Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

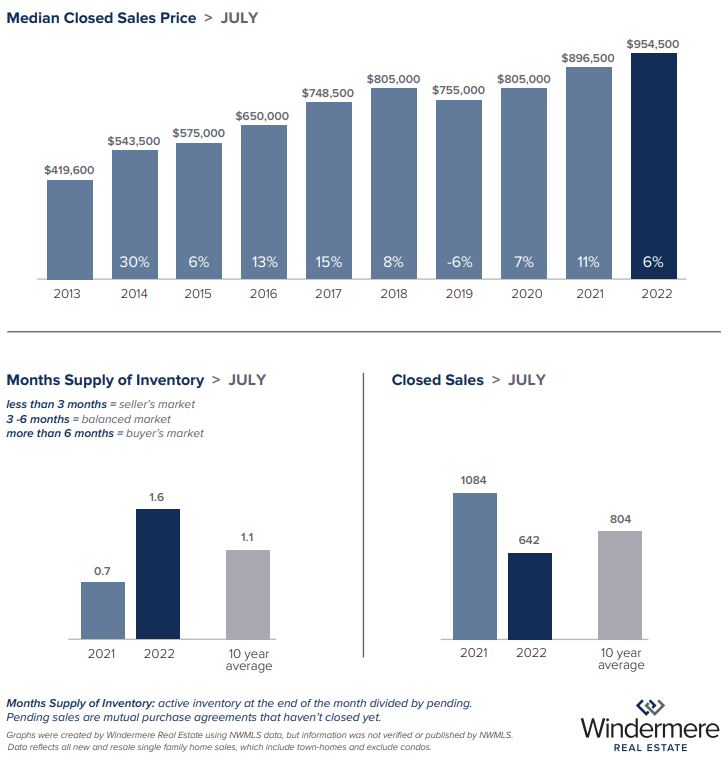

August 2022 Real Estate Market Update

The summer continues to heat up, and patient buyers are being rewarded as market shifts create a new dynamic between buyers and sellers. After years of intense competition between buyers for the most desirable listings, increasing inventory and slower price appreciation across the region have caused a pivot, with sellers competing more strongly against each other than they have in previous years.

The Return to a Balanced Housing Market

While this may cause uncertainty in some sellers, the rise in active inventory is an indication that we are returning to a more balanced housing market as a whole. Sellers can still be very successful with their home sales, as long as they price their homes accurately and understand that they may not see the exorbitant offers that were typical a few months ago. This is a pragmatic approach, and we should see some relief in the “buyer gridlock” that had kept homeowners in place who wanted to sell and move but simply had no place to go.

Inventory, Affordability, & Median Sale Prices

Even with the increased inventory across the Puget Sound region, we may start 2023 with low supply, high demand, and multiple offer situations. Prices are coming down largely as a result of the previous rapid price appreciation and rising interest rates. However, Puget Sound’s underlying lack of supply and huge demand has not changed, although rates have improved. Seattle’s median price for single-family homes rose 6.4% year-over-year, from $896,500 to $954,500. That’s down slightly from the million-dollar median the city hit in April, and should help create a more inviting market for prospective buyers. The median price for condos is currently a more affordable $537,000, with 2.5 months of inventory.

King County as a whole is experiencing much the same phenomenon, with the median sale price for single-family homes decreasing from $938,225 in June to $890,000 last month. However, that’s still up 2.1% from $871,000 in July 2021. Single-family homes on the Eastside currently have the most inventory in the tri-county area, with 2.5 months’ supply. The median price for single-family homes has dropped to $1,420,000, down from $1,500,000 in June, but up 6.7% year-over-year. It’s important to note that this decrease in the median price is likely not due entirely to price depreciation, but from the fact that lower-priced homes made up a larger percentage of the overall sales in the area, thus lowering the median sold price. Real estate experts believe that the area continues to model a price correction based on the 2018 market, suggesting the median closed sales price will bottom out in about two months’ time around $1,300,000 or higher.

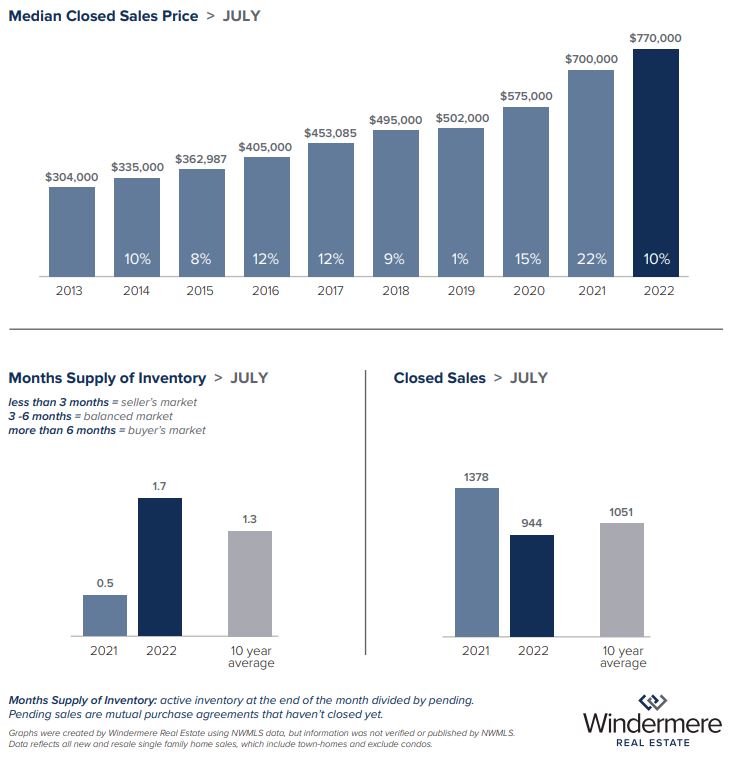

Snohomish continues to remain a more affordable area for buyers, with a median sold price for single-family homes of $770,000. Although that’s down from June, it is up a full 10% year-over-year, from $700,000 in July 2021. The area also has more active inventory—nearly two months’ supply. This, combined with the lower median price for condos of $500,000, makes it an appealing option for buyers with more constrained budgets.

Conclusion

The increase in active inventory across the region is not an indication of slowing demand. The majority of homes are selling in under two weeks, and prices continue to appreciate year-over-year. Builders are working diligently to meet demand, but until more projects come online, buyers and sellers will have to navigate these new market dynamics together.

If you have questions about these changes in the market or about real estate in general, please reach out to the Kari Haas Real Estate Team, we are happy to help!

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

Q2 Western Washington – The Gardner Report

The following analysis of the Q2 2022 Western Washington real estate market report is provided by Windermere Real Estate Chief Economist, Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact Kari Haas.

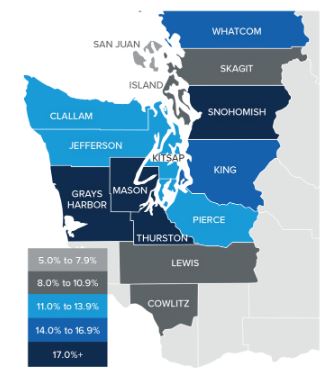

Regional Economic Overview

The most recent employment data (from May) showed that all but 2,800 of the jobs lost during the pandemic have been recovered. More than eight of the counties contained in this report show employment levels higher than they were before COVID-19 hit. The regional unemployment rate fell to 4.5% from 5.2% in March, with total unemployment back to pre-pandemic levels. For the time being, the local economy appears to be in pretty good shape. Though some are suggesting we are about to enter a recession, I am not seeing it in the numbers given rising employment and solid income growth.

Western Washington Home Sales

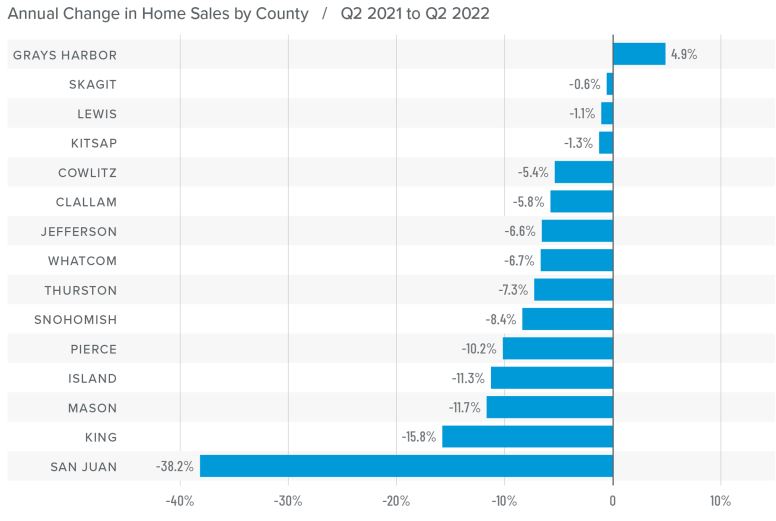

- In the second quarter of 2022, 23,005 homes sold, representing a drop of 11% from the same period a year ago, but up by a significant 52% from the first quarter of this year.

- Sales rose in Grays Harbor County compared to a year ago but fell across the balance of the region. The spring market, however, was very robust, likely due to growing inventory levels and buyers trying to get ahead of rising mortgage rates.

- Second quarter growth in listing activity was palpable: 175% more homes were listed than during the first quarter and 61.98% more than a year ago.

- Pending sales outpaced listings by a factor of 3:1. This is down from the prior year but only because of the additional supply that came to market.

Home Prices

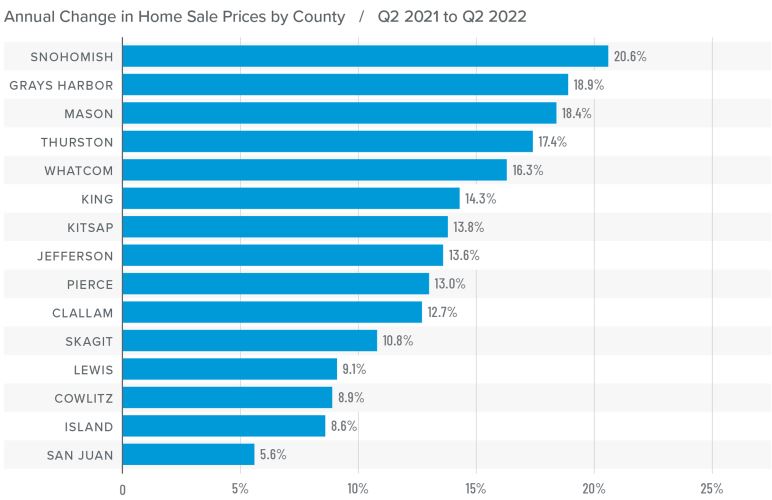

- Even in the face of rising mortgage rates, home prices continue to rise at a well-above-average pace, with average prices up 13.3% year over year to $830,941.

- I have been watching list prices as they are a leading indicator of the health of the housing market. Thus far, despite rising mortgage rates and inventory levels, sellers remain confident. This is reflected in rising median list prices in all but three counties compared to the previous quarter. They were lower in San Juan, Island, and Jefferson counties.

- Prices rose by double digits in all but four counties. Snohomish, Grays Harbor, Mason, and Thurston counties saw significant growth.

- List prices and supply are both trending higher, but this has yet to slow price growth significantly. I believe we will see the pace of appreciation start to slow, but not yet.

Mortgage Rates

Although mortgage rates did drop in June, the quarterly trend was still moving higher. Inflation—the bane of bonds and, therefore, mortgage rates—has yet to slow, which is putting upward pressure on financing costs.

That said, there are some signs that inflation is starting to soften and if this starts to show in upcoming Consumer Price Index numbers then rates will likely find a ceiling. I am hopeful this will be the case at some point in the third quarter, which is reflected in my forecast.

Days on Market

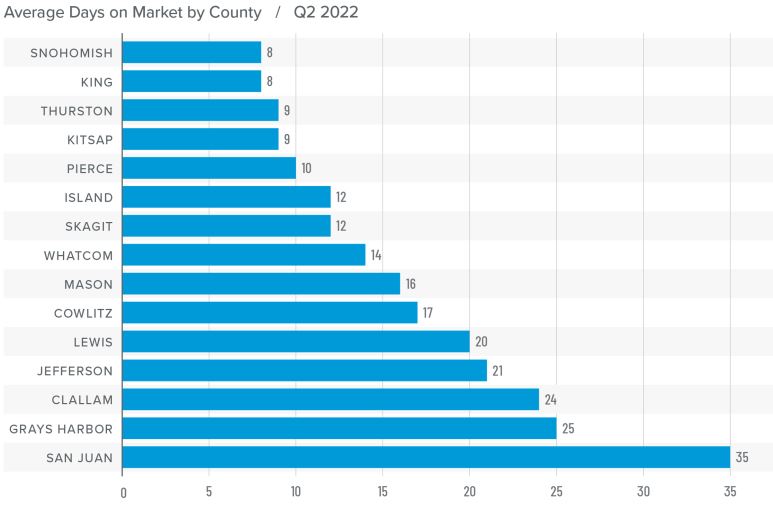

- It took an average of 16 days for a home to go pending in the second quarter of the year. This was 2 fewer days than in the same quarter of 2021, and 9 fewer days than in the first quarter.

- Snohomish, King, and Pierce counties were, again, the tightest markets in Western Washington, with homes taking an average of between 8 and 10 days to sell. Compared to a year ago, average market time dropped the most in San Juan County, where it took 26 fewer days for a seller to find a buyer.

- All but six counties saw average time on market drop from the same period a year ago. The markets where it took longer to sell a home saw the length of time increase only marginally.

- Compared to the first quarter of this year, average market time fell across the board. Demand remains very strong.

Conclusions

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog.

How to Successfully Move and Start a Business at the Same Time

If you’re moving house and starting a business at the same time, proper planning is key to easing stress and making smart decisions. Bellevue, WA has a lot to offer new business owners and homeowners, so it’s a great place to start your search. If you take the time to consider your needs, this venture can be an opportunity for the best start possible rather than an additional challenge.

Buying Your New Home

If you’re starting a home-based business, there are additional concerns to take into account. To help the process go smoothly, here are some steps you should take:

- Secure a mortgage. It can be difficult for self-employed people to get home loans. If you don’t have a partner helping with expenses, you may want to keep your day job until after settlement.

- Define your needs. List any special requirements of your business, whether that’s inventory storage or a separate entrance and waiting area for clients.

- Hire a real estate agent. The right agent listens to your needs and budget and presents properties that meet those requirements.

- Consider laws and regulations. Zoning laws and HOA regulations can restrict your ability to run a business from your home. Bellevue’s zoning regulations can be found online.

By following these steps, you’ll minimize the challenges that can come up during the buying process.

Moving In

Getting professional assistance for your move can be useful. Movers can pack and transport the majority of your belongings while you concentrate on your most important possessions. These important possessions include paperwork, your computer, any inventory you have, and other tools or equipment that let you do your work. It can be best to put this all in one box or bag that you move yourself so that it remains easy to access. If your new property doesn’t have space for everything, you can look at alternative storage. This can be a temporary or more permanent solution for storing inventory. In the Bellevue, WA area, 5×5 storage units start at $45.

Launching Your Business

The next step is to launch your business. The Small Business Administration has a good guide that can help you through the process, from market research to opening a business bank account. You can also look into getting a business degree to cover all the ins and outs of being a successful entrepreneur. You can choose to study online to better balance your studies with your other responsibilities.

Spend some time deciding on the structure of your business. Your options include sole proprietorship, partnership, corporation, or limited liability company. An LLC limits your personal liability, which can protect your assets, such as your new home. In Washington, you can register your LLC online. This helps you avoid legal fees.

Also, keep track of your finances. No matter what your business structure is, it’s important to keep personal and business expenses separate. Consider using business accounting software that can keep track of income, business receipts, and expenditures. Accurate records can help you at tax time, especially when it comes to the deductions you’re allowed for a home office.

The Right Help

No matter how well you plan, having the right assistance can be essential to your success. The right real estate agent can also help you make your home and business ownership dreams come true. While we might not be able to help you start a business, we are prepared to take the weight of home buying off your shoulders. Contact Kari Haas to start your journey.

We pride ourselves in having the best track to success in real estate and while we aren’t business advisors, we do have a long list of referrals for those seeking help. i.e., a financial advisor, property manager, and more.

Image via Pexels

This post was originally written by a guest blogger, Lisa Walker.

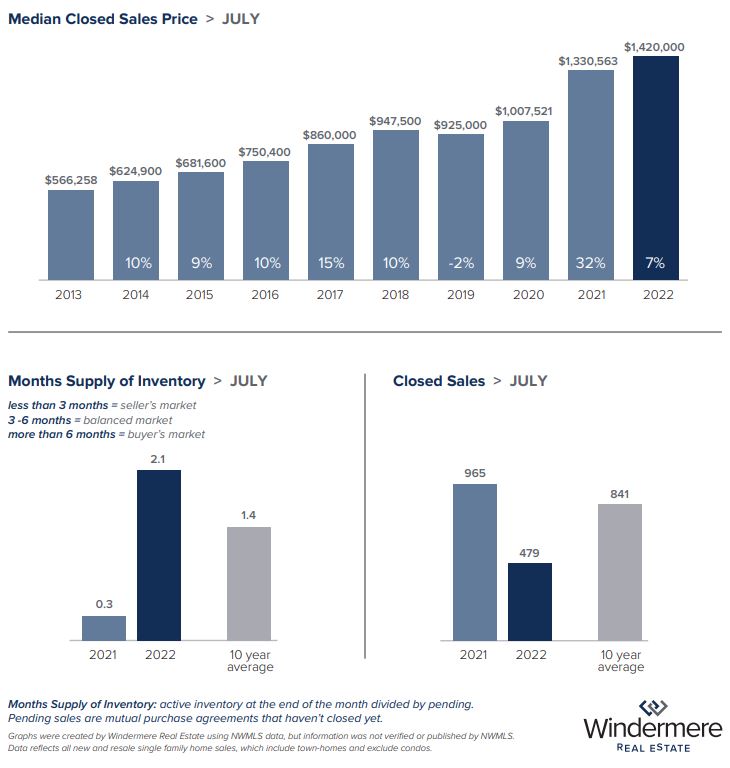

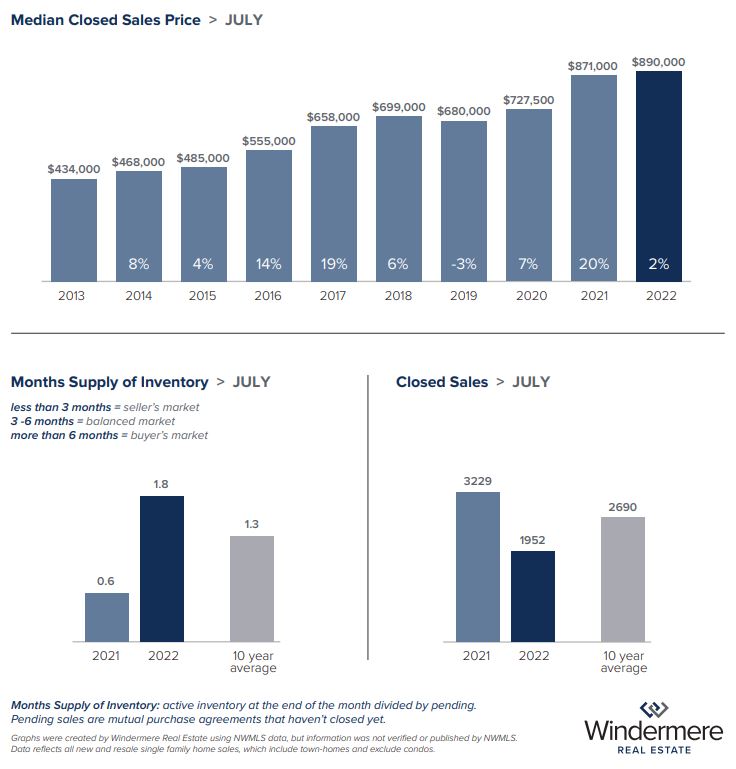

July 2022 Real Estate Market Update

Cooler temperatures and a cooler regional real estate market have been this summer’s hallmark thus far. After months of blazing hot sales and a breakneck pace, buyers are finally seeing inventory levels accelerate and price gains slow. With inspection and financing contingencies once again becoming the norm, the region may, at last, be shifting toward a more balanced market.

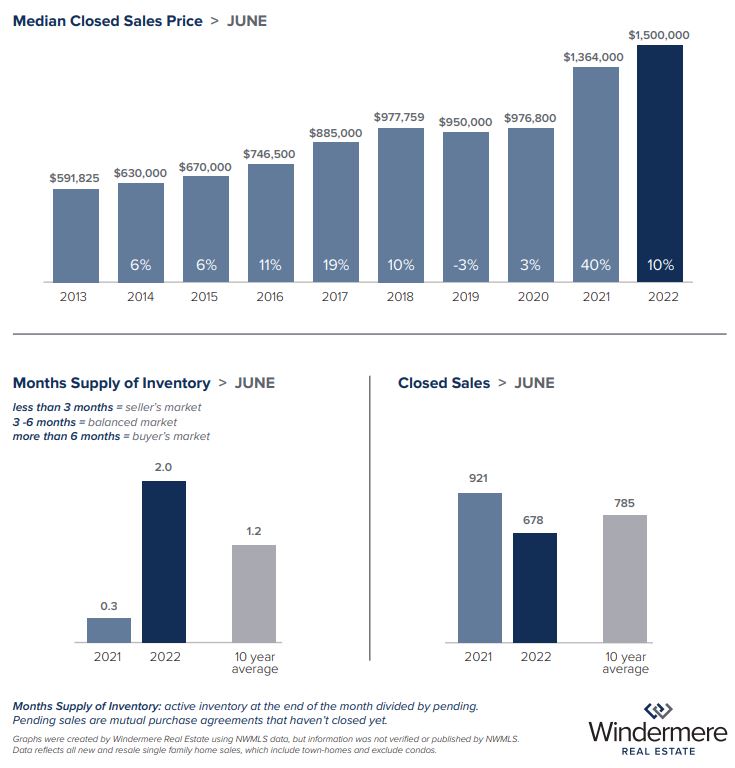

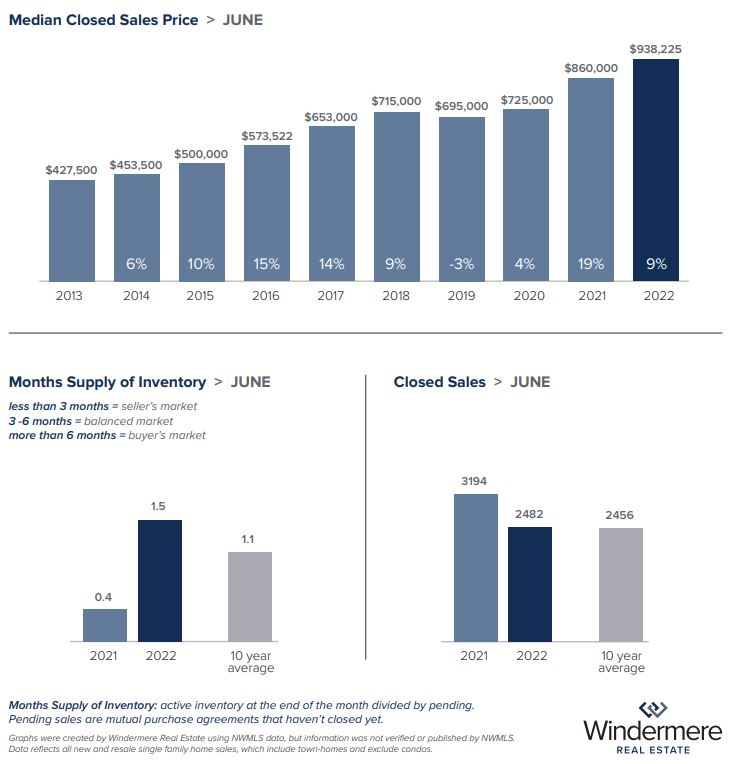

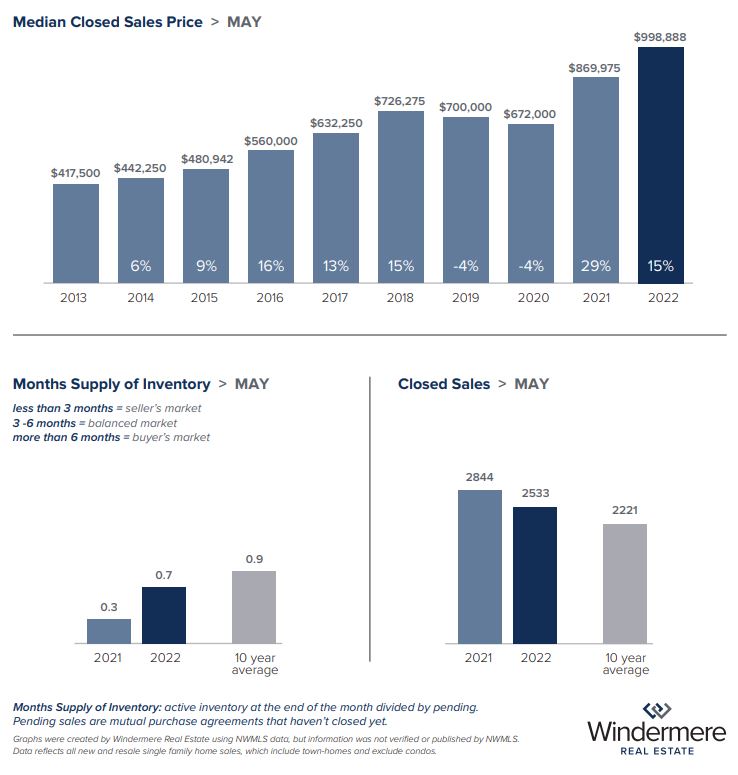

Area home prices were down across the board last month. The median sold price for King County single-family homes dropped to $938,225, slightly lower than May’s near million-dollar price ($998,888). Year-over-year, however, King County prices were still up by 9%, despite the higher 1.5 months of available inventory.

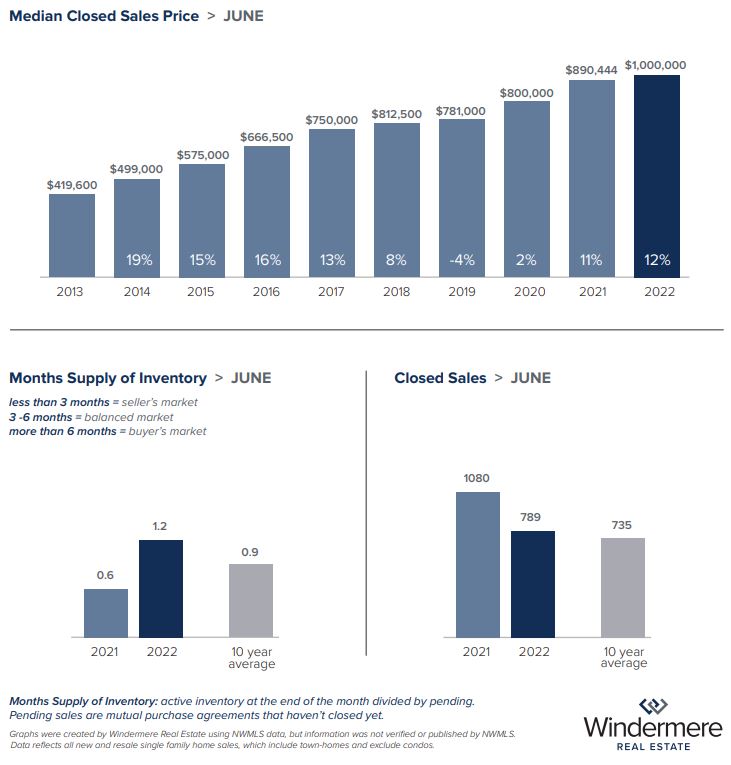

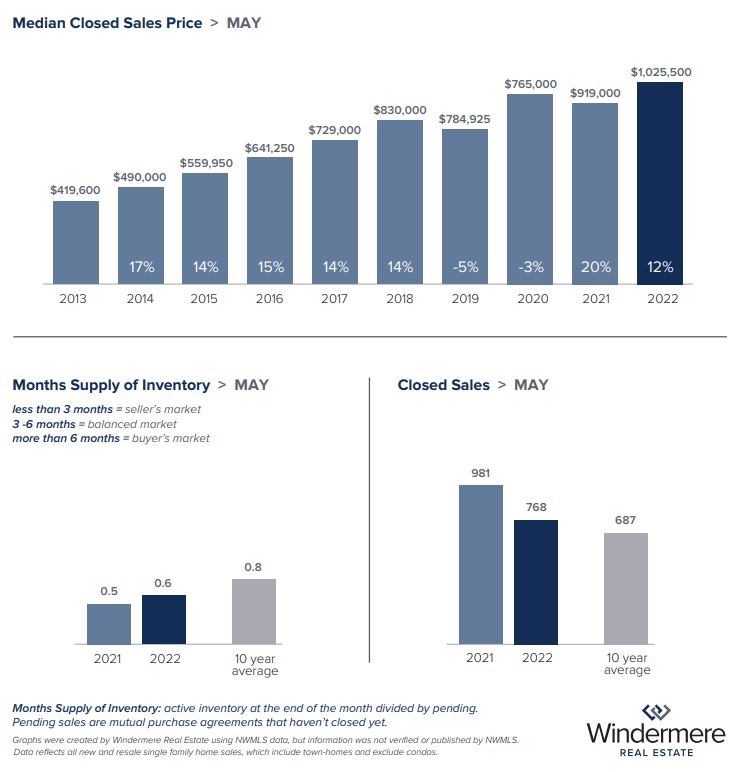

Seattle mirrored the county’s trend, with the median price dropping from $1,025,500 in May to an even $1,000,000 in June. This price was still up 12% year-over-year, indicating continued demand for housing in the city.

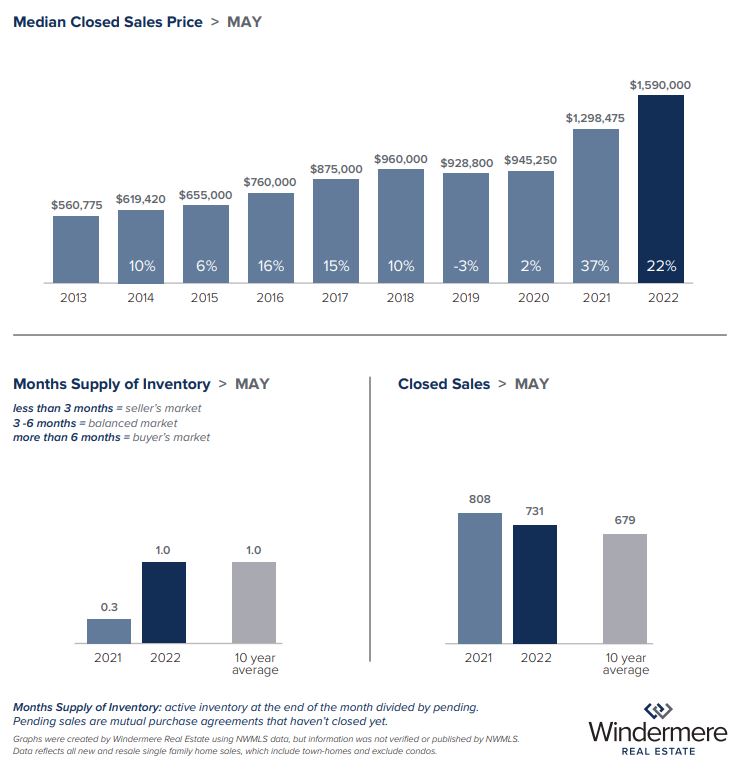

Real estate experts have pointed out that areas that saw the greatest appreciation earlier this year will likely see a more significant dip in prices as the market rebalances. The Eastside market bore out this theory in June as the median sold price for single-family homes was $1,500,000 — down almost $100k from May’s median price of $1,590,000. That said, last month’s Eastside median sold prices were still up over June 2021, increasing 10% year-over-year in the residential market and 12% in the condo market. And with two months’ supply of homes currently listed, Eastside buyers have significantly more options to choose from than they would have had earlier in the year.

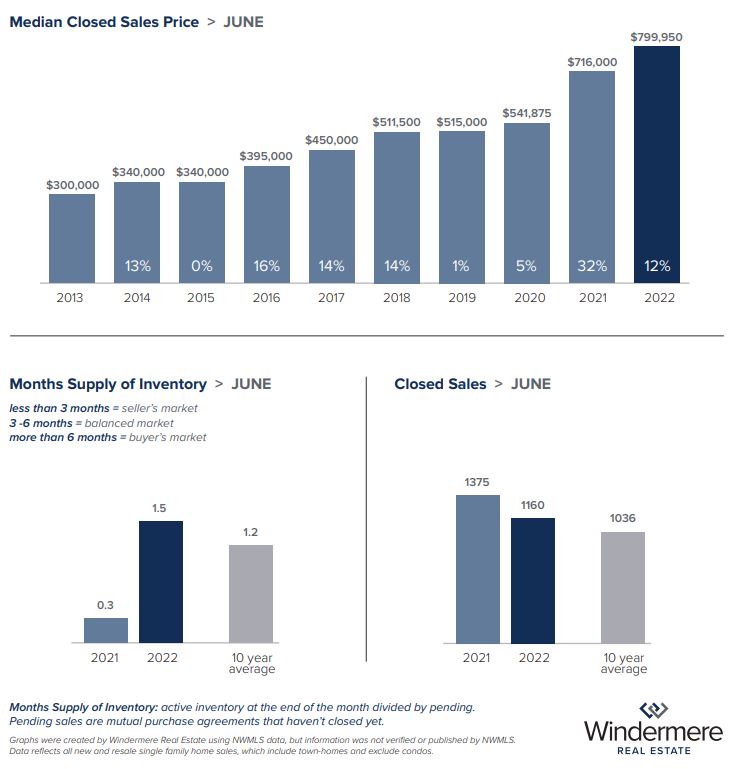

Snohomish County — long a refuge for buyers seeking more bang for their buck — followed a similar trend. The median sold price for single-family homes dropped to a more attainable $799,950, down from May but still up 11% year-over-year. Snohomish County condo prices dipped in June as well, with the median sold price of $500,000 down 9% from May and up a meager 1.6% from June of last year.

While these recent price dips may cause concern for some sellers, local real estate experts reiterate that this is a necessary step toward a more balanced market. “The increase in listings has started to slow the rapid pace of price gains that we’ve experienced,” said Matthew Gardner, Windermere’s Chief Economist. “This is a good thing, not a cause for concern.”

Other factors influencing the summer real estate market are higher mortgage rates, higher post-pandemic rates of travel, and typical seasonal buyer patterns. With graduations occurring and school years finishing up, many potential buyers are scratching their itch for travel and family time, putting off their home search until a little later in the year.

For sellers looking to make the most of the current market, flexibility is key. Pricing their home correctly from the get-go and being willing to negotiate with buyers on terms can still result in a top-of-market sale, albeit one in which multiple offers are less expected.

If you have questions about real estate opportunities in the current market, please reach out for additional insights and analysis. The Kari Haas Real Estate Team is here for you! “Let’s Sell Your House & Find Your Home!”

Eastside

King County

Seattle

Snohomish County

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

June 2022 Real Estate Market Update

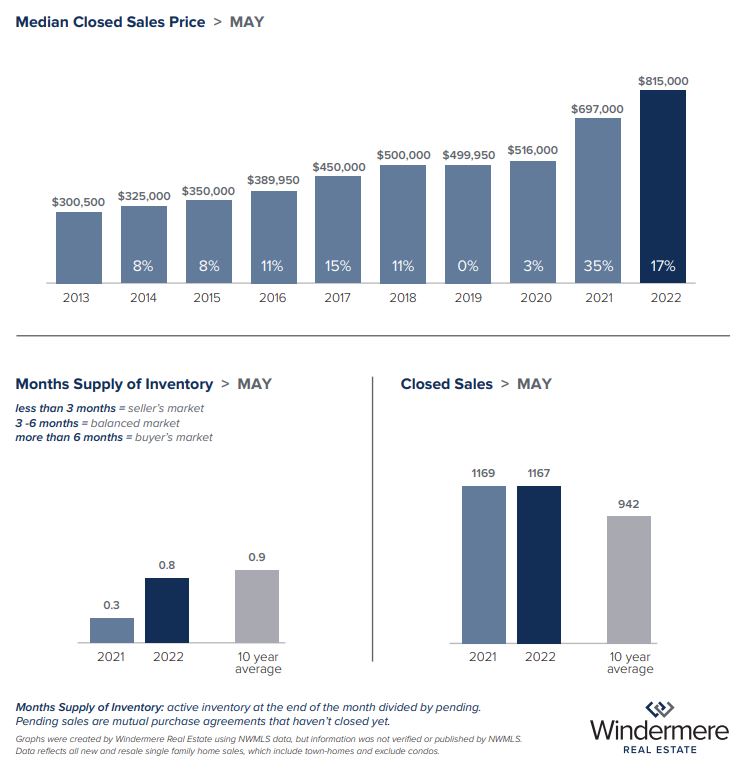

Windermere just released the market statistics from May, so let’s review what’s happening in the real estate market.

The tides of our local real estate market may, at last, be shifting, as buyers find relief in increasing inventory and the frenetic pace of sales slows noticeably. At the end of May, inventory across the 26 counties served by the Northwest MLS had increased by 59%, with 8,798 active listings in the database, compared to 5,533 active listings just a year ago. While this shift may cause concern from some who anticipate a drop in the market, Windermere’s Chief Economist Matthew Gardner had this to say: “What’s more likely to occur is that the additional supply will lead us toward a more balanced market, which after years of such lopsided conditions, is much needed.”

Are Price Hikes Slowing?

While inventory has increased, the meteoric price hikes seen in this first part of 2022 – including again in May’s closed sales – are expected to slow dramatically in the next half of the year. Seattle saw a historic first in April, with the median sold price for a single-family home topping $1 million for the first time. May home sales continued that trend, with the median sold price inching up to $1,025,500, which is a 12% increase from $919,000 in May 2021. King County as a whole mirrored this trend, with the median price of single-family homes reaching $998,888 in May, up from $995,000 in April, and up 14.8% from last May’s median price of $869,975.

Eastside & Snohomish Markets Cool

May closings reveal that the Eastside and Snohomish County didn’t follow this same pattern, instead experiencing a much-needed cooling of prices. On the Eastside, the median sold price for single-family homes fell from $1,722,500 in April to $1,590,000 in May. While last month’s median price is the lowest since January of this year, it was still up 22% year-over-year. The Eastside saw an increase in the percentage of homes that had a price change before selling, hitting 10% in May — double that of April. This is likely due to Eastside sellers needing to adjust their price expectations. While a majority of listings in the area — about 66% — still sold over list price last month, a full month of inventory and a 403% increase in active inventory on the Eastside from February to May means that buyers have more choice and agency than they’ve had in some time. Homes are still selling, but multiple offers are far fewer, and sellers are more likely than before to accept an offer written with contingencies.

Snohomish County also saw a shift in May, likely due to the combination of increasing inventory running headfirst into decreasing buyer budgets thanks to rising mortgage rates. With .85 months of inventory, prices reflected this, with the median sold price for single-family homes falling slightly to $815,000 last month, down from $839,298 in April. However, most homes sold for over list price and quite quickly, averaging less than two weeks on the market. It’s worth noting that these statistics largely reflect home sales that went under contract in prior months when the competition was at its fiercest. The median sold price for Snohomish County condos dropped just slightly to $545,000 last month, down from $550,000 in April. With only two weeks of inventory on hand, the county’s condo market is likely to remain competitive for a while.

A Chance for Buyers

Falling prices in the Puget Sound region may have caused concern for some, but most analysts see this as a necessary and long-overdue price correction. Prices for single-family homes (excluding condos) in King County rose from $775,000 in January to a whopping $995,000 in April, a change of $220,000 in only four months, or 28.4%. Last month, the Eastside saw prices decrease by only 8%, and this was likely only because prices had previously risen so astronomically in the area. Neighborhoods that saw the highest appreciation will likely experience a sharper correction, but this may serve to help some previously unlucky buyers re-enter the market and finally find success.

If you have questions about pricing trends in your neighborhood, or how to make the most of your purchase or sale, please reach out!

Seattle

Eastside

VIEW FULL EASTSIDE REPORT HERE

King County

VIEW FULL KING COUNTY REPORT HERE

Snohomish County

VIEW FULL SNOHOMISH COUNTY REPORT HERE

This post originally appeared on GetTheWReport.com

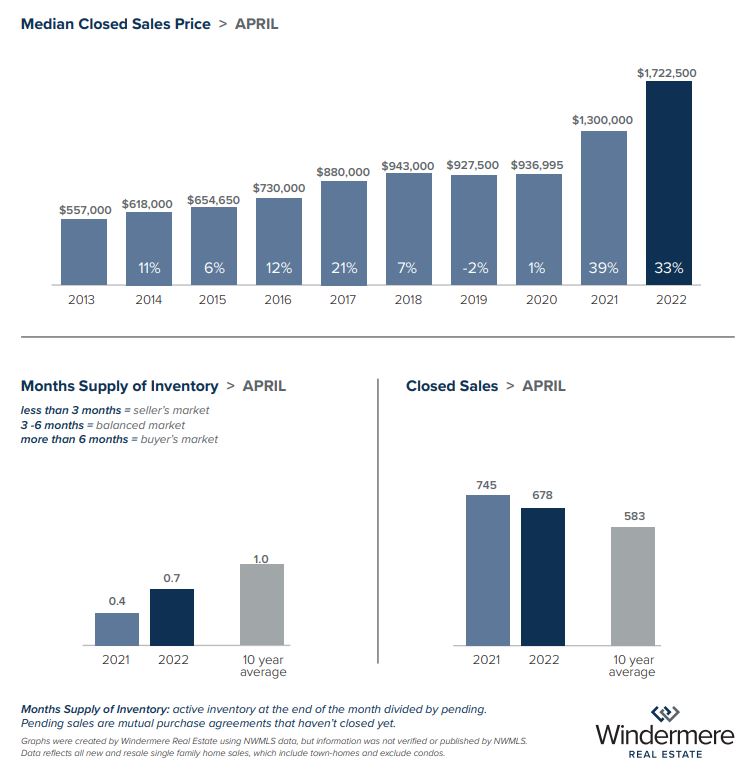

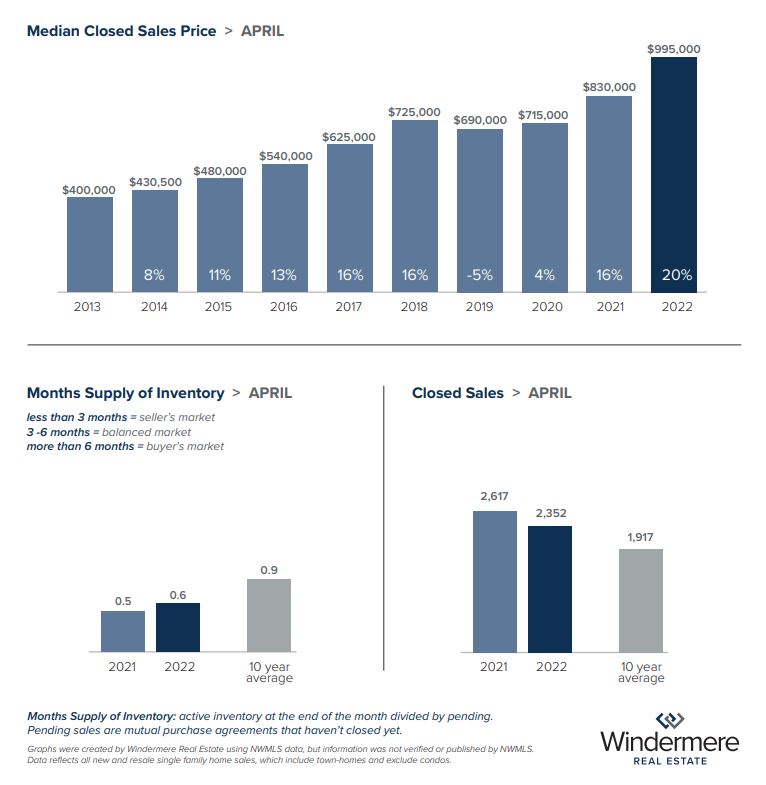

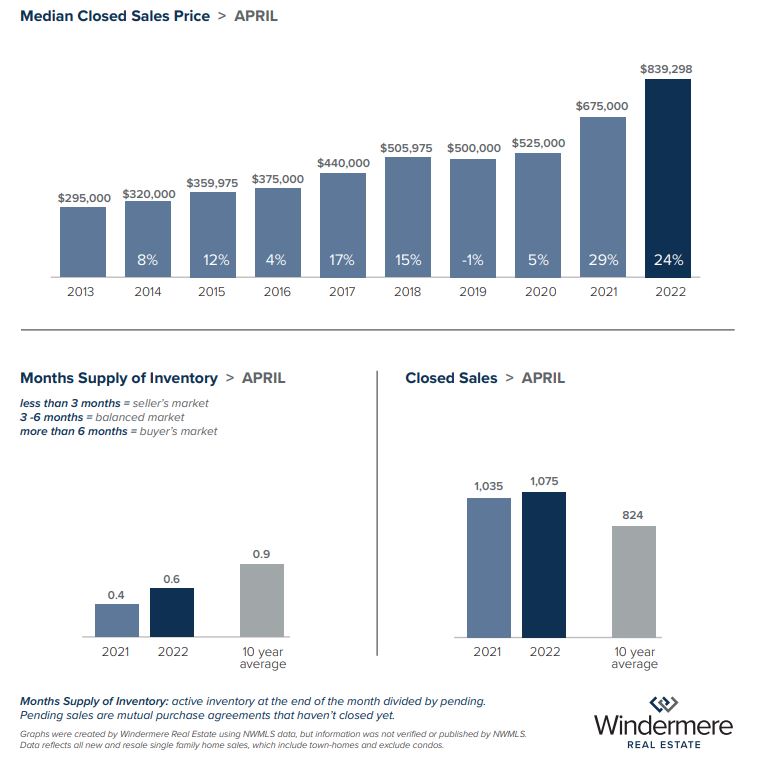

May 2022 Real Estate Market Update

After a long stint of suppressed housing inventory across our region, buyers may, at last, have more options as the supply of available homes ticks up ahead of the summer market. The month-over-month increase in inventory has been as much as 50% in some areas, offering renewed opportunities for those buyers who are not dissuaded by high home prices and rising mortgage rates.

The Eastside appears to have experienced the most dramatic inventory growth, with .79 months of available single-family homes last month compared to .46 in March. Seattle increased slightly to .59 months of inventory, while Snohomish also had a notable increase up to .67 months of inventory compared to .46 in March.

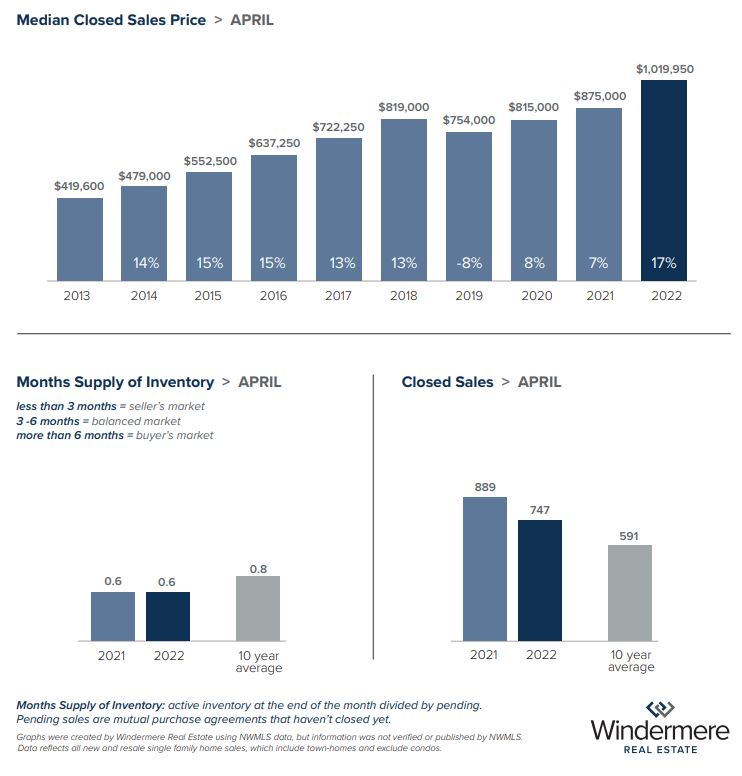

The increase in supply is likely occurring because rising home prices and mortgage rates have put a slight damper on sales in the area. Last month, the median sold price for a single-family home in Seattle surpassed $1 million for the first time—landing at a historic $1,019,950. This is up 16.6% year-over-year from $875,000 in April 2021. The median price for single-family homes on the Eastside last month was an eye-watering $1,722,500, with 80% of homes selling over list price. Although inventory has increased in the area, Eastside homes are still selling quickly, with 96% of listings selling in under two weeks. King County as a whole also saw prices increase, with the median sold price for single-family homes reaching $995,000, up from $830,000 a year ago.

Snohomish County home prices have kept pace with the market, with the median sold price for a single-family home reaching $839,298. That’s an increase of 24.3% year-over-year from $675,000 in April 2021. This is likely due to increased demand from buyers who can’t compete in the intense Seattle and Eastside market, seeking more bang for their buck in the relatively more affordable Snohomish County market.

Affordability issues have also trickled into the condominium market, as some prospective homebuyers divert from the single-family market to condos. Eastside condo prices have increased 29.7% year-over-year to $674,444 last month from $520,000 in April 2021. In Snohomish County, the median sold price for condos rose to $550,000 year-over-year from $432,250 last year. That’s an increase of 27.2%.

Despite rising home prices and heftier mortgage rates, many buyers are still eager to take advantage of the financial benefits of homeownership. According to Windermere’s Chief Economist, Matthew Gardner, “Owning real estate is a hedge against rising inflation. Homeowners with a fixed-rate mortgage will always have the same monthly payment, even as other costs rise.”

If you have questions about how to find the opportunities presented by today’s market, please don’t hesitate to contact me.

Seattle

Eastside

King County

Snohomish County

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Mid-Century Charmer with City View on Mercer Island

This charming mid-century modern Mercer Island home is ideally located and awaiting a visionary to make it theirs!

Upon entry, you are greeted by the soaring tongue and groove cedar-lined ceilings and the large windows that grace the living room. The large windows offer a peek through the trees at Lake Washington and a view of downtown Bellevue. This quiet scenic neighborhood has everything to offer including a neighborhood path down to the Mercerwood Shore Club with access to Lake Washington.

The light and bright living room and dining room give this house a warm and welcoming atmosphere.  The focus of the living spaces is oriented around the stunning natural stone fireplace. The dining room also features convenient wood built-ins and a sliding glass door that leads outside to the private flagstone patio.

The focus of the living spaces is oriented around the stunning natural stone fireplace. The dining room also features convenient wood built-ins and a sliding glass door that leads outside to the private flagstone patio.

This home has wonderful mid-century modern vibes and would be a spectacular home and/or project. The eat-in kitchen and bathrooms offer a step back in time, with original tiles and cabinetry. The kitchen has a stunning brick wall feature and another door to the secluded back patio. This house is a charming blast from the past, live in or remodel to your taste!

In the west wing of the home, there are 2 spacious bedrooms, a full bath, and a king-sized primary suite with an attached ¾ bath.

On the lower level, there is a rec room with a brick fireplace and views from the large windows, another bedroom that would make a great guest bedroom or office, a half bathroom, a designated laundry room, and access to the huge 2-car garage with a workshop area.

Mercer Island is a highly sought-after neighborhood with the best school district in King County. Easy access to Mercerwood Shore Club, shops, services, and all this wonderful Pacific Northwest Island has to offer. Minutes to Seattle or Bellevue, this is an ideal place to be!

Highlights:

- 4 bed / 2.25 bath / 2,540 sq. ft. / 8,265 sq. ft. lot

- Built in 1956

- Vaulted tongue and groove cedar-lined ceilings

- Beautiful views of downtown Bellevue and more!

- Main level primary suite

- #1 school district in King County

- 2 car garage with shop

Listed at $1,700,000

MLS # 1925455

Mid-Century Charmer with City View on Mercer Island – view the listing here

Have any questions or want a tour? Give me a call! 206-719-2224

April 2022 Real Estate Market Update

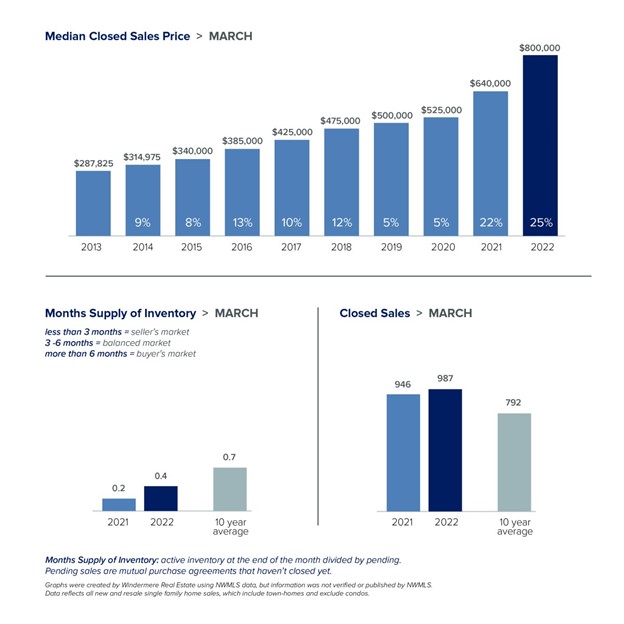

The spring market continues its frenzied pace, with soaring prices and stiff competition testing the resolve of buyers. Despite these obstacles and rising mortgage rates, inventory remains low across King County, as pending sales keep pace with new listings, demonstrating a strong demand from buyers. Continue reading for the April 2022 real estate market update.

Buyer Demand

This demand has factored into the way sellers are approaching the market. Windermere’s Chief Economist Matthew Gardner notes that median listing prices continue to rise, saying “this suggests that sellers remain quite bullish when it comes to pricing their homes.”

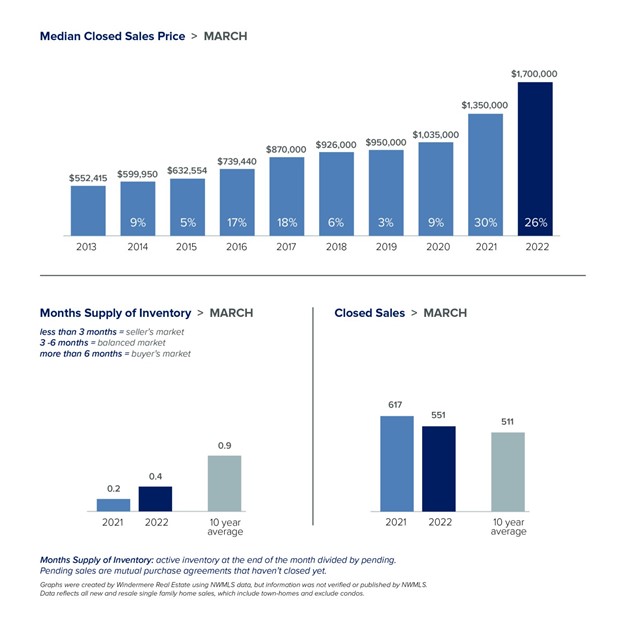

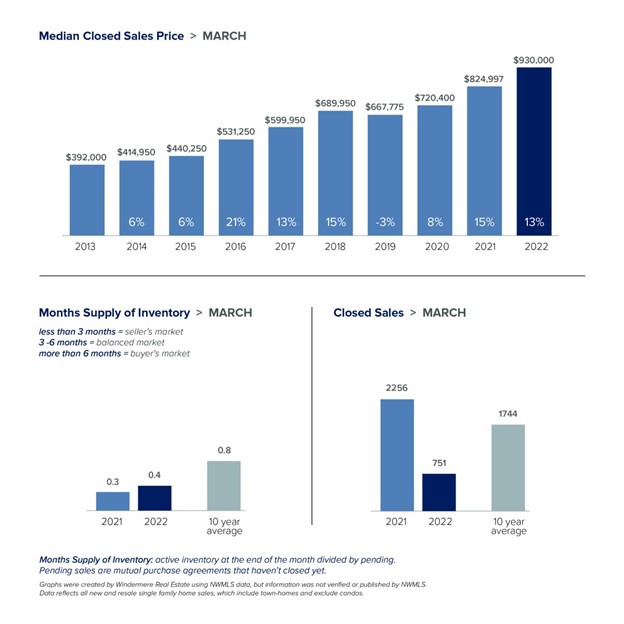

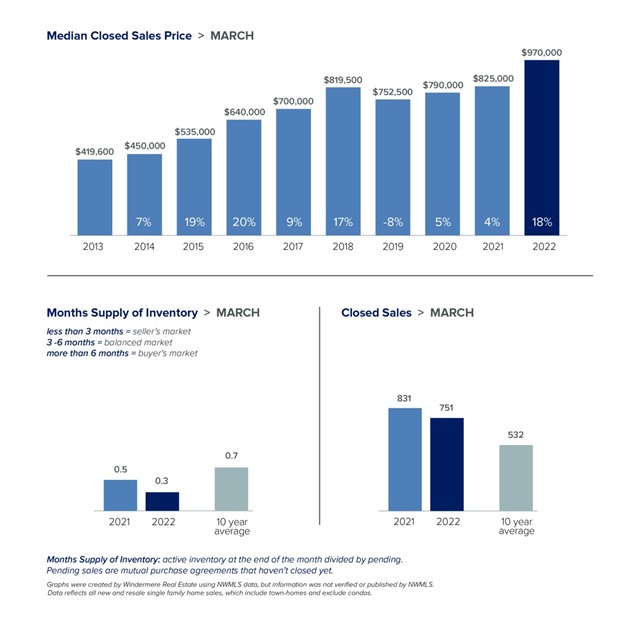

This was certainly true in March on the Eastside, where the median closed sale price for single-family homes was $1,700,000, an all-time high. This was up 26% year-over-year, and slightly up from February, when the median was $1,697,500. In Seattle, the median price for single-family homes achieved an all-time high of $970,000, up 18% year-over-year. Snohomish County continues to feel the impact of this voracious demand, with a median closed sale price of $1,298,000 for single-family homes — that’s an increase of 38.1% year-over-year.

Selling Over List Price

Not only are asking prices increasing across the region, but many homes are selling for well over the list price. On the Eastside, a staggering 85% of closed sales in March 2022 sold for more than the list price. Overall, that’s down from an all-time record last month of 87% but tied for the second-highest month ever with April 2021. Of the Eastside homes that sold over asking last month, the median difference was 21% over asking, and they spent an average of just 4 days on the market.

Seattle is experiencing a similar pattern, with 71% of the closed sales in March going over the list price. This is high for Seattle; in March and April of 2018, 63% and 68% of listings closed over asking, respectively. Last month, the Seattle listings that sold over the list price sold for a median of 15% over the list price, and were on the market for 5 days.

In Snohomish County, homes that sold over list price went for a median of 21% over the asking price.

With these conditions, many buyers are looking to condos as a more affordable way to break into the market. Consequently, condo prices have also seen a year-over-year increase. In King County, condos remain relatively more affordable, with a median price of $540,000 in March 2022. That’s up from $470,000 in March 2021, a 14.9% increase. Snohomish County has seen a more dramatic increase, as the median condo price in March 2022 was $555,000 — up 33.1% year-over-year, from $417,000 in March 2021.

Expectations

Matthew Gardner expects mortgage rates to continue trending higher in the coming months, but so far he says there’s nothing to be too concerned about, as the interest rates have not yet caused sales to taper off. Savvy sellers can still easily benefit from the opportunities presented by this market, and although rates are higher, buyers can finance their home purchase with rates still far lower than the historical norm.

If you’re looking for knowledgeable advice as you consider when might be your best time to enter the market, whether as a buyer or a seller, please give me a call or text. We are here to give you professional insight to help you make the best decisions possible.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

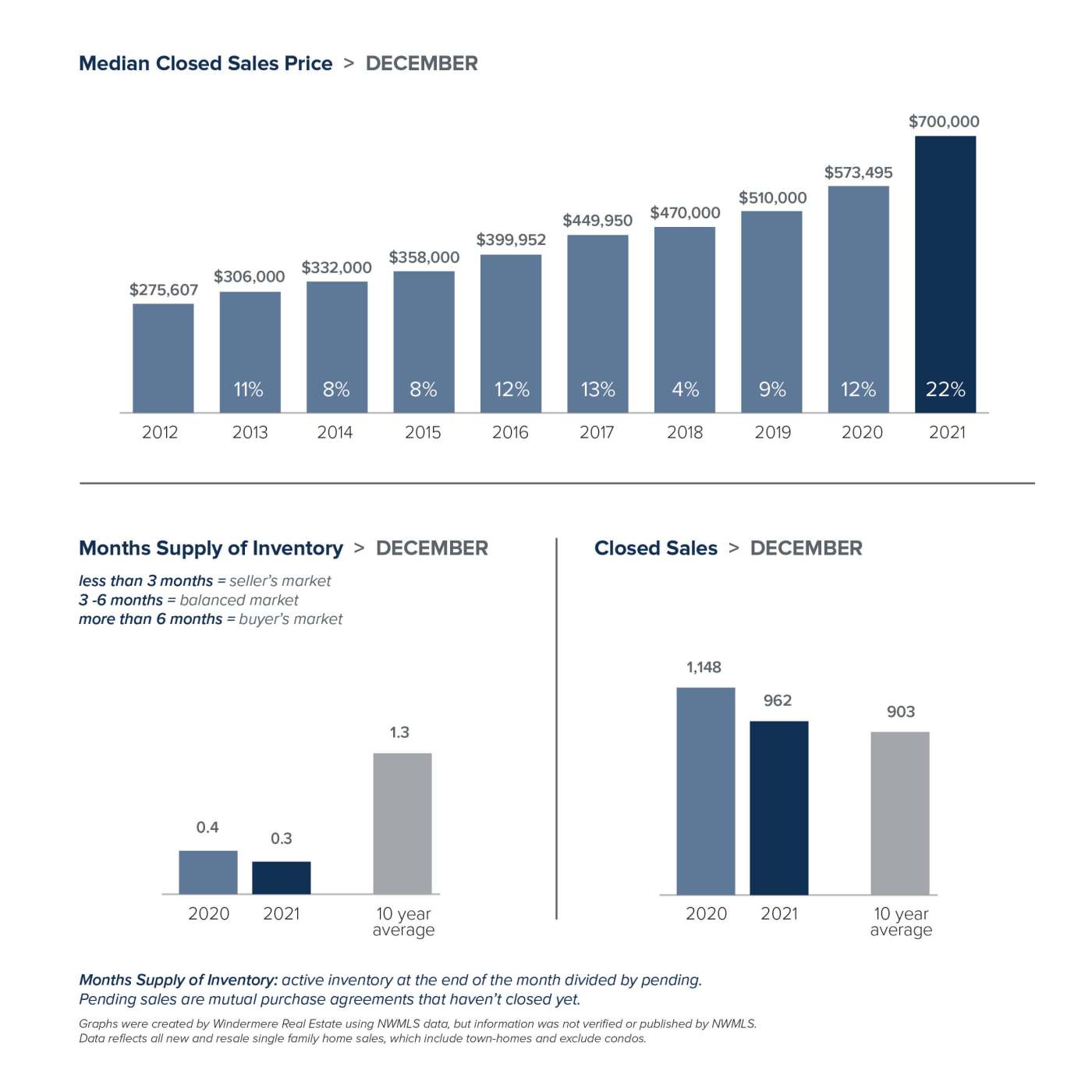

January 2021 Real Estate Market Update

What’s Happening in the Market

In this January 2021 real estate update we see record-low temperatures combined with record-low inventory put a chill on housing activity in December. With very few homes available to buy, sales were down. Lack of supply and high demand continued to push prices up. Since the winter months historically bring the smallest number of new listings, buyers should not expect relief anytime soon.

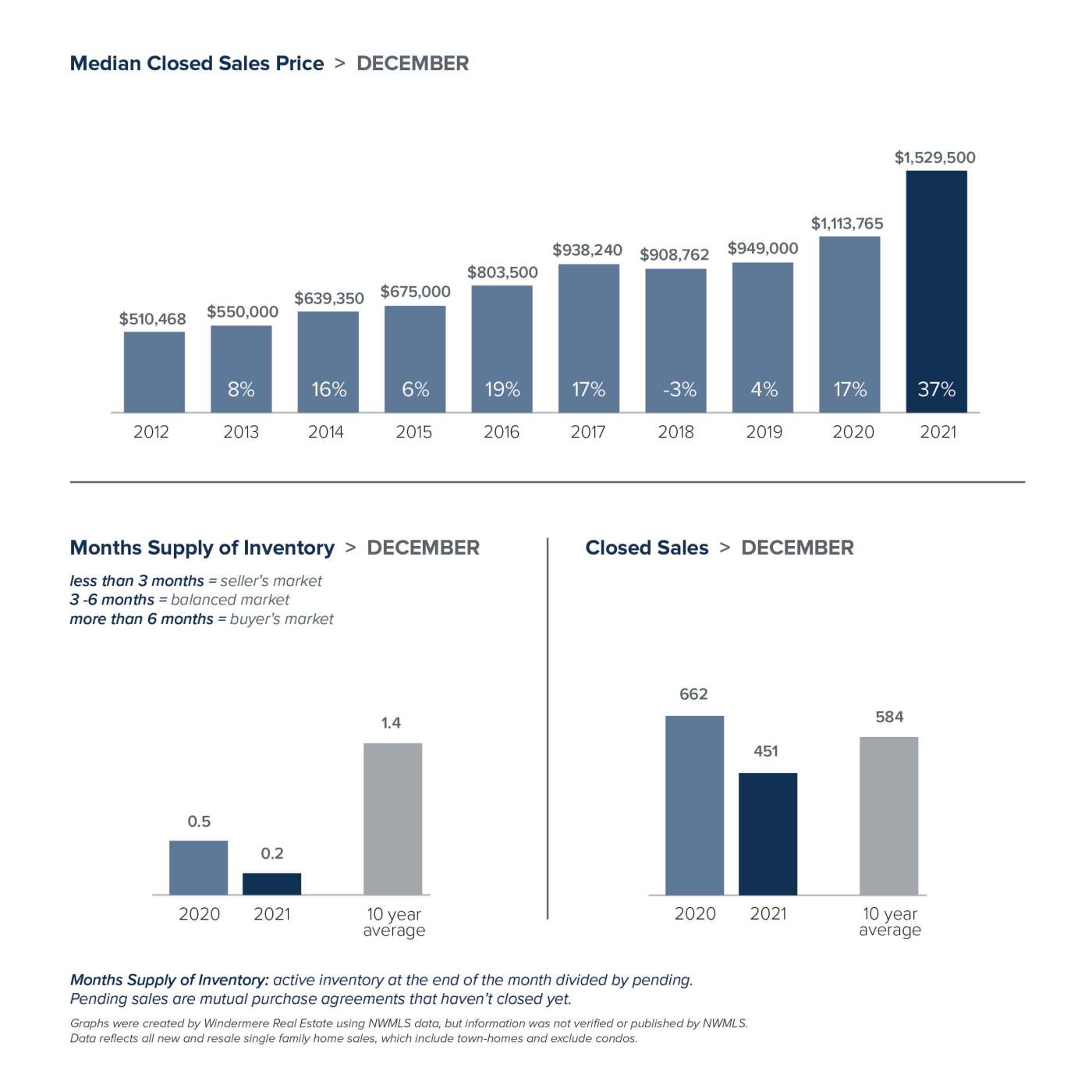

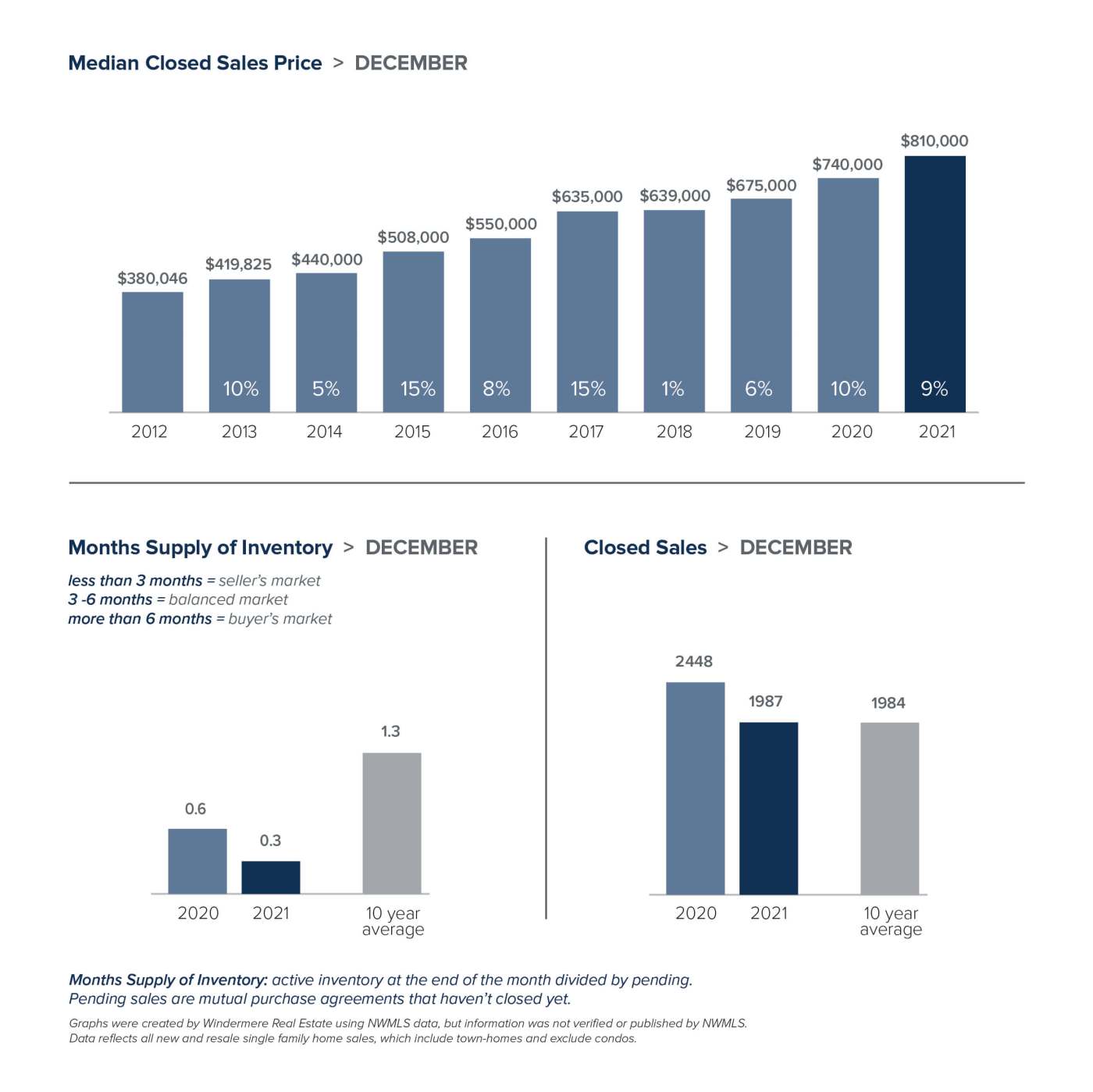

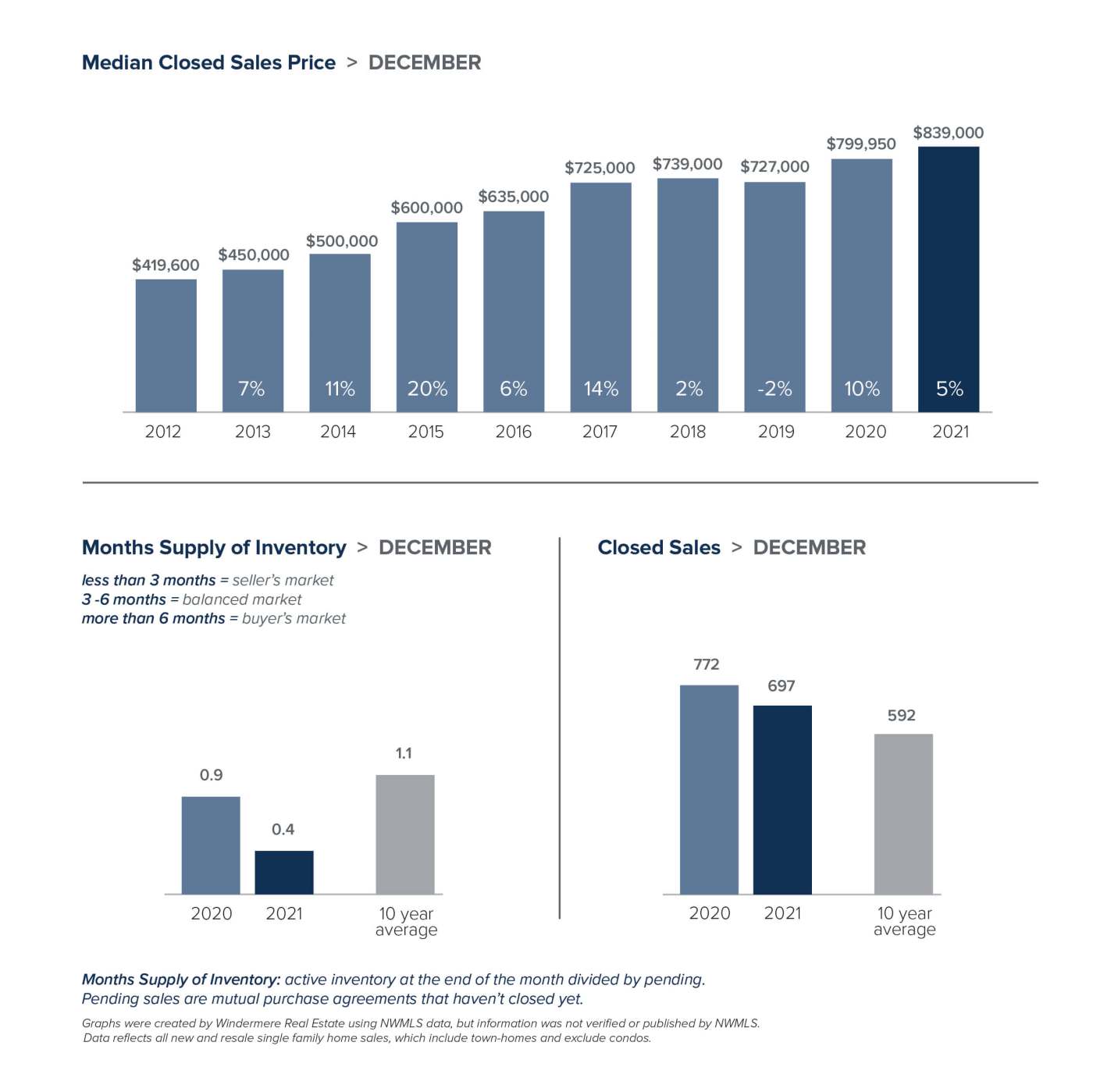

December Results

While up from a year ago, home prices in general were relatively flat from November to December. In King County, the median single-family home price rose 9% from last December to $810,000. Despite high demand and low inventory, prices in Seattle continue to level off. While down slightly from November, the median price increased a modest 5% over a year ago to $839,000. The Eastside was again the outlier. After breaking price records in October and November, home prices soared 37% year-over-year to set yet another all-time high of $1,529,500 in December. That represents a 7% increase from November. In further evidence of just how hot the Eastside market is, 75% of the properties there sold for over list price. Prices in Snohomish County continued to inch closer to King County. The median home price there jumped 22% to $700,000.

The driving force affecting affordability is lack of inventory. In both Snohomish and King counties it would take less than a week to sell the homes that are currently on the market. At the end of December, Snohomish County has just 210 single-family homes for sale in the entire county. Seattle had only 167 homes for sale; the Eastside just 55. That represented 70% less inventory for both Seattle and the Eastside as compared to a year ago. To give some historical perspective, the ten-year average inventory for the end of December is 545 homes in Seattle and 743 homes on the Eastside.

Matthew Gardner, Chief Economist at Windermere, registered his concern. “The Puget Sound region is in dire need of more housing units which would function to slow price growth of the area’s existing housing,” he said. “However, costs continue to limit building activity, and that is unlikely to change significantly this year.”

The demand side of the equation isn’t expected to wane any time soon either. With millions of square feet of new office space and new light rail developments in the works, the area continues to be a draw for employers – and more potential homebuyers.

2022 Predictions

What’s ahead for 2022? Matthew Gardner expects the market to continue to be strong, but believes the pace of appreciation will slow significantly from this year. “I predict single family prices will increase by around 8% in King and Snohomish counties. Affordability issues and modestly rising interest rates will take some of the steam out of the market in 2022.”

From working remotely to finally retiring, life events often trigger housing decisions. If you find yourself looking to buy or sell a property, we’re here to help.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

Check back next month for a new local market update.

Connect With Us On:

Instagram!

Facebook!

YouTube

This post originally appeared on GetTheWReport.com.

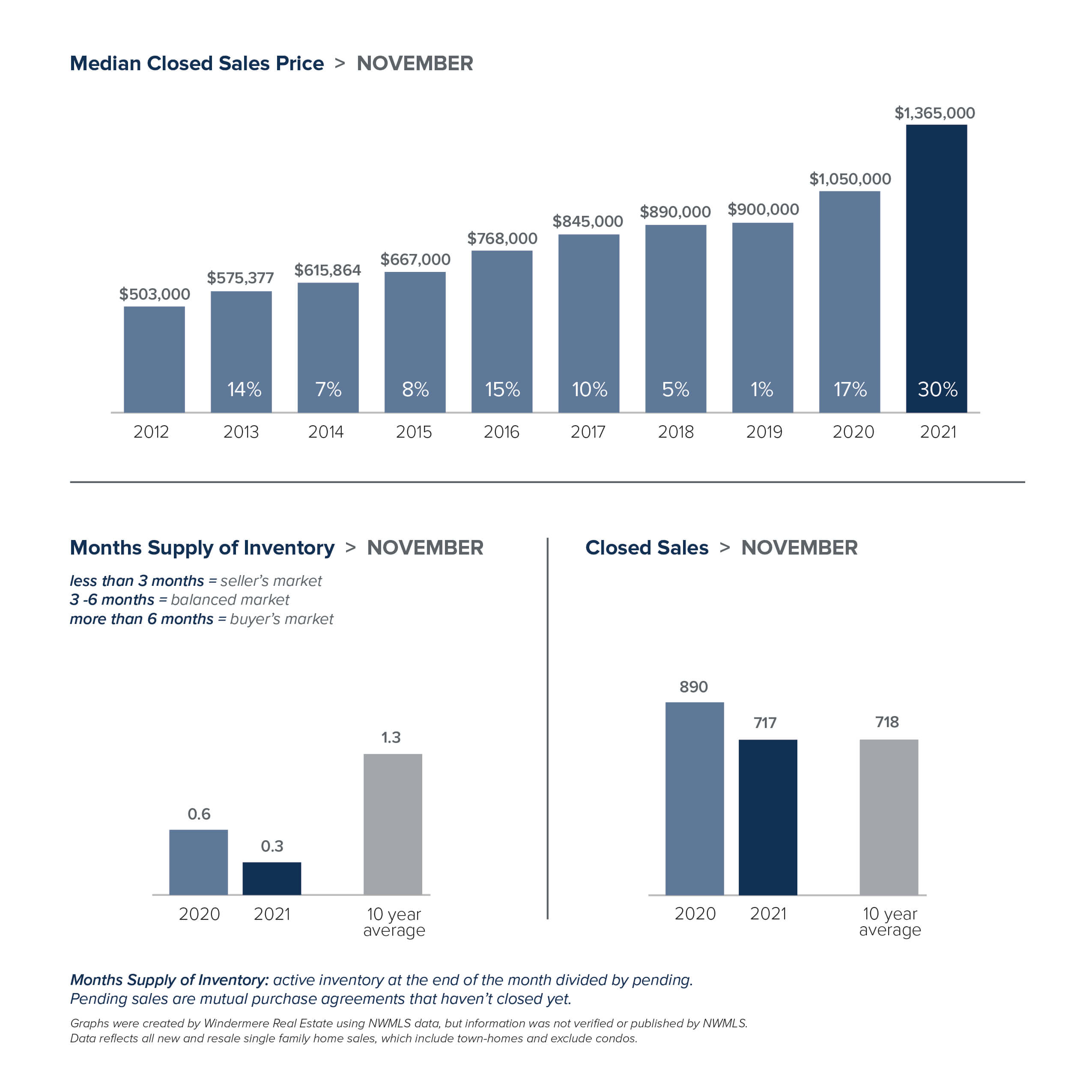

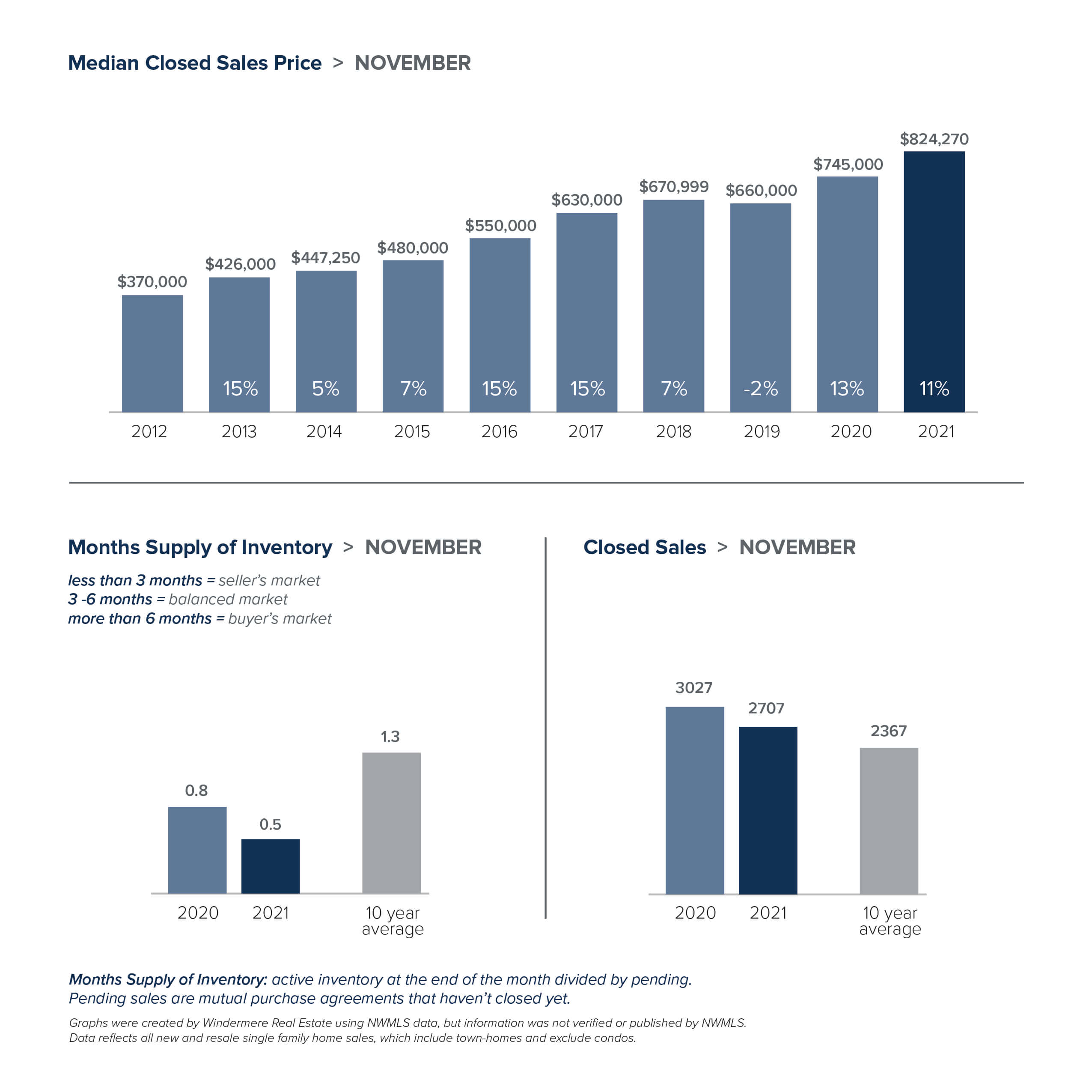

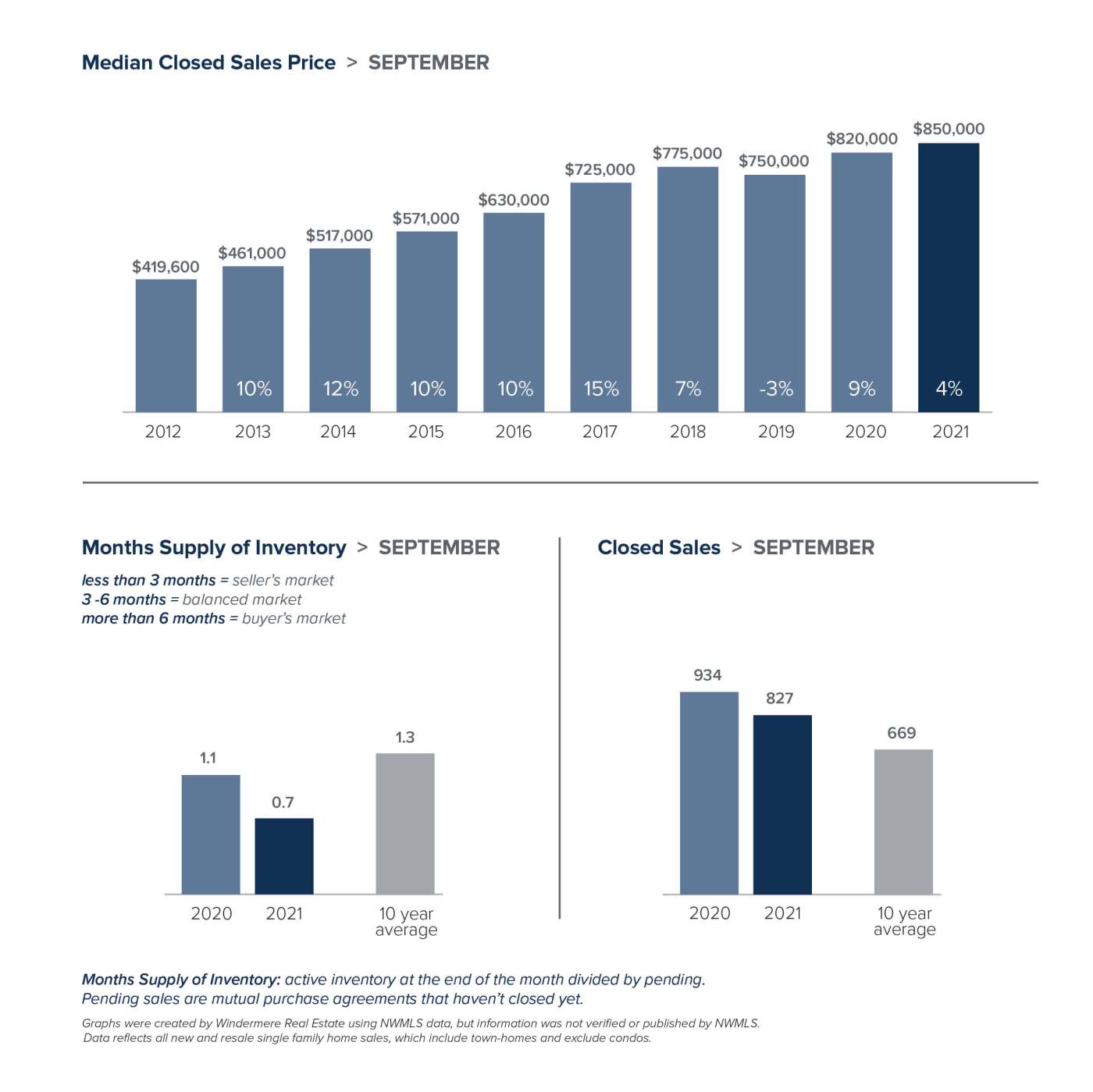

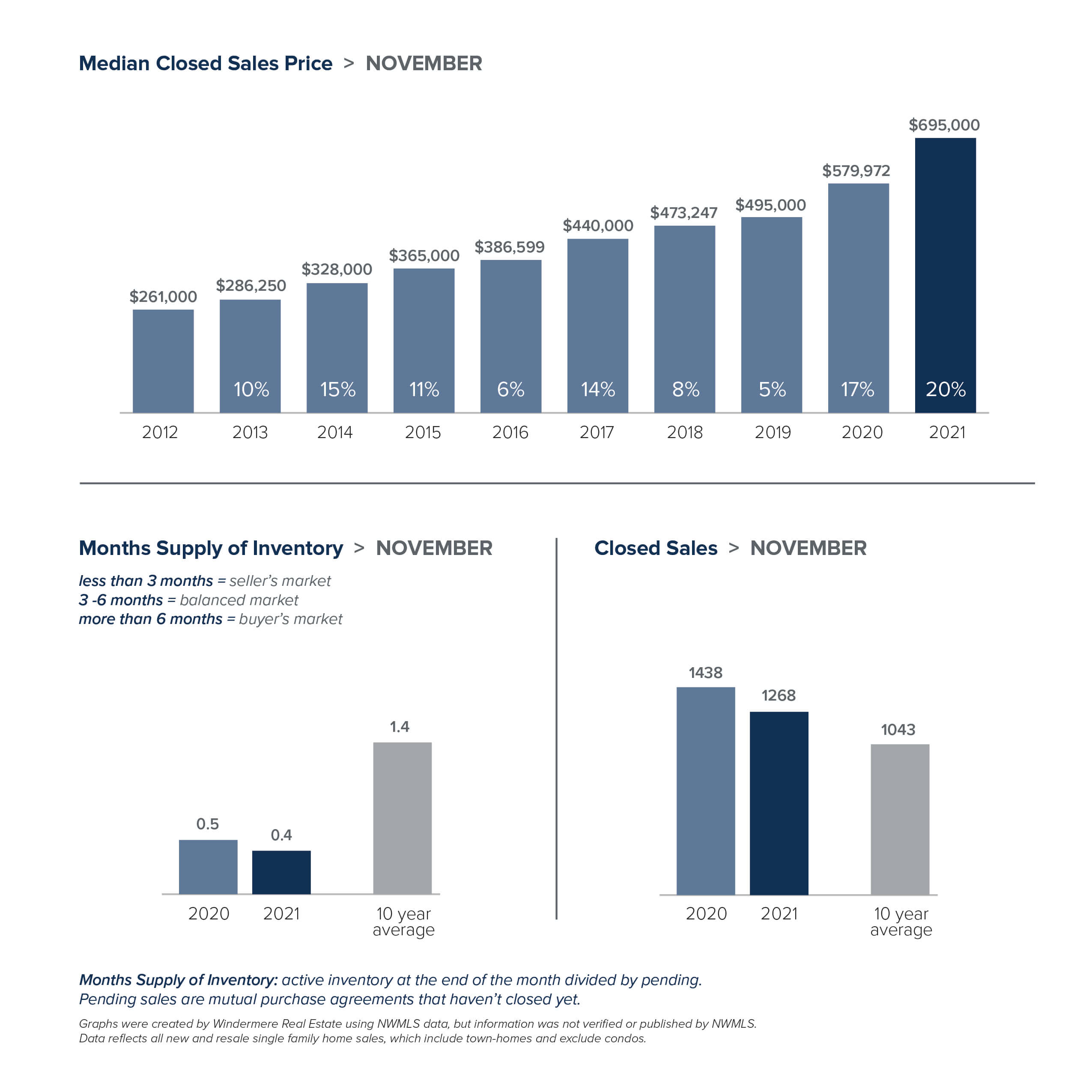

November 2021 Real Estate Market Update

What’s Happening in the Market

As we head towards the end of the year, the housing market traditionally slows down. As a matter of fact, this year’s activity was even slower than normal, with record-low inventory and correspondingly fewer sales. What’s happening in the market now? At this point, prices aren’t appreciating at the pace they were in the spring, but they continue up as compared to a year ago. While potential home sellers usually wait until after the holiday season to list their homes, those who opt to put their home on the market now can count on strong buyer interest.

With the number of buyers far outstripping supply, inventory is at historic lows. King County as a whole has less than two weeks of inventory. The supply of homes is especially strained on the Eastside where there was just one week of inventory at the end of October – 61% fewer homes were on the market than the same time last year. Snohomish County is starved for supply as well, with just over one week of inventory. The entire county had just 492 single-family homes for sale at the end of October.

Strong buyer demand has kept prices steady, and most areas saw home prices increase from a year ago but remain fairly flat over the past few months. The median price of a single-family home in King County rose 11% from twelve months ago, increasing from $745,000 to $824,270. Within the county, the Eastside experienced the greatest gain. Home prices soared 30% to $1,365,000, inching above the previous all-time high of $1,364,000 set in June of this year. Prices in Seattle registered the smallest gain at 6%, up from $800,000 a year ago to $850,000.

Homes that sold in the North, Southeast, and Southwest parts of the county saw price gains ranging from 16% to 20%. Buyers may find some relief with condominiums. The median price of a condo in King County was $459,970, an increase of 3% from the prior year. Tight inventory kept prices strong in Snohomish County. The median price of a single-family home jumped 20% in October to $695,000. Like most of King County, home prices in Snohomish County have been fairly flat over the past few months.

Have home prices plateaued? Will strong buyer demand continue? After all, the real estate market can change quickly, so whether you’re looking to buy or sell, your broker can provide you with the most current data so you can make the best decision for your situation. Let us know how we can help.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

Check back next month for a new local market update.

Connect With Us On:

Instagram!

Facebook!

YouTube

This post originally appeared on GetTheWReport.com.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link