The more frenetic activity of a typical spring real estate market has certainly hit our area, with buyers out in droves looking for homes. What they’ve found, however, is high competition and scant listings. The region’s low housing inventory has been a constraint that has resulted in fewer closed sales than we’ve seen in recent spring markets.

According to real estate experts, housing supply and interest rates are the defining obstacles for buyers at the moment. On the Eastside, active inventory is only 32% of the 10-year average, and new listings are off 34% year-to-date. This is driving prices up, while interest rates put a damper on what buyers can afford. While recent demand has been strong, experts expect that demand will taper off as interest rates approach the 7% mark.

However, because inventory is so scant, sellers who adequately price their homes are seeing success in this market. As an example, around 44% of properties on the Eastside are selling above their asking price, at an average of 5% over list. Anecdotally, the homeowners who are most likely to sell at the moment are those who purchased before the historic low-interest rates of the pandemic or have paid off their homes and are thus mortgage-free. Buyers in this market also have some negotiating power, having successfully negotiated pre-inspections, homeowner warranties, and seller-paid closing costs to mitigate the high rates.

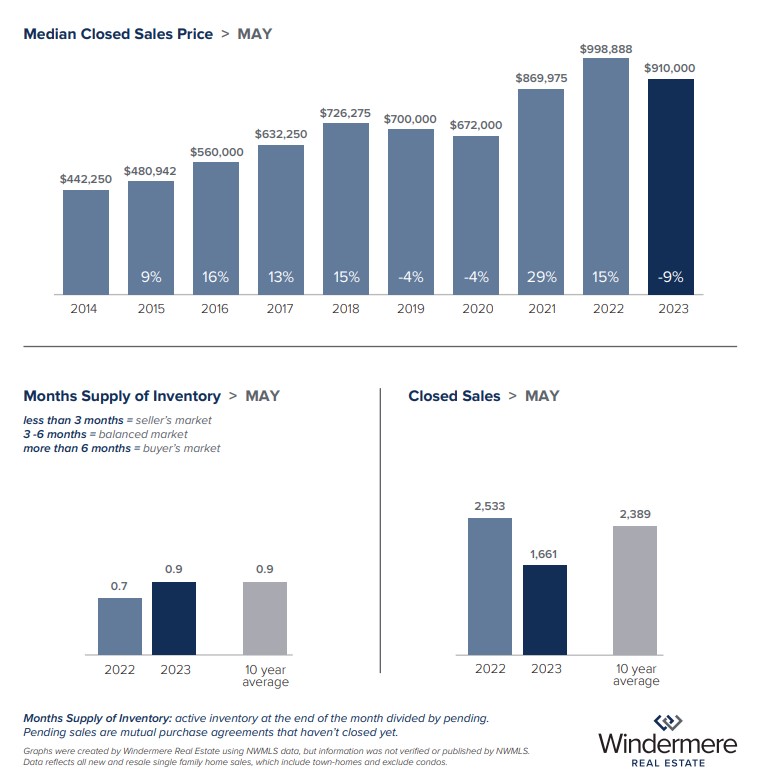

In King County, with just shy of one month’s inventory, competition in the area is fierce, and buyers will need to be ready to negotiate when the right listing comes along. The county’s median sold price for a single-family home dropped almost 9% year-over-year, from $998,888 in May 2022 to $910,000 this year. However, that’s still an increase from April’s median of $875,000.

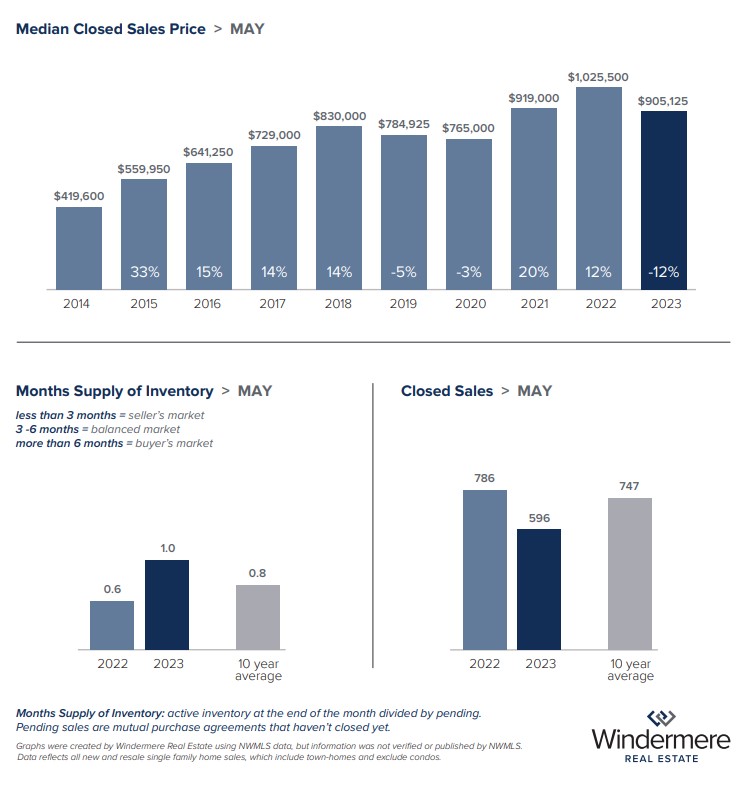

Seattle had a similar low inventory, at one month’s supply. The median sold price for single-family homes rose from $886,000 in April to $905,125 last month. While there’s been continued monthly price growth so far this year, May’s median sold price was still down 11.7% from the median of $1,025,500 in May 2022. Although residential inventory is tight, buyers in the city may have more luck with condos, which are both more affordable and plentiful. The Seattle condo market currently has almost two months of inventory and a more reasonable median price of $550,000.

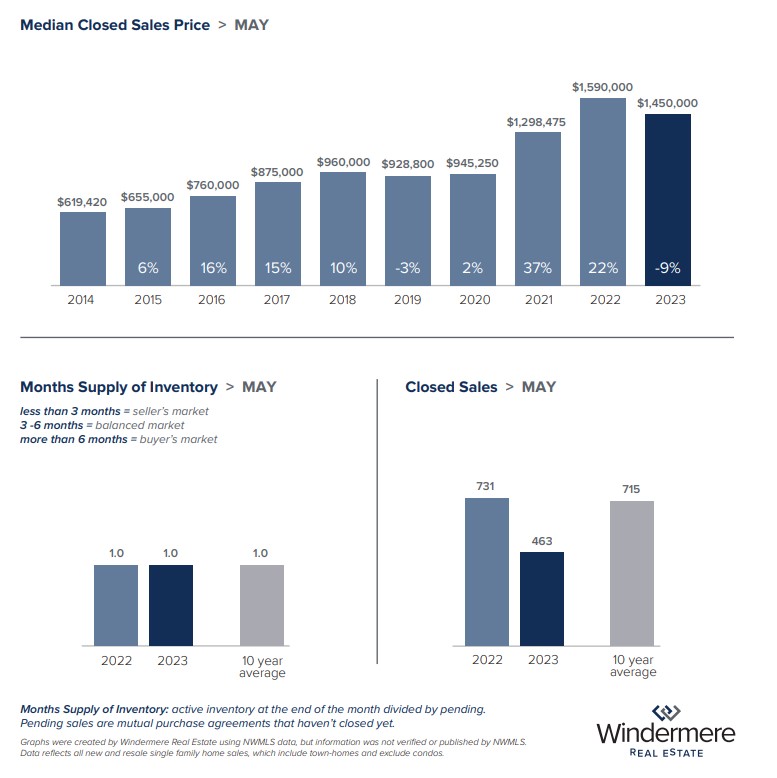

Like Seattle, the Eastside has just one month of inventory at the moment. However, higher interest rates are being felt a little more in this pricier area, as May’s median sold price for a single-family home did not change from April’s median of $1,450,000. This is down 8.8% from the median of $1,590,000 in May 2022. The supply of Eastside condos is lower than the residential supply, with just .8 months’ inventory. At a median sold price of $582,000 last month, condos may be a slightly easier path to homeownership for those searching on the Eastside.

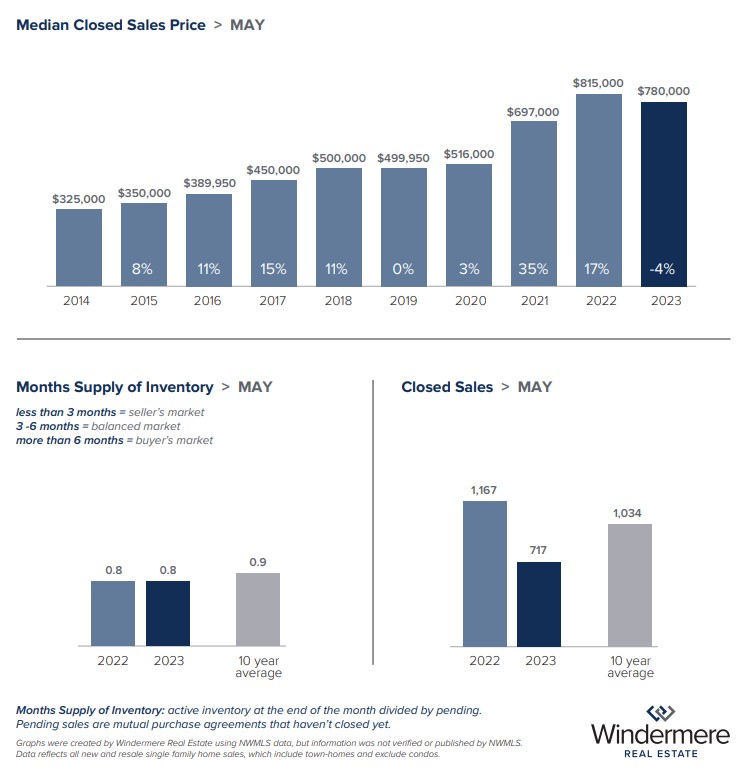

Finally, Snohomish County saw month-over-month price gains in May, landing at a median sold price of $780,000 for a single-family home, up from $767,500 in April. May’s median price was down 8% from $782,000 in May 2022. The county’s more affordable price points may allow for better appreciation in the area, despite the continued higher interest rates that have stifled other local markets. With just two weeks of inventory, the Snohomish County condo market is the tightest regional market at the moment. The median price for condos in the area is $544,900, down less than 1% from $550,000 in May 2022.

As buyers and sellers navigate continued low inventory and high-interest rates, they both must be comfortable negotiating terms to achieve the best possible outcome. Buyers should be ready to move fast and bring as much cash as possible, while sellers should be cognizant of the burden higher rates can create and price their listings accordingly.

If you have questions about these housing market trends or real estate, please give the Kari Haas Real Estate Team a call.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link