January 2021 Real Estate Market Update

What’s Happening in the Market

In this January 2021 real estate update we see record-low temperatures combined with record-low inventory put a chill on housing activity in December. With very few homes available to buy, sales were down. Lack of supply and high demand continued to push prices up. Since the winter months historically bring the smallest number of new listings, buyers should not expect relief anytime soon.

December Results

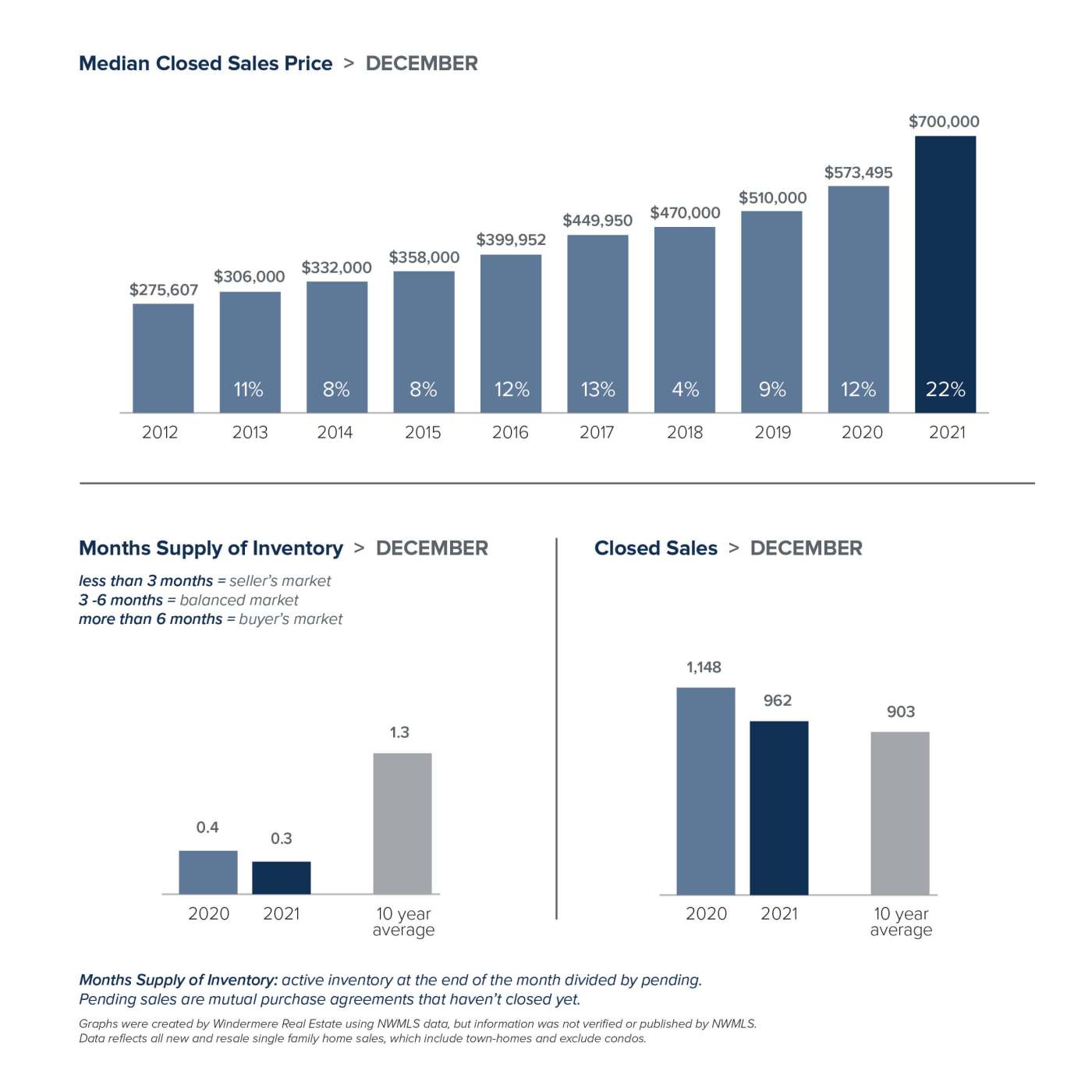

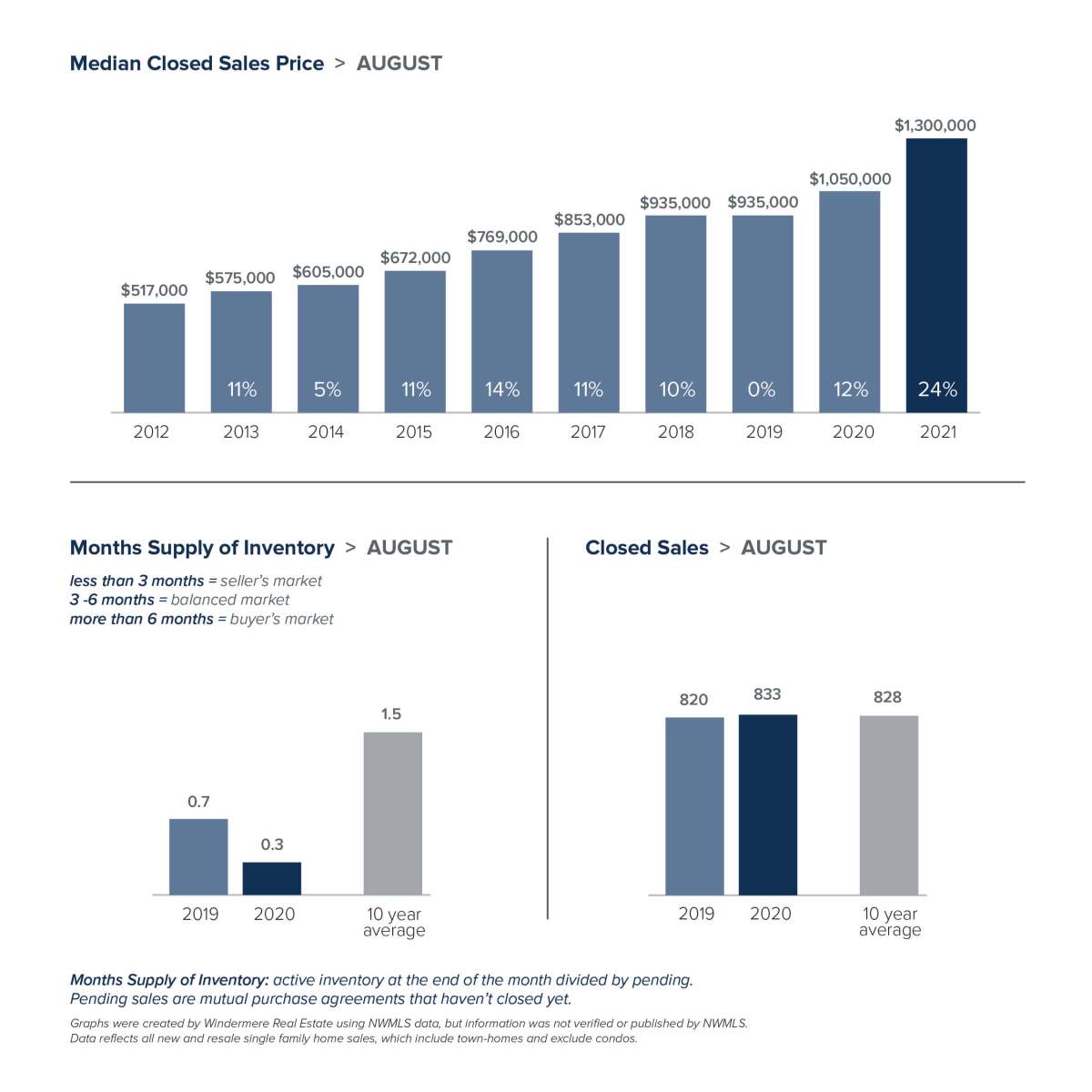

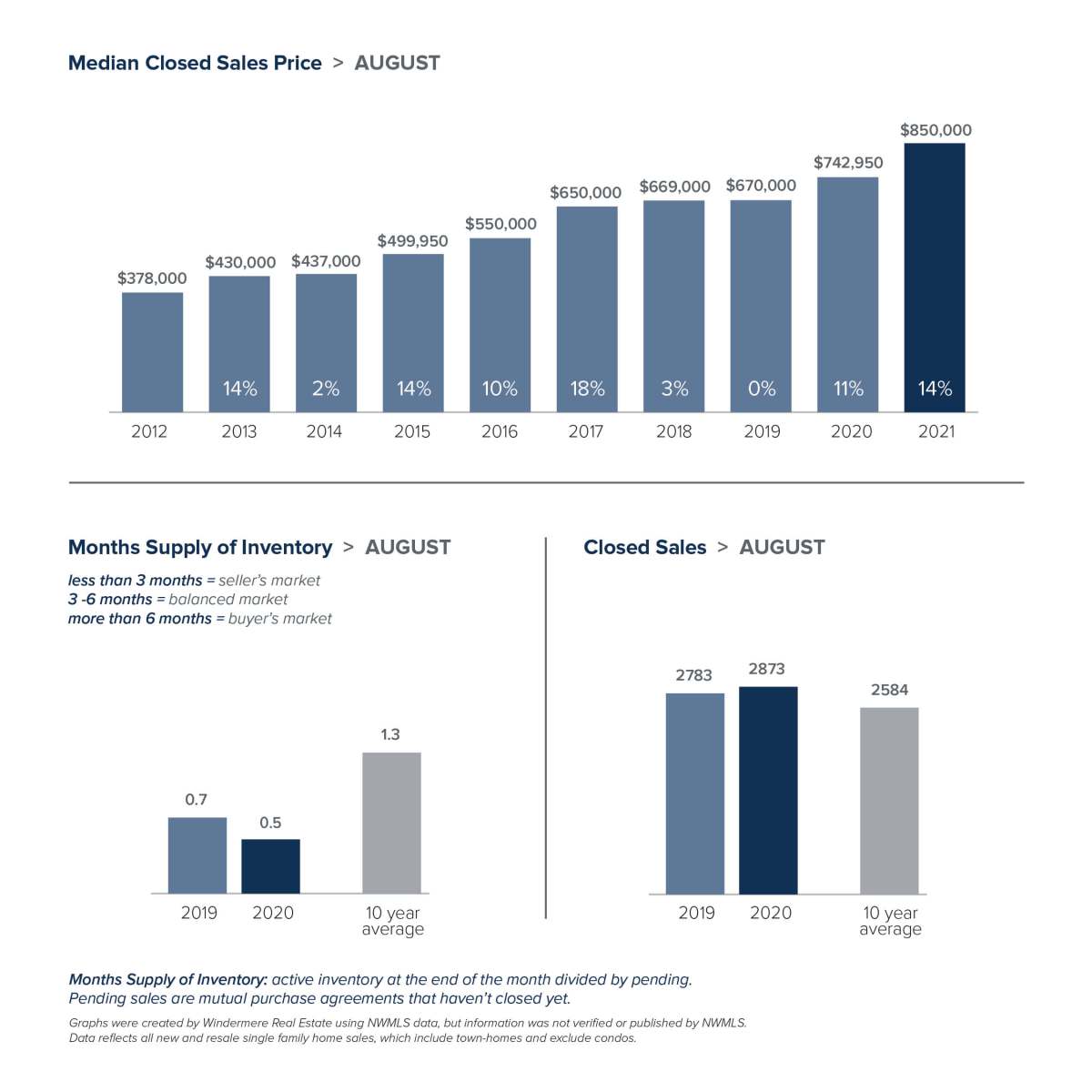

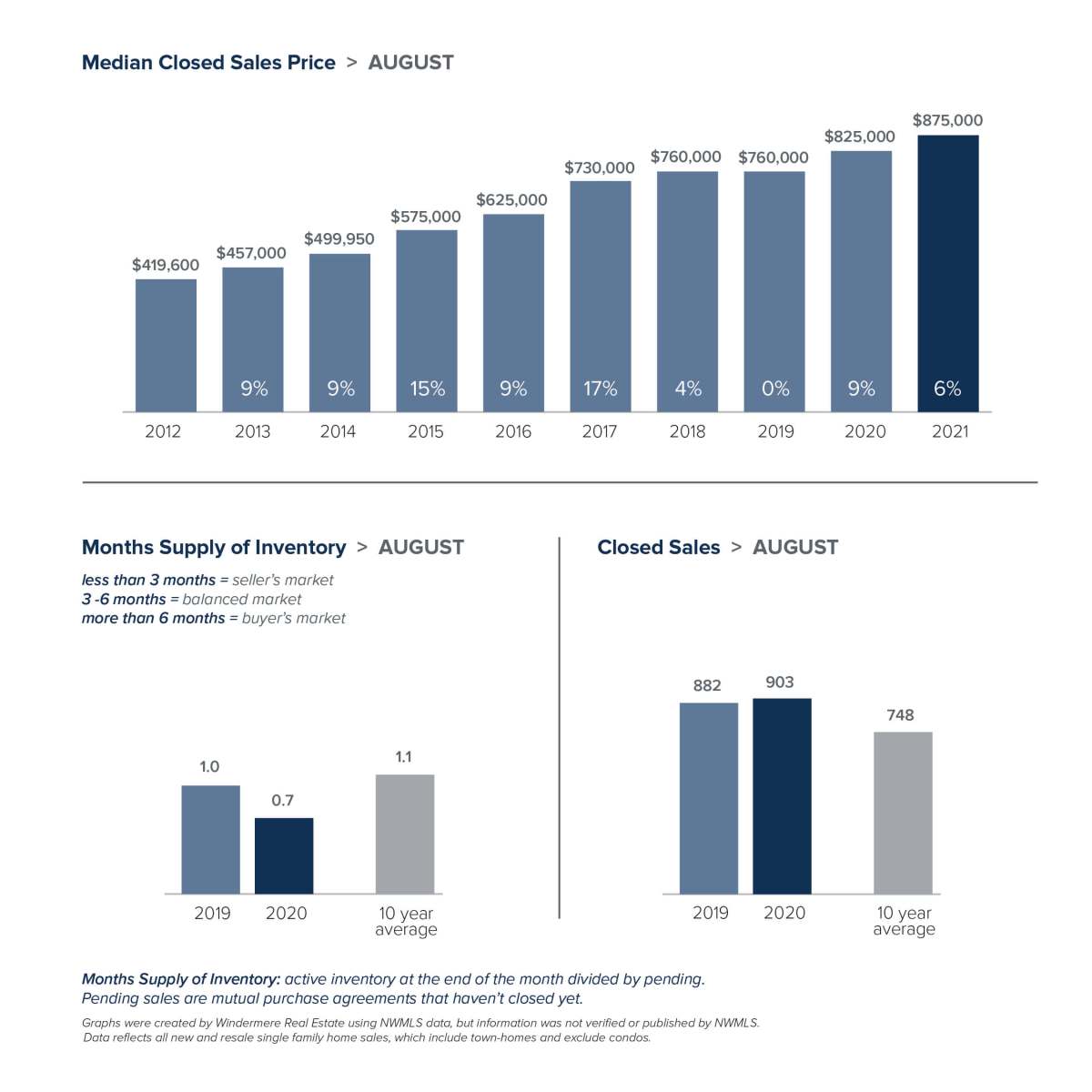

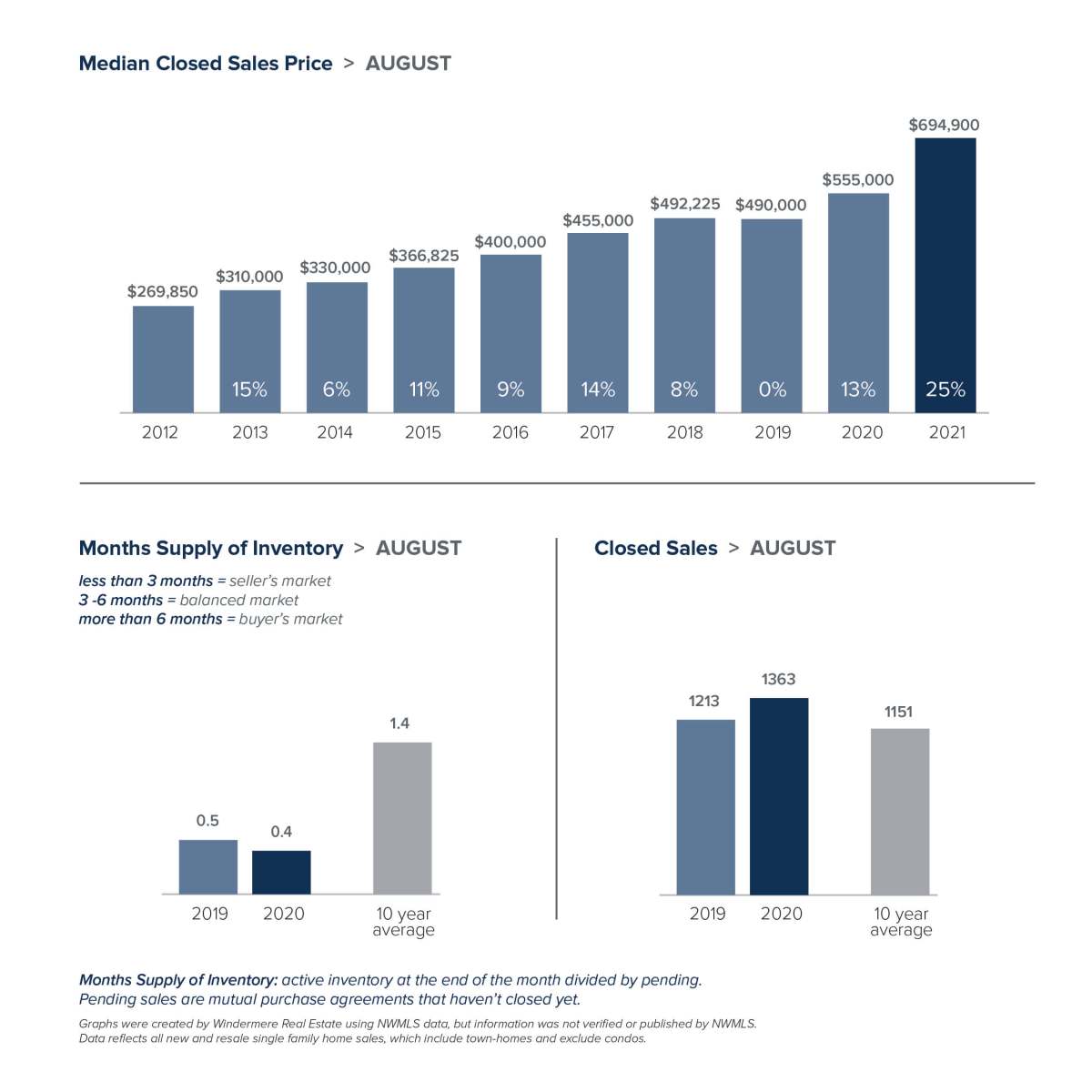

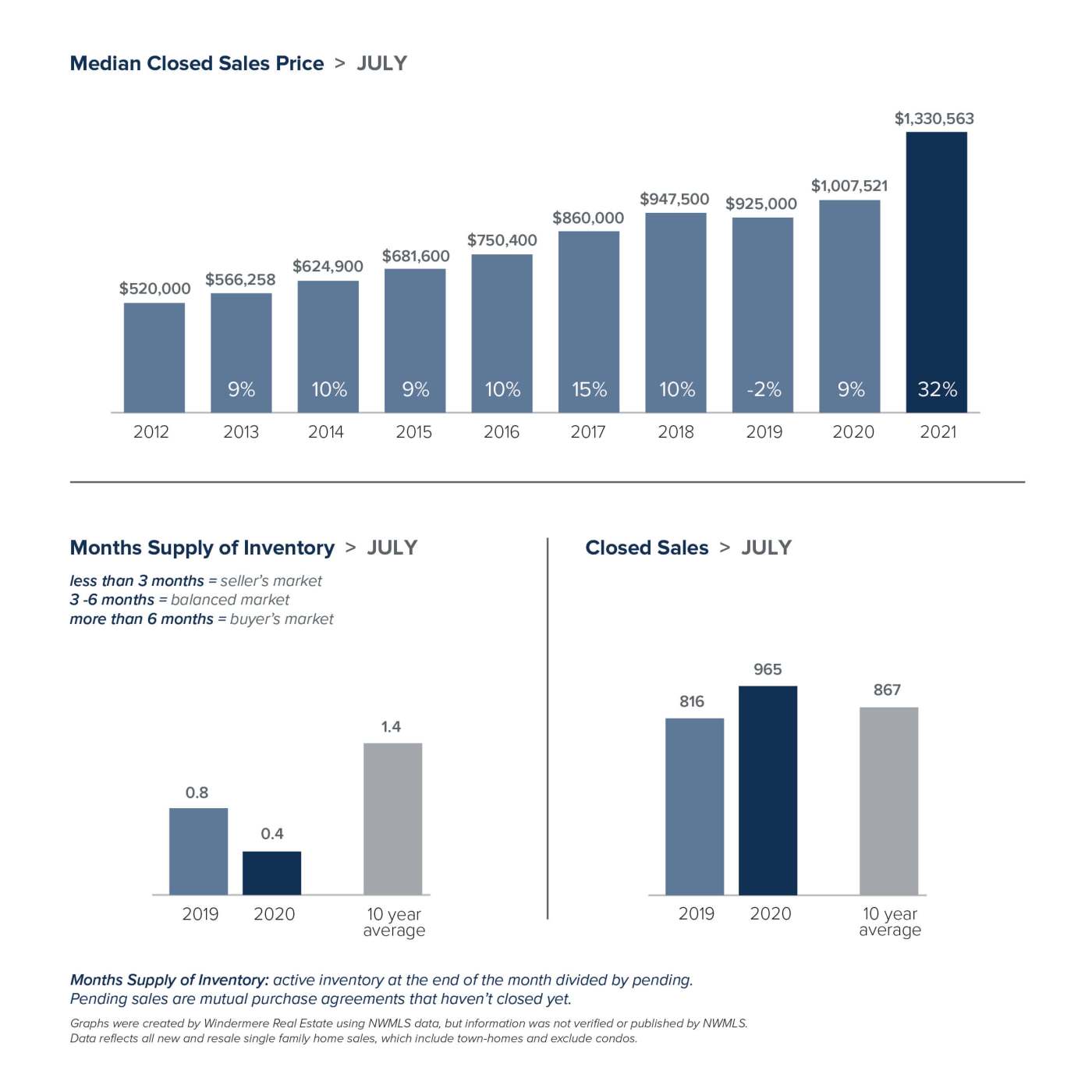

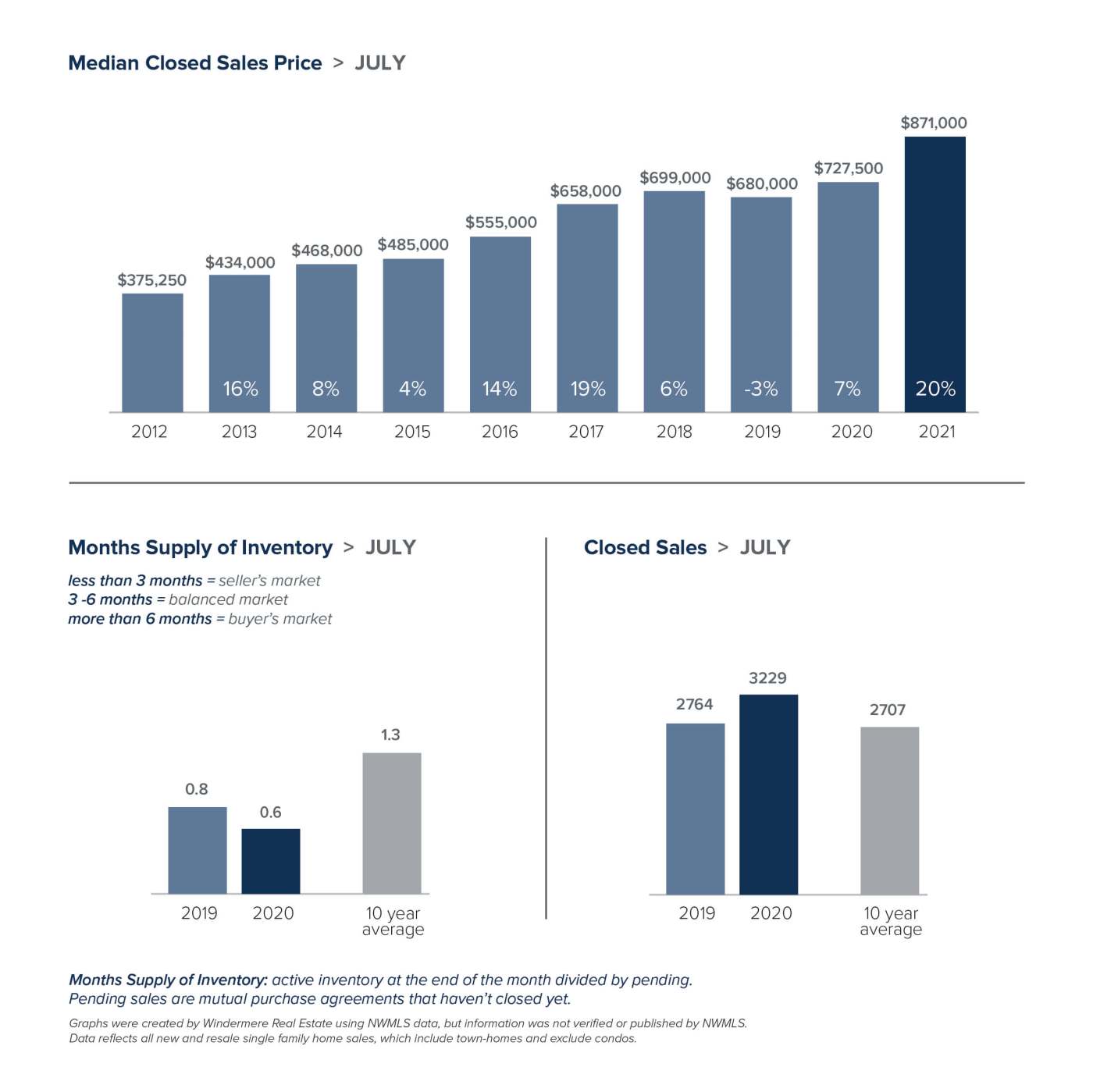

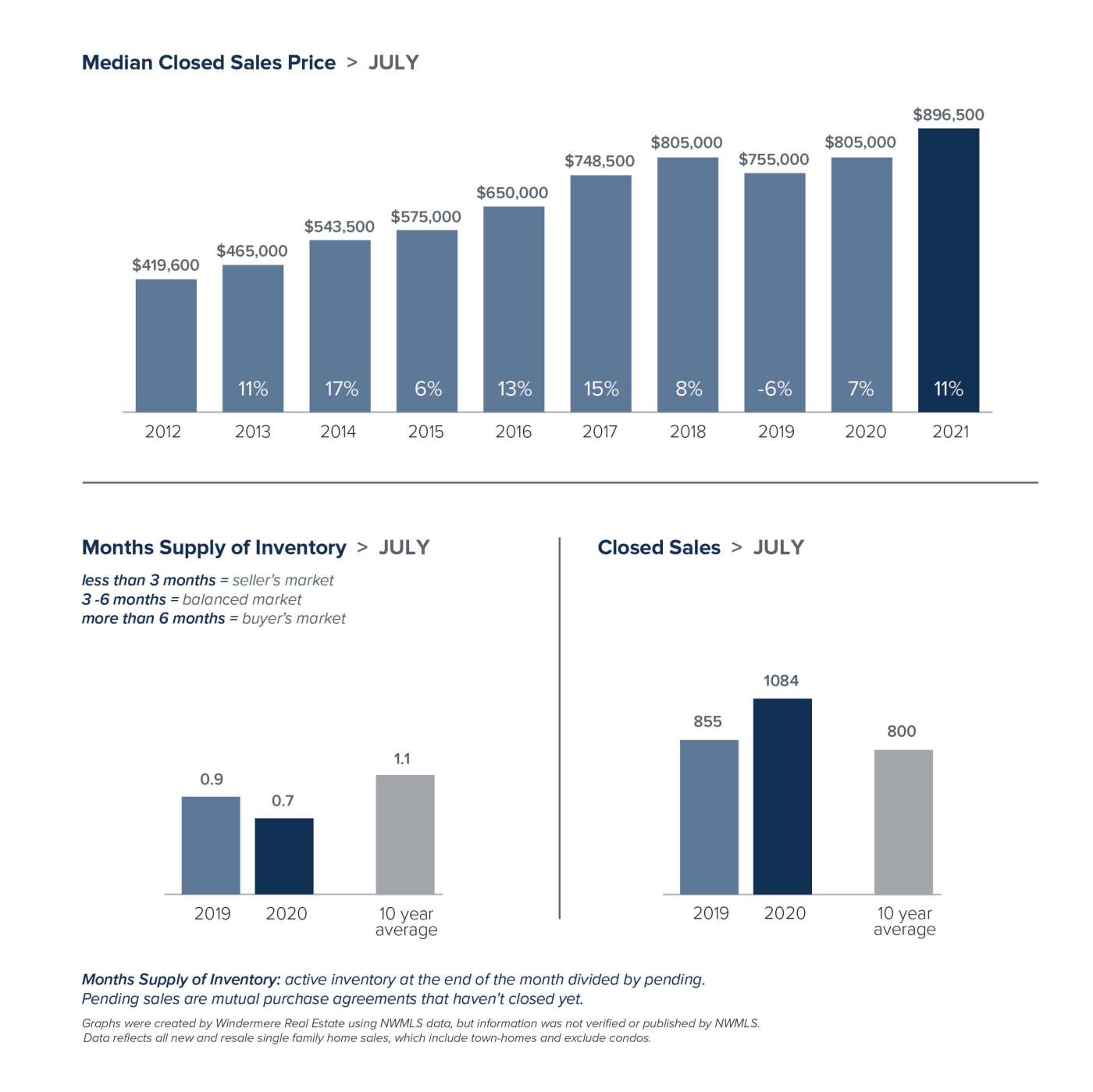

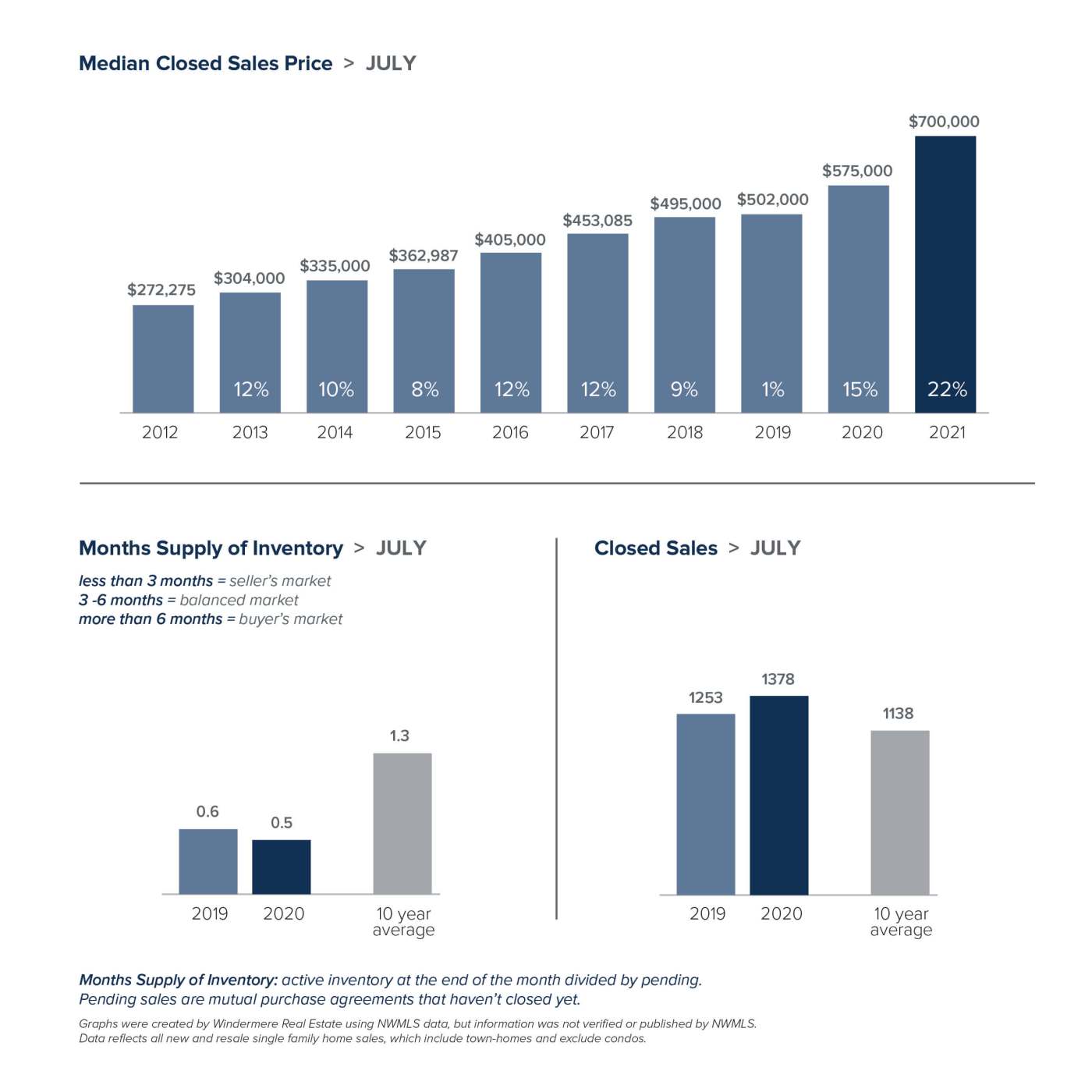

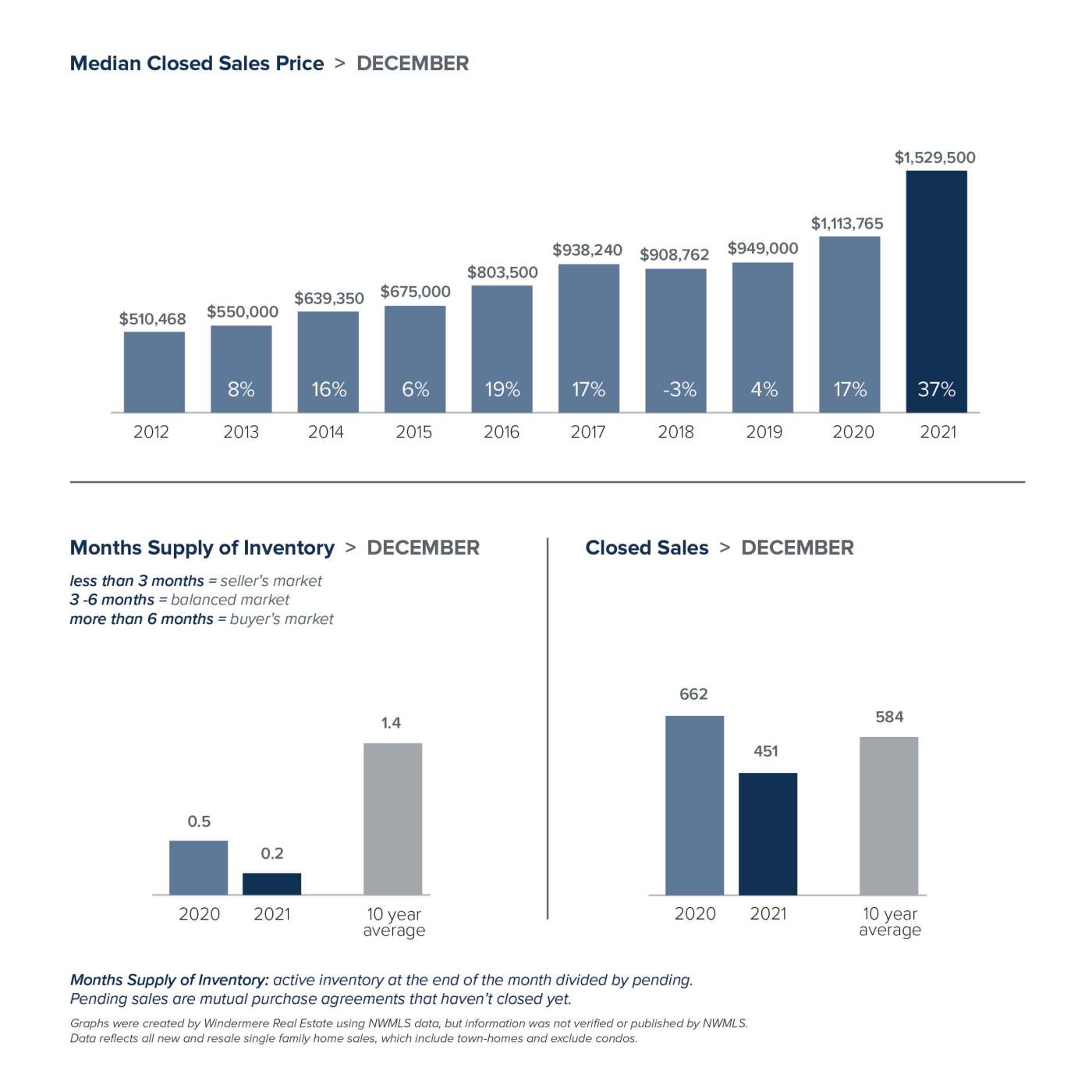

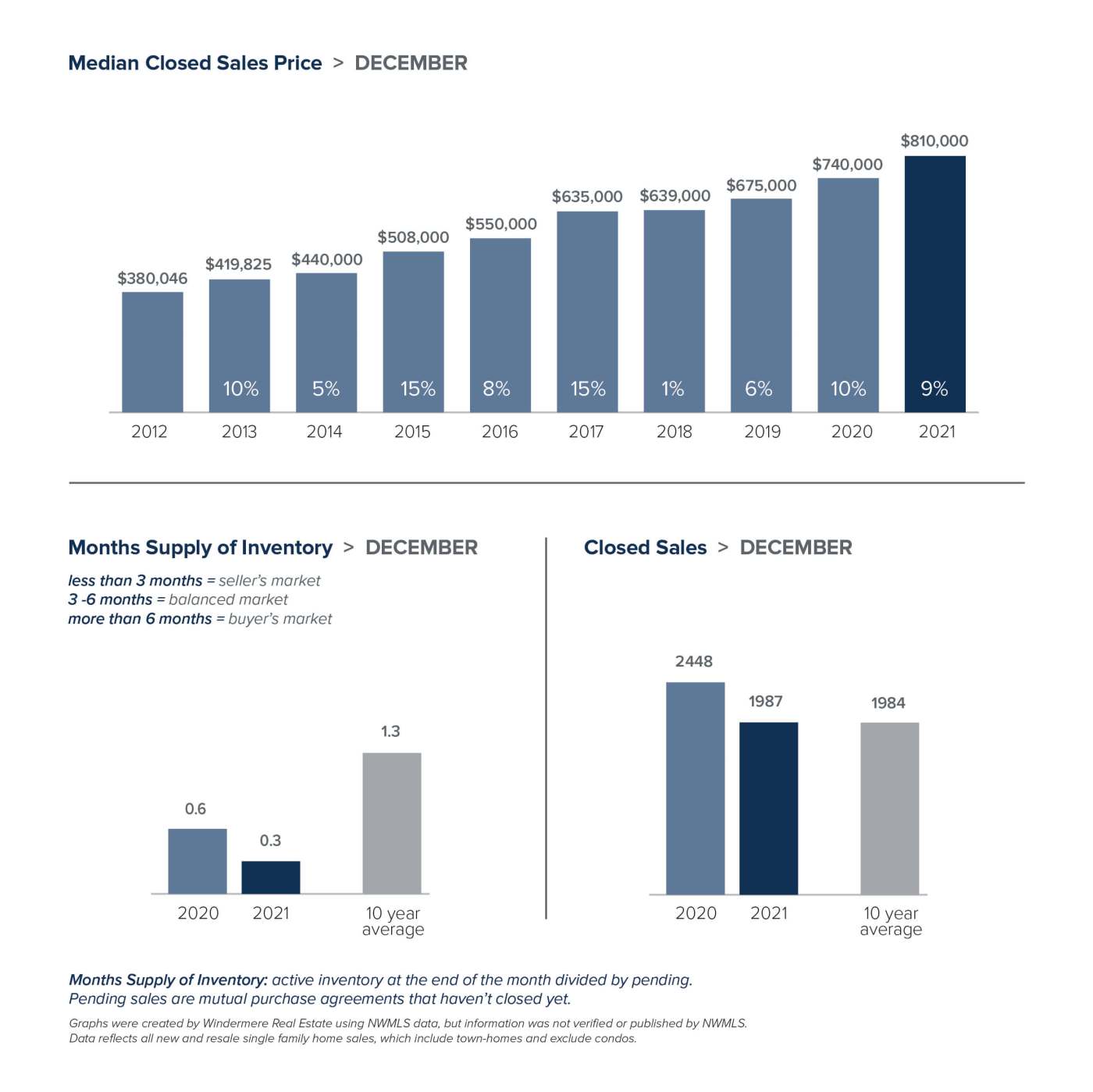

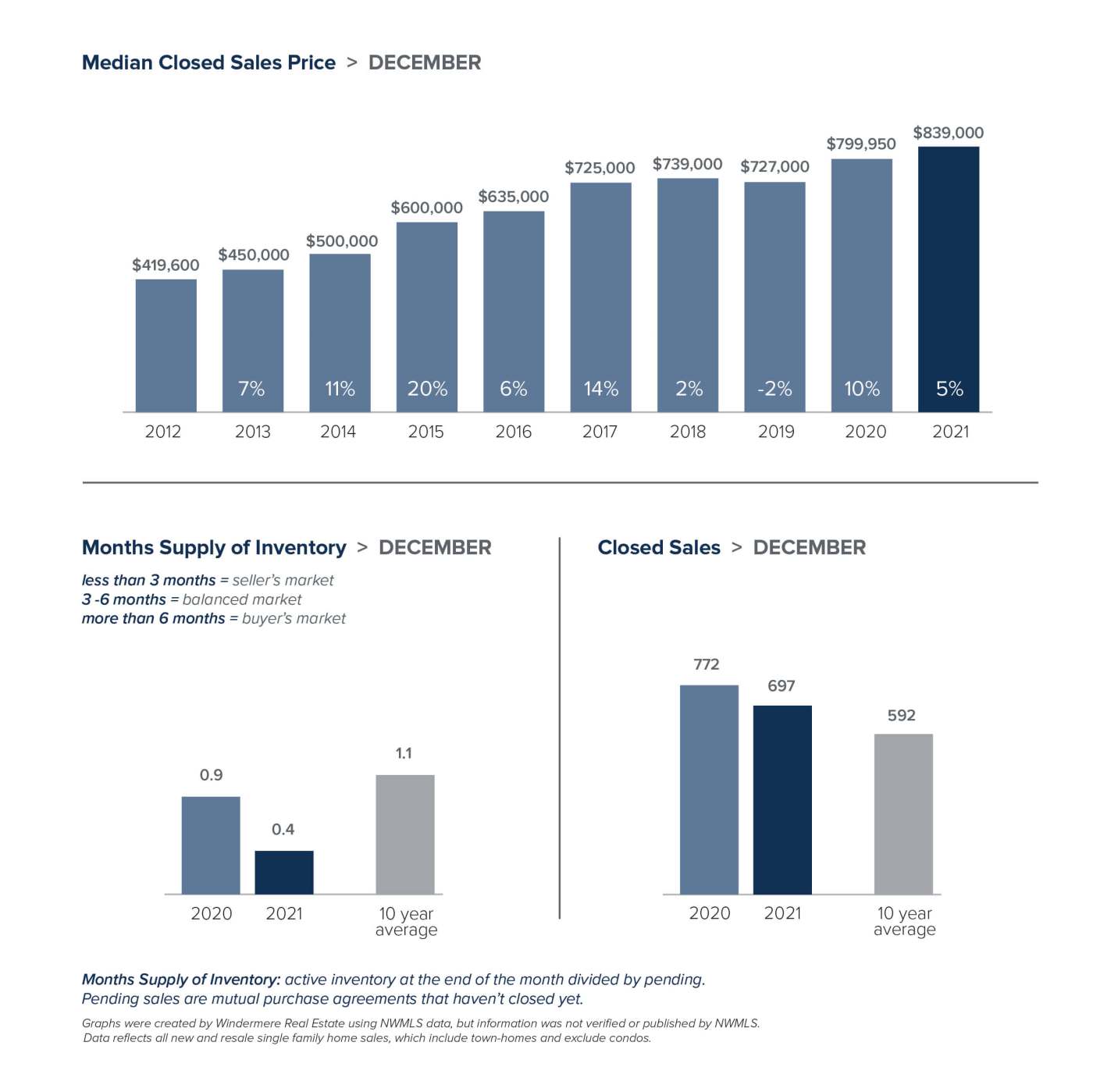

While up from a year ago, home prices in general were relatively flat from November to December. In King County, the median single-family home price rose 9% from last December to $810,000. Despite high demand and low inventory, prices in Seattle continue to level off. While down slightly from November, the median price increased a modest 5% over a year ago to $839,000. The Eastside was again the outlier. After breaking price records in October and November, home prices soared 37% year-over-year to set yet another all-time high of $1,529,500 in December. That represents a 7% increase from November. In further evidence of just how hot the Eastside market is, 75% of the properties there sold for over list price. Prices in Snohomish County continued to inch closer to King County. The median home price there jumped 22% to $700,000.

The driving force affecting affordability is lack of inventory. In both Snohomish and King counties it would take less than a week to sell the homes that are currently on the market. At the end of December, Snohomish County has just 210 single-family homes for sale in the entire county. Seattle had only 167 homes for sale; the Eastside just 55. That represented 70% less inventory for both Seattle and the Eastside as compared to a year ago. To give some historical perspective, the ten-year average inventory for the end of December is 545 homes in Seattle and 743 homes on the Eastside.

Matthew Gardner, Chief Economist at Windermere, registered his concern. “The Puget Sound region is in dire need of more housing units which would function to slow price growth of the area’s existing housing,” he said. “However, costs continue to limit building activity, and that is unlikely to change significantly this year.”

The demand side of the equation isn’t expected to wane any time soon either. With millions of square feet of new office space and new light rail developments in the works, the area continues to be a draw for employers – and more potential homebuyers.

2022 Predictions

What’s ahead for 2022? Matthew Gardner expects the market to continue to be strong, but believes the pace of appreciation will slow significantly from this year. “I predict single family prices will increase by around 8% in King and Snohomish counties. Affordability issues and modestly rising interest rates will take some of the steam out of the market in 2022.”

From working remotely to finally retiring, life events often trigger housing decisions. If you find yourself looking to buy or sell a property, we’re here to help.

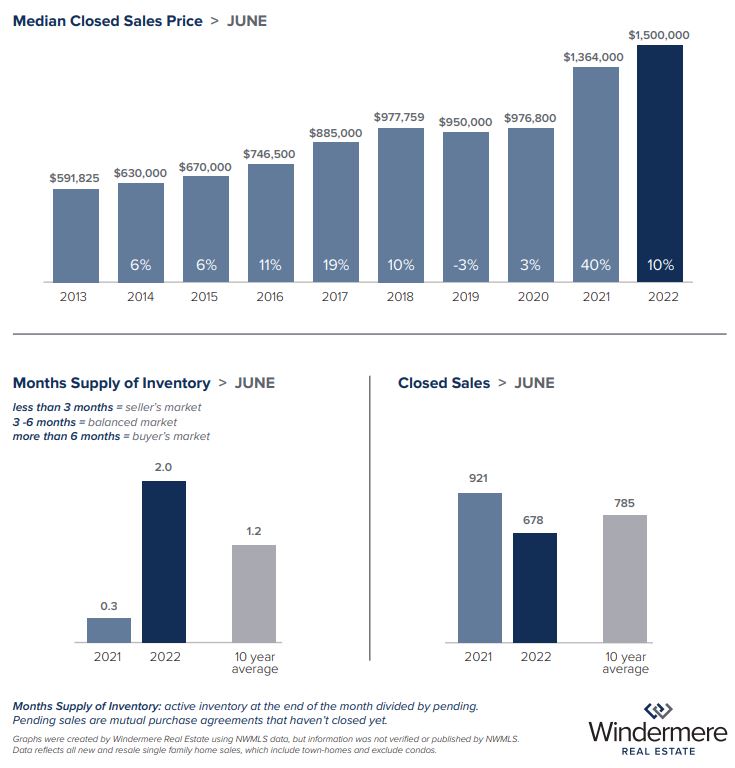

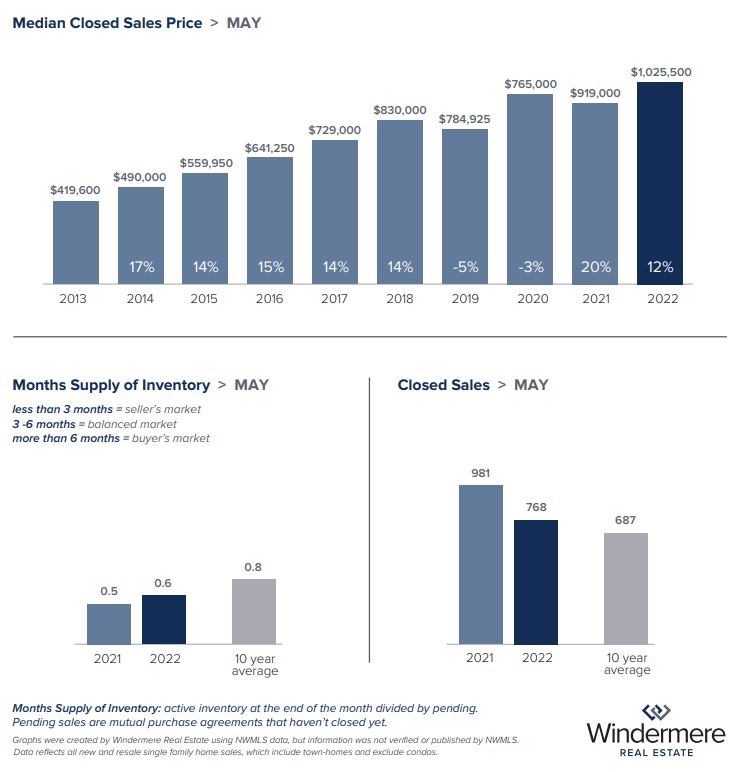

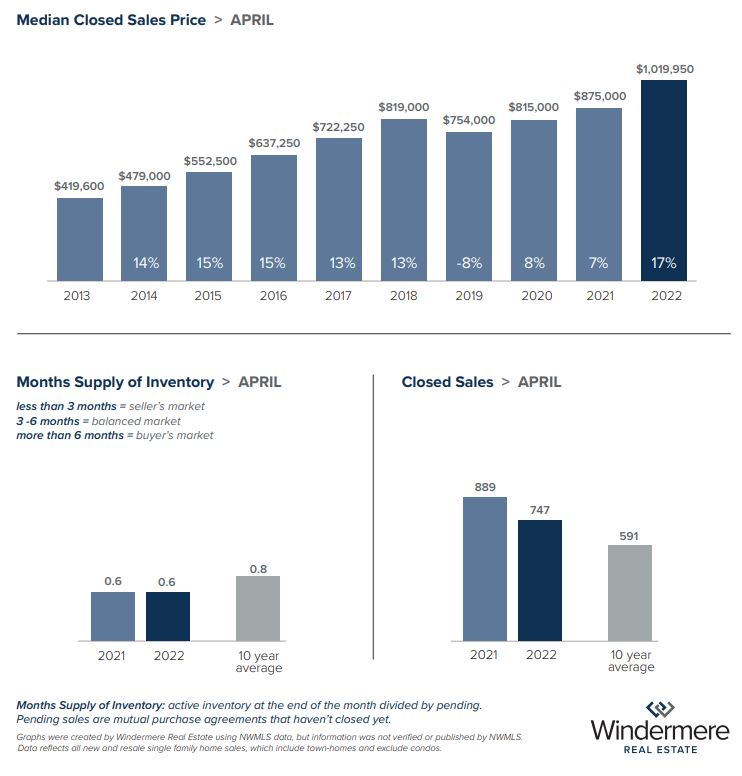

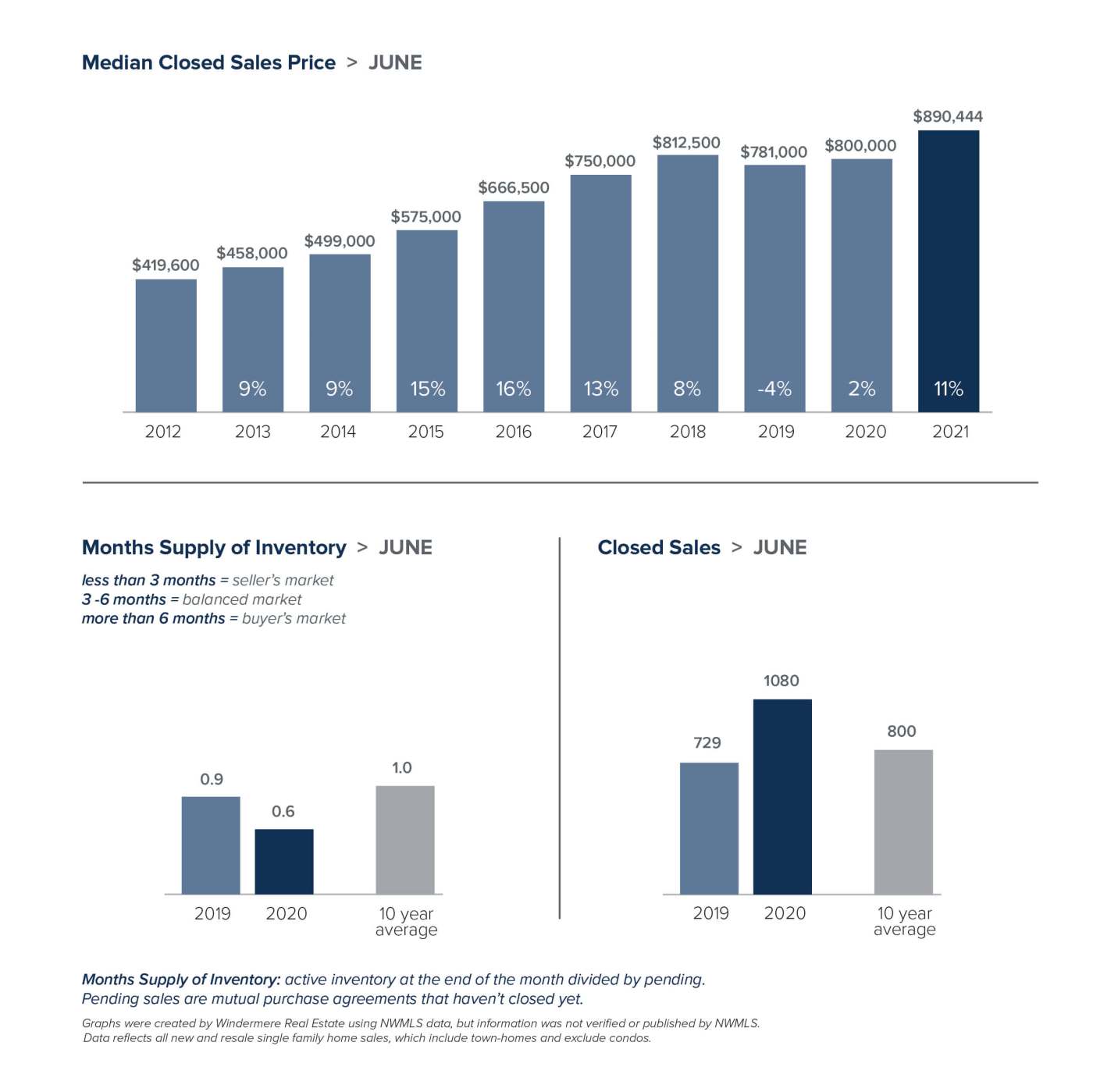

EASTSIDE

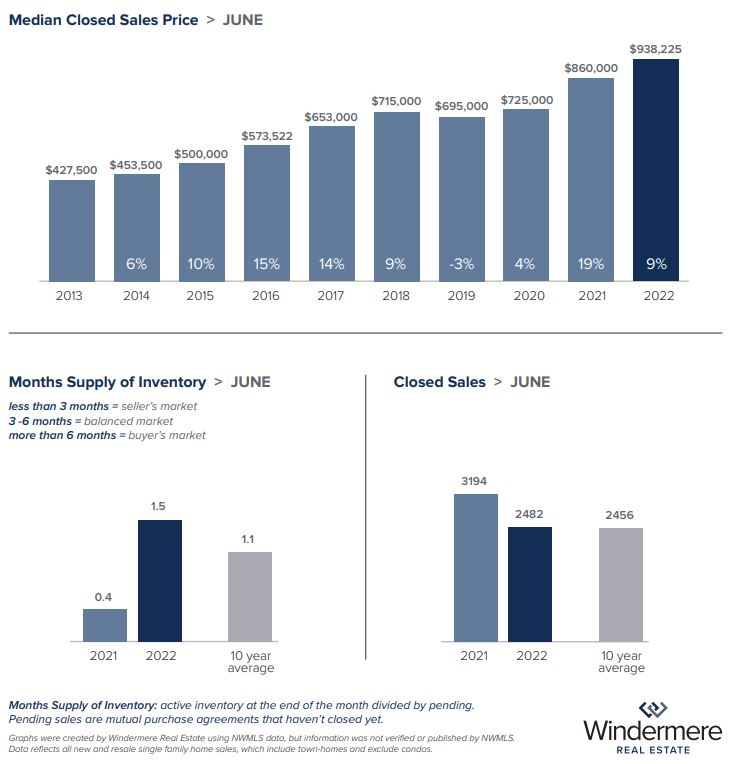

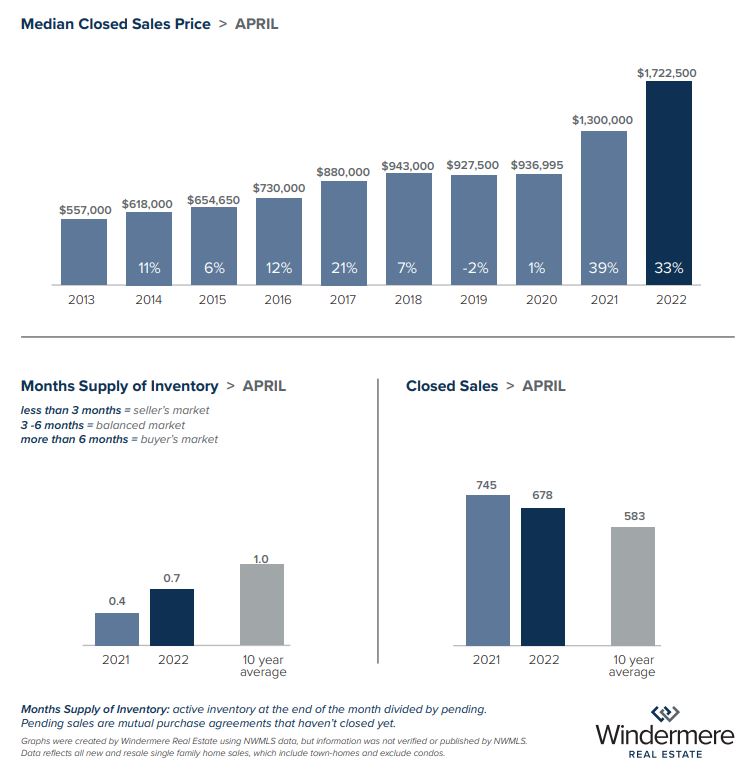

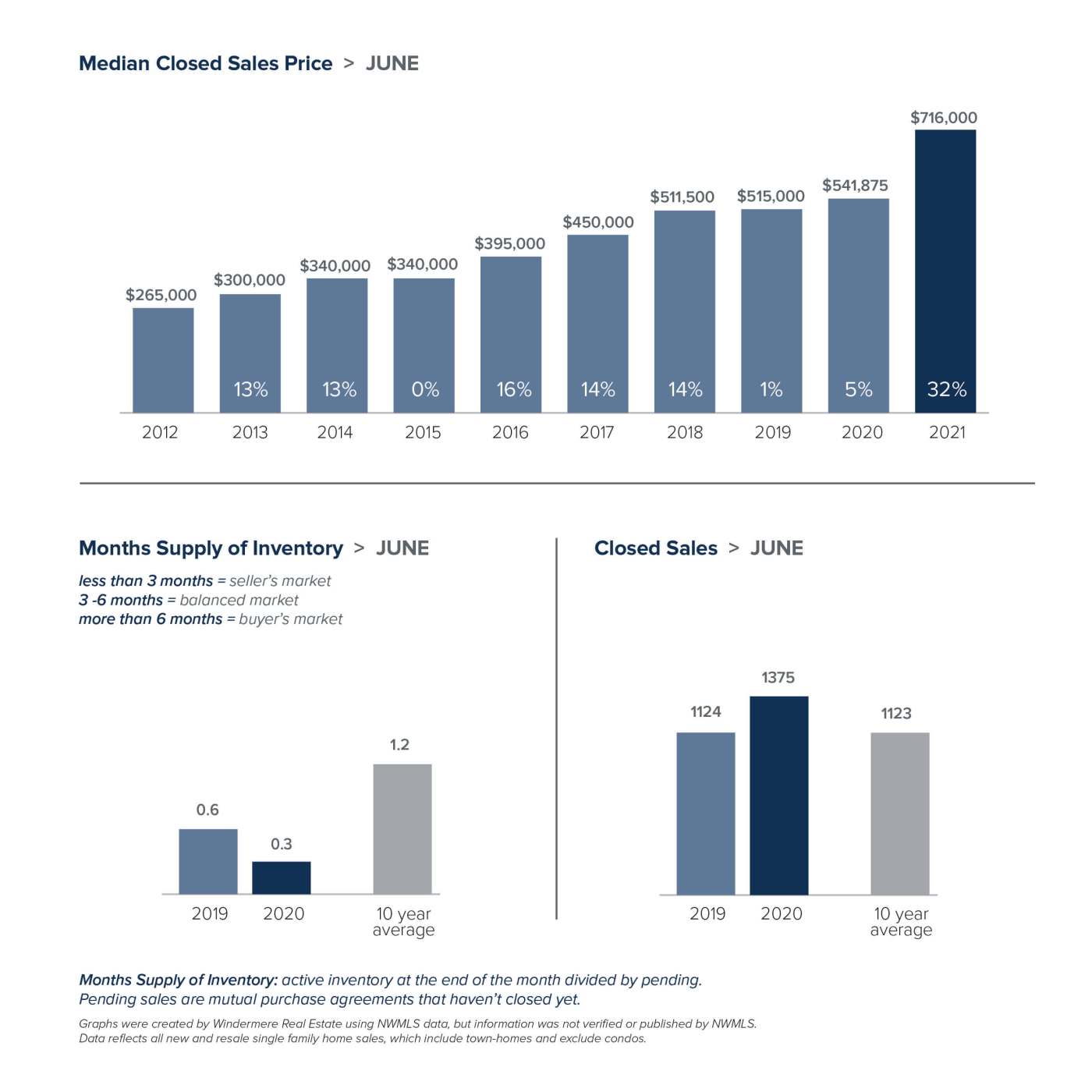

KING COUNTY

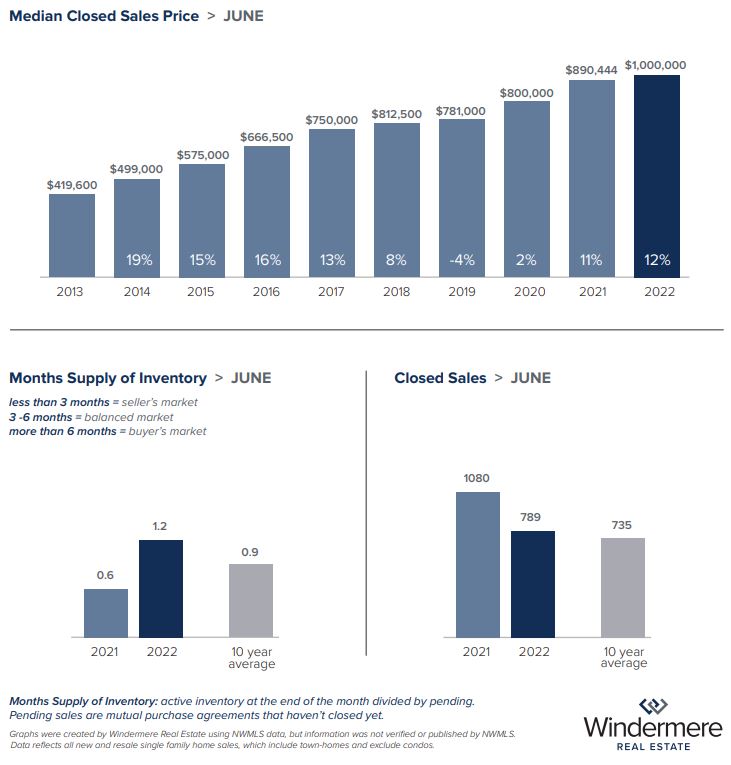

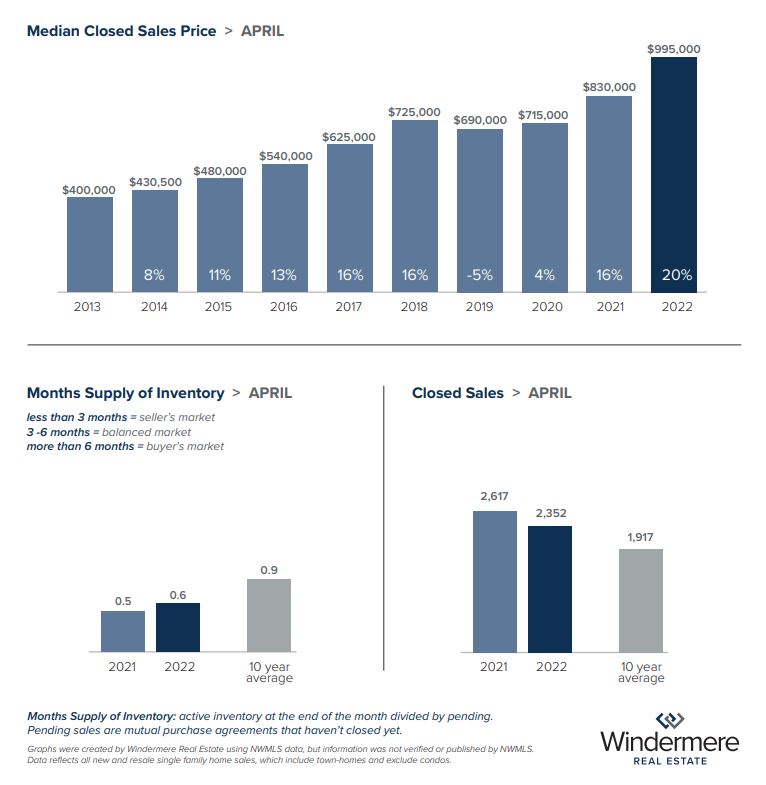

SEATTLE

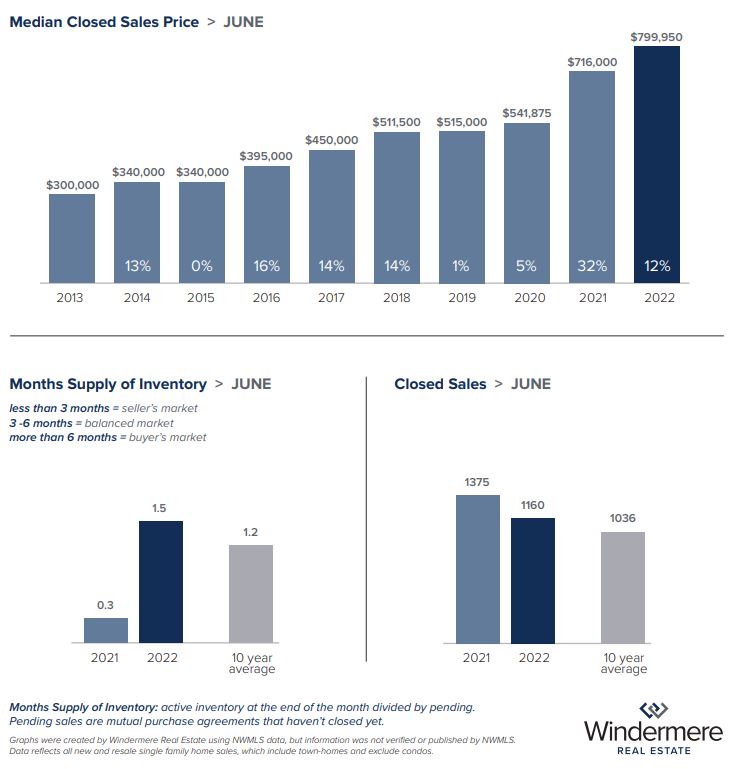

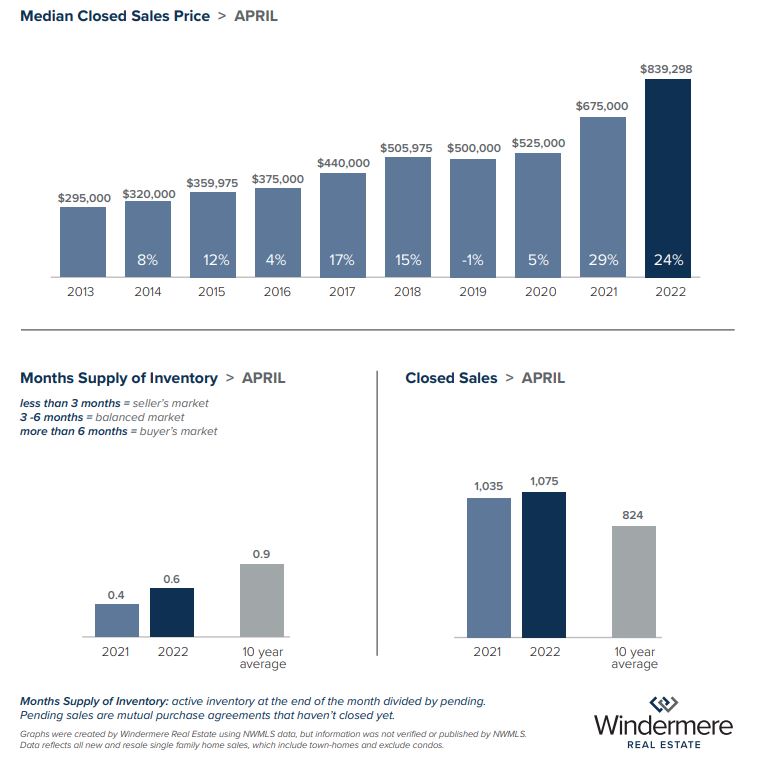

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

Check back next month for a new local market update.

Connect With Us On:

Instagram!

Facebook!

YouTube

This post originally appeared on GetTheWReport.com.

December 2021 Real Estate Market Update

What’s Happening in the Market

While the housing market typically slows down in the winter, fewer buyers are taking a break this year. High demand and scant inventory still favor sellers, who continue to see multiple offers. In one bright spot for buyers, home prices – while up from over a year ago – appear to be evening out in most of the region. Potential home sellers who’ve been sitting on the fence may want to consider taking a leap into the market now.

November Results

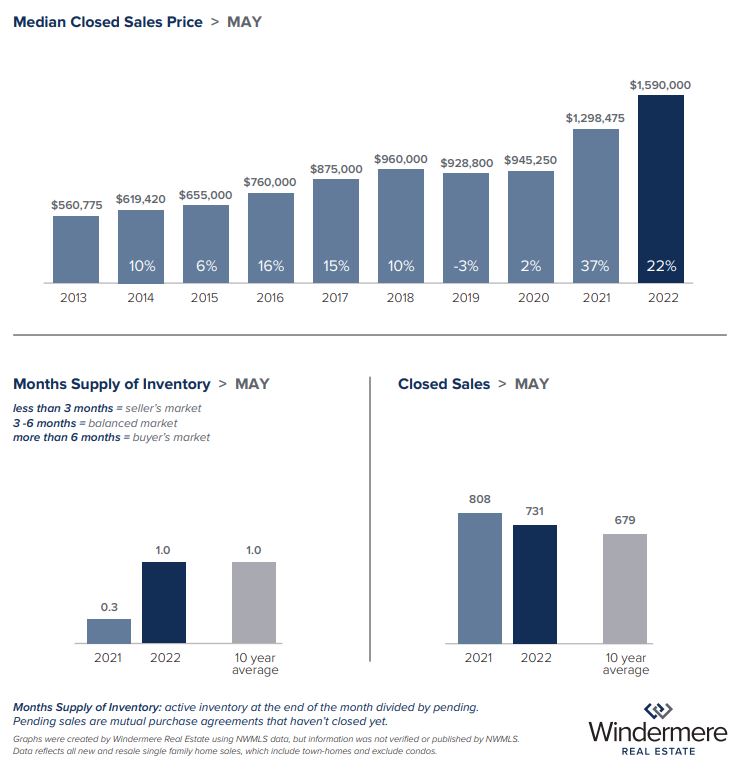

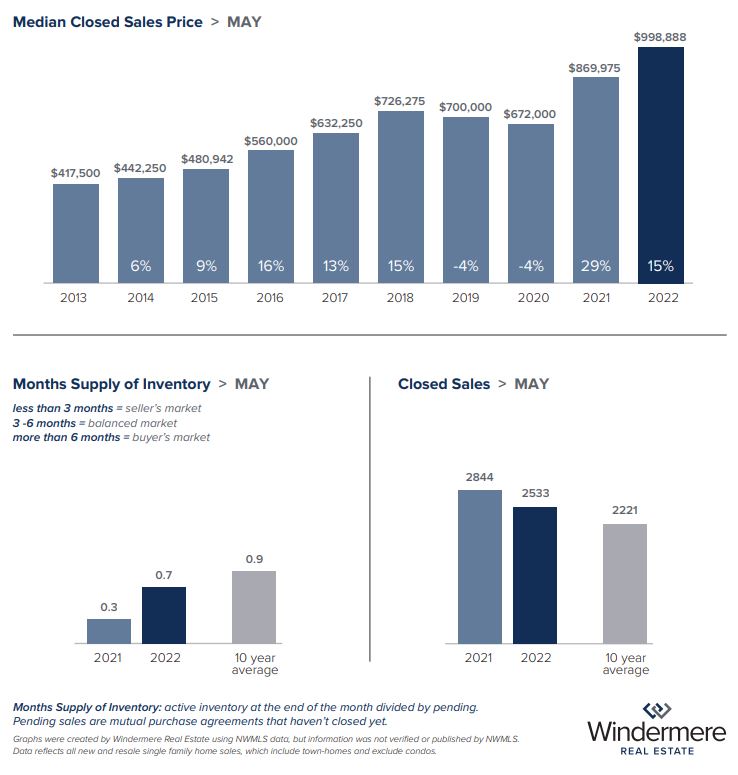

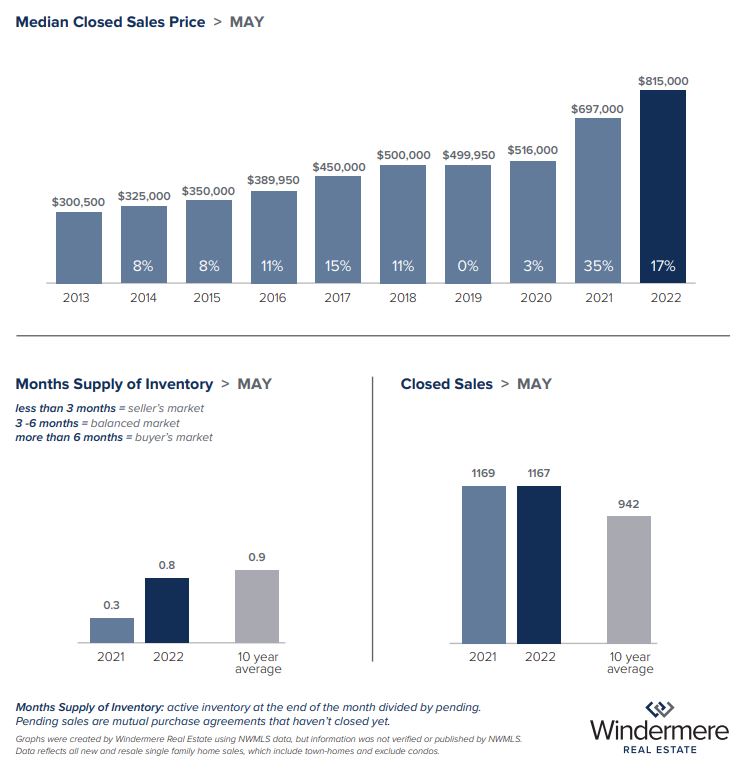

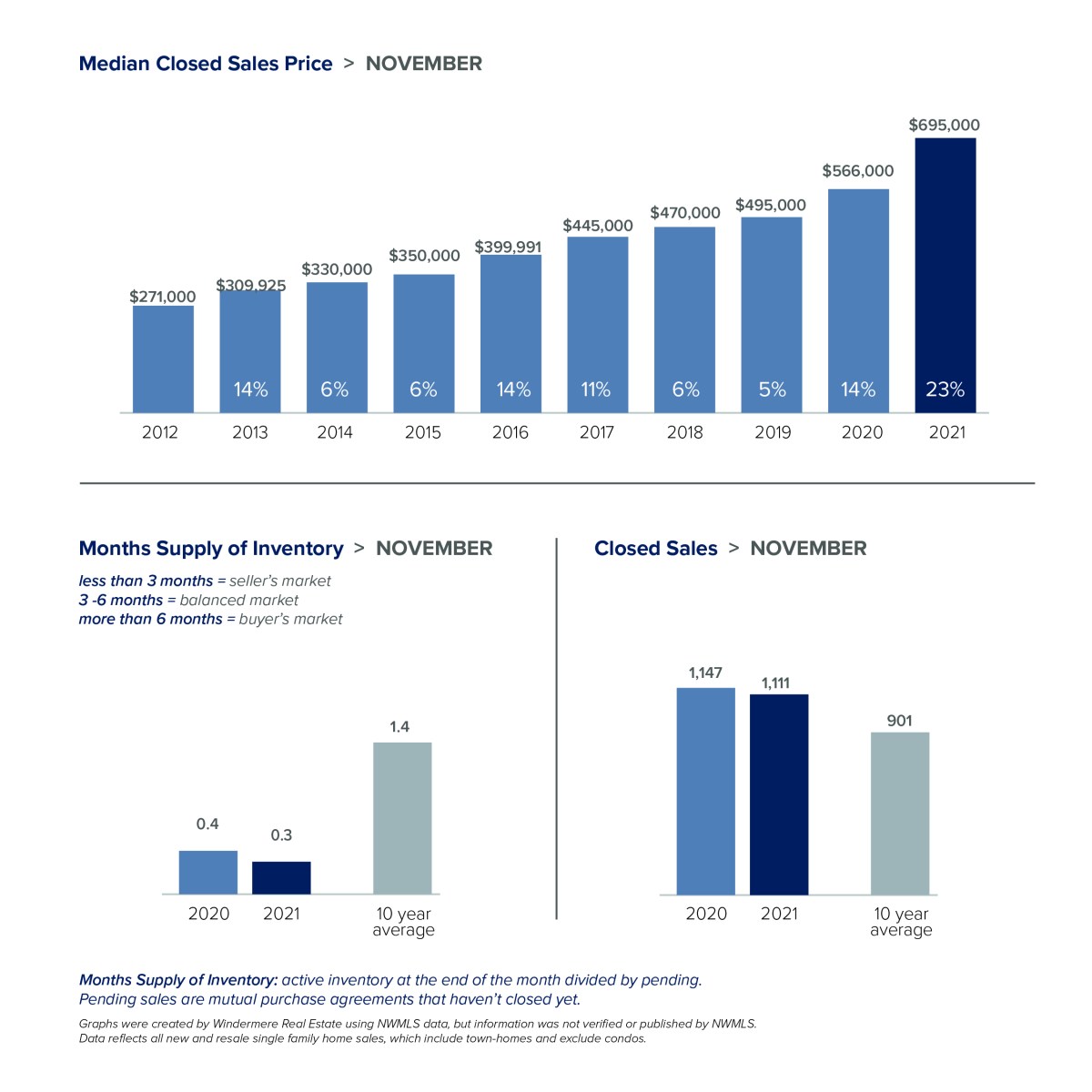

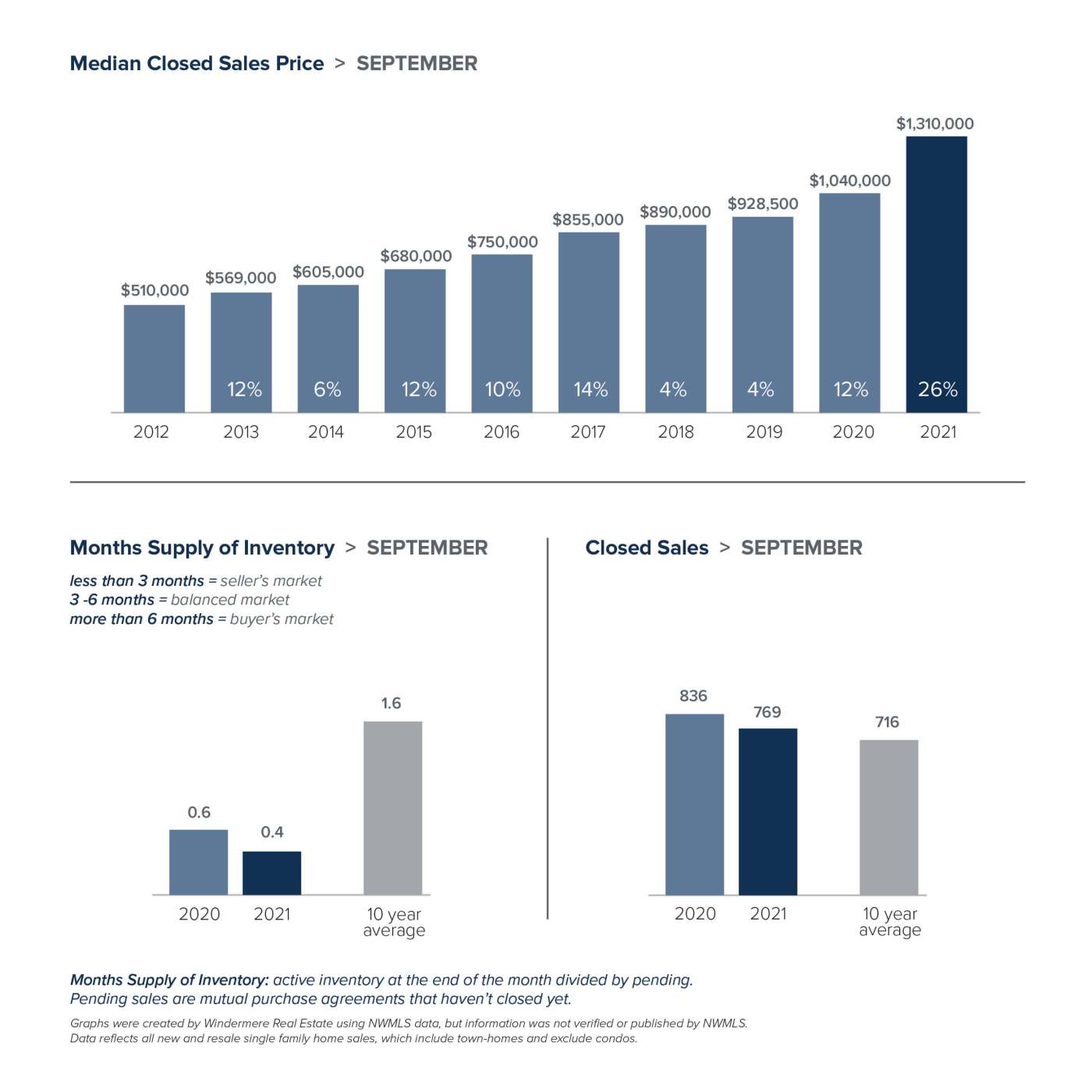

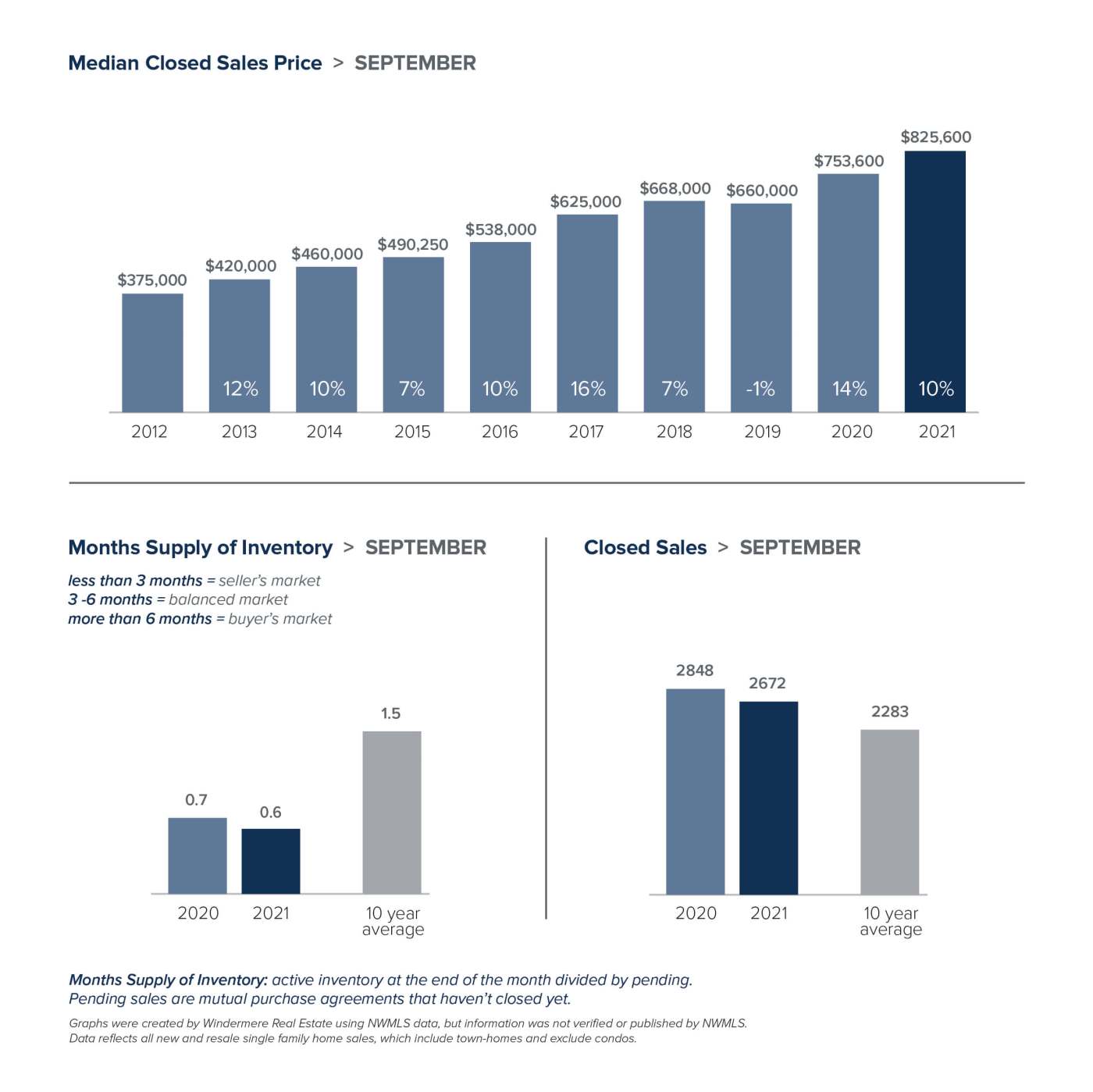

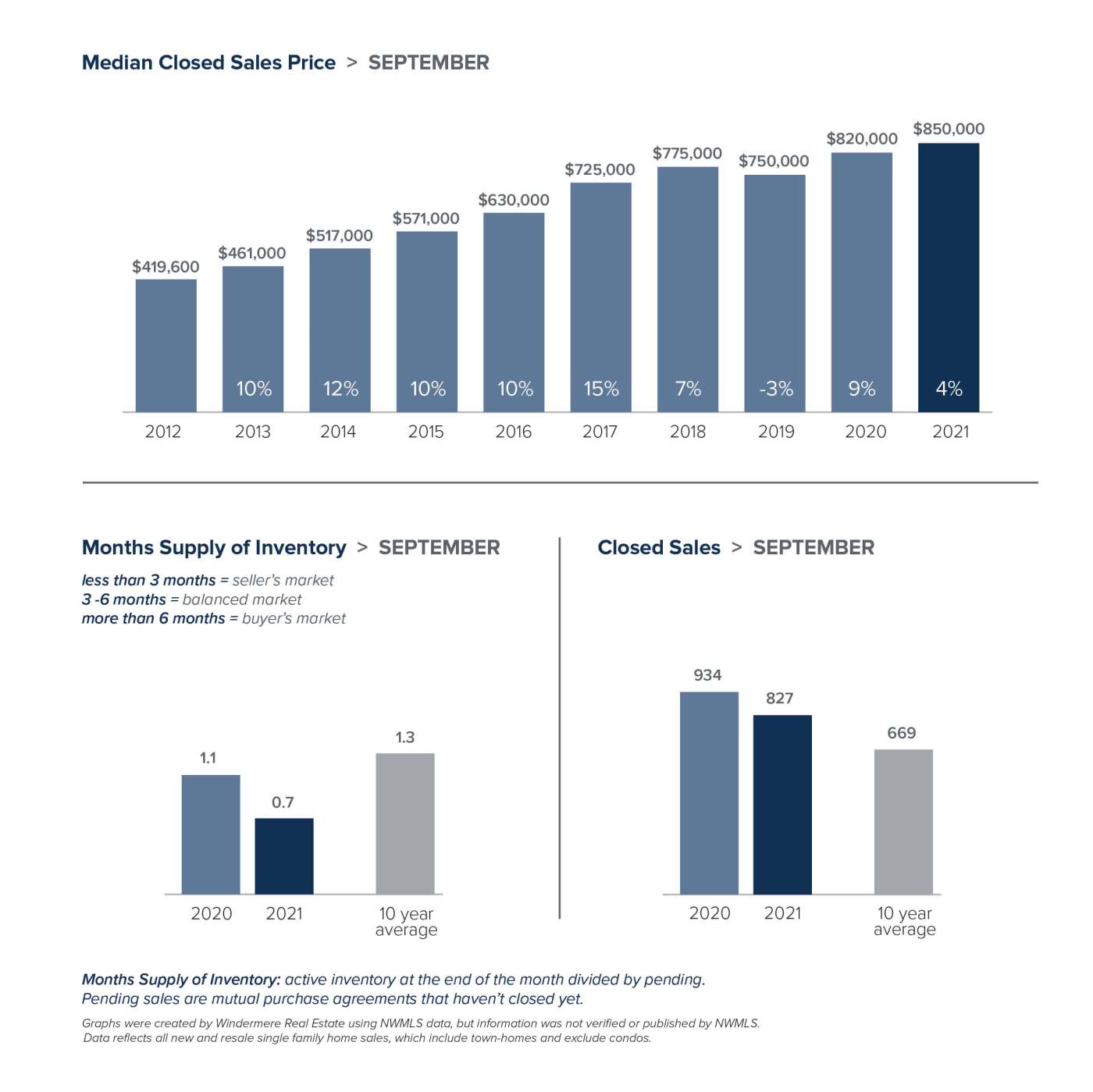

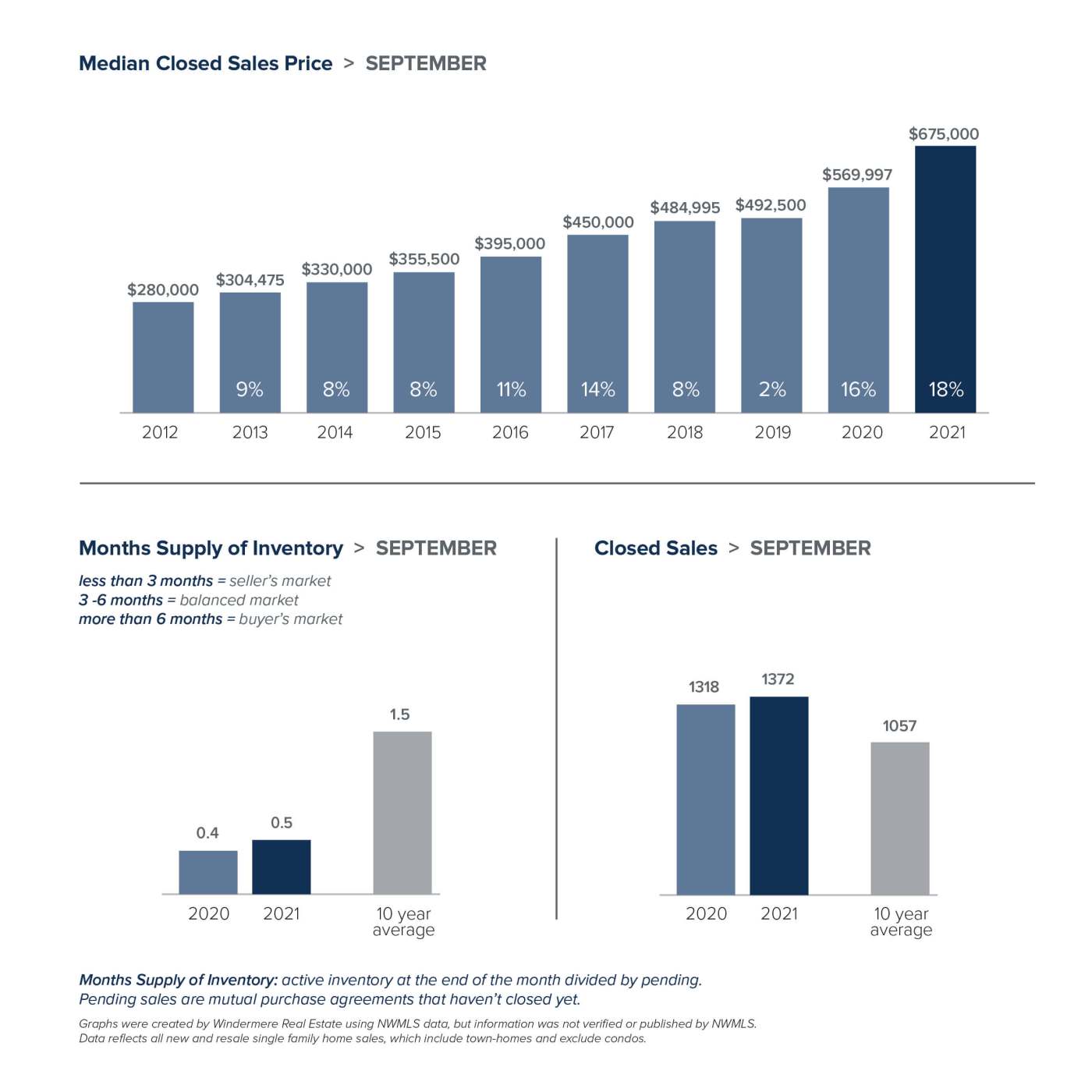

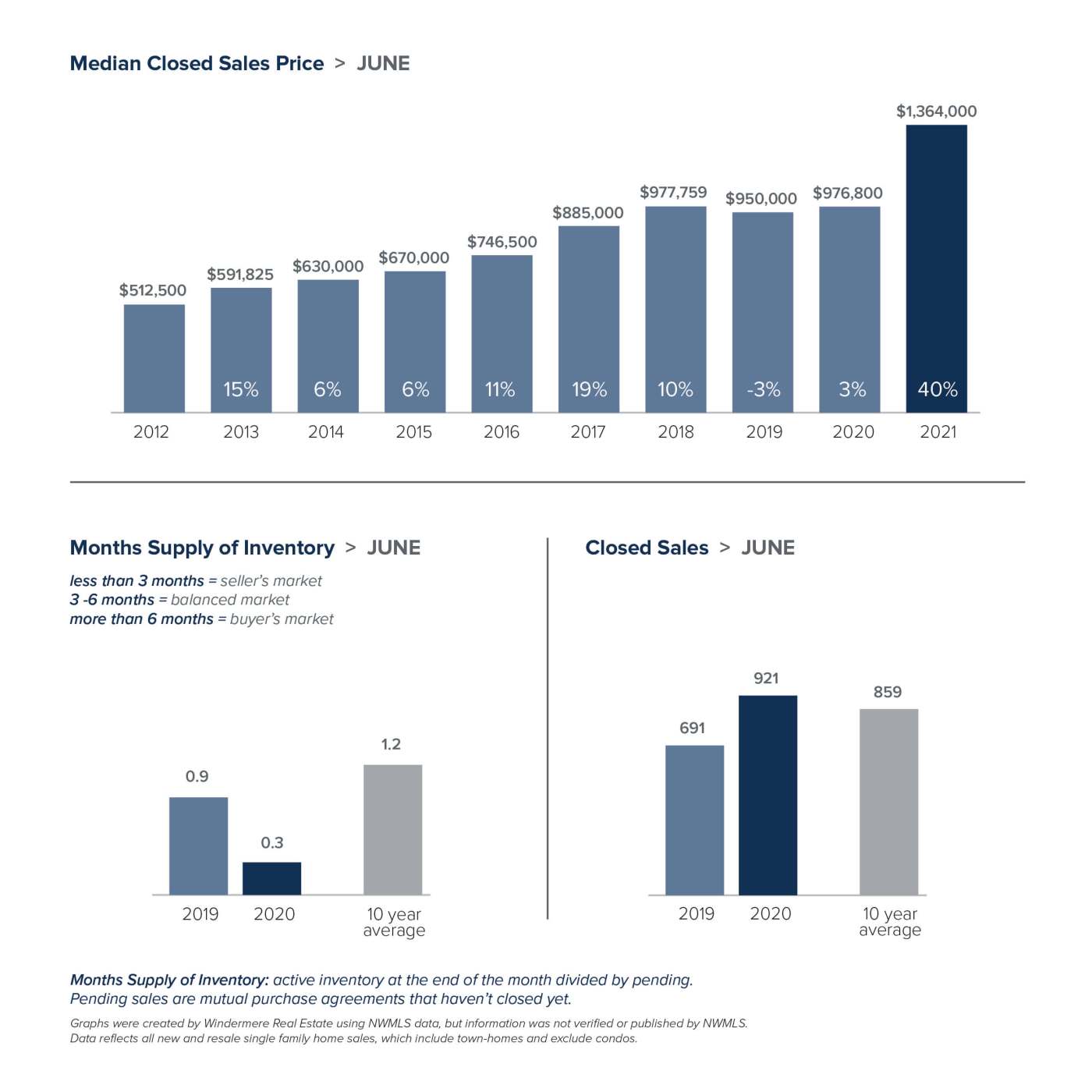

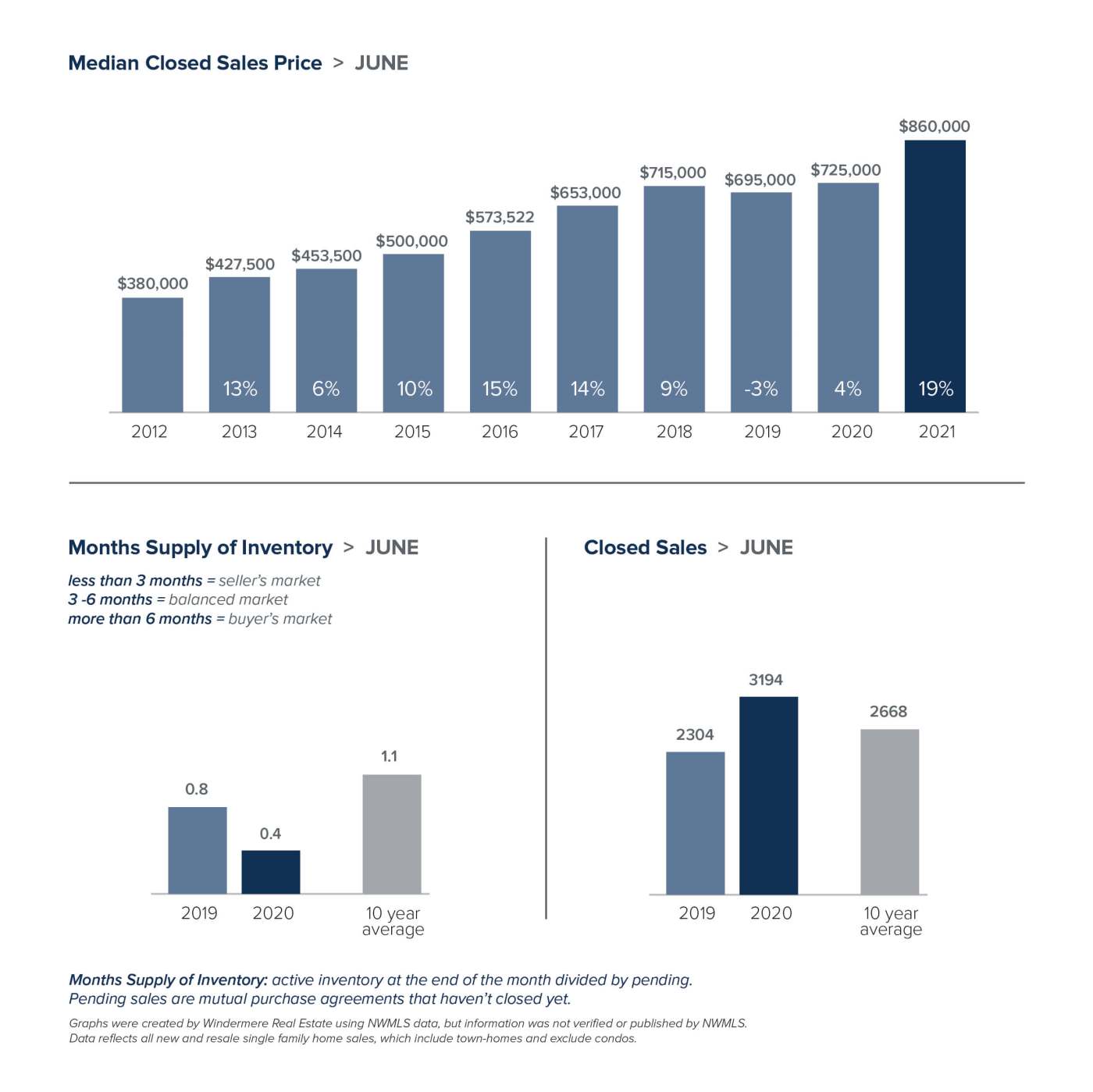

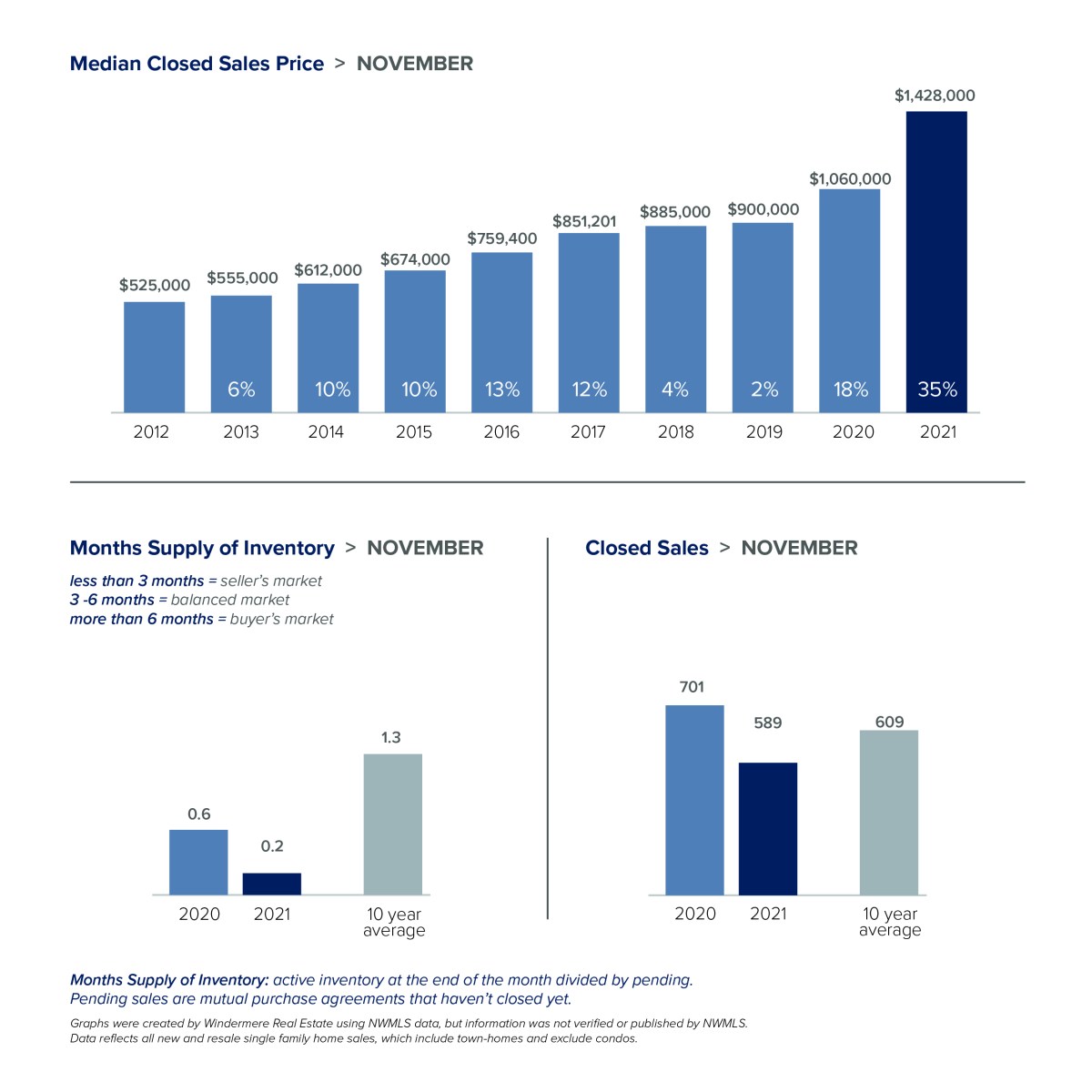

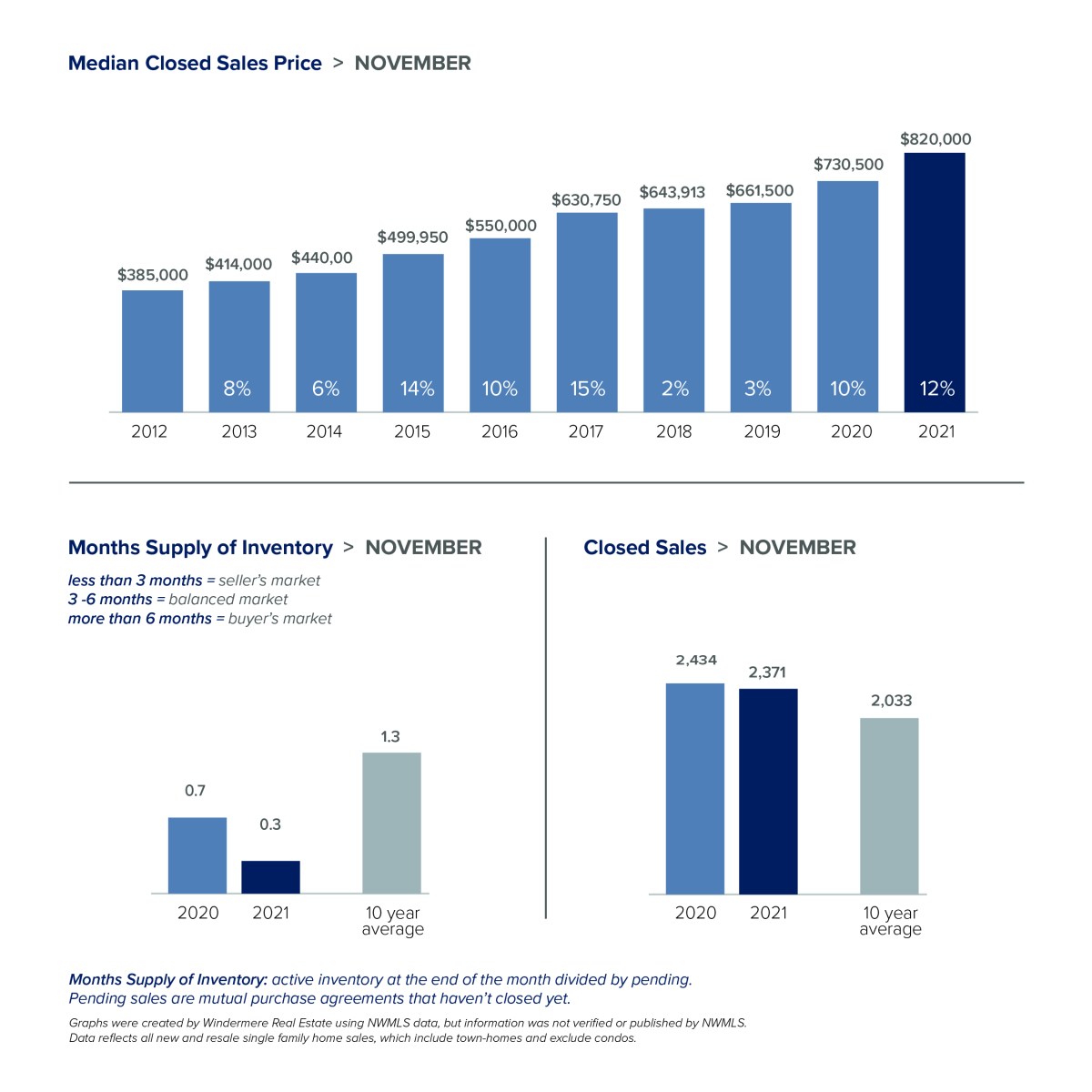

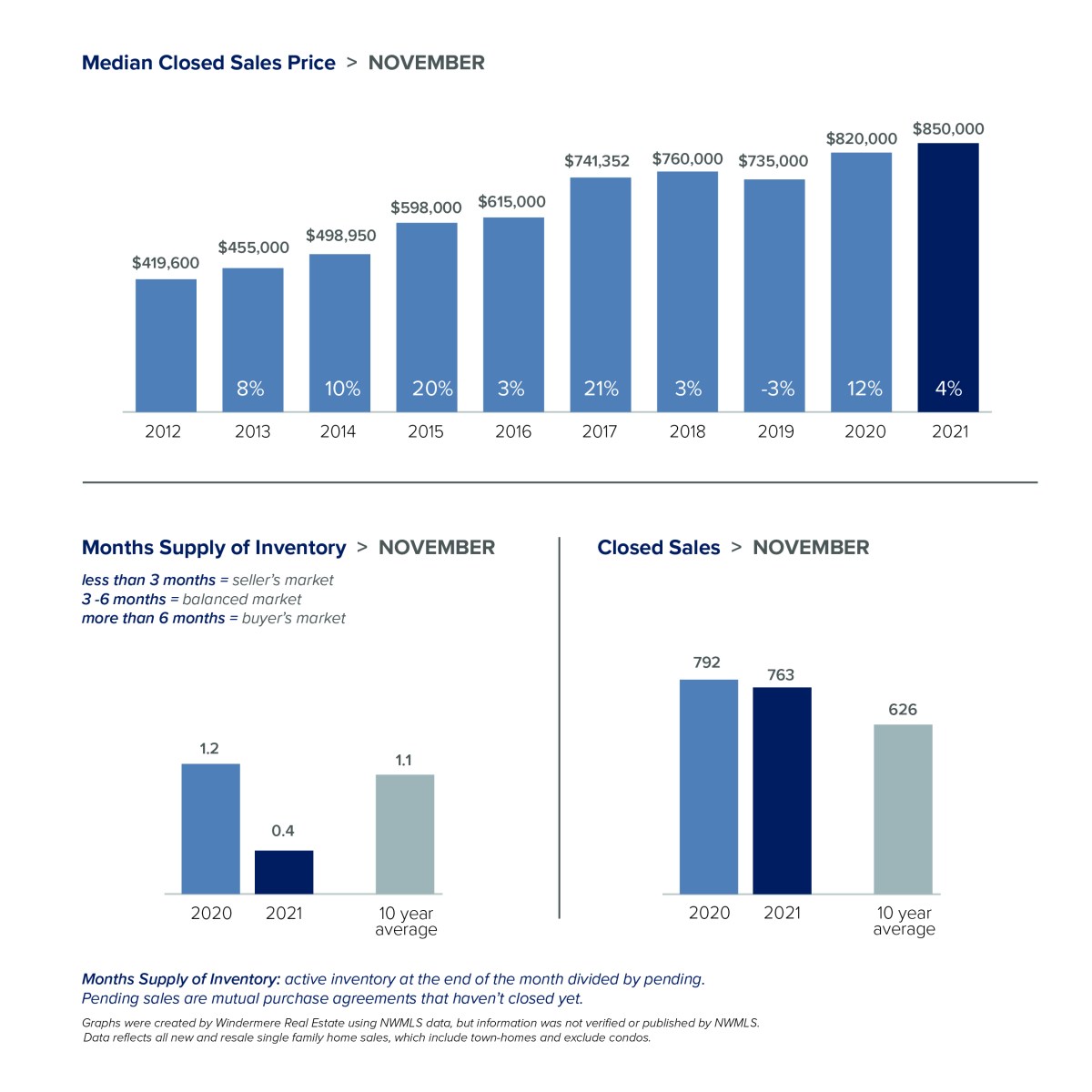

With the exception of the Eastside, Puget Sound median home prices were essentially flat in November compared to the previous month. However, prices increased by double-digits in most areas from last year. In King County, the median single-family home price rose 12% from last November to $820,000. Home prices in Seattle continue to level off, with the median price of $850,000 up just 4% from a year earlier. The Eastside maintained its strong appreciation, with prices soaring 35% from a year ago to a new record. The median home price there of $1,428,000 topped the previous all-time high price of $1,365,000 set in October. Prices in Snohomish County jumped as well, rising 23% to $695,000.

Despite the traditional winter slowdown, the supply of homes for sale just isn’t budging. Snohomish County has just three weeks of inventory. In King County it would take just over a week to sell through all the homes for sale. Inventory is at an all-time low on the Eastside, where there are only 100 single-family homes for sale in the entire area, which stretches from Issaquah to Woodinville. Homes there are snapped up quickly, with 85% of properties selling within two weeks. With demand at a peak, the inventory crunch is expected to continue. Developers are particularly bullish on the Eastside, where plans are in the works for numerous projects, including a new condo tower in Bellevue, a $500 million transit-oriented development, and over 7,500 new apartment units that are being built in Redmond.

2022 Predictions

What’s ahead for 2022? Matthew Gardner, Chief Economist at Windermere, expects the market to continue to be strong, but believes the pace of appreciation will slow significantly from this year. “I predict single family prices will increase by around 8% in King and Snohomish counties. Affordability issues and modestly rising interest rates will take some of the steam out of the market in 2022.”

Do your New Year’s plans include buying or selling a home? Your broker can keep you up to date on the latest trends and help you create a plan to meet your goals. Let us know how we can help.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

Check back next month for a new local market update.

Connect With Us On:

Instagram!

Facebook!

YouTube

This post originally appeared on GetTheWReport.com.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link