Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Mastering the BRRRR Strategy: Tips for Real Estate Investors

Real estate investors looking to grow their portfolio understand the importance of adopting the BRRRR strategy (buy, rehab, rent, refinance, repeat). While this strategy can be rewarding, it requires a combination of skills, knowledge, and expertise. Here are some tips to help you master the BRRRR approach.

Up-And-Coming Areas

Choosing the right location is crucial when it comes to real estate investing. As a BRRRR investor, focusing your search on up-and-coming areas will cause the property to appreciate as you work on it. The best thing about up-and-coming areas is that they are affordable and offer great potential for growth and development. Identifying these areas early on can be the difference between a profitable investment and a failed one.

Undervalued Properties

The next step is to look for undervalued properties with the potential for appreciation. You want to find properties that are sold below market value but have the potential to increase in value after renovations. Doing so ensures that you get the best profit possible. Keep in mind that the key to finding undervalued properties is research, persistence, and patience.

Choosing Renovations

Once you’ve found the perfect property, the next step is to start making renovations. However, budget constraints can cause you to run out of funds before completing the project. To minimize this risk, focus on renovating the most valuable and necessary aspects of the property first.

Digitizing Paperwork

Real estate investment involves managing a lot of paperwork, which can be overwhelming if you have multiple properties. However, digitizing your documents into PDFs and storing them in the cloud is an effective solution. Digitization saves space, reduces clutter, improves security, and makes it easier to retrieve documents when you need them. If you use a PDF file converter, you can streamline your real estate investment process and focus on growing your portfolio.

Timeline and Budget

Time and budget are crucial factors when it comes to real estate investing. As a BRRRR investor, it’s essential to be mindful of your timeline and budget. You want to ensure that you complete the project on time and within budget. Running over budget or taking too long to complete the project can eat into your profits.

Understanding the Local Real Estate Market

Having a solid understanding of the local real estate market is key to making informed decisions when investing. You need to know when the right time to sell is, what properties are in demand, and what features buyers are looking for. A good way to stay informed is by networking with local real estate agents, attending industry events, and following market trends online.

Market Effectively

The final step is to market the property effectively. You want to attract as many potential buyers as possible to increase your chances of selling quickly and at a good price. Effective marketing involves professional photography, virtual tours, detailed descriptions, and listing your property on reputable real estate websites. The more exposure your property gets, the higher the chance of finding the right buyer.

In conclusion, mastering the BRRRR strategy requires a combination of skills, knowledge, and expertise. By focusing your search on up-and-coming areas, looking for undervalued properties with potential for appreciation, keeping all paperwork digitized, and more, you can increase your chances of success as a BRRRR investor.

When you’re ready to purchase a home, contact the Kari Haas Real Estate Team for exceptional service and local expertise.

Image: Pexels

This post was written by Micah Norris for the Kari Haas Real Estate Team blog.

June 2023 Real Estate Market Update

The more frenetic activity of a typical spring real estate market has certainly hit our area, with buyers out in droves looking for homes. What they’ve found, however, is high competition and scant listings. The region’s low housing inventory has been a constraint that has resulted in fewer closed sales than we’ve seen in recent spring markets.

According to real estate experts, housing supply and interest rates are the defining obstacles for buyers at the moment. On the Eastside, active inventory is only 32% of the 10-year average, and new listings are off 34% year-to-date. This is driving prices up, while interest rates put a damper on what buyers can afford. While recent demand has been strong, experts expect that demand will taper off as interest rates approach the 7% mark.

However, because inventory is so scant, sellers who adequately price their homes are seeing success in this market. As an example, around 44% of properties on the Eastside are selling above their asking price, at an average of 5% over list. Anecdotally, the homeowners who are most likely to sell at the moment are those who purchased before the historic low-interest rates of the pandemic or have paid off their homes and are thus mortgage-free. Buyers in this market also have some negotiating power, having successfully negotiated pre-inspections, homeowner warranties, and seller-paid closing costs to mitigate the high rates.

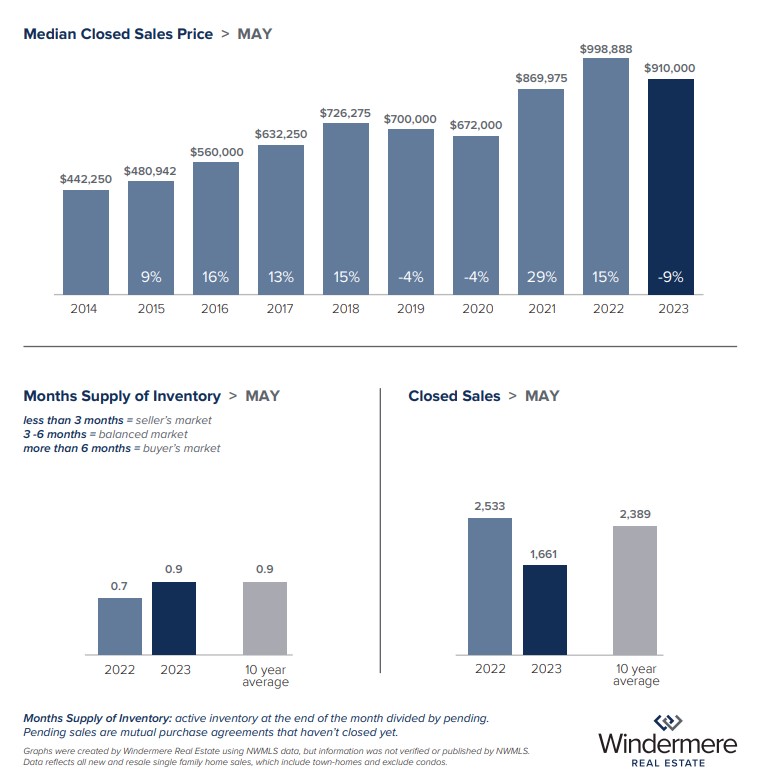

In King County, with just shy of one month’s inventory, competition in the area is fierce, and buyers will need to be ready to negotiate when the right listing comes along. The county’s median sold price for a single-family home dropped almost 9% year-over-year, from $998,888 in May 2022 to $910,000 this year. However, that’s still an increase from April’s median of $875,000.

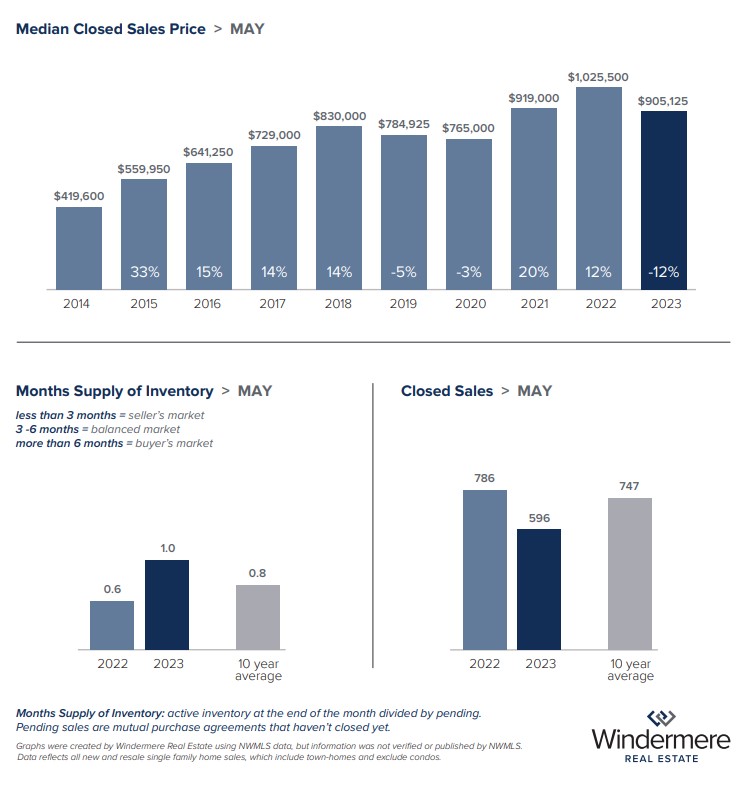

Seattle had a similar low inventory, at one month’s supply. The median sold price for single-family homes rose from $886,000 in April to $905,125 last month. While there’s been continued monthly price growth so far this year, May’s median sold price was still down 11.7% from the median of $1,025,500 in May 2022. Although residential inventory is tight, buyers in the city may have more luck with condos, which are both more affordable and plentiful. The Seattle condo market currently has almost two months of inventory and a more reasonable median price of $550,000.

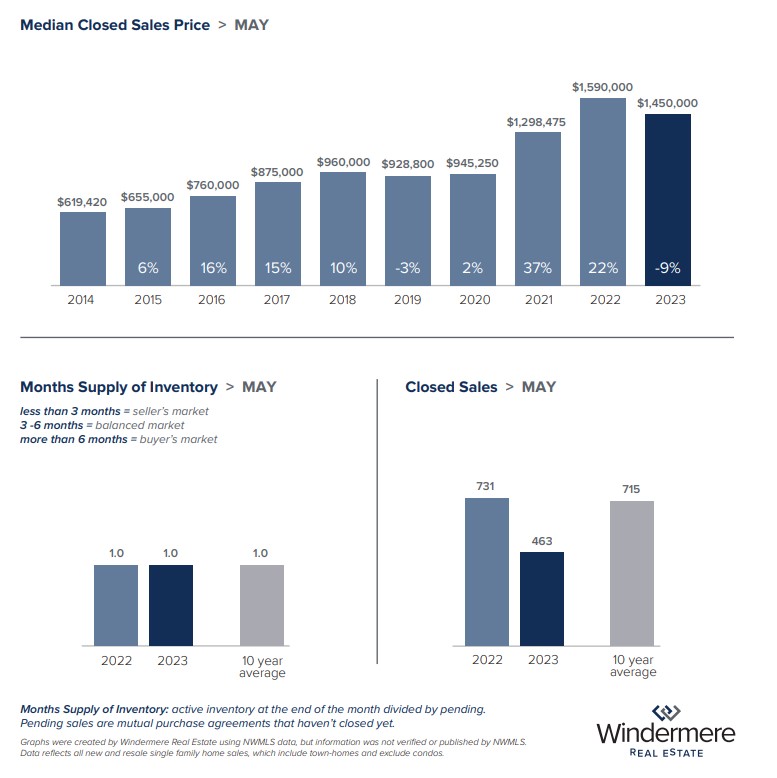

Like Seattle, the Eastside has just one month of inventory at the moment. However, higher interest rates are being felt a little more in this pricier area, as May’s median sold price for a single-family home did not change from April’s median of $1,450,000. This is down 8.8% from the median of $1,590,000 in May 2022. The supply of Eastside condos is lower than the residential supply, with just .8 months’ inventory. At a median sold price of $582,000 last month, condos may be a slightly easier path to homeownership for those searching on the Eastside.

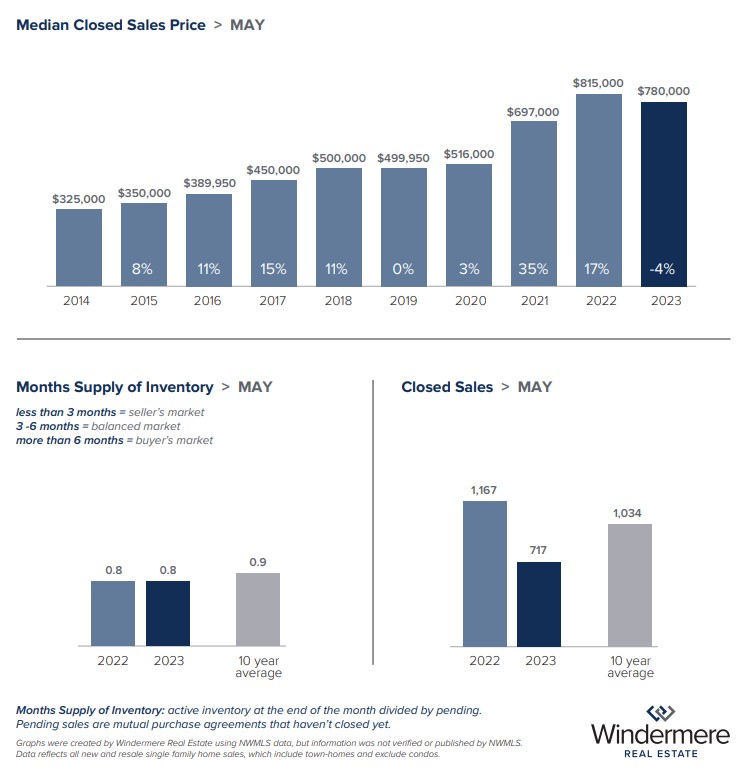

Finally, Snohomish County saw month-over-month price gains in May, landing at a median sold price of $780,000 for a single-family home, up from $767,500 in April. May’s median price was down 8% from $782,000 in May 2022. The county’s more affordable price points may allow for better appreciation in the area, despite the continued higher interest rates that have stifled other local markets. With just two weeks of inventory, the Snohomish County condo market is the tightest regional market at the moment. The median price for condos in the area is $544,900, down less than 1% from $550,000 in May 2022.

As buyers and sellers navigate continued low inventory and high-interest rates, they both must be comfortable negotiating terms to achieve the best possible outcome. Buyers should be ready to move fast and bring as much cash as possible, while sellers should be cognizant of the burden higher rates can create and price their listings accordingly.

If you have questions about these housing market trends or real estate, please give the Kari Haas Real Estate Team a call.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

How to Sell a Home After the Death of a Loved One

The loss of a loved one is a heartbreaking experience for everyone involved. But as an heir, along with grieving for your loss, there are other responsibilities you may have to dedicate your attention towards. One of these is handling the sale of the deceased’s estate. At the Kari Haas Real Estate Team, we understand that selling your loved one’s home can be a lengthy and emotional process. This article discusses the important steps you can take to navigate through this difficult time and make the right decisions.

Start the Probate Process

Probate is a legal process through which a court verifies the authenticity of the deceased’s will and grants an executor the power to manage the estate. Often an executor is named in the will itself and can be a beneficiary such as the deceased’s spouse or children. As reported by LegalMatch, a typical probate process can take around 12-24 months; hence it’s advised to start it as soon as possible and seek assistance from legal experts.

As an executor, you also need to fulfill additional responsibilities such as:

- Provide notice to all creditors of the estate

- Take inventory of the estate property

- Ensure that all debts, taxes, and liens are paid from the sale of the estate

An alternative to probate is a beneficiary deed, which allows for the instant transfer of property on the individual’s death. This does not involve any legal process and allows you to sell the estate at your convenience.

Prepare for the Sale

Once the legalities of estate transfer are complete, you can turn your attention towards planning to sell. The first step will be to clean and declutter the property. Go room by room and segregate items based on ones you can discard, sell or donate. Buy numerous plastic storage boxes and store items as per these categories. Depending on the size of the home, it can take you days or weeks to complete cleaning. Fortunately, the Kari Haas Team has plenty of resources to assist you with this.

Hiring a real estate agent, like a professional like Kari Haas, will streamline the selling process and ensure you get the best price. Our team will conduct an inspection and guide you on whether you should sell the house as is or make necessary repairs. If the deceased was elderly or sick for quite some time, they may not have paid much attention to the upkeep of the property.

In such situations, you will have two options. First, you can hire contractors to fix what is broken or in disrepair. The Kari Haas team has a long list of trusted vendors to help you find the right professionals in your area. Once you have found the right person or team for the job, you can start the renovation process.

Second, you can consider selling the home as a fixer-upper, which can help speed up the process. Fixer-uppers are often priced lower and appeal to buyers who want to create a home based on their ideas and preferences. To get the best price for your home, focus on advertising its most desirable features, such as central location, large outdoor spaces, open floor plan, etc. Using our experience, the Kari Haas Real Estate Team will help set the price, which will invite the most bids and meet your selling expectations.

Stage Your Property

Whether you are selling the property as a fixer-upper or not, it’s important to invest in staging. Staging involves undertaking activities that make your home appealing to buyers. When done right, it can help secure a higher selling price than expected. Here are some go-to staging practices to use:

- Deep clean all rooms of your home, including the attic, basement, and garage. You can do it yourself or hire professional cleaners.

- Add a fresh coat of paint to rooms that look run-down and dull.

- Replace all broken/flickering lights across the house.

- As reported by HGTV, landscaping your front lawn and back garden can increase your curb appeal.

Additionally, it’s best not to be home while your agent brings buyers over for showings. This allows them to freely navigate the home and ask questions. With a fixer-upper, your agent will be obliged to disclose any major complications with the property, such as a leaky roof, old floorboard, etc. This is to safeguard against any future claims regarding the property. Once you receive a few offers, select the one that best meets your expectations and let us, the Kari Haas Real Estate Team, complete the formalities.

Treat Your Responsibility with Care

When dealing with the responsibility of selling your loved one’s home, reduce the burden on yourself by enlisting the help of professionals who can handle legalities in a streamlined manner and guide you toward making informed decisions. But also remember that your loved one has entrusted their home to you. This was potentially a place they loved for many, many years, so treat it and the responsibility with the care it deserves.

The Kari Haas Real Estate Team guides several people through transactions like this each and every year. We are prepared to help you through any situation. Give Kari a call when you are ready!

Photo Credit: Brett Warton via Unsplash

This post was written by Micah Norris for the Kari Haas Real Estate Team blog.

January 2023 Real Estate Market Update

The close of 2022 brought the housing market extremes of the last year into sharp focus. With decreased sales, generally increasing inventory, and lower prices, the December market finally seemed to hit the winter slowdown that has characterized typical market cycles of years past. This stands in contrast to the early months of 2022, which saw sky-high prices and scarce inventory before the threat of inflation and rising mortgage rates caused the shift in the latter half of the year.

Windermere Chief Economist Matthew Gardner commented on this phenomenon. “The local housing market in 2022 ended with a whimper rather than a bang. Overall, the housing market is going to continue falling off the artificial ‘sugar high’ that was a function of the artificially low mortgage rates during the pandemic,” he said.

This is not necessarily a bad thing, as stability in the market could translate to more predictable price appreciation for sellers and better circumstances for buyers to enter the market. In most cases, it’s low- and middle-priced homes that are missing from the market, so many first-time buyers still have plenty of pent-up demand for inventory that meets their needs and financial situations.

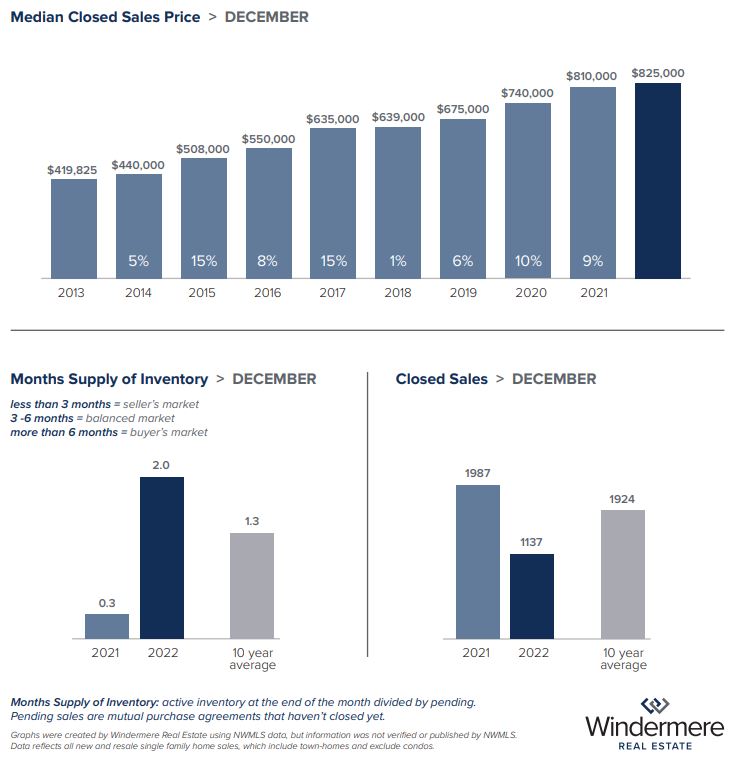

Despite a 43.3% drop in closed sales compared to December 2021, last month saw the median price for single-family homes in King County rise to $825,000. That’s up from the median of $810,000 this time last year. This could speak to the lingering effects of inflation on the market or be a factor in the lack of entry and mid-level homes currently available to buyers.

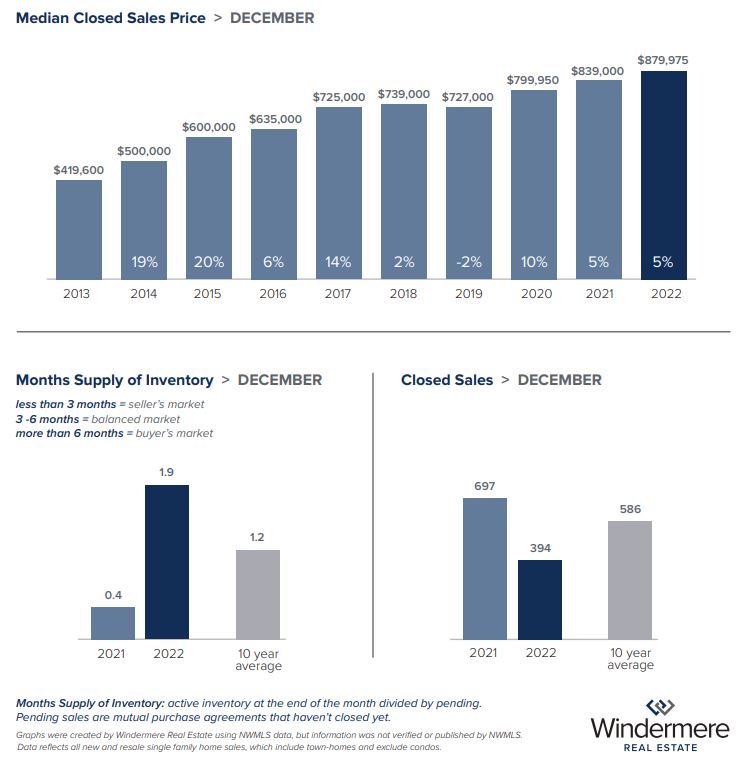

The Seattle market experienced the same pattern, with a year-over-year price increase of almost 5%, from $839,000 in December 2021 to $879,975 last month. Closed sales were down in the city as well, dropping 43.5% from last year to just 394 units, leaving the market with just under six weeks of inventory. The condo market mimicked this trend, with the median price rising to $512,500 last month, up from $490,000 in December 2021. Additionally, Seattle condos offered the highest amount of inventory, with 2.5 months of stock.

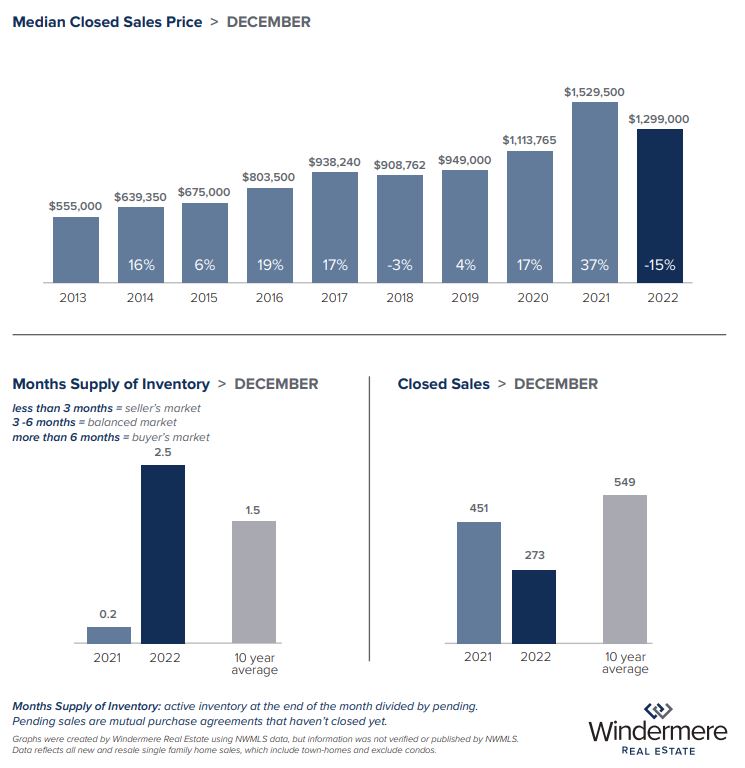

Things were a little different on the Eastside, which had experienced perhaps the highest price boom during the “sugar high” of the pandemic. There, single-family home prices decreased around 15% year-over-year, landing at a median of $1,299,000 last month, compared to $1,529,500 in December 2021. This is likely due to higher mortgage rates dampening the buying power of potential homebuyers in the area. Entry-level buyers may be forced to look in more affordable markets for the time being, and December’s 39.5% decrease in closed sales compared to December 2021 reflects this. Interestingly, Eastside condos experienced a sold price increase to a median of $565,000, up from $550,000 last year. This is likely because condos are a much more affordable entry point to the Eastside market and may be experiencing higher demand as buyers tailor their expectations to the current market conditions.

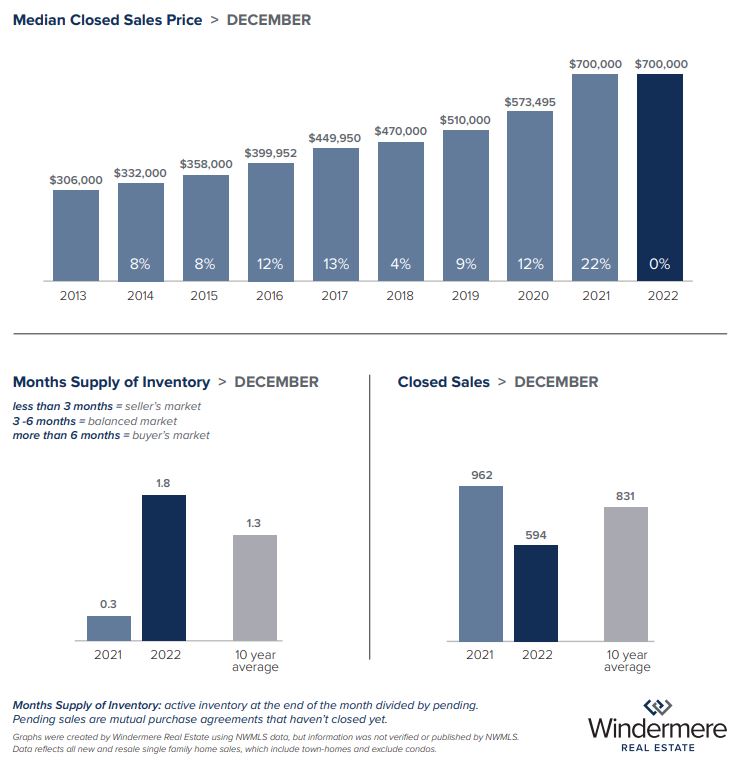

After the ups and downs of the last year, Snohomish County ended exactly where it began, with a median single-family home price of $700,000 — the same as in December 2021. Closed sales in the area were down 38.3%, leaving the market with about six weeks of inventory. Throughout the pandemic, Snohomish County has been a relatively stable market compared to the fluctuations of Seattle and the Eastside, making it a desirable area for first-time buyers and those looking to maximize their buying power.

Looking ahead, Matthew Gardner expects 2023 will see continued price declines. However, “With mortgage rates expected to fall from current levels slowly, sale prices should start increasing again in the second half of the year,” he said.

Gardner continued, “Ultimately, once prices pull back to where they would have been if the pandemic had never occurred, they will start to stabilize and then return to a more normalized pace of appreciation.”

Sellers and buyers have certainly felt the impacts of shifting economic conditions on the housing market. A slower market pace and modest price decreases may be necessary to help reset expectations on both sides and set up sustained future success.

If you have questions about how to make the most of the current market conditions, give Kari a call.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

How to Make Moving to a New State Hassle-Free

Moving to a new state is a big adjustment and can be draining. However, having the right information can make it less challenging. Here are some tips from Kari Haas Real Estate Team on how to make moving to a new state hassle-free and help you make the transition as smooth as possible.

Find a Job

If you’re moving to a new state, you’ll need to find a job in your new location. Check out job boards or networking in your new city to find job openings. Your job search should start with finding who needs your skills in the new state. Also, update your resume and cover letter to match the new job market. And if you’re moving to a new state, make sure you find information about the cost of living, as well.

Start a Business

Starting a new business in a new location can be daunting. Here are the steps to follow:

- Get familiar with laws and regulations. Research the laws and regulations regarding starting a business in a specific state.

- Choose a business location. Pick a convenient location that suits your budget and needs.

- Craft a business plan. Create a detailed outline of the services or products you’ll be selling, how to structure the business, your financial projections, and funding options for your new business.

- Create a plan of action. Craft a plan of action to follow since starting a business can be chaotic. If possible, create a team and delegate tasks.

Also, don’t forget about marketing! A lot of your advertising can be done through social media platforms, which will save you lots of money. However, you should also spend some time on content marketing, which means generating interest in a topic rather than simply advertising a specific product. This is a great way to build your customer base from the ground up, and Cornerstone Content can help you get started.

Adjust to the New Location

When you first move to a new state, it can be difficult to figure out where everything is. Take the time to familiarize yourself with your new surroundings. Explore your new city and find things to do that you enjoy. Consider joining social groups in your new state and making friends. You’ll also need to adjust to the weather in the new location.

Ready To Move?

Moving can be challenging but it’s also an exciting opportunity to start a bold new chapter of your life. Also, you can greatly reduce stress by doing some simple research and preparation beforehand. Research the job market, familiarize yourself with your new setting, and you’ll feel right at home in no time!

Kari Haas Real Estate Team exudes a passion for real estate that carries through to every client. Call 206-719-2224

Image via Pexels.

This post was originally written by Lisa Walker and was submitted exclusively to KariHaas.com

Fix It Up and Sell It: A Senior’s Guide to House Flipping

Believe it or not, retirement doesn’t suit everyone. In fact, some people simply enjoy working while others want to earn a little extra cash. That’s where house-flipping comes in. It can be an extremely profitable side gig for seniors willing to invest time and money. If you’re curious about learning more, you’re in luck. Kari Haas has some tips and resources to help you get started in the house-flipping business. Continue reading for a Senior’s Guide to House Flipping.

Finding Your Ideal Property

To find your ideal property, start by:

- Employing an agent: They know the best areas for flipping homes. If you’re looking for rehab properties, HomeLight suggests hiring an REO agent.

- Look for auctions: If you’re looking for a good discount, estate and foreclosure auctions provide good opportunities.

- Short sales: Some homeowners need to sell their property quickly, sometimes for less than the amount owed on their mortgage. These are known as short sales.

Finding a Mortgage

There are several options when it comes to finding a mortgage. FHA 203 (K) is a type of government-insured mortgage that allows a borrower to take out a loan for the property’s purchase and renovation costs. Other options include a VA renovation loan, HomeStyle loans, and a CHOICE Renovation loan. The Kari Haas Real Estate Team has trusted mortgage brokers to assist you in finding the right fit for you.

Caution Is the Name of the Game

The primary purpose of buying a fixer-upper home is to save money on the purchase price. Still, it doesn’t always work out as expected due to unforeseen repairs and necessary renovations. When searching for a property to renovate, look out for certain red flags, such as structural damage or dry rot. Add 20% to your estimate, particularly for major repairs, such as electrical work, HVAC upgrades, foundation problems, or issues with mold or asbestos.

Formalize Your Business as an LLC

When starting a house-flipping business, consider forming a limited liability company (LLC). This business entity offers benefits when it comes to filing taxes and helps shield you from personal liability. Each state has its own rules and procedures for setting up an LLC. In most cases, it’s easy and affordable and can often be done online.

Now that you’re legitimately structured and ready to operate as a going concern, you’ll need to take initial necessary steps to get up and running. This includes drafting a business plan, setting a budget, and developing a marketing strategy. This strategy should involve digital marketing on social media, which in today’s day and age is essential. Fortunately, you don’t have to be a technological wiz; in fact, these days, you can easily design banners online then let them do the work for you. With free online templates, you’re able to customize and share posts in no time.

Renovations to Boost Value

Homes & Gardens notes that there are several options to add value to your property through renovations. For instance, you can upgrade the kitchen lighting or hood range over the cooking surface, or add insulation to the attic to make the house more energy-efficient.

Some renovations, such as kitchen remodels, add more value to a property than others. Remodeling a kitchen requires a competent plumber, especially if you plan to have pipes repaired or replaced. Plumbing services typically cost between $45 and $150 per hour. Before hiring, always take a close look at reviews and insist on only working with licensed and insured professionals.

If you plan to hire contractors for repairs or renovation projects or a property manager, it’s important to set up a payroll system before contacting them. Keep in mind that there are many payroll software options; just be sure the platform you choose offers automatic payroll scheduling, as well as automatic calculating and tax filing, in addition to same-day direct deposit and the ability to manage employee benefits.

Selling Your Fixer-Upper

When the time comes to sell your fixer-upper, find a real estate agent who’s as invested in selling your home as you are. When searching for one, ask for referrals from people you trust. Set a realistic sale price using a home estimate tool.

House Flipping in Your Senior Years

House flipping is an exciting side gig, and if done correctly, it can be considerably rewarding financially. If you can avoid the pitfalls, employ the right professionals, and deal with the finances, you can enjoy all the benefits of house flipping in your senior years.

Whatever your real estate needs, Kari Haas can help you reach your goals with confidence. Call 206-719-2224.

This post was written by guest blogger, Lisa Walker.

Image courtesy of Unsplash

Upsizing for Retiring: Find a Home for Your Homestead

Some retirees plan to downsize their lives and homes after a while, ostensibly to make things simpler and to have less baggage in retirement. But you’re different: You want to upsize and pursue a grander new life of homesteading as a retiree, with enough space to welcome family whenever they wish to visit, pursue crafts you never got to do, and create a different kind of life that you never got to experience.

The good news is that it is within your power to create the homesteading life you wish to live. Here are some tips from Kari Haas for finding a new home that will help you build the kind of self-sufficient environment you seek:

Look for the right kind of home

For true self-sufficiency and proper homesteading, Treehugger notes that you’ll need a large space—in both land and square footage of your house. Before you get a loan or do any specific research, know your budget and make a list of features that you will prioritize. Do you want a large enough plot of land so that you can raise horses? The Extension Foundation notes that one to two acres is a general rule of thumb when it comes to land needed for a horse to forage (30-38 acres per horse for non-irrigated dryland pastures).

Do you want enough room for a workshop—enough land to build one after the fact or one already on the property? Do you want to have enough space to have a large garden? Write these down to identify which are most important to you.

Hire a realtor

This could be the most crucial step in the process of buying your new home. They are practically necessary if you’re both buying and selling a home simultaneously. Having someone like Kari Haas on your team who understands the market, knows what you’re looking for, and can negotiate on your behalf is an incredible advantage. Realtors pay attention to details that you may not even think of, as well. If you have a real estate agent sell your current home, there’s a better chance of it selling at a higher price—there’s data to back it up.

Make sure you can afford your new home

A huge part of upsizing is making sure you have enough funds to afford the bigger space. You may be able to sell your old house and, thereby, cover the majority of the cost of moving into your new homestead. Just make sure you research the number of properties available in your area and check the property prices in your area and get a handle on how much similar houses are selling for, especially as the market fluctuates.

Start a new business in your home

As a retiree, you have time now to pursue activities you didn’t necessarily have the bandwidth for when you were working full-time. Why not turn those hobbies into a business to make money on the side? Not only will it help you afford your new home, but it will present you with an opportunity to do something fulfilling and provide a service or products to other people.

If you do decide to start a small business, consider using a formation service to form a limited liability company (LLC) to limit your liability, get personal asset protection, and enjoy tax advantages. Make sure to check on the rules of forming an LLC in the state so you’re up to speed.

There are countless options out there for aspiring and ambitious entrepreneurs – not to mention ways to streamline your business for the new age! For instance, if you’re looking to automate your business, spend some time getting acquainted with the leading robotics companies that are helping to shape the future of technology.

With a good amount of research and due diligence, finding a home for your homestead is certainly within reach. Follow these guidelines and you’ll be up and running in no time!

Whatever your real estate needs, Kari Haas can help you reach your goals with confidence.

Call 206-719-2224

Image via Pexels

This post was originally written by a guest blogger, Ray Flynn

6 Tips for Moving and Starting Over in New State

Moving is both exciting and overwhelming at the same time. Without proper planning, it can become chaos, slowing down your chance to adjust quickly to your new home. If you’re moving to a new state, you may come across even more obstacles. Consider these tips to help you simplify the process.

-

Start Planning Far in Advance

Planning a move properly means starting the process far in advance. For example, research shows that you should have enough to cover at least three months of expenses before you move. Start the packing process at least two months before the moving date, and consider putting items in storage if you’re not sure you want to take them or think you may not have room. You can find storage companies that offer discounts, such as a month free, for new customers.

-

Consider Location When Looking for a Home

Talk to a local real estate agent before you start looking for a home in your new state. Kari Haas can help you find your dream home. Your goal should always be to find a place that best suits your needs in a location you love. Remember, location is often the most important aspect when searching for a home. You want an agent who can tell you about the school districts and shopping available in the area. A more desired location will cost more, but it will also have a higher resale value.

-

Starting Your Own Business

If you’re thinking about starting your own business in your new location, make sure you have all the plans in order before you make the big move. Create a thorough business plan to help you stay on track and show potential investors what your company has to offer. Your plan should include an executive summary about the business and products or services you’ll provide, how you plan to structure your business, any funding you will need, and any financial projections you’ve made about the company.

-

Join Your Community

If you’re looking for ways to get involved in your new community, join local social media groups or look for a community app where you can access local news and necessary information. Introduce yourself to neighbors virtually and in person to get to know people quickly. Being more involved helps you adjust more quickly.

-

Consider Investing in a Home Warranty

A home warranty is a service contract that covers the repair or replacement of major home appliances and systems, such as air conditioning, electrical, plumbing, and more. Many homeowners choose to get a home warranty to protect themselves from the high cost of repairs and replacements. Home warranties typically cover items for one year and can be renewed annually. When you’re weighing home warranty cost vs benefit, be sure to look over the home inspection report to see if there are any red flags.

-

Figure Out Your New Cost of Living

One of the first things you should do is research the cost of living in your new state. Start by looking for averages of things such as rent or mortgage, food, education, and entertainment. In Washington, housing costs are above the national average, but you can expect to pay less for health care and utilities. Washington is home to some of the best public schools in the country, so you can find affordable education for your children.

Before moving to a new state, choose a location, learn about the cost of living, consider investing in a home warranty, and think about starting a new business. Once you’ve completed your move, you’ll be ready to settle into your new life. Take the time to get to know your area, and you’ll speed up the process of feeling comfortable. Focusing on the positives of the move will help you overcome any possible homesickness.

Image via Pexels

This post was originally written by a guest blogger, Lisa Walker.

Tips for Moving Without the Headache

Top Moving Tips:

Packing up your life into cardboard boxes and schlepping it across town or across the country can be a hassle. But, as Huffington Post suggests, you can make your move a lot simpler if you plan ahead. With that in mind, here are some tips from realtor Kari Haas for moving without the headache.

Purchase a Home

Before you begin the moving process, you’ll have to buy a suitable home. To get started, your first step is finding a realtor. It’s really important who you choose to represent you. A professional team with a good track record of being able to negotiate and market successfully for your benefit can put far more in your pocket than you might save with a discount broker or friend of a friend. This is many people’s largest investment and it always amazes me that a lot of people choose their cousin’s wife’s brother’s best friend without checking their success rate or reviews, based on relationship alone without regard for their financial well-being. A good realtor will also have connections within the industry and will have mortgage professionals that they recommend and who will help you with the preapproval process.

Pay a Pro

If your budget permits it and you have a lot to pack, consider hiring a professional moving company. Consumer Reports recommends selecting a company with good references and making sure they are properly licensed and insured for damage. Of course, the Kari Haas Real Estate Team has a list of resources and vendors, as well as a professional support team to help streamline the process.

Movers are well-trained and know the best methods and techniques for packaging and shipping your valuables. Their inventory process ensures you won’t have boxes that get knocked around in a friend’s truck or get left behind at the old place by mistake. You’ll avoid the potential for mishaps and injuries.

Get Organized

If you elect to do this without professional movers, create a checklist and start packing well in advance of moving day. Pack heavy items in small boxes and lightweight items in larger boxes. Pack your glasses and dishware in your table linens and kitchen towels for extra padding.

Color-code your boxes by room and load them with respect to what you’ll need access to first. Fill an overnight bag with a change of clothes, toiletries, medications and cleaning supplies and keep it with you close at hand; these are the things you’ll need as soon as you arrive in the new place.

Look After Your Devices

Before disassembling electronic setups, take photos of how they are configured. This will make it easier to get everything back up and working in the new place. Use small baggies to store screws and other hardware, and tape them to the component they were removed from.

Make sure to back up your data beforehand, and if you have manuals it’s a good idea to box them with their items. Consider removing batteries to prevent them from breaking down (or exploding) in warm conditions or on bumpy roads. Wrap all electronics carefully in protective materials designed for that purpose. Also, some electronic items respond badly to being shaken, so you should minimize movement in their boxes.

Know Where the Important Stuff Is

Gather up important documents, such as birth certificates, licenses, passports, wills, insurance papers, and vaccination and medical records, because it’s important to transport these yourself, keeping them close at hand. For example, it is better to have them with you than lost in a box you may not open for a few days.

Ensure your pets’ shots and certifications are up to date and take pictures of them in case of emergency. Make sure not to lose track of your pet’s information. Microchipping can be helpful in this instance, so make sure your vet is updated with your new contact information.

Get Help

Hire a babysitter if you have children and consider hiring a pet sitter if you have pets. Moving day is usually a little bit chaotic and stressful. It’s always easier if the kids and the pets aren’t underfoot. If you can’t take children and critters to the sitter, consider enlisting one of your moving buddies to act as chief child chaser and pet wrangler on the day.

With the right preparations and proper planning, your move will go smoothly and your property will be protected from damage. You’ll cut down on the time spent unboxing and organizing in your new home and prevent needless rummaging through unidentified boxes. To prepare your move in advance, use a checklist, pack items carefully, and identify them correctly for the trip. This will make moving day less stressful and time-consuming for you and your family.

The Kari Haas Real Estate Team has a team of professionals prepared to help you every step of the way. Whether it is junk removal, professional organization, or packing services our team is here for you!

Not only does Kari Haas have more than 300 real estate deals under her belt, but she has an outstanding success rate. When multiple offer situations arise, Kari’s clients win in over 95% of those instances! Put the Kari Haas Real Estate team behind you. Call or email us today!

This post was originally submitted by Lisa Walker and has been edited by the Kari Haas Real Estate Team.

Eco-Friendly Smart Home Upgrades For Greener Living

Smart home tech obviously offers a lot to get excited about, but did you know it can also make your home more eco-friendly? There are a ton of smart home upgrades that go a long way toward reducing your carbon footprint. This will make your home greener, lower your electricity bills, and can even boost your property value!

Here’s a look at how to turn your house into an eco-friendly smart home:

Staying Safe While Getting Smart

Adding smart devices to your home is a great way to improve your day-to-day life and reduce your impact on the environment. However, you must do it right, and that means doing it safely. The more devices you have connected to the internet, the more vulnerable your home is to hackers. You want to make sure you’ve secured your network as much as possible, and stay careful and thoughtful every time you add a device.

Start by creating an additional hidden WiFi network, and make that the only network you connect smart devices to. The great thing about a hidden WiFi network is that it won’t come up in “available network” searches for people nearby. Although they’re not impossible to find, they prevent you from being an easy target. You should also always set up your networks with randomly generated passwords, and only give network access to people you really trust. It is also smart to change your WiFi password after, say, a breakup — just in case.

Smart Utilities

The most straightforward way to use smart technology to reduce your carbon footprint is to build smart tech into your utility usage. For example, you could invest in a smart thermostat. This offers several carbon-footprint-friendly features — most notably, it allows you to keep your heating and cooling output low while you’re out of the house, but brings the temperature back to comfort-level before you get home.

You could also look into installing a smart faucet in your kitchen. This gives you the ability to be really specific with your water usage. For example, if you need two cups of water for a recipe, it’ll measure two cups exactly — no overage to pour out. It can also help you track your water usage, which keeps you aware and helps you moderate where possible.

Obviously, it is wonderful how these devices help reduce harm on the planet, but let’s be honest: the reduced utility bills are nice, too.

Smart Tech for Eco-Friendly Lifestyle Changes

Smart technology can make your life eco-friendlier indirectly as well by encouraging environmentally conscious lifestyle decisions. For example, you might be surprised how much smart tech is out there for indoor container gardening. You can use smart sensors to know exactly when your plants need water, whether or not they’re getting enough light, and more. This is a great support tool for anyone who wants to move toward a more self-sustainable lifestyle by growing their own herbs and foods at home.

Even something as simple as a smart home hub can encourage you to stay eco-friendly. Subscribe to environmentally-minded podcasts and set them to play on your smart speaker throughout the day. This keeps you up to date on the latest technology and science for keeping the planet healthy and empowers you to make smart decisions on a personal, professional, and political level.

Smart home tech can do a lot to keep our lives as eco-friendly as possible while also making them easier and more pleasant. Focus on the forms of tech that will shrink your utility bill, reduce your carbon footprint, and improve your property value all at once to create the perfect eco-friendly smart home.

Looking for a property so you can get started? Contact Kari Haas for help finding the perfect fit!

Photo Credit: Pexels

This post was originally submitted by Lisa Walker and has been edited by the Kari Haas Team. Lisa walker is the creator of NeighborhoodSprout.org, which provides inspiration for people putting time and energy into their homes.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link