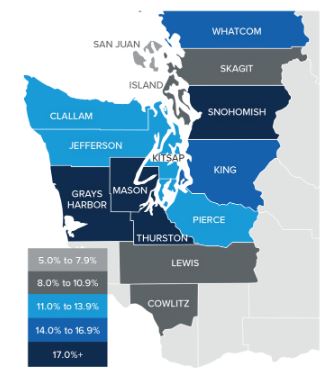

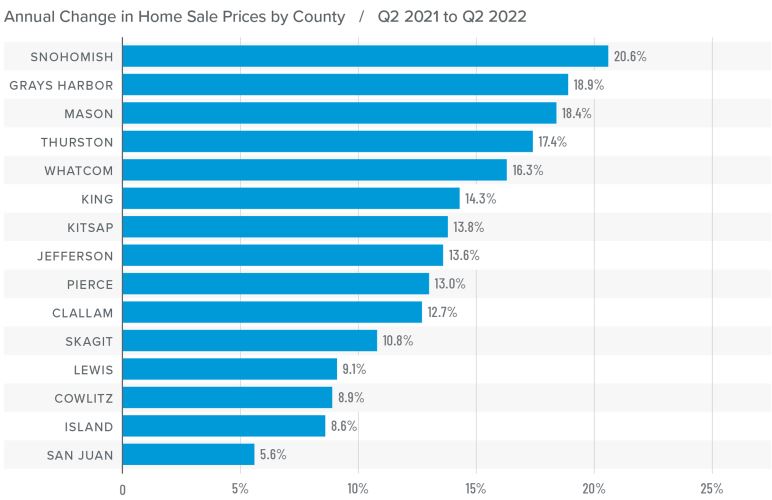

❱ Higher financing costs and more choices in the market continue to impact home prices. Although prices rose an average of 3.6% compared to a year ago, they were down 9.9% from the prior quarter. The current average sale price of a home in Western Washington is $748,569.

❱ The change in list prices is a good leading indicator and we have seen a change in the market. All but two counties (Island and Jefferson) saw median list prices either static or lower than in the second quarter of 2022.

❱ Prices rose in all but two counties, and several counties saw price growth well above their long-term averages.

❱ With the number of homes for sale rising and list prices starting to pull back, it’s not surprising to see price growth falter. We are going through a reversion following the overstimulated market of 2020 and 2021. There will be some ugly numbers in terms of sales and prices as we move through this period of adjustment, but the pain will be temporary.

MORTGAGE RATES

❱ This remains an uncertain period for mortgage rates. When the Federal Reserve slowed bond purchases in 2013, investors were accused of having a “taper tantrum,” and we are seeing a similar reaction today. The Fed appears to be content to watch the housing market endure a period of pain as they throw all their tools at reducing inflation.

❱ As a result, mortgage rates are out of sync with treasury yields, which not only continues to push rates much higher but also creates violent swings in both directions. My current forecast calls for rates to peak in the fourth quarter of this year before starting to pull back slowly. That said, they will remain in the 6% range until the end of 2023.

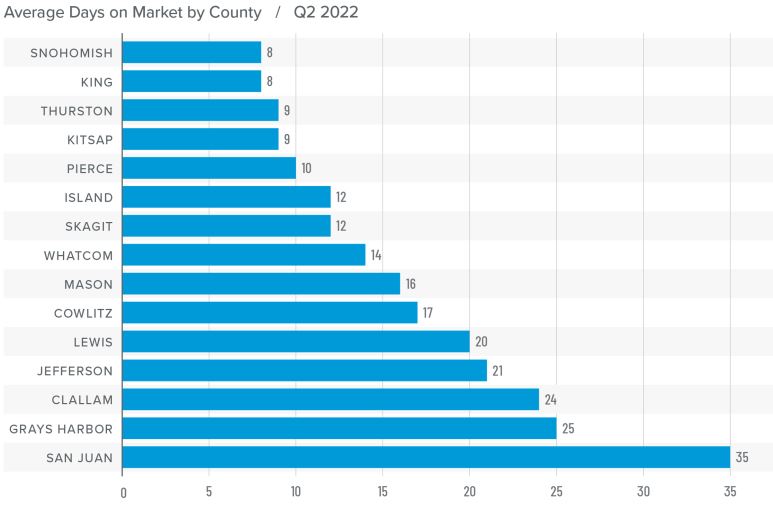

DAYS ON MARKET

❱ It took an average of 24 days for a home to sell in the third quarter of the year. This was seven more days than in the same quarter of 2021, and eight days more than in the second quarter.

❱ King and Kitsap counties were the tightest markets in Western Washington, with homes taking an average of 19 days to sell.

❱ Only one county (San Juan) saw the average time on the market drop from the same period a year ago. San Juan was also the only county to see market time drop between the second and third quarters of this year.

❱ The greatest increase in market time compared to a year ago was in Grays Harbor, where it took an average of 13 more days for homes to sell. Compared to the second quarter of 2022, Thurston County saw the average market time rise the most (from 9 to 20 days).

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Listings are up, sales are down, and a shift toward buyers has started. After a decade of sellers dominating the market, it is far too early to say that the shift is enough to turn the market in favor of buyers, but the pendulum has started to swing in their direction.

A belief that the housing market is on its way to collapsing will keep some buyers sidelined, while others may be waiting for mortgage rates to settle down. Whatever their reasons, Matthew Gardner maintains that we will see a brief period where annual price growth will turn negative in several markets, but it is only because the market is normalizing. He certainly doesn’t see any systemic risk of home values falling as they did in the mid-to-late 2000s.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog.

October 2022 Real Estate Market Update

Increasing listings inventory, lengthening time on the market and a slowdown in home price increases across the Puget Sound region herald a return to normalcy and better opportunities for buyers. According to September data from the NWMLS, active listings nearly doubled from a year ago, with pending sales declining by about 31%.

“The ‘Great Reversion’ continues, with the number of homes in the tri-county market of King, Pierce, and Snohomish counties up 106% from a year ago,” says Windermere’s Chief Economist Matthew Gardner. “It’s worth noting that current inventory levels in King and Snohomish counties are still around 13% lower than they were in September 2019 prior to the pandemic-induced market shift.”

While the recent sales data may be pointing to a market shift of a different sort, they may reflect some normal seasonal trends as well. October is typically an average selling month, with November typically performing about 76% as well as an average month, and December and January slowing even further as the holidays and end of year pull some buyers from their home searches.

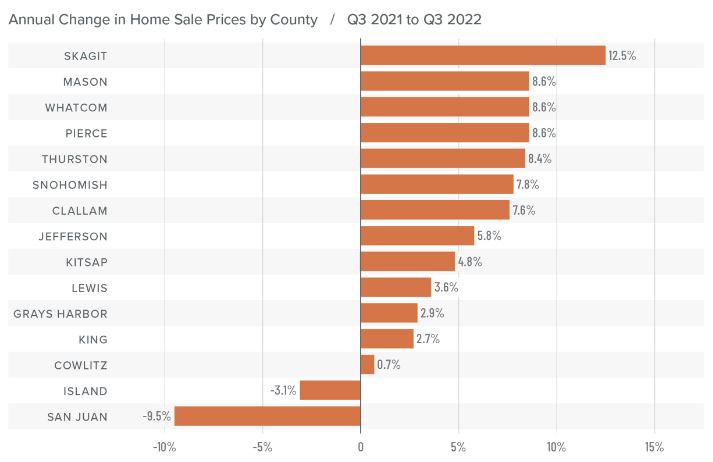

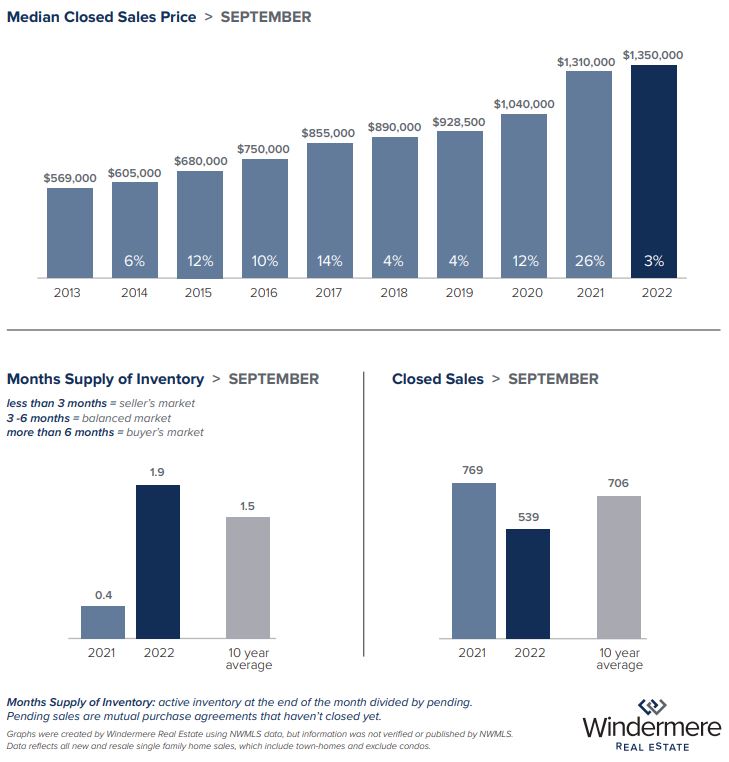

That being said, last month still saw year-over-year price increases in Puget Sound’s busiest metros, despite some month-over-month price dips. King County single-family homes saw a price decrease from $899,999 in August to $875,000 last month. That’s still up from last September’s median price of $825,600, and condos also saw year-over-year price increases, from $466,501 last September to $483,000 this September. With about two months’ inventory for both housing types, King County buyers are better able to take their time and consider the details of their purchase.

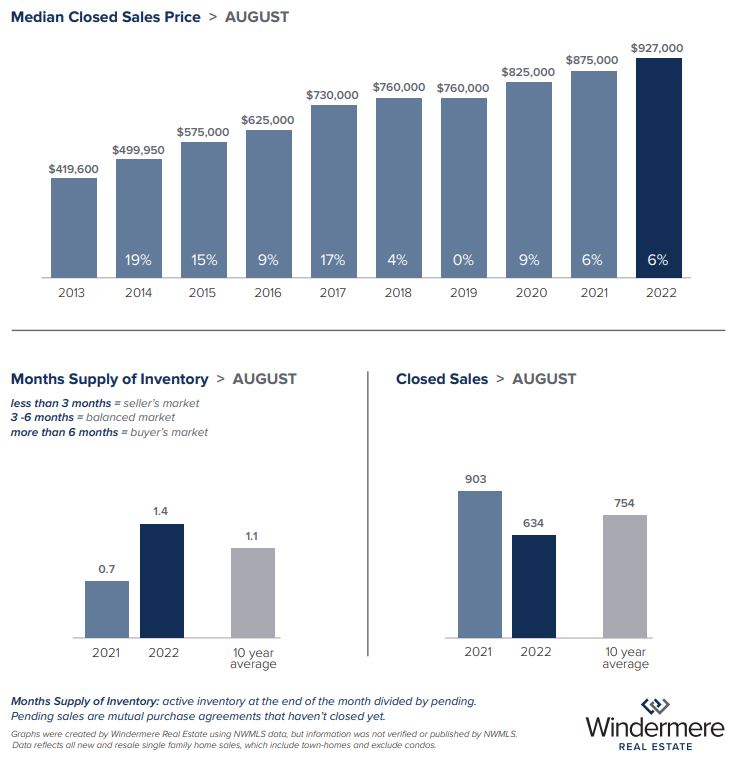

Seattle also saw a slight month-over-month decrease in single-family home prices, from a median price of $927,000 in August to $900,000 last month. That’s still up six percent from $850,000 in September 2021. Conversely, year-over-year condo prices slumped a bit, falling to $499,000 last month from $505,000 in September 2021. Condo inventory has also increased, with buyers benefitting from over two months’ supply. Sellers are encouraged to price wisely and accurately to beat the competition in these conditions.

The Eastside was the only area to see prices stay the same month-over-month, with the median price for a single-family home remaining constant at $1,350,000. That’s an increase from the median price of $1,310,000 in 2021. Active inventory also increased, up to 1.9 months’ supply. The last time the Eastside had this many listings (approximately 1,200) was before the pandemic in 2019.

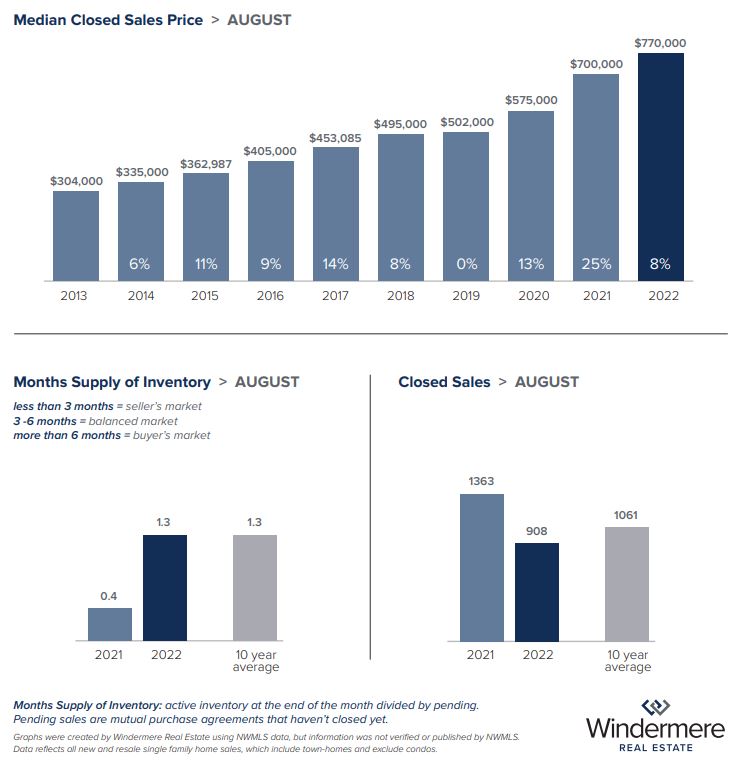

Snohomish County followed Seattle and King County, with prices dropping slightly to a median of $735,000 for single-family homes last month — down from $749,000 in August. Inventory was slightly tighter in the area, with about 1.75 months’ supply, though it’s still an improvement over the tight inventory at the height of the pandemic.

Many buyers are feeling a bit of a “pandemic hangover” when it comes to interest rates, which may be contributing to the increase in inventory across the region. The conditions that led to the historic low-interest rates were unprecedented, and buyers now need to be willing to consider buying at a higher rate with the goal of refinancing later on if they’re able.

The future of the local market will be dictated by fluctuations in interest rates. If rates increase from the September average of 6.11%, real estate experts expect new pending sales to continue to be 25% – 30% below the prior year in units. Median closed sale prices will roughly decline 10% for each 1% increase in interest rates. However, if interest rates decline from the September average, we can expect pending sales to increase, prices to remain flat, and active inventory to decline more than normal.

Matthew Gardner also points out that home prices “remain positive compared to a year ago.” He doesn’t expect this to change by the end of 2022. By spring, however, Gardner believes “it’s likely that year-over-year prices will start to trend negative. That said, I firmly believe that this will only be a short period of correction, so homeowners in the Puget Sound area shouldn’t be too concerned, especially given that 64% of them are sitting on over 50% of home equity.”

If you have questions about how home inventory or inflation could impact your position in the real estate market, please call the Kari Haas Real Estate Team.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

September 2022 Real Estate Market Update

After its breakneck pace over the last two years, it appears the housing market has finally reached a soft bottom to the price corrections that began in April of this year. Reports that we’re entering a bear market are generally exaggerated, however, as the market seems simply to be resetting to a more balanced state where buyers and sellers are at last on more equal footing. Perhaps as much as anything, the market’s performance in August reflects a typical pattern for a month that has traditionally been a slower time for housing sales.

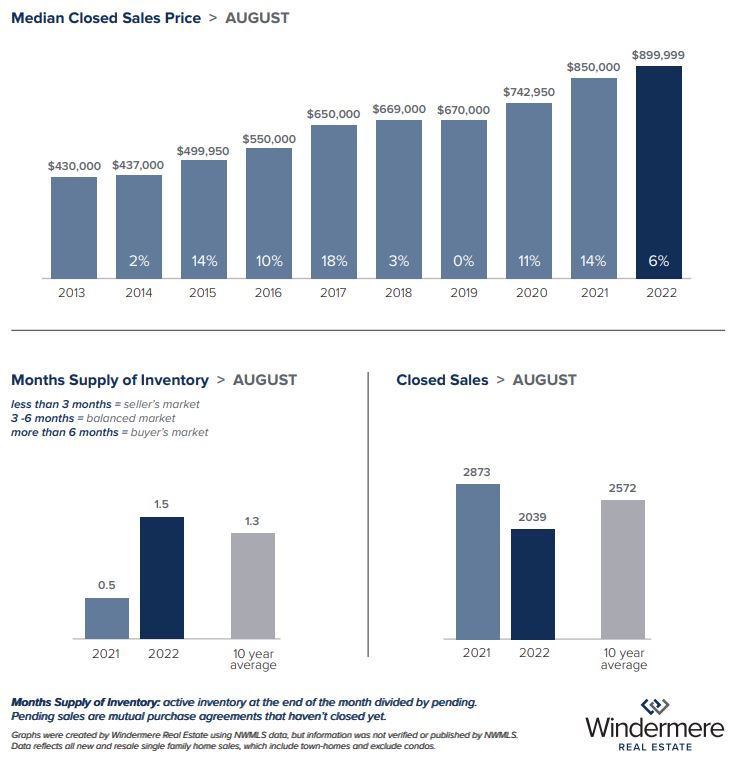

In King County last month, available inventory declined slightly to 1.5 months’ supply, with the median home price of $899,999 up slightly over July’s median of $890,000. That’s also an increase of 5.8% from $850,000 in August 2021. With 57% of homes selling in under two weeks and 22% selling over list price, many King County home buyers still have to move quickly and competitively, although with more leverage than they had earlier this year thanks to recent supply increases.

The Eastside had slightly higher levels of housing inventory available, at about 1.6 months. The median sold price for single-family homes rose 4% year-over-year, to $1,350,000. The higher asking prices in this area mean fewer homes are selling over asking than in Seattle, with about one in four homes selling at or over list price. Condos remain a more affordable option in this highly desired area, with the median price for an Eastside condo sitting at $569,500 last month.

Seattle has slightly less supply than King County as a whole, sitting around 1.4 months of inventory. The median sold price for single-family homes was up 6% year-over-year, at $927,000. About 65% of single-family homes in the city sold within two weeks, while 26% of homes sold above list price. With 2.4 months of inventory, condos may offer buyers an easier way to break into the market. The median sold price for condos last month was also a more affordable $520,000, though that’s still up 8.3% year-over-year. Increasing rents in the city and across the Puget Sound region are driving some buyers into the market, as homeownership is a hedge against inflation and rising rent costs. Even with that in mind, sellers still need to price accurately to avoid their homes sitting on the market for too long.

Snohomish County had the lowest inventory level at 1.3 months of supply (which is still more than the county’s average the past few years). The median sold price for single-family homes was $749,999, which is up 8% from August 2021. Just over half of the available homes sold within two weeks, and 19% sold over list price. The median price for condos in Snohomish County fell almost 5% year-over-year, landing at $474,999. This area continues to be a draw for buyers who may be priced out of the Seattle and Eastside markets.

Windermere’s Chief Economist Matthew Gardner believes the decrease in prices is a sign we’re entering a more typical housing market than we’ve seen in the last few years. “Home sales increased month-over-month, but the rise in listings is causing prices to soften,” he said. “I predict prices will drop further as we move into the fall. The market is simply reverting to its long-term average as it moves away from the artificial conditions caused by the pandemic.”

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

August 2022 Real Estate Market Update

The summer continues to heat up, and patient buyers are being rewarded as market shifts create a new dynamic between buyers and sellers. After years of intense competition between buyers for the most desirable listings, increasing inventory and slower price appreciation across the region have caused a pivot, with sellers competing more strongly against each other than they have in previous years.

The Return to a Balanced Housing Market

While this may cause uncertainty in some sellers, the rise in active inventory is an indication that we are returning to a more balanced housing market as a whole. Sellers can still be very successful with their home sales, as long as they price their homes accurately and understand that they may not see the exorbitant offers that were typical a few months ago. This is a pragmatic approach, and we should see some relief in the “buyer gridlock” that had kept homeowners in place who wanted to sell and move but simply had no place to go.

Inventory, Affordability, & Median Sale Prices

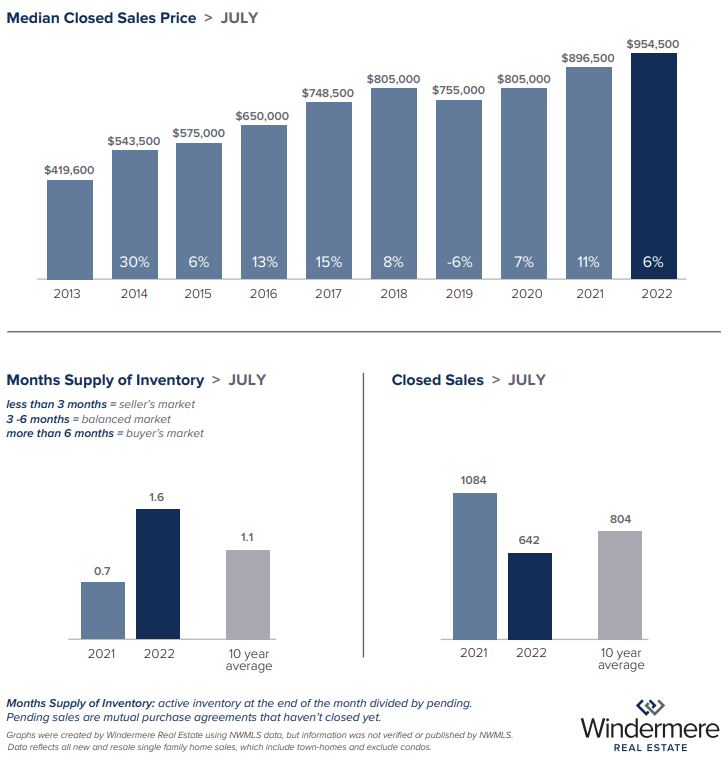

Even with the increased inventory across the Puget Sound region, we may start 2023 with low supply, high demand, and multiple offer situations. Prices are coming down largely as a result of the previous rapid price appreciation and rising interest rates. However, Puget Sound’s underlying lack of supply and huge demand has not changed, although rates have improved. Seattle’s median price for single-family homes rose 6.4% year-over-year, from $896,500 to $954,500. That’s down slightly from the million-dollar median the city hit in April, and should help create a more inviting market for prospective buyers. The median price for condos is currently a more affordable $537,000, with 2.5 months of inventory.

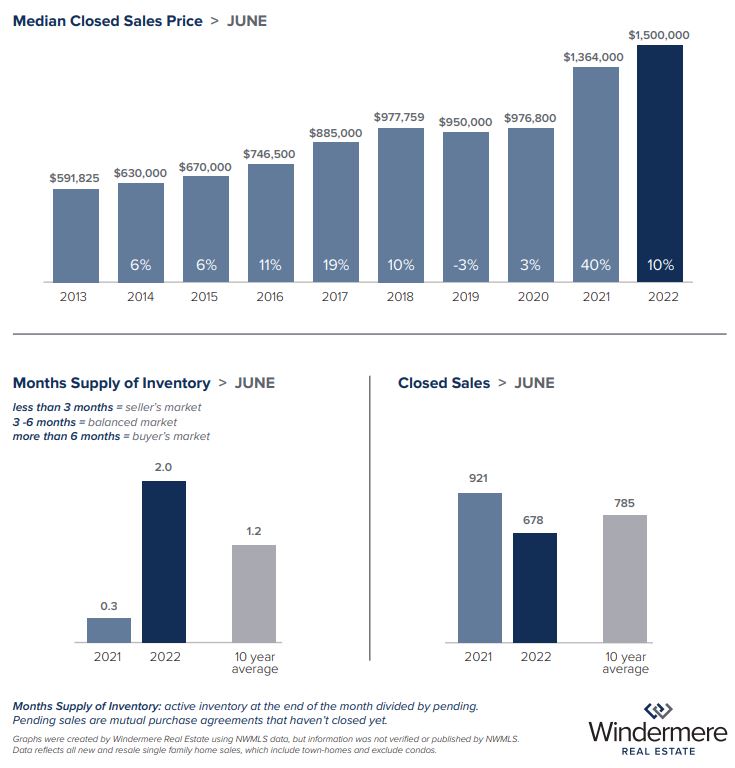

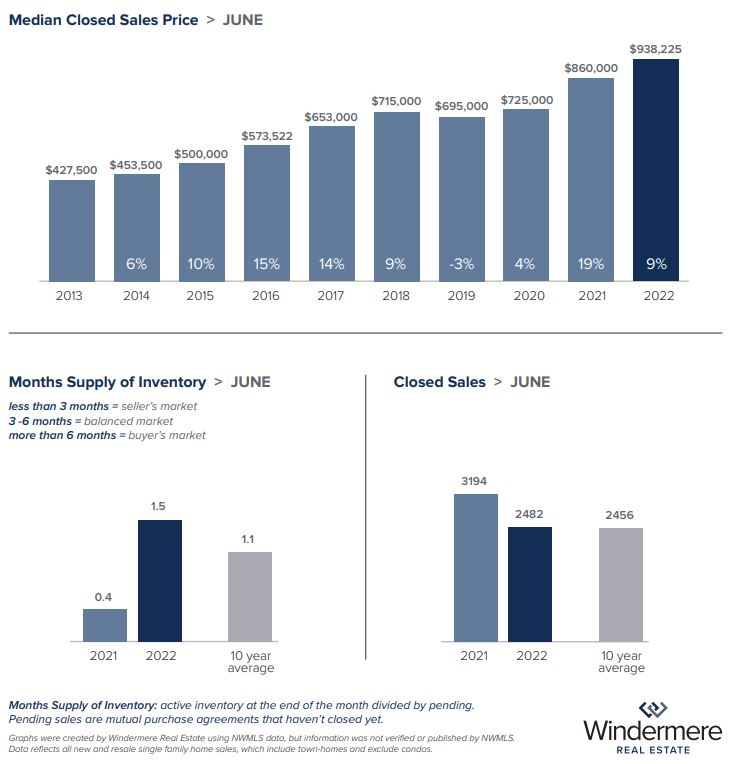

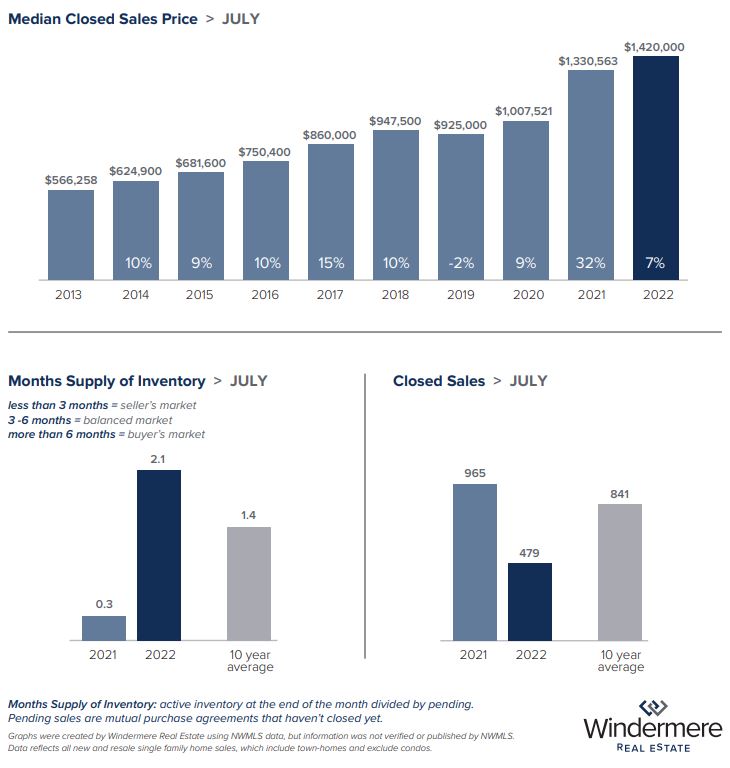

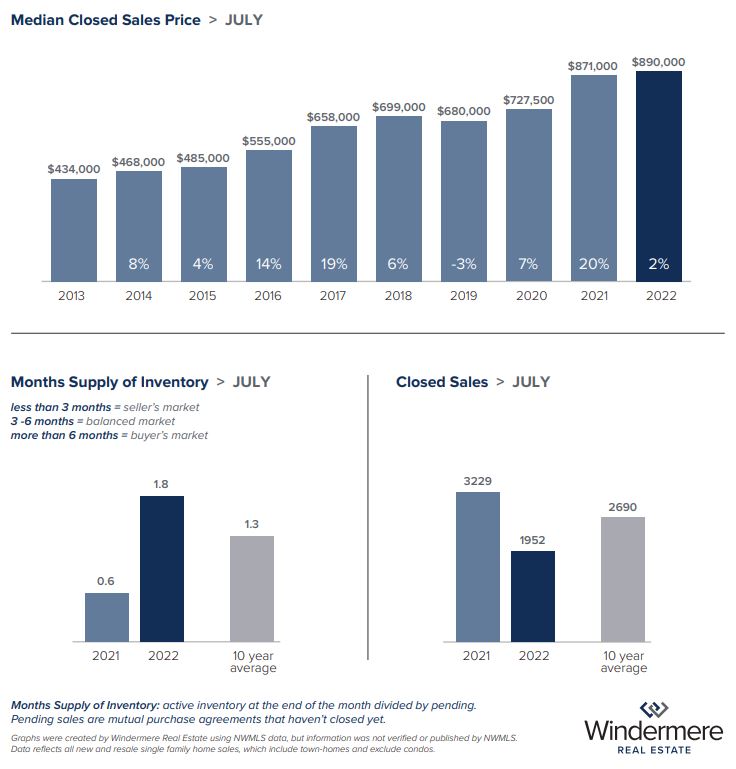

King County as a whole is experiencing much the same phenomenon, with the median sale price for single-family homes decreasing from $938,225 in June to $890,000 last month. However, that’s still up 2.1% from $871,000 in July 2021. Single-family homes on the Eastside currently have the most inventory in the tri-county area, with 2.5 months’ supply. The median price for single-family homes has dropped to $1,420,000, down from $1,500,000 in June, but up 6.7% year-over-year. It’s important to note that this decrease in the median price is likely not due entirely to price depreciation, but from the fact that lower-priced homes made up a larger percentage of the overall sales in the area, thus lowering the median sold price. Real estate experts believe that the area continues to model a price correction based on the 2018 market, suggesting the median closed sales price will bottom out in about two months’ time around $1,300,000 or higher.

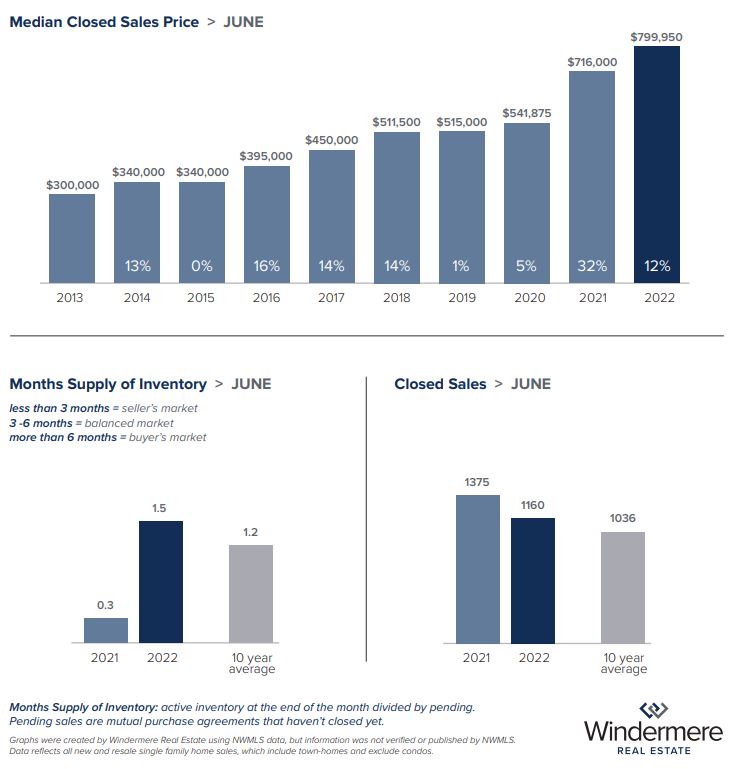

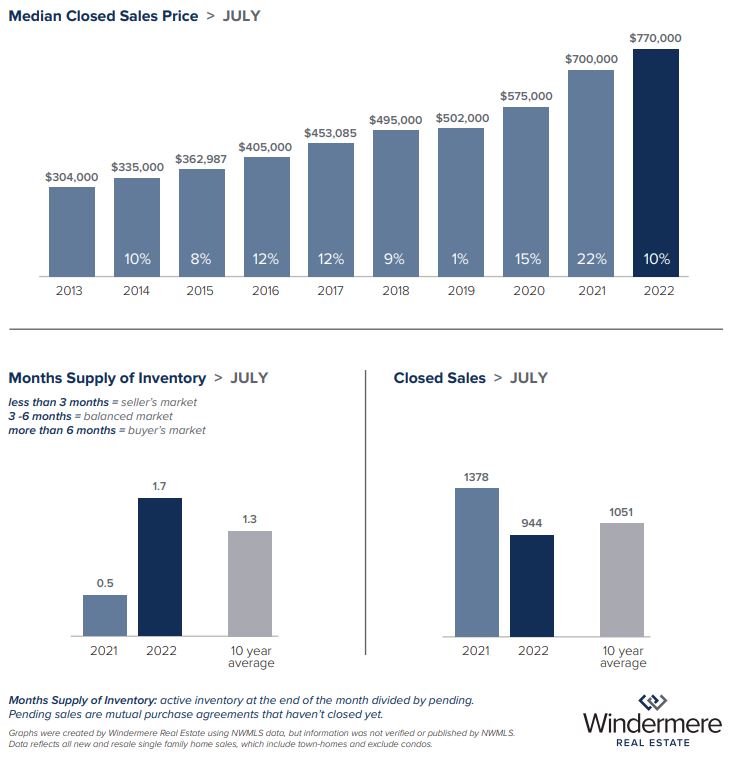

Snohomish continues to remain a more affordable area for buyers, with a median sold price for single-family homes of $770,000. Although that’s down from June, it is up a full 10% year-over-year, from $700,000 in July 2021. The area also has more active inventory—nearly two months’ supply. This, combined with the lower median price for condos of $500,000, makes it an appealing option for buyers with more constrained budgets.

Conclusion

The increase in active inventory across the region is not an indication of slowing demand. The majority of homes are selling in under two weeks, and prices continue to appreciate year-over-year. Builders are working diligently to meet demand, but until more projects come online, buyers and sellers will have to navigate these new market dynamics together.

If you have questions about these changes in the market or about real estate in general, please reach out to the Kari Haas Real Estate Team, we are happy to help!

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

Q2 Western Washington – The Gardner Report

The following analysis of the Q2 2022 Western Washington real estate market report is provided by Windermere Real Estate Chief Economist, Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact Kari Haas.

Regional Economic Overview

The most recent employment data (from May) showed that all but 2,800 of the jobs lost during the pandemic have been recovered. More than eight of the counties contained in this report show employment levels higher than they were before COVID-19 hit. The regional unemployment rate fell to 4.5% from 5.2% in March, with total unemployment back to pre-pandemic levels. For the time being, the local economy appears to be in pretty good shape. Though some are suggesting we are about to enter a recession, I am not seeing it in the numbers given rising employment and solid income growth.

Western Washington Home Sales

- In the second quarter of 2022, 23,005 homes sold, representing a drop of 11% from the same period a year ago, but up by a significant 52% from the first quarter of this year.

- Sales rose in Grays Harbor County compared to a year ago but fell across the balance of the region. The spring market, however, was very robust, likely due to growing inventory levels and buyers trying to get ahead of rising mortgage rates.

- Second quarter growth in listing activity was palpable: 175% more homes were listed than during the first quarter and 61.98% more than a year ago.

- Pending sales outpaced listings by a factor of 3:1. This is down from the prior year but only because of the additional supply that came to market.

Home Prices

- Even in the face of rising mortgage rates, home prices continue to rise at a well-above-average pace, with average prices up 13.3% year over year to $830,941.

- I have been watching list prices as they are a leading indicator of the health of the housing market. Thus far, despite rising mortgage rates and inventory levels, sellers remain confident. This is reflected in rising median list prices in all but three counties compared to the previous quarter. They were lower in San Juan, Island, and Jefferson counties.

- Prices rose by double digits in all but four counties. Snohomish, Grays Harbor, Mason, and Thurston counties saw significant growth.

- List prices and supply are both trending higher, but this has yet to slow price growth significantly. I believe we will see the pace of appreciation start to slow, but not yet.

Mortgage Rates

Although mortgage rates did drop in June, the quarterly trend was still moving higher. Inflation—the bane of bonds and, therefore, mortgage rates—has yet to slow, which is putting upward pressure on financing costs.

That said, there are some signs that inflation is starting to soften and if this starts to show in upcoming Consumer Price Index numbers then rates will likely find a ceiling. I am hopeful this will be the case at some point in the third quarter, which is reflected in my forecast.

Days on Market

- It took an average of 16 days for a home to go pending in the second quarter of the year. This was 2 fewer days than in the same quarter of 2021, and 9 fewer days than in the first quarter.

- Snohomish, King, and Pierce counties were, again, the tightest markets in Western Washington, with homes taking an average of between 8 and 10 days to sell. Compared to a year ago, average market time dropped the most in San Juan County, where it took 26 fewer days for a seller to find a buyer.

- All but six counties saw average time on market drop from the same period a year ago. The markets where it took longer to sell a home saw the length of time increase only marginally.

- Compared to the first quarter of this year, average market time fell across the board. Demand remains very strong.

Conclusions

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog.

July 2022 Real Estate Market Update

Cooler temperatures and a cooler regional real estate market have been this summer’s hallmark thus far. After months of blazing hot sales and a breakneck pace, buyers are finally seeing inventory levels accelerate and price gains slow. With inspection and financing contingencies once again becoming the norm, the region may, at last, be shifting toward a more balanced market.

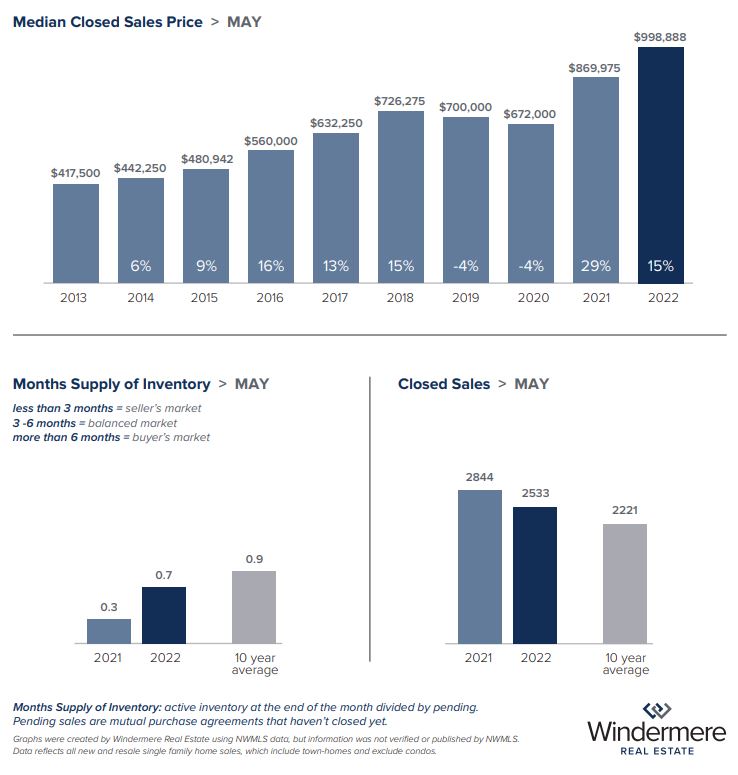

Area home prices were down across the board last month. The median sold price for King County single-family homes dropped to $938,225, slightly lower than May’s near million-dollar price ($998,888). Year-over-year, however, King County prices were still up by 9%, despite the higher 1.5 months of available inventory.

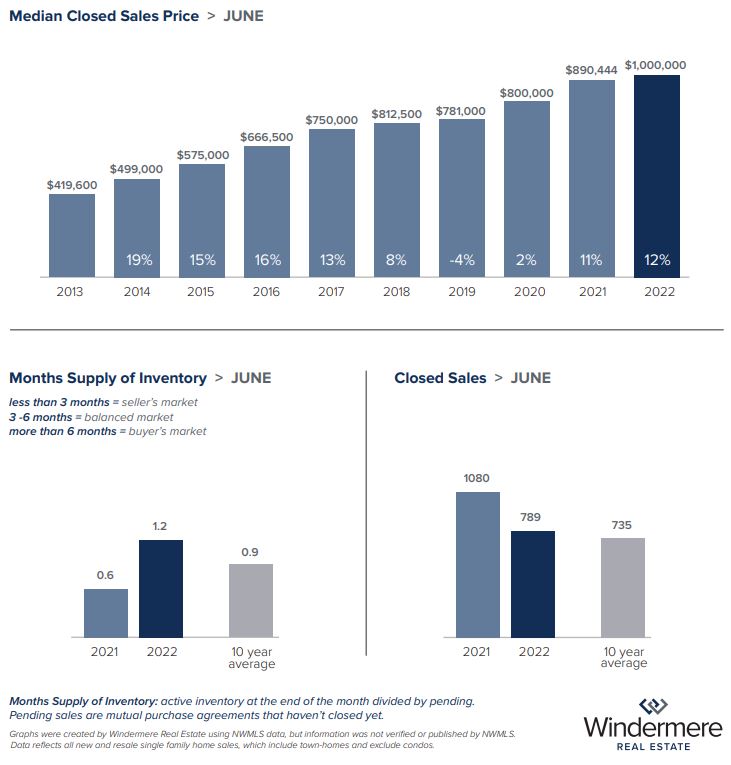

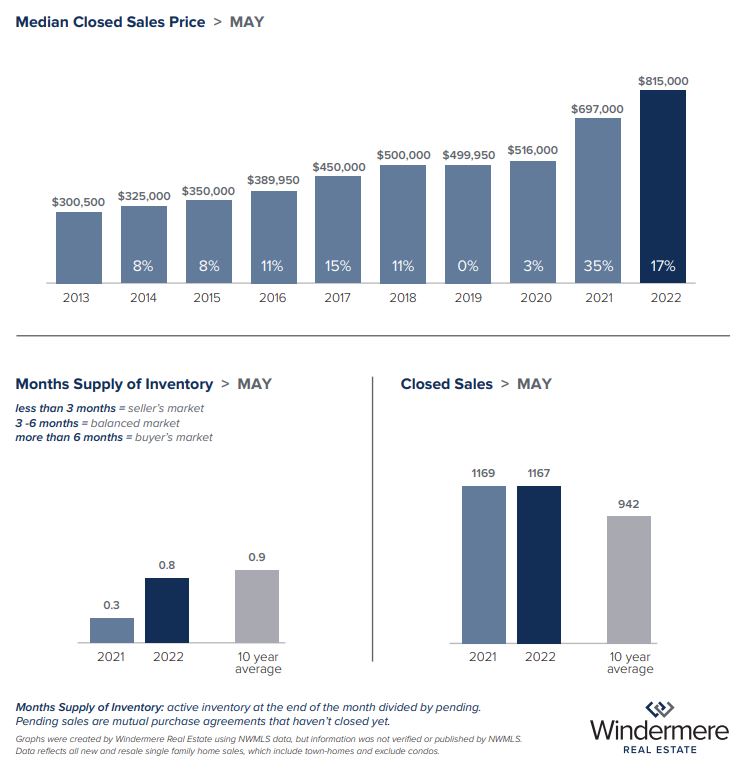

Seattle mirrored the county’s trend, with the median price dropping from $1,025,500 in May to an even $1,000,000 in June. This price was still up 12% year-over-year, indicating continued demand for housing in the city.

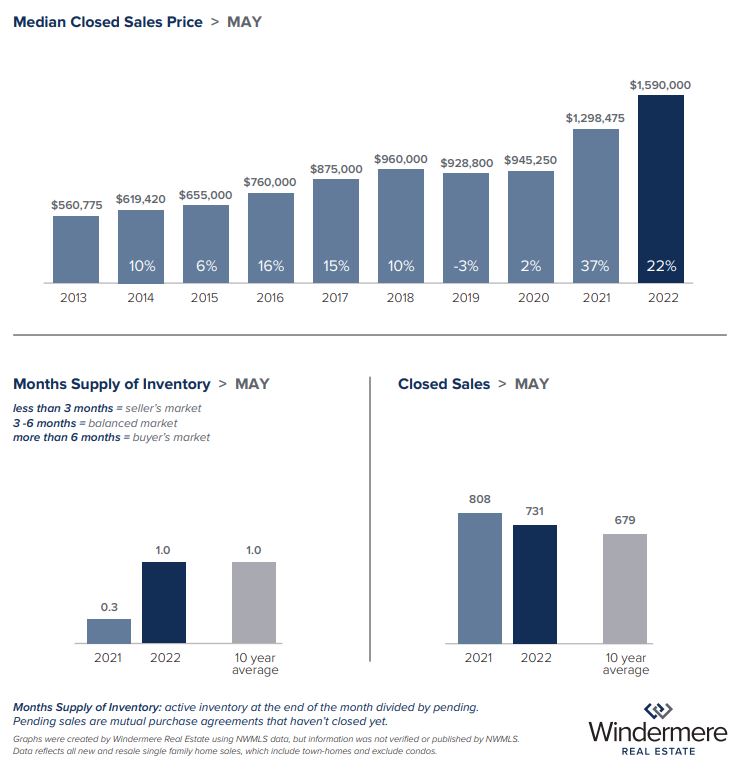

Real estate experts have pointed out that areas that saw the greatest appreciation earlier this year will likely see a more significant dip in prices as the market rebalances. The Eastside market bore out this theory in June as the median sold price for single-family homes was $1,500,000 — down almost $100k from May’s median price of $1,590,000. That said, last month’s Eastside median sold prices were still up over June 2021, increasing 10% year-over-year in the residential market and 12% in the condo market. And with two months’ supply of homes currently listed, Eastside buyers have significantly more options to choose from than they would have had earlier in the year.

Snohomish County — long a refuge for buyers seeking more bang for their buck — followed a similar trend. The median sold price for single-family homes dropped to a more attainable $799,950, down from May but still up 11% year-over-year. Snohomish County condo prices dipped in June as well, with the median sold price of $500,000 down 9% from May and up a meager 1.6% from June of last year.

While these recent price dips may cause concern for some sellers, local real estate experts reiterate that this is a necessary step toward a more balanced market. “The increase in listings has started to slow the rapid pace of price gains that we’ve experienced,” said Matthew Gardner, Windermere’s Chief Economist. “This is a good thing, not a cause for concern.”

Other factors influencing the summer real estate market are higher mortgage rates, higher post-pandemic rates of travel, and typical seasonal buyer patterns. With graduations occurring and school years finishing up, many potential buyers are scratching their itch for travel and family time, putting off their home search until a little later in the year.

For sellers looking to make the most of the current market, flexibility is key. Pricing their home correctly from the get-go and being willing to negotiate with buyers on terms can still result in a top-of-market sale, albeit one in which multiple offers are less expected.

If you have questions about real estate opportunities in the current market, please reach out for additional insights and analysis. The Kari Haas Real Estate Team is here for you! “Let’s Sell Your House & Find Your Home!”

Eastside

King County

Seattle

Snohomish County

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

June 2022 Real Estate Market Update

Windermere just released the market statistics from May, so let’s review what’s happening in the real estate market.

The tides of our local real estate market may, at last, be shifting, as buyers find relief in increasing inventory and the frenetic pace of sales slows noticeably. At the end of May, inventory across the 26 counties served by the Northwest MLS had increased by 59%, with 8,798 active listings in the database, compared to 5,533 active listings just a year ago. While this shift may cause concern from some who anticipate a drop in the market, Windermere’s Chief Economist Matthew Gardner had this to say: “What’s more likely to occur is that the additional supply will lead us toward a more balanced market, which after years of such lopsided conditions, is much needed.”

Are Price Hikes Slowing?

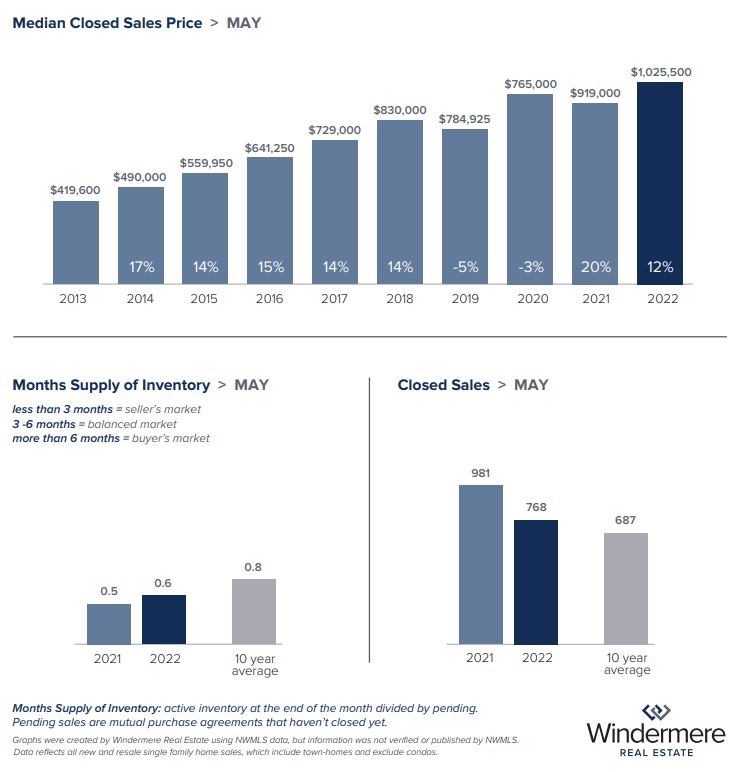

While inventory has increased, the meteoric price hikes seen in this first part of 2022 – including again in May’s closed sales – are expected to slow dramatically in the next half of the year. Seattle saw a historic first in April, with the median sold price for a single-family home topping $1 million for the first time. May home sales continued that trend, with the median sold price inching up to $1,025,500, which is a 12% increase from $919,000 in May 2021. King County as a whole mirrored this trend, with the median price of single-family homes reaching $998,888 in May, up from $995,000 in April, and up 14.8% from last May’s median price of $869,975.

Eastside & Snohomish Markets Cool

May closings reveal that the Eastside and Snohomish County didn’t follow this same pattern, instead experiencing a much-needed cooling of prices. On the Eastside, the median sold price for single-family homes fell from $1,722,500 in April to $1,590,000 in May. While last month’s median price is the lowest since January of this year, it was still up 22% year-over-year. The Eastside saw an increase in the percentage of homes that had a price change before selling, hitting 10% in May — double that of April. This is likely due to Eastside sellers needing to adjust their price expectations. While a majority of listings in the area — about 66% — still sold over list price last month, a full month of inventory and a 403% increase in active inventory on the Eastside from February to May means that buyers have more choice and agency than they’ve had in some time. Homes are still selling, but multiple offers are far fewer, and sellers are more likely than before to accept an offer written with contingencies.

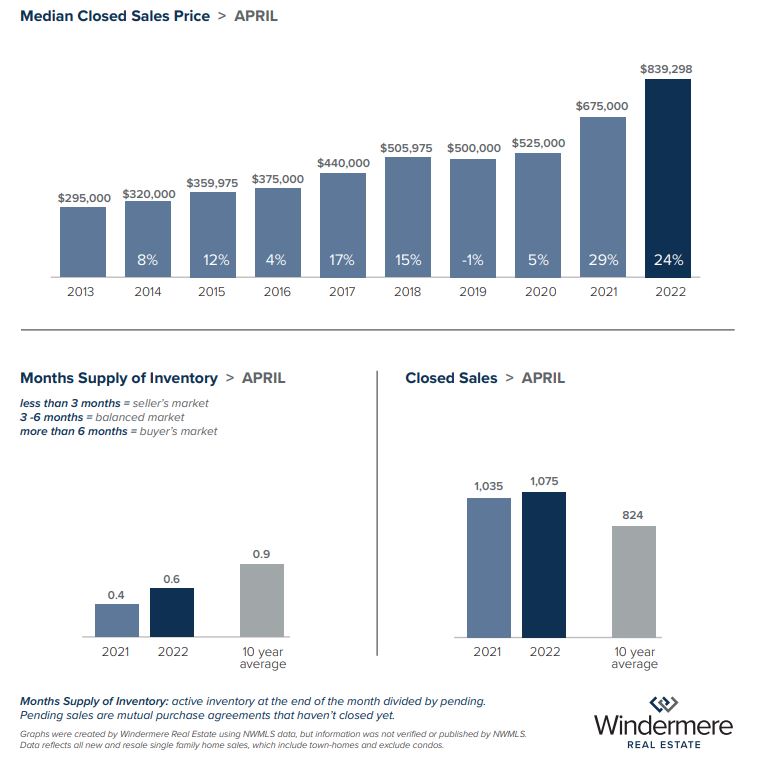

Snohomish County also saw a shift in May, likely due to the combination of increasing inventory running headfirst into decreasing buyer budgets thanks to rising mortgage rates. With .85 months of inventory, prices reflected this, with the median sold price for single-family homes falling slightly to $815,000 last month, down from $839,298 in April. However, most homes sold for over list price and quite quickly, averaging less than two weeks on the market. It’s worth noting that these statistics largely reflect home sales that went under contract in prior months when the competition was at its fiercest. The median sold price for Snohomish County condos dropped just slightly to $545,000 last month, down from $550,000 in April. With only two weeks of inventory on hand, the county’s condo market is likely to remain competitive for a while.

A Chance for Buyers

Falling prices in the Puget Sound region may have caused concern for some, but most analysts see this as a necessary and long-overdue price correction. Prices for single-family homes (excluding condos) in King County rose from $775,000 in January to a whopping $995,000 in April, a change of $220,000 in only four months, or 28.4%. Last month, the Eastside saw prices decrease by only 8%, and this was likely only because prices had previously risen so astronomically in the area. Neighborhoods that saw the highest appreciation will likely experience a sharper correction, but this may serve to help some previously unlucky buyers re-enter the market and finally find success.

If you have questions about pricing trends in your neighborhood, or how to make the most of your purchase or sale, please reach out!

Seattle

Eastside

VIEW FULL EASTSIDE REPORT HERE

King County

VIEW FULL KING COUNTY REPORT HERE

Snohomish County

VIEW FULL SNOHOMISH COUNTY REPORT HERE

This post originally appeared on GetTheWReport.com

May 2022 Real Estate Market Update

After a long stint of suppressed housing inventory across our region, buyers may, at last, have more options as the supply of available homes ticks up ahead of the summer market. The month-over-month increase in inventory has been as much as 50% in some areas, offering renewed opportunities for those buyers who are not dissuaded by high home prices and rising mortgage rates.

The Eastside appears to have experienced the most dramatic inventory growth, with .79 months of available single-family homes last month compared to .46 in March. Seattle increased slightly to .59 months of inventory, while Snohomish also had a notable increase up to .67 months of inventory compared to .46 in March.

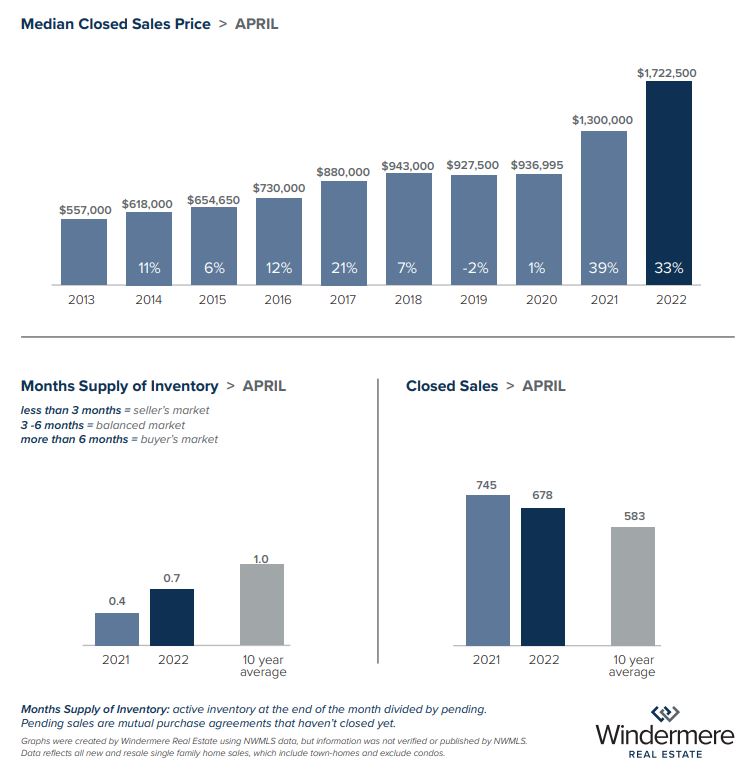

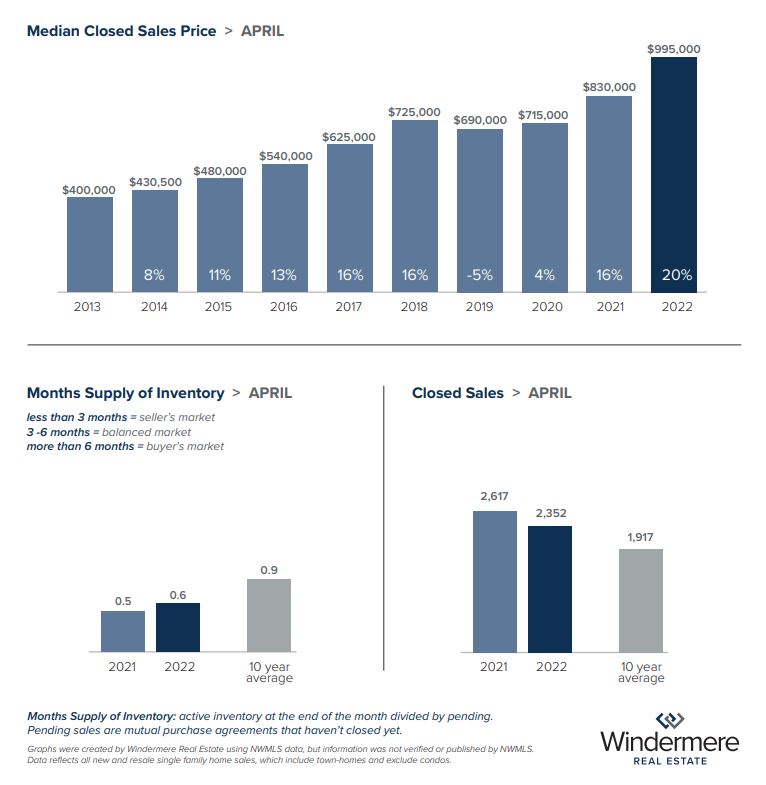

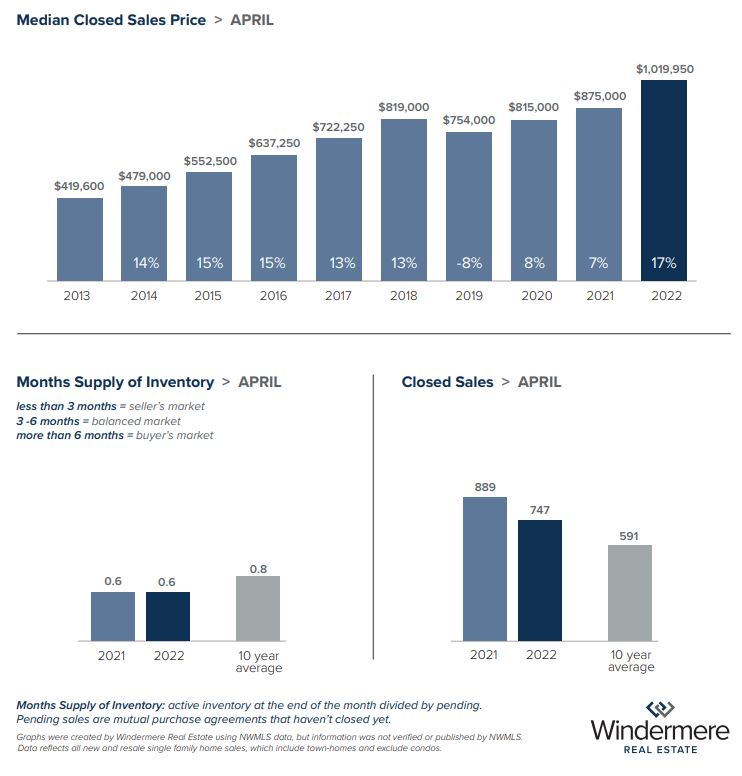

The increase in supply is likely occurring because rising home prices and mortgage rates have put a slight damper on sales in the area. Last month, the median sold price for a single-family home in Seattle surpassed $1 million for the first time—landing at a historic $1,019,950. This is up 16.6% year-over-year from $875,000 in April 2021. The median price for single-family homes on the Eastside last month was an eye-watering $1,722,500, with 80% of homes selling over list price. Although inventory has increased in the area, Eastside homes are still selling quickly, with 96% of listings selling in under two weeks. King County as a whole also saw prices increase, with the median sold price for single-family homes reaching $995,000, up from $830,000 a year ago.

Snohomish County home prices have kept pace with the market, with the median sold price for a single-family home reaching $839,298. That’s an increase of 24.3% year-over-year from $675,000 in April 2021. This is likely due to increased demand from buyers who can’t compete in the intense Seattle and Eastside market, seeking more bang for their buck in the relatively more affordable Snohomish County market.

Affordability issues have also trickled into the condominium market, as some prospective homebuyers divert from the single-family market to condos. Eastside condo prices have increased 29.7% year-over-year to $674,444 last month from $520,000 in April 2021. In Snohomish County, the median sold price for condos rose to $550,000 year-over-year from $432,250 last year. That’s an increase of 27.2%.

Despite rising home prices and heftier mortgage rates, many buyers are still eager to take advantage of the financial benefits of homeownership. According to Windermere’s Chief Economist, Matthew Gardner, “Owning real estate is a hedge against rising inflation. Homeowners with a fixed-rate mortgage will always have the same monthly payment, even as other costs rise.”

If you have questions about how to find the opportunities presented by today’s market, please don’t hesitate to contact me.

Seattle

Eastside

King County

Snohomish County

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

April 2022 Real Estate Market Update

The spring market continues its frenzied pace, with soaring prices and stiff competition testing the resolve of buyers. Despite these obstacles and rising mortgage rates, inventory remains low across King County, as pending sales keep pace with new listings, demonstrating a strong demand from buyers. Continue reading for the April 2022 real estate market update.

Buyer Demand

This demand has factored into the way sellers are approaching the market. Windermere’s Chief Economist Matthew Gardner notes that median listing prices continue to rise, saying “this suggests that sellers remain quite bullish when it comes to pricing their homes.”

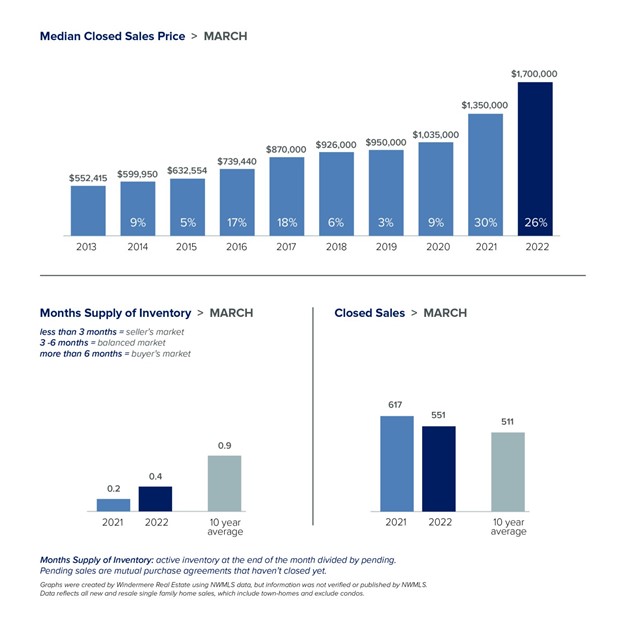

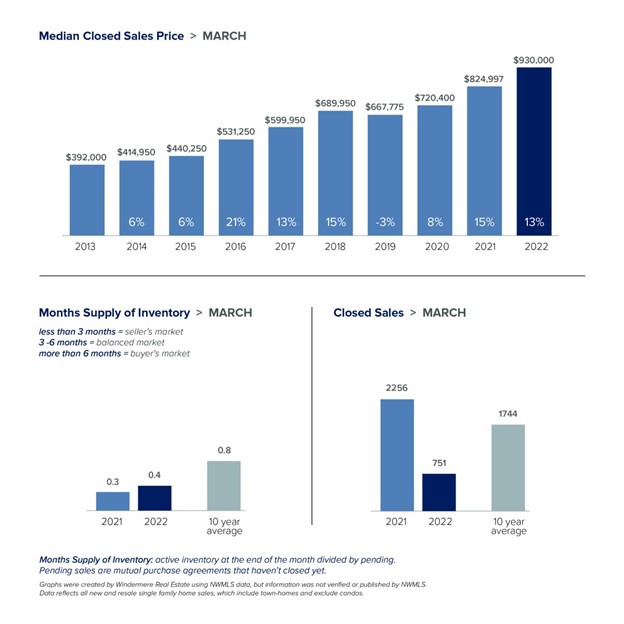

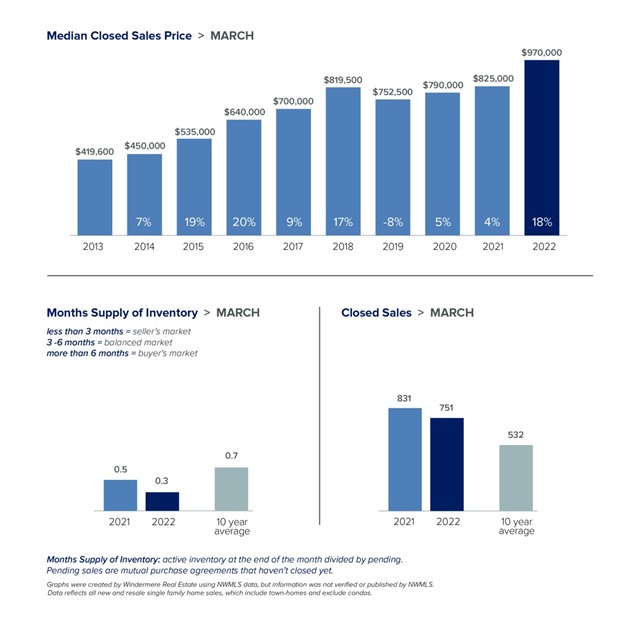

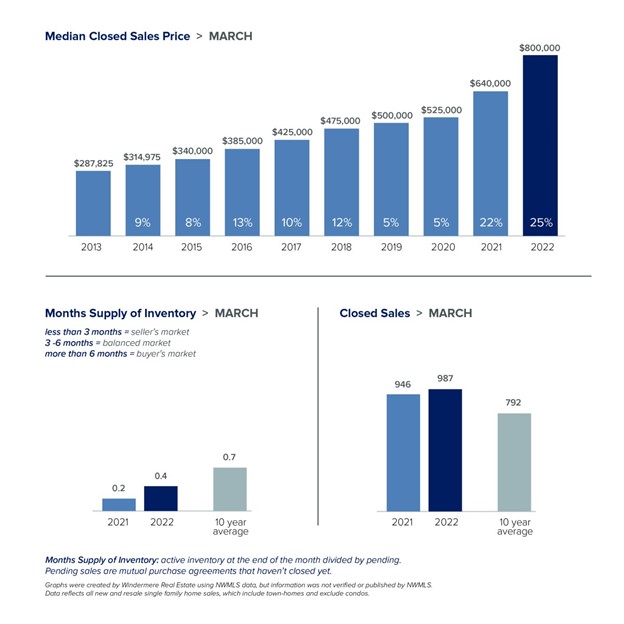

This was certainly true in March on the Eastside, where the median closed sale price for single-family homes was $1,700,000, an all-time high. This was up 26% year-over-year, and slightly up from February, when the median was $1,697,500. In Seattle, the median price for single-family homes achieved an all-time high of $970,000, up 18% year-over-year. Snohomish County continues to feel the impact of this voracious demand, with a median closed sale price of $1,298,000 for single-family homes — that’s an increase of 38.1% year-over-year.

Selling Over List Price

Not only are asking prices increasing across the region, but many homes are selling for well over the list price. On the Eastside, a staggering 85% of closed sales in March 2022 sold for more than the list price. Overall, that’s down from an all-time record last month of 87% but tied for the second-highest month ever with April 2021. Of the Eastside homes that sold over asking last month, the median difference was 21% over asking, and they spent an average of just 4 days on the market.

Seattle is experiencing a similar pattern, with 71% of the closed sales in March going over the list price. This is high for Seattle; in March and April of 2018, 63% and 68% of listings closed over asking, respectively. Last month, the Seattle listings that sold over the list price sold for a median of 15% over the list price, and were on the market for 5 days.

In Snohomish County, homes that sold over list price went for a median of 21% over the asking price.

With these conditions, many buyers are looking to condos as a more affordable way to break into the market. Consequently, condo prices have also seen a year-over-year increase. In King County, condos remain relatively more affordable, with a median price of $540,000 in March 2022. That’s up from $470,000 in March 2021, a 14.9% increase. Snohomish County has seen a more dramatic increase, as the median condo price in March 2022 was $555,000 — up 33.1% year-over-year, from $417,000 in March 2021.

Expectations

Matthew Gardner expects mortgage rates to continue trending higher in the coming months, but so far he says there’s nothing to be too concerned about, as the interest rates have not yet caused sales to taper off. Savvy sellers can still easily benefit from the opportunities presented by this market, and although rates are higher, buyers can finance their home purchase with rates still far lower than the historical norm.

If you’re looking for knowledgeable advice as you consider when might be your best time to enter the market, whether as a buyer or a seller, please give me a call or text. We are here to give you professional insight to help you make the best decisions possible.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link