As the final quarter of 2022 rolls on, it’s clear that these last months will be anything but typical for home buyers and sellers in King and Snohomish counties. In a real estate market that’s been defined by high competition and low supply for the last number of years, buyers and sellers are changing tactics as market dynamics shift due to rising mortgage rates and growing inventory.

While some buyers are waiting to see if rates and home prices drop, others are getting creative with their financing by utilizing buydowns, adjustable rate loans, carrying back second deeds of trust, and closing cost allowances to make their purchases. Sellers have been slower to adjust, with many resisting the idea of lowering their asking price to meet the constraints of buyers dealing with high-interest rates. However, for sellers willing to correctly market and position their listing, successful sales – and even occasionally multiple offers – can still be attained.

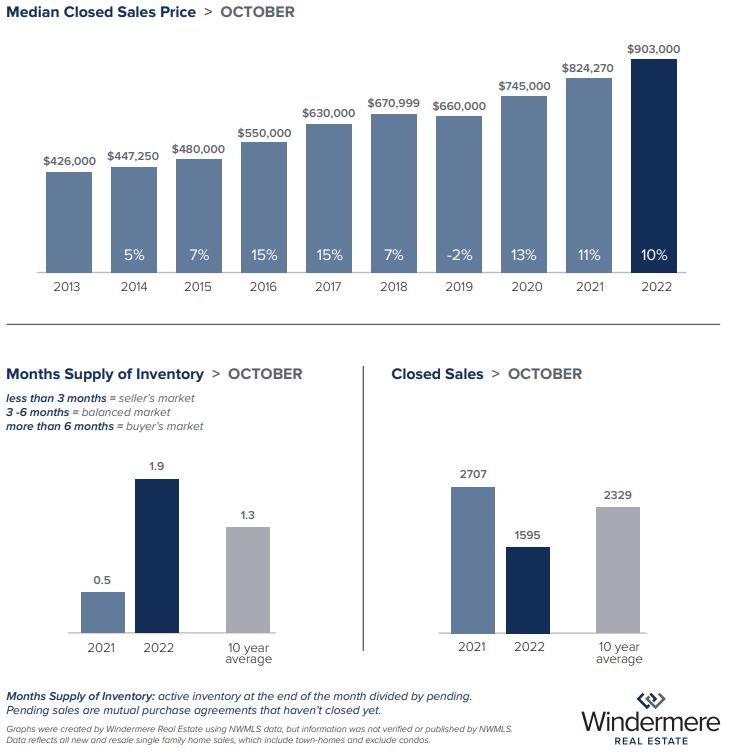

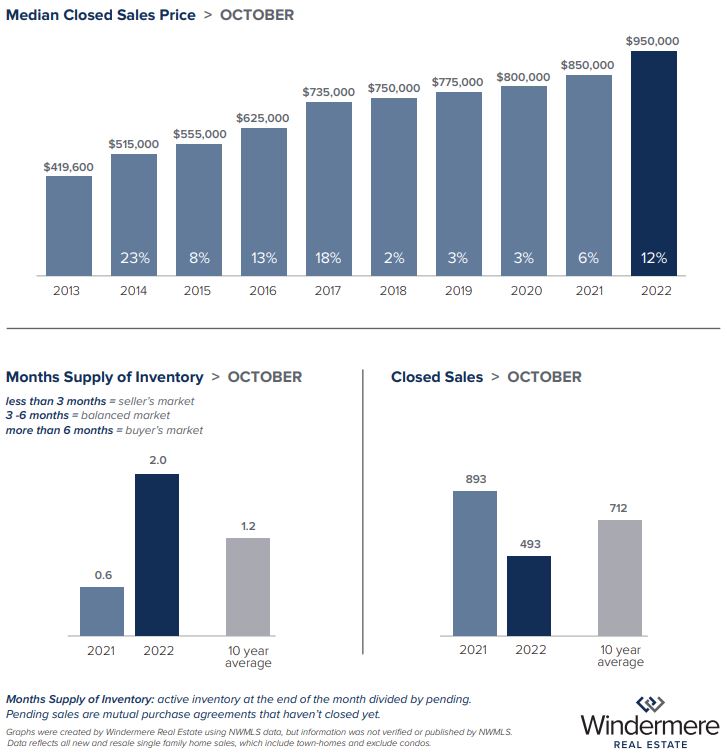

Seattle & King County

King County as a whole saw the median price of a single-family home increase from $875,000 in September to $903,000 last month. This was primarily a function of price gains in Seattle, where single-family homes sold for a median of $950,000 in October — up from $900,000 in September. Seattle and King County both have about two months of available supply, which is the most balanced inventory level the market has seen in years. The Seattle condo market has slowed a bit more than residential sales, with over 3 months of inventory and a median price of $522,500 — down from $525,000 year-over-year.

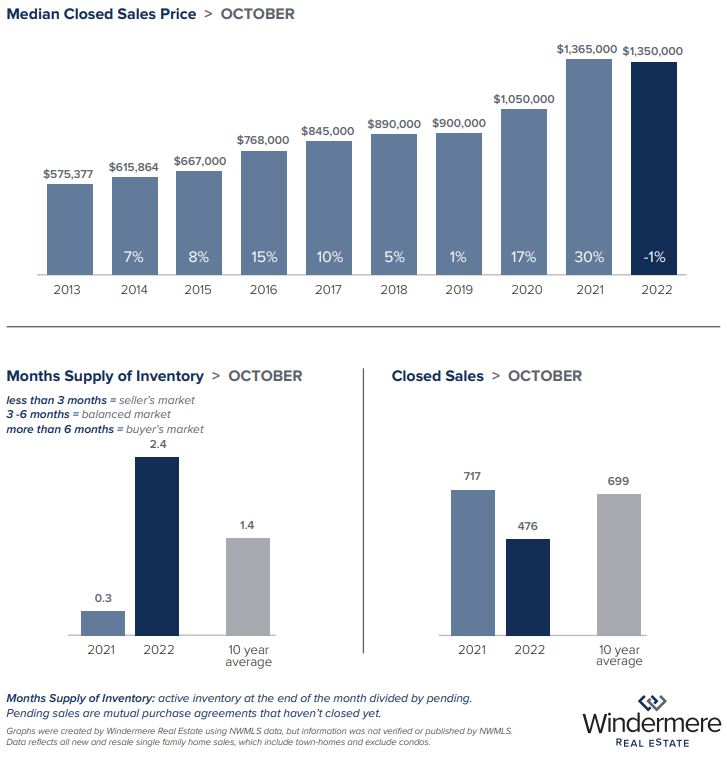

Eastside

On the Eastside, the median price for single-family homes has remained constant, sitting at $1,350,000 for the third month in a row. The average monthly mortgage payment on the Eastside dropped 19% from $9,226 in April 2022 (when the median price was $1,722,500 with a 4.98% interest rate) to $7,430 in August 2022 (with a median price of $1,350,000 at a 5.22% interest rate). However, while the median price has remained the same since August, the 30-year interest rate rose to 6.9% in October. At that rate, the average monthly payment is $8,891 — only 4% off the peak payment of $9,226 in April; this is despite a 22% drop in prices since then.

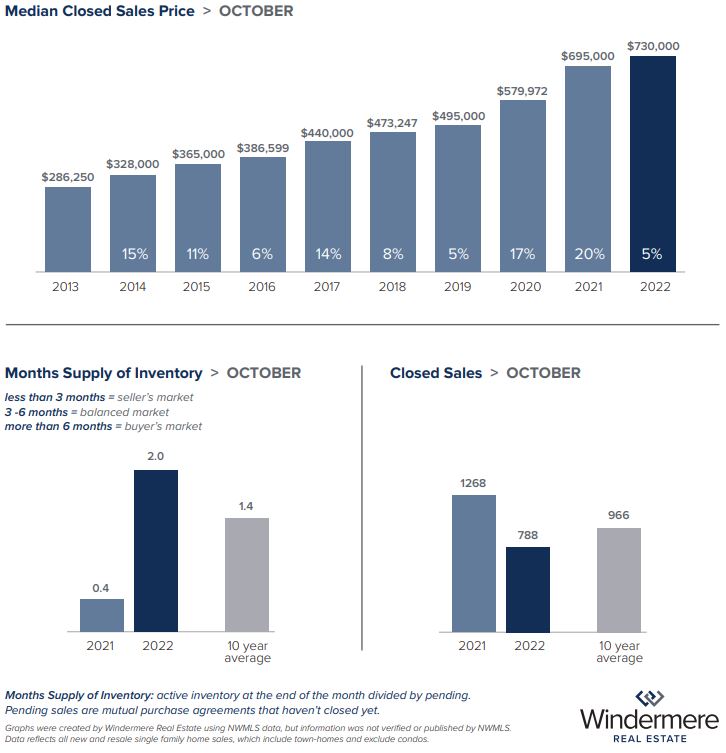

Snohomish County

Snohomish County saw prices fall slightly from a median of $735,000 for single-family homes in September to $730,000 last month. With less than two months of inventory, that market remains slightly more competitive than the Eastside or Seattle, possibly due to lower prices making it more accessible for buyers as they combat the higher interest rates.

Matthew Gardner’s Take

Windermere’s Chief Economist Matthew Gardner weighed in on the effect of mortgage rates on buyer behavior. While he believes many buyers may be forced to wait (either voluntarily or not) for interest rates to stabilize, he advises would-be buyers not to wait for prices to bottom out. “Those who hope to pick up a home ‘on the cheap’ are likely in for a long wait,” he said.

For many buyers, the answer to this conundrum is a pivot to adjustable rate mortgages, which are currently set at around 5.9%. With the 30-year fixed mortgage rate currently at 6.9% or higher, adjustable rate mortgages offer a more affordable inroad to homeownership, with the possibility of refinancing to a lower rate in a few years.

As we navigate these changing market conditions, Kari can help you assess the best path forward for your home sale or purchase.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link