As the weather warms, so too does our real estate market, it seems. With dwindling inventory and climbing prices, the housing market is on an upswing, even if it’s a small one. This places sellers back in the driver’s seat, with buyers forced to compete against multiple offers and in the face of higher interest rates than last spring.

The evidence for the market’s positive growth can be found in higher median closed sales prices, an increased percentage of multiple offers, and a higher median percentage paid above the original asking price. At this point, the primary constraint on the market is a lower number of active listings. Many sellers are reluctant to part with their historically low-interest rates from the pandemic years, and with volatile interest rates, it’s an understandable predicament.

The lower number of available homes on the market has contributed to rising prices as buyers compete for a limited pool of properties. This trend often leads to multiple offers and bidding wars, further increasing prices.

For those buyers who do decide to jump into the fray, interest rates remain a key factor in determining their buying power. For the last few months, activity in the market has ticked up when rates dip, but some buyers are willing to face higher interest rates with the plan of refinancing when rates settle.

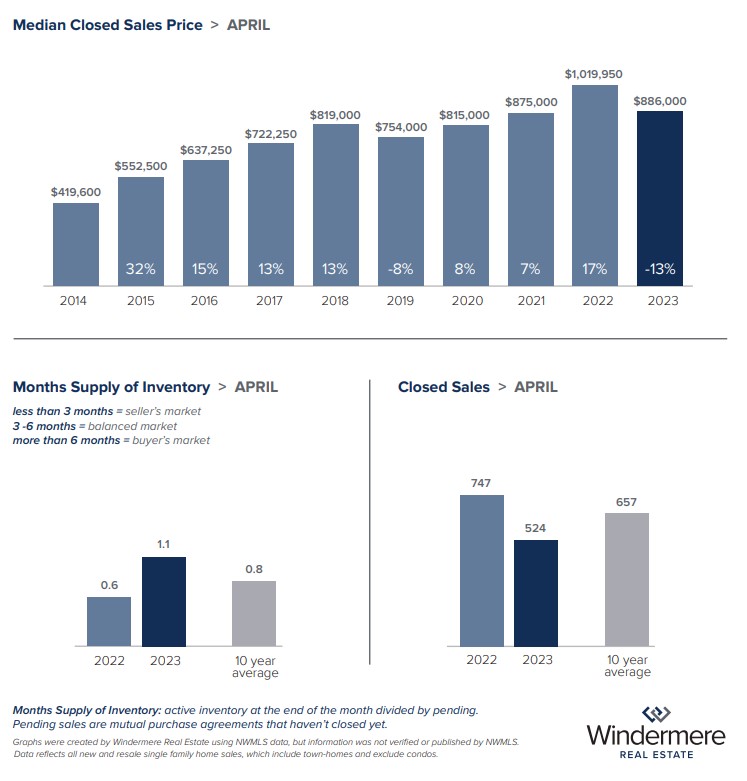

Even with that in mind, interest rates can have a huge impact on a buyer’s price bracket. For example, the median Seattle home price has declined by about 13% ($133,950) year-over-year. However, the increase in interest rates has offset this reduction. As a result, the median monthly mortgage payment remains around $5,507, which is comparable to the payment amount from a year ago — despite a lower median sold price.

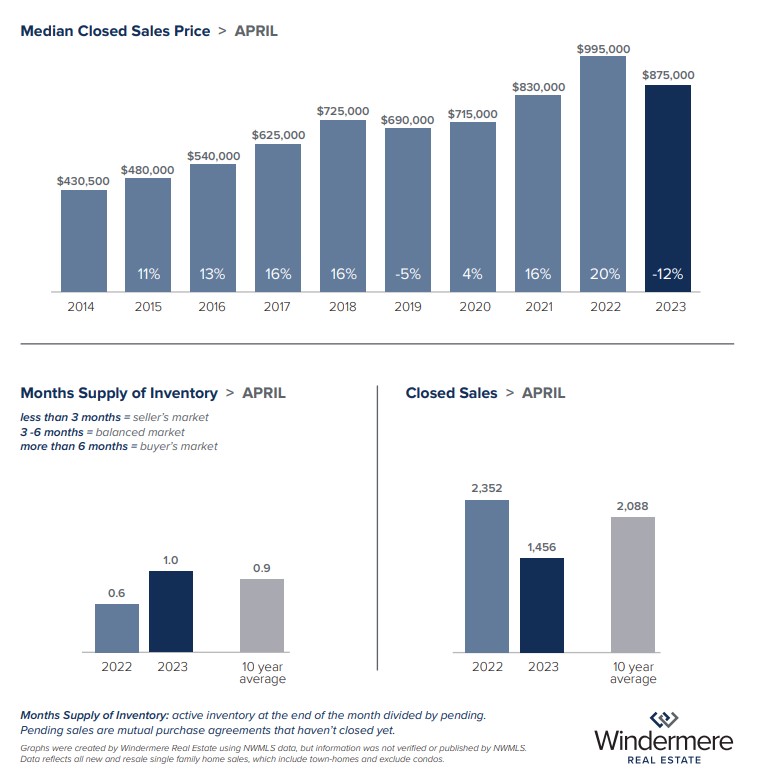

Although home prices in our region may be lower year-over-year, prices have generally been increasing each month this year. In King County, April’s median single-family home price was $875,000. That’s down 12.6% from last April’s $995,000 but up from a median of $840,000 in March. A single month of available inventory means competition for homes is tight throughout the county.

In Seattle, April’s median price for a single-family home was $886,000 — down quite a bit from the same month last year, when the median price was $1,019,950. However, prices were up from a median of $869,975 in March, and a low inventory of just over a month’s supply means demand is still high, and prices are likely to keep inching upward. Condo prices in the city were actually up year-over-year, with a median sold price of $539,000 in April, compared to $512,500 in April 2022.

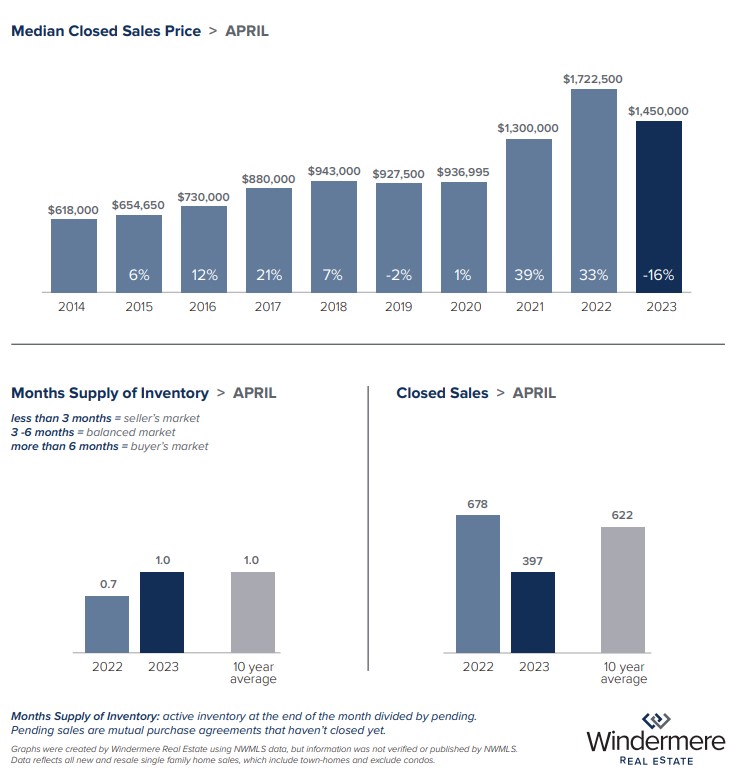

The Eastside also saw month-over-month price growth in April, with the median price for a single-family home landing at $1,450,000. This is up from $1,411,500 in March. Despite a 15% decrease in year-over-year prices, the current monthly price growth trend is notable. It’s likely we will not see the exponential price increases of the pandemic again anytime soon, making slow, steady growth the norm once again. The Eastside also has about one month of inventory for single-family homes, making it once again a competitive market.

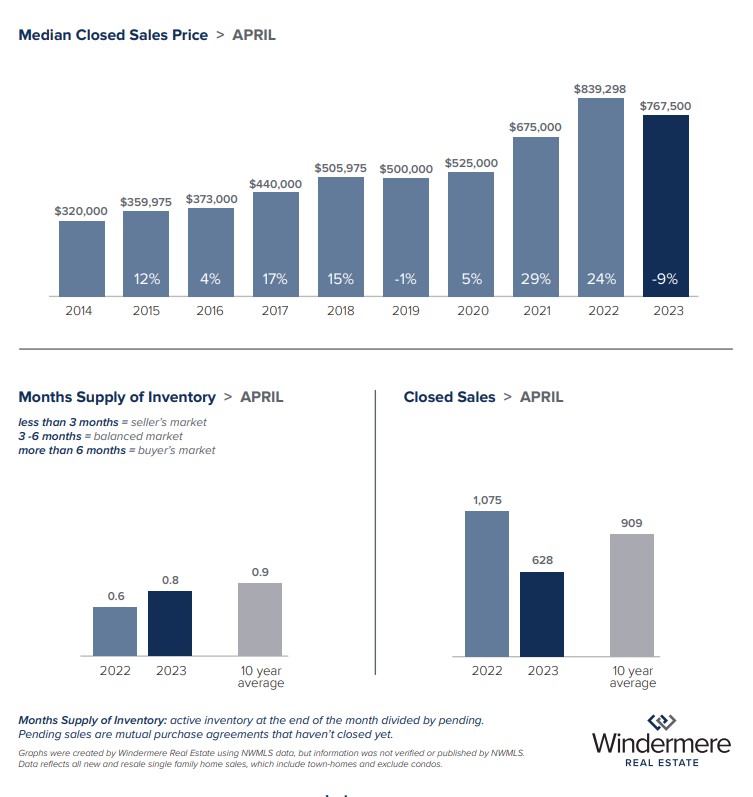

Finally, Snohomish County saw month-over-month price growth in April as well. The median price of a single-family home was $767,500, up from $724,000 in March. With less than one month of available inventory, the housing market in Snohomish County is trending warm-to-hot. Condos in the county had the tightest inventory of any market, with less than two weeks’ supply. That, combined with April’s median sold price of $544,900, makes the Snohomish County condo market a competitive market for buyers to break into.

If you have questions about these housing market trends or real estate in general, please reach out to Kari (206)719-2224

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link